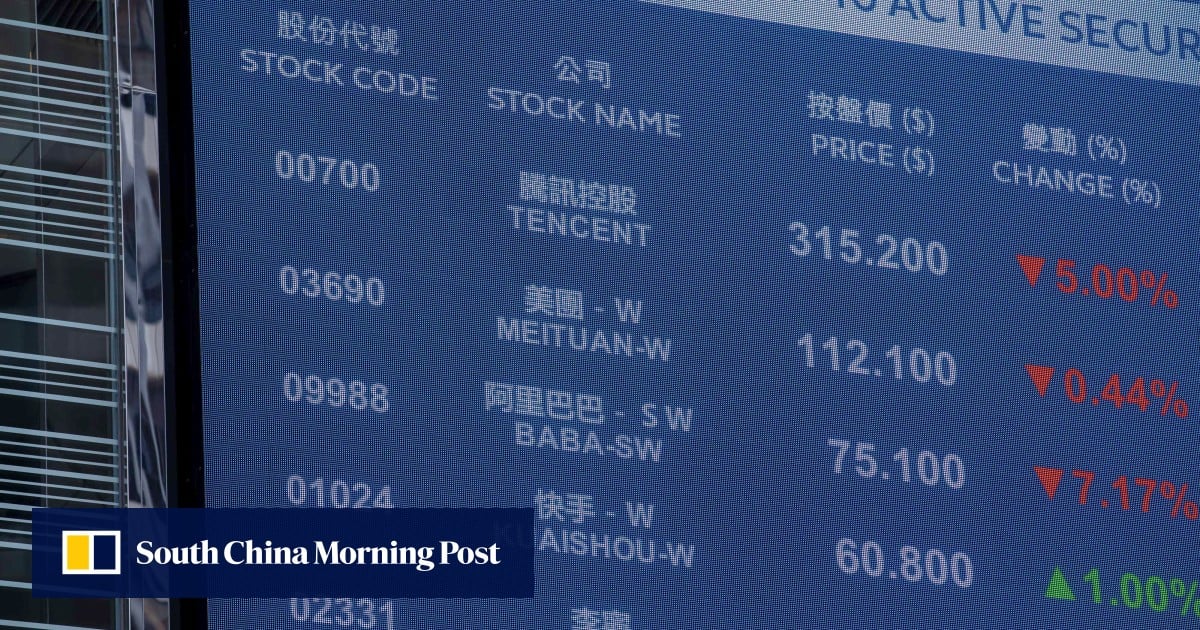

Trade Deal Hopes Lift Chinese Stocks Traded In Hong Kong

Table of Contents

Rising Investor Sentiment and the Impact on Chinese Stocks in Hong Kong

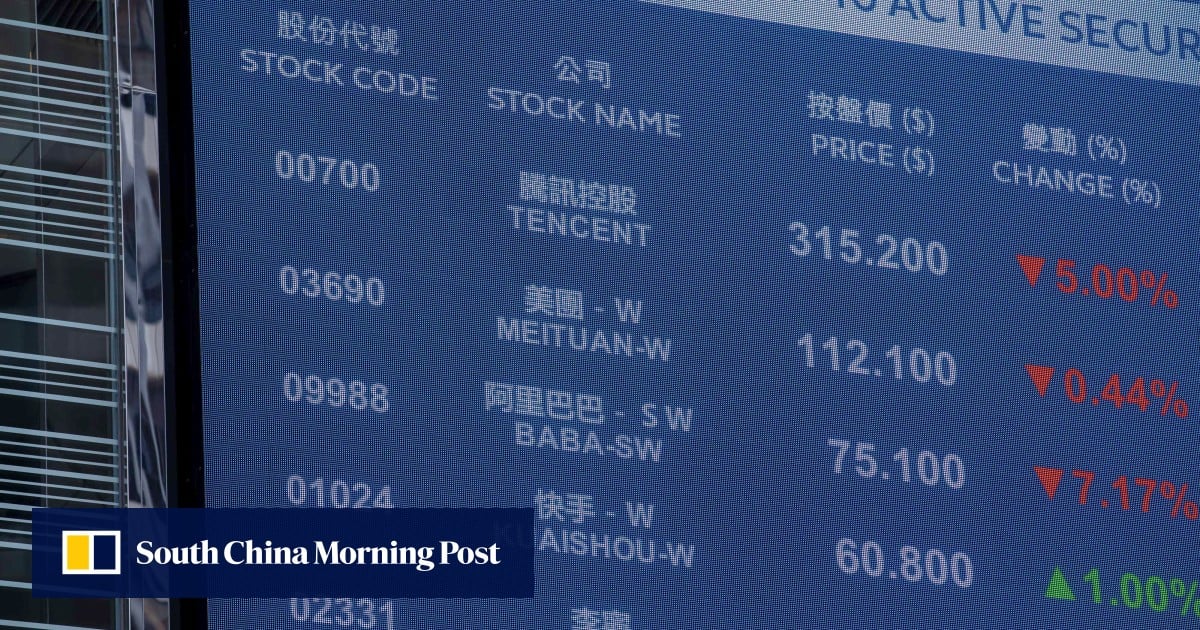

Positive news regarding US-China trade negotiations has a direct correlation with the increase in value of Chinese stocks listed in Hong Kong. A more conciliatory tone between the two economic superpowers translates into reduced uncertainty, encouraging investors to take a more bullish stance. This improved sentiment leads to several key changes in the market:

- Increased foreign investment flows into Hong Kong: International investors, sensing less risk, are channeling more capital into Hong Kong-listed Chinese companies. This influx of capital further boosts stock prices.

