Why Is The Canadian Dollar Falling Despite Its Rise Against The Greenback?

Table of Contents

The Impact of Global Economic Uncertainty

Global economic headwinds significantly impact the Canadian dollar, a currency heavily influenced by the performance of its commodity-based exports. Canada's economy relies significantly on the export of natural resources like oil, lumber, and minerals. Fluctuations in global demand for these commodities directly affect the Canadian dollar's value.

Weakening Global Demand for Commodities:

- Decreased global demand: Slowdowns in major global economies translate to reduced demand for Canadian exports.

- Lower commodity prices: Reduced demand leads to lower prices for commodities, decreasing the revenue earned by Canadian exporters.

- Impact on Canadian exports: This decrease in revenue negatively impacts the Canadian economy, weakening the Canadian dollar.

- Effect on the CAD: A weaker economy generally leads to a weaker currency.

For example, a recent slowdown in Chinese economic growth directly impacted the price of lumber, a significant Canadian export. This price decrease negatively affected Canadian exporters and subsequently put downward pressure on the CAD.

Geopolitical Risks and Their Influence:

Geopolitical instability creates uncertainty in global markets, impacting investor confidence and capital flows.

- Examples of geopolitical events impacting the Canadian dollar: The ongoing war in Ukraine, political tensions in various regions, and trade disputes all influence investor sentiment.

- Flight to safety: During times of uncertainty, investors often move their money into "safe haven" assets like the US dollar, weakening other currencies, including the CAD.

- Investor sentiment: Negative news and geopolitical risks often lead to a decrease in investor confidence in riskier assets, including the Canadian dollar.

The ongoing conflict in Ukraine, for instance, has significantly impacted energy markets and global supply chains, indirectly contributing to the weakening of the Canadian dollar.

The Relative Strength of the US Dollar

Even as the Canadian dollar strengthens against the US dollar at times, other factors can still contribute to its overall decline.

The US Dollar as a Safe Haven:

- The US dollar as a global reserve currency: The US dollar maintains its position as the world's primary reserve currency, making it a favored investment during periods of global uncertainty.

- Investor preference for USD during uncertainty: Investors flock to the USD as a safe haven, increasing demand and bolstering its value against other currencies, including the CAD.

The Impact of US Monetary Policy:

- Interest rate hikes: The Federal Reserve's interest rate hikes make US assets more attractive to foreign investors, increasing demand for the USD.

- Capital flows: Increased interest rates draw capital towards the US, further strengthening the USD and weakening the CAD.

- Impact on the value of the USD and its knock-on effect on CAD: A stronger USD puts downward pressure on the CAD, even if the Canadian economy is performing relatively well.

The recent aggressive interest rate hikes by the Federal Reserve have significantly strengthened the USD, placing considerable pressure on the Canadian dollar.

Internal Economic Factors Affecting the Canadian Dollar

Domestic economic factors also play a crucial role in determining the Canadian dollar's value.

Canadian Interest Rates and Monetary Policy:

- Interest rate changes: The Bank of Canada's interest rate decisions influence the attractiveness of Canadian investments. Higher rates generally attract foreign investment, strengthening the CAD.

- Inflation targets: The Bank of Canada's inflation targets and its actions to achieve these targets significantly affect investor confidence and, subsequently, the CAD's value.

- Impact on investor confidence, capital inflow/outflow: Monetary policy decisions directly influence capital flows into and out of Canada.

Recent Bank of Canada decisions on interest rates have been aimed at curbing inflation, but their impact on the CAD has been complex and intertwined with global factors.

Domestic Economic Performance:

- Key economic indicators: Unemployment rates, GDP growth, and consumer confidence are all important indicators reflecting the health of the Canadian economy.

- Their correlation to the CAD's value: A strong economy generally supports a strong currency, while a weaker economy leads to a weaker currency.

- Impact of domestic economic growth/slowdown: Economic growth strengthens the CAD, while a slowdown weakens it.

While Canada's economy has shown resilience, certain challenges, such as high inflation and potential slowdowns, contribute to the uncertainty surrounding the Canadian dollar's future performance.

Conclusion

The decline of the Canadian dollar, despite its relative strength against the US dollar, is a result of a complex interplay of global and domestic factors. Global economic uncertainty, the strength of the US dollar, and internal Canadian economic factors all contribute to this fluctuation. Understanding these factors is crucial for navigating the complexities of the foreign exchange market. The key takeaway is that currency exchange rates are dynamic and influenced by numerous interconnected variables.

To better manage your financial decisions and investments, stay informed about global and domestic economic events and their potential impact on the Canadian dollar. Resources like the Bank of Canada website and reputable financial news sources are invaluable tools for tracking the Canadian dollar's value and making informed decisions. Understanding the intricacies behind why the Canadian dollar is falling is key to successful financial planning.

