India Market Buzz: Nifty's Bullish Run Fueled By Positive Trends

Table of Contents

Strong Macroeconomic Fundamentals Driving Nifty's Growth

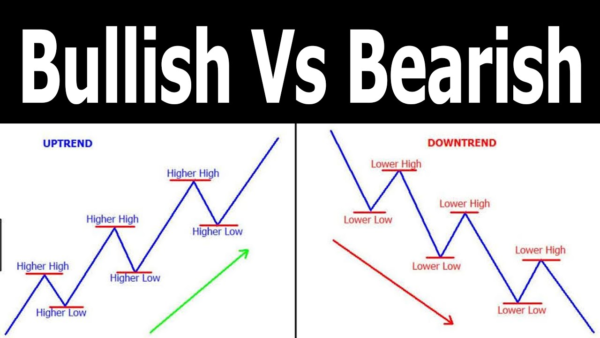

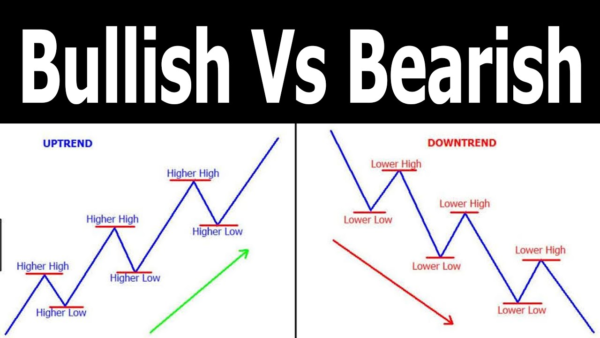

The robust performance of the Nifty 50 index is strongly underpinned by India's strengthening macroeconomic fundamentals. Several key indicators point towards a positive economic outlook, boosting investor confidence and driving the bullish trend.

Robust GDP Growth

India's consistently strong GDP growth figures are a major catalyst for the Nifty's rise. The Indian economy has demonstrated resilience, with [insert recent GDP growth rate]% growth in [insert quarter/year], driven by significant contributions from key sectors.

- Services Sector: The services sector continues to be a major engine of growth, contributing [insert percentage]% to the overall GDP.

- Manufacturing Sector: The manufacturing sector has also shown healthy growth, fueled by government initiatives like "Make in India."

- Government Initiatives: Government policies focused on infrastructure development, digitalization, and ease of doing business are further bolstering economic growth and creating a positive investment climate. These factors contribute significantly to the positive "India Market Buzz" surrounding the Nifty 50. Keywords related to this include "Indian GDP growth," "economic indicators," "macroeconomic factors," and "positive economic outlook."

Improving Corporate Earnings

A significant surge in corporate earnings and profitability across various sectors is another key driver of the Nifty's bullish run. Many companies have reported exceeding expectations, leading to increased investor confidence.

- Strong Earnings Growth: Companies in sectors like [mention specific high-performing sectors, e.g., technology, pharmaceuticals] have demonstrated impressive earnings growth, exceeding market forecasts.

- Improved Profitability: Higher profitability signifies improved operational efficiency and strong market positioning for many businesses, further enhancing investor sentiment.

- Sectoral Growth: The broad-based improvement in corporate earnings across various sectors points to a healthy and expanding Indian economy, contributing to the positive "India Market Buzz." Relevant keywords here include "corporate earnings," "profitability," "sectoral growth," and "earnings reports."

Positive Foreign Institutional Investor (FII) Flows

Significant inflows of foreign capital from Foreign Institutional Investors (FIIs) are playing a crucial role in boosting the Nifty's performance. The increased interest from FIIs reflects their confidence in the long-term growth potential of the Indian market.

- Inflow of Foreign Capital: FIIs have injected significant capital into the Indian stock market, increasing market liquidity and driving up stock prices.

- Attractive Valuations: The relatively attractive valuations of Indian stocks compared to other global markets are a significant draw for foreign investors.

- Growth Potential: India's burgeoning middle class, expanding digital economy, and young demographic profile represent strong growth prospects, attracting substantial FII investment. Keywords like "Foreign Institutional Investors," "FII investments," "foreign capital inflow," and "market liquidity" are crucial here.

Global Factors Contributing to the Nifty's Bullish Trend

Beyond domestic factors, several global trends are contributing to the Nifty's positive trajectory. A recovering global economy and favorable geopolitical developments are boosting investor sentiment and fueling the bullish run.

Global Economic Recovery

A recovering global economy is creating a positive spillover effect on the Indian market. Reduced global uncertainty and increased international trade are contributing to the bullish trend.

- Positive Global Economic Indicators: Positive global economic indicators, such as improving manufacturing indices and rising consumer confidence in developed economies, are creating a more optimistic global outlook.

- Reduced Global Uncertainty: Decreased geopolitical tensions and improved global cooperation are contributing to reduced market uncertainty, encouraging investment flows into emerging markets like India.

- Increased International Trade: Increased global trade activity benefits India's export-oriented sectors, boosting economic growth and investor confidence. Keywords such as "global economic recovery," "global growth," "international trade," and "reduced global uncertainty" are relevant here.

Favorable Geopolitical Developments

Positive geopolitical developments are also contributing to increased investor confidence in the Indian market. A stable geopolitical environment fosters a more favorable climate for investment.

- Improved Global Relations: Improved diplomatic relations between India and other key global players are contributing to a more stable geopolitical landscape.

- Political Stability: Domestic political stability and strong governance contribute to a conducive environment for long-term investment.

- Regional Cooperation: Increased regional cooperation and partnerships further enhance investor confidence in India’s future prospects. Keywords like "geopolitical stability," "global relations," "investor confidence," and "political stability" are important here.

Sector-Specific Performance Driving the Nifty's Rise

The Nifty's