- Improved market confidence leading to higher trading volumes: Higher trading volumes indicate increased investor activity and a greater willingness to participate in the market. This surge is a clear indicator of growing confidence in the future prospects of these companies.

- Specific examples of stocks experiencing significant gains: Several sectors have seen impressive gains. Tech companies, particularly those involved in AI and fintech, are experiencing significant growth, along with mainland Chinese banks benefiting from improved economic outlook.

- Analysis of investor behavior – risk appetite increase: The shift towards higher-risk investments reflects a growing belief that the potential rewards outweigh the perceived risks associated with investing in Chinese equities.

The Role of the Hong Kong Stock Exchange as a Gateway to Chinese Markets

The Hong Kong Stock Exchange plays a crucial role as a gateway for international investors seeking exposure to Chinese companies. Its strategic location, robust regulatory framework, and relatively transparent market make it an attractive destination for both Chinese companies seeking to raise capital and global investors looking for diversification.

- HKEX's regulatory framework and its influence on investor confidence: The HKEX's well-established regulatory environment fosters trust and confidence among investors, making it a preferred destination compared to some other less regulated markets.

- Comparison with other Asian markets and their attractiveness for Chinese companies: Compared to markets in mainland China, the HKEX offers a more internationalized platform, attracting a wider range of investors.

- The benefits of listing on the HKEX for Chinese companies: Listing on the HKEX provides Chinese companies with access to a larger pool of capital, enhances their international profile, and improves brand recognition.

- Discussion on potential challenges and risks associated with investing in Chinese stocks via HKEX: While the HKEX offers advantages, investors should still be aware of potential risks such as geopolitical instability and regulatory changes in both China and Hong Kong. Due diligence is crucial.

Specific Sectors Showing Strong Growth

Certain sectors within the Chinese economy are experiencing particularly strong growth due to the optimism surrounding trade deal prospects.

- Technology sector performance and its susceptibility to trade policy changes: The tech sector remains a key driver of growth, although its sensitivity to trade policy shifts requires careful monitoring.

- Performance of consumer goods companies reflecting increased consumer spending: Rising consumer confidence is reflected in the strong performance of consumer goods companies.

- Growth in infrastructure and real estate sectors linked to government spending: Government investment in infrastructure and real estate continues to support growth in these sectors.

- Analysis of any sector-specific risks that may offset gains: While these sectors are flourishing, it's essential to assess sector-specific risks that might affect future performance.

Potential Risks and Uncertainties

While the current upswing in Chinese stocks traded in Hong Kong is encouraging, it's crucial to acknowledge the inherent risks and uncertainties. This positive trend isn't guaranteed to continue indefinitely.

- Geopolitical risks and their impact on investor sentiment: Geopolitical tensions can quickly shift investor sentiment, impacting market performance.

- Potential for renewed trade tensions to dampen market enthusiasm: The possibility of renewed trade friction remains a significant risk factor.

- Concerns regarding the overall health of the Chinese economy: Understanding the broader economic context is vital to accurately assess the long-term prospects of these stocks.

- Impact of regulatory changes within China and Hong Kong: Changes in regulations within China and Hong Kong could significantly influence market dynamics.

Conclusion

The recent surge in Chinese stocks traded in Hong Kong reflects a wave of optimism fueled by hopes for a positive resolution in US-China trade relations. While the current market sentiment is positive, investors should remain cautious and consider the potential risks involved. The Hong Kong Stock Exchange remains a key gateway for global access to Chinese equities, offering both opportunities and challenges.

Call to Action: Stay informed about developments in US-China trade negotiations and their impact on Chinese stocks Hong Kong to make informed investment decisions. Understanding the nuances of investing in Chinese stocks traded in Hong Kong is critical for navigating this dynamic market. Conduct thorough research and consider seeking professional financial advice before making any investment decisions related to Hong Kong-listed Chinese stocks.

Featured Posts

-

India Market Buzz Niftys Bullish Run Fueled By Positive Trends

Apr 24, 2025

India Market Buzz Niftys Bullish Run Fueled By Positive Trends

Apr 24, 2025 -

Startup Airlines Controversial Use Of Deportation Flights

Apr 24, 2025

Startup Airlines Controversial Use Of Deportation Flights

Apr 24, 2025 -

Why Is The Canadian Dollar Falling Despite Its Rise Against The Greenback

Apr 24, 2025

Why Is The Canadian Dollar Falling Despite Its Rise Against The Greenback

Apr 24, 2025 -

Trump Administration Open To Talks Following Harvards Legal Challenge

Apr 24, 2025

Trump Administration Open To Talks Following Harvards Legal Challenge

Apr 24, 2025 -

Why Middle Managers Are Essential For Company And Employee Success

Apr 24, 2025

Why Middle Managers Are Essential For Company And Employee Success

Apr 24, 2025