Unpacking Trump's Economic Goals: Distributional Impacts

Table of Contents

Donald Trump's presidency left an undeniable mark on the US economy, sparking significant debate about the distributional effects of his policies. His approach, often characterized by deregulation, tax cuts, and protectionist trade policies, generated controversy and continues to fuel discussions about its long-term consequences and its impact on economic inequality under Trump. This article aims to analyze the distributional impacts of Trump's economic goals, examining who benefited and who ultimately suffered under his administration. We will explore the distributional effects of Trump's policies across various sectors, shedding light on the complex interplay between economic growth and inequality.

<h2>Tax Cuts and Their Distributional Effects</h2>

The cornerstone of Trump's economic agenda was the 2017 Tax Cuts and Jobs Act (TCJA). This legislation significantly altered the US tax code, resulting in substantial tax cuts for corporations and high-income earners. Understanding the distributional effects of Trump's policies necessitates a close examination of this act.

<h3>The 2017 Tax Cuts and Jobs Act</h3>

- Corporate Tax Rate Reduction: The TCJA slashed the corporate tax rate from 35% to 21%, a considerable reduction intended to stimulate business investment and job creation.

- Individual Tax Bracket Changes: The act also modified individual income tax brackets, lowering rates for many but providing disproportionately larger tax savings to higher-income individuals.

- Statistical Evidence: Numerous studies, including those from the Tax Policy Center and the Congressional Budget Office, indicated that the majority of tax savings flowed to the wealthiest households, exacerbating income inequality. For example, the top 1% received a disproportionately large share of the tax cuts, while lower- and middle-income households saw comparatively smaller benefits.

<h3>Impact on Income Inequality</h3>

The TCJA's distributional effects significantly impacted income inequality in the US. Several metrics demonstrate this:

- Gini Coefficient: While the precise effect on the Gini coefficient (a measure of income inequality) is subject to ongoing debate, some studies suggest a slight increase in income inequality following the tax cuts.

- Wealth Distribution: The concentration of wealth at the top likely increased further, as the tax cuts primarily benefited those already possessing significant assets and income.

- Scholarly Research: Academic research on the TCJA's impact on inequality continues to evolve, with some studies highlighting the short-term benefits for certain demographics offset by long-term negative consequences for others.

<h3>Long-term economic consequences of the tax cuts on different income groups</h3>

The long-term effects of the TCJA are still unfolding, but several potential consequences warrant consideration:

- Multiplier Effect: The extent to which the corporate tax cuts stimulated investment and subsequent economic growth is debated. While some argue for a positive multiplier effect, others point to a limited impact or even potential crowding out of private investment.

- Increased Investment vs. Increased Consumption: A central question is whether the tax cuts primarily fueled investment in productive capacity or simply increased consumption among high-income households.

- Effects on National Debt: The TCJA significantly increased the national debt. This increase could have long-term implications for economic growth and could potentially constrain future government spending on social programs that benefit lower-income households.

<h2>Trade Policies and Their Distributional Impacts</h2>

Trump's trade policies, characterized by tariffs and trade disputes, also had significant distributional effects. His "America First" approach aimed to protect domestic industries but resulted in complex and often unforeseen consequences.

<h3>Tariffs and Their Effects on Workers and Consumers</h3>

Trump's imposition of tariffs on various goods, particularly steel and aluminum, had a mixed impact:

- Specific Industry Impacts: While some domestic industries benefited from increased protection, others suffered from higher input costs and retaliatory tariffs from trading partners. The agricultural sector, for instance, faced significant challenges due to trade disputes with China.

- Job Losses and Gains: The net impact on job creation is difficult to definitively quantify. While some jobs may have been preserved or created in protected industries, others were lost in sectors affected by retaliatory tariffs or reduced exports.

- Consumer Price Increases: Tariffs generally increased the prices of imported goods, leading to higher costs for consumers. This disproportionately affected low- and middle-income households, who spend a larger share of their income on essential goods.

<h3>Trade Wars and Global Economic Uncertainty</h3>

Trump's trade wars created global economic uncertainty:

- Trade Disputes: The trade disputes with China and other countries disrupted global supply chains and created uncertainty for businesses.

- Impact on Supply Chains: Businesses faced disruptions in their supply chains, leading to increased costs and production delays.

- Consequences for Specific Countries/Regions: Specific countries and regions experienced negative economic consequences due to reduced exports and trade disruptions.

<h3>Winners and Losers in the Trade Wars</h3>

The distributional effects of Trump's trade policies were uneven:

- Beneficiaries: Certain domestic industries, particularly those receiving significant tariff protection, experienced short-term gains.

- Sufferers: Many industries reliant on exports or importing intermediate goods faced significant challenges, leading to job losses and economic hardship. Consumers also bore the brunt of increased prices.

<h2>Deregulation and its Distributional Consequences</h2>

Trump's administration pursued a significant deregulation agenda, with far-reaching consequences for various sectors.

<h3>Environmental Deregulation</h3>

The rollback of environmental regulations had potentially significant distributional consequences:

- Specific Deregulations: The administration weakened or repealed regulations related to clean air and water, emission standards, and environmental protection.