Featured Posts

-

Kci Johna Travolte Zapanjujuca Transformacija U Prekrasnu Mladu Zenu

Apr 24, 2025

Kci Johna Travolte Zapanjujuca Transformacija U Prekrasnu Mladu Zenu

Apr 24, 2025 -

Judge Abrego Garcia Condemns Stonewalling Tactics By Us Lawyers

Apr 24, 2025

Judge Abrego Garcia Condemns Stonewalling Tactics By Us Lawyers

Apr 24, 2025 -

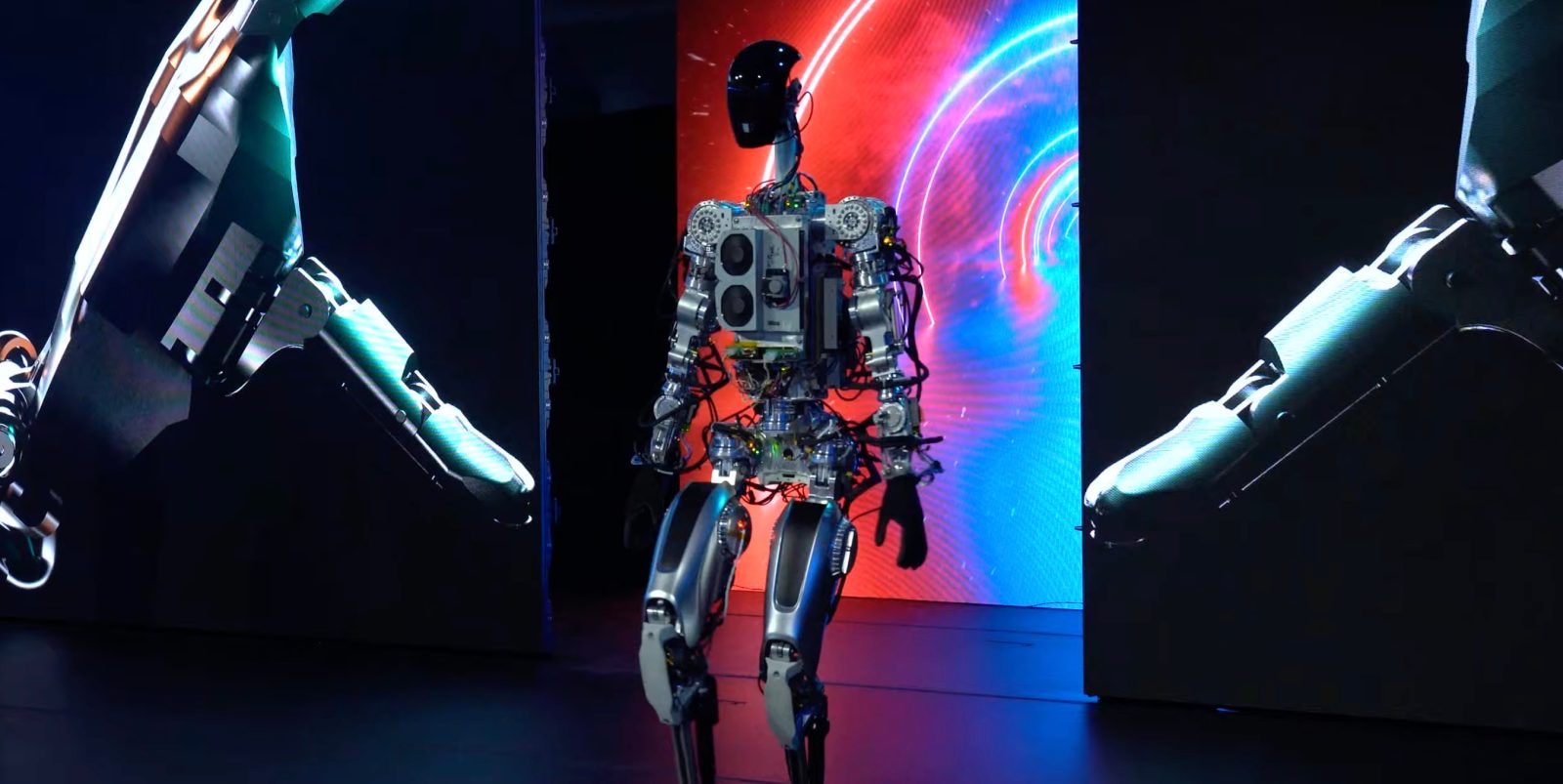

Teslas Optimus Robot Chinas Rare Earth Restrictions Cause Delays

Apr 24, 2025

Teslas Optimus Robot Chinas Rare Earth Restrictions Cause Delays

Apr 24, 2025 -

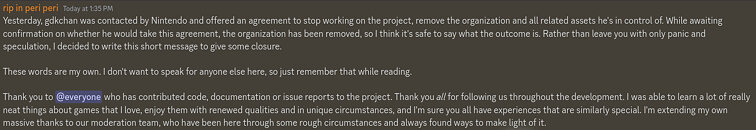

Ryujinx Emulator Project Ends After Reported Nintendo Intervention

Apr 24, 2025

Ryujinx Emulator Project Ends After Reported Nintendo Intervention

Apr 24, 2025 -

Us Dollar Gains Momentum Against Major Peers Amid Eased Trump Powell Tensions

Apr 24, 2025

Us Dollar Gains Momentum Against Major Peers Amid Eased Trump Powell Tensions

Apr 24, 2025