Who Will Bear The Cost Of Trump's Economic Policies?

Table of Contents

The Impact on Working-Class Families

Trump's economic policies disproportionately impacted working-class families, leading to a widening gap in economic inequality.

Wage Stagnation and Declining Real Income

- Trade Wars and Tariffs: Trump's imposition of tariffs on imported goods, intended to protect American industries, resulted in higher prices for consumers and disrupted supply chains. This negatively impacted manufacturing jobs, leading to job losses and wage stagnation in some sectors. The economic consequences of these trade wars were far-reaching and often unpredictable.

- Decreased Union Power: Policies perceived as anti-labor weakened unions' bargaining power, hindering workers' ability to negotiate for higher wages and better benefits. This further contributed to wage stagnation and declining real income for many working-class families.

- Data and Statistics: Studies from the Economic Policy Institute and other reputable sources show a clear correlation between Trump's economic policies and the slow growth of wages for lower and middle-income workers, compared to the growth experienced by higher-income earners.

Increased Healthcare Costs

- Repeal of the Affordable Care Act (ACA): Attempts to repeal and replace the Affordable Care Act threatened to leave millions without health insurance, increasing healthcare costs and reducing access to care for low- and middle-income families. While the ACA wasn't fully repealed, efforts to weaken it led to higher insurance premiums and deductibles.

- Impact on Healthcare Access: The resulting uncertainty and rising costs created significant financial burdens for working-class families already struggling with medical debt and limited access to affordable healthcare.

Rising Cost of Living

- Inflation and Essential Expenses: Inflation during this period affected the cost of essentials, including housing, food, and education, disproportionately impacting working-class families with fixed or low incomes. The increased cost of living eroded any potential gains from minimal wage increases.

- Housing Costs: Rising housing costs, particularly in urban areas, placed further strain on working-class budgets, leaving many families struggling to afford adequate housing.

The Burden on the Middle Class

While some aspects of Trump's policies aimed to benefit the middle class, many argue that the net effect increased their financial burdens.

Tax Cuts for the Wealthy

- Disproportionate Benefits: Tax cuts enacted during this period primarily benefited high-income earners and corporations. While some middle-class families saw modest tax reductions, the overall effect was a widening of the income inequality gap.

- Increased National Debt: These tax cuts, coupled with increased government spending, contributed to a significant rise in the national debt. Economists warn that this will necessitate future tax increases or cuts to essential government programs, ultimately impacting the middle class.

Increased Student Loan Debt

- Lack of Action on Student Loan Debt: There was a lack of significant action to address the rising burden of student loan debt, leaving many middle-class families struggling with repayment. This hindered their ability to save for retirement, buy homes, and build financial security.

- Higher Education Costs: The continuing rise in higher education costs further exacerbated the problem, creating a cycle of debt for many seeking higher education.

Reduced Social Safety Nets

- Proposed Cuts to Social Programs: While not always enacted, proposed cuts to social programs such as unemployment benefits and food stamps raised concerns about the erosion of the social safety net, leaving middle-class families more vulnerable to economic shocks.

- Impact on Financial Security: These potential cuts heightened anxieties regarding financial security, particularly for families facing unexpected job losses or other hardships.

The Benefits (and Costs) for Corporations and the Wealthy

Trump's economic policies generated significant benefits for corporations and high-income individuals, although these benefits were not without potential negative consequences.

Corporate Tax Cuts and Deregulation

- Positive Economic Impact: Corporate tax cuts and deregulation led to increased profits for many businesses and higher returns for investors. Proponents argue this stimulated economic growth and job creation.

- Negative Consequences: Critics highlight potential negative consequences, including increased market concentration, environmental damage due to relaxed environmental regulations, and a widening of the wealth gap.

Increased Stock Market Valuations

- Impact on Wealth Inequality: The rise in stock market valuations during this period disproportionately benefited high-income individuals who hold a larger share of stock market investments, further increasing wealth inequality.

- Economic Indicators: While stock market performance is a key economic indicator, it's important to consider its uneven distribution of benefits and its limited reflection of the overall economic well-being of the population.

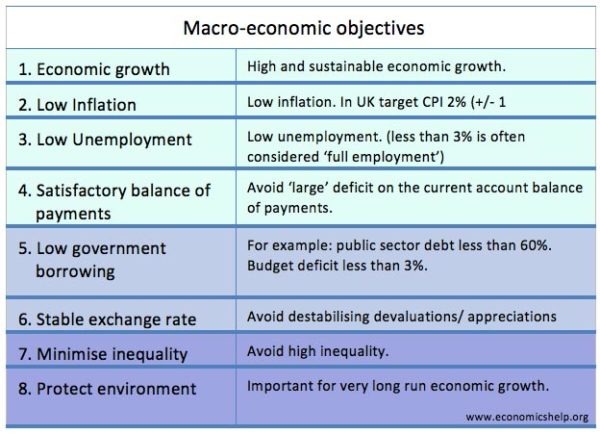

Conclusion: Understanding the True Cost of Trump's Economic Policies

In summary, the distributional effects of Trump's economic policies were uneven. While corporations and high-income individuals largely benefited from tax cuts, deregulation, and stock market growth, working-class families and the middle class bore a disproportionate share of the costs, facing wage stagnation, rising healthcare costs, increased debt burdens, and a weakened social safety net. Who bore the cost of Trump's economic policies? The answer, based on this analysis, is clear: those least equipped to handle economic hardship. To fully understand the long-term impact, continued research and informed discussion are crucial. We encourage you to explore resources like the Economic Policy Institute ([link to EPI website]) for further insights into the complex economic consequences of these policies and to advocate for policies that promote economic justice and shared prosperity.

Featured Posts

-

Robotic Limitations In Nike Sneaker Manufacturing Challenges And Opportunities

Apr 22, 2025

Robotic Limitations In Nike Sneaker Manufacturing Challenges And Opportunities

Apr 22, 2025 -

Razer Blade 16 2025 Review Ultra Settings On A Thin Laptop High Price

Apr 22, 2025

Razer Blade 16 2025 Review Ultra Settings On A Thin Laptop High Price

Apr 22, 2025 -

Los Angeles Palisades Fire Impact On Celebrity Homes Full List

Apr 22, 2025

Los Angeles Palisades Fire Impact On Celebrity Homes Full List

Apr 22, 2025 -

Unpacking Trumps Economic Goals Distributional Impacts

Apr 22, 2025

Unpacking Trumps Economic Goals Distributional Impacts

Apr 22, 2025 -

Auto Dealers Intensify Opposition To Mandatory Electric Vehicle Sales

Apr 22, 2025

Auto Dealers Intensify Opposition To Mandatory Electric Vehicle Sales

Apr 22, 2025