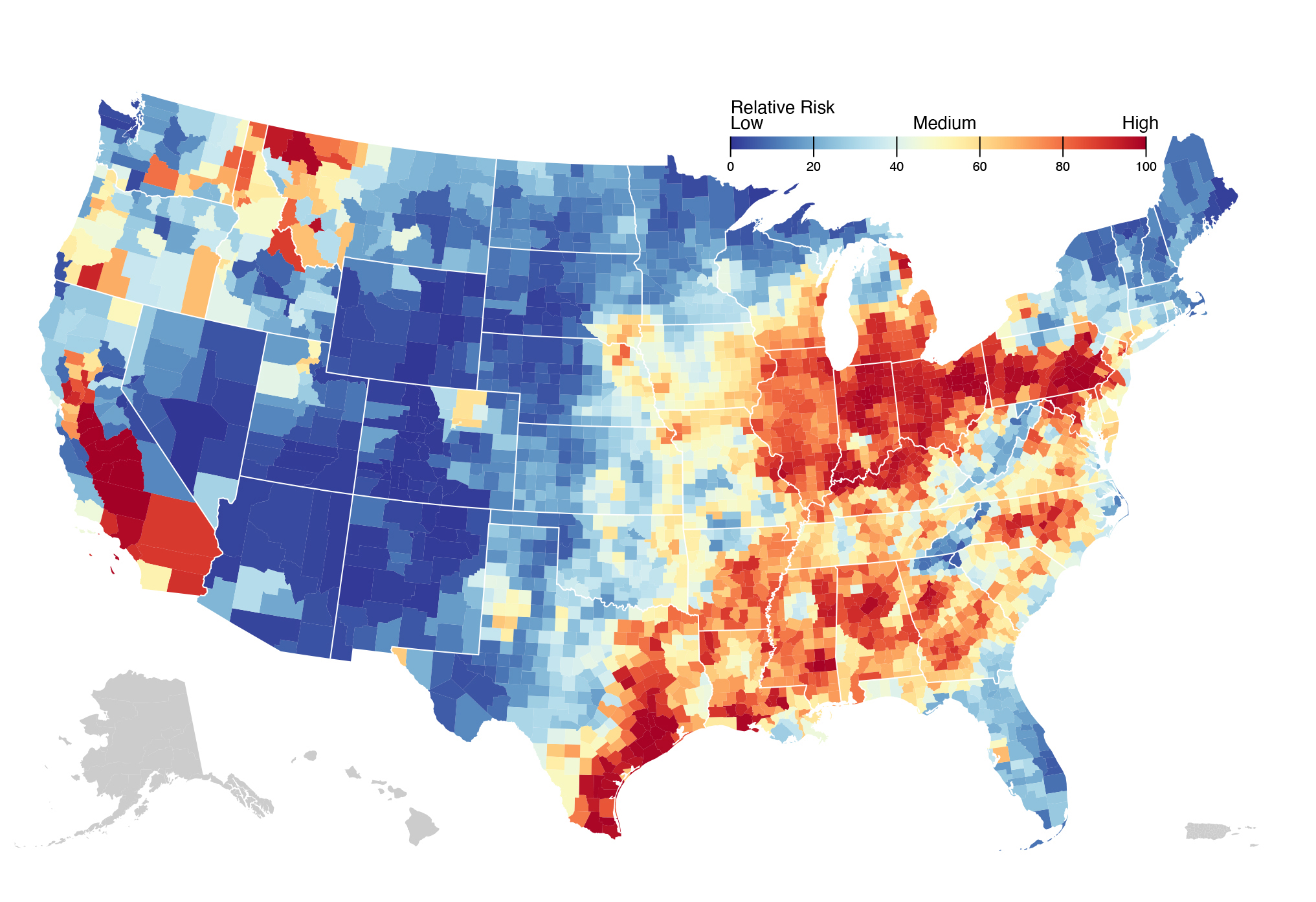

- Impacts on Public Health and Environment: These actions potentially exacerbated environmental pollution and negatively impacted public health, disproportionately affecting low-income communities and communities of color who often live closer to polluting industries.

- Economic Costs: While deregulation may offer short-term economic benefits to some businesses, the long-term costs associated with environmental damage can be substantial and fall disproportionately on vulnerable populations.

<h3>Financial Deregulation</h3>

The potential effects of financial deregulation were debated:

- Specific Examples: The administration considered measures to ease regulations on banks and financial institutions.

- Potential Impacts: Relaxing financial regulations could potentially increase financial stability or risk depending on the approach taken.

<h3>Labor Market Deregulation</h3>

Policies affecting labor unions, minimum wage, and worker protections had distributional impacts:

- Weakening Labor Protections: Actions to weaken labor unions and worker protections potentially reduced income for lower and middle-income workers.

<h2>Conclusion: Summarizing the Distributional Impacts of Trump's Economic Goals</h2>

Trump's economic policies produced significant distributional impacts. Tax cuts primarily benefited high-income earners and corporations, potentially exacerbating income inequality. Trade policies, while aiming to protect some domestic industries, led to higher prices for consumers and disrupted global supply chains. Deregulation efforts carried significant risks, particularly concerning the environment and labor protections. The long-term economic consequences of these policies are still unfolding and are subject to ongoing debate. Understanding the distributional impacts of Trump's economic goals is crucial for shaping future economic policies that promote equitable growth for all Americans. Further research is necessary to fully assess the long-term effects on various segments of the population and to inform the development of policies that mitigate inequality and promote inclusive economic growth.

Featured Posts

-

Is Google Facing An Existential Threat Of Breakup

Apr 22, 2025

Is Google Facing An Existential Threat Of Breakup

Apr 22, 2025 -

Joint Effort South Sudan And Us Government To Manage Deportees Return

Apr 22, 2025

Joint Effort South Sudan And Us Government To Manage Deportees Return

Apr 22, 2025 -

Anti Trump Protests Hear Their Stories

Apr 22, 2025

Anti Trump Protests Hear Their Stories

Apr 22, 2025 -

The Countrys New Business Hot Spots A Geographic Analysis

Apr 22, 2025

The Countrys New Business Hot Spots A Geographic Analysis

Apr 22, 2025 -

Statement On The Passing Of Pope Francis At 88

Apr 22, 2025

Statement On The Passing Of Pope Francis At 88

Apr 22, 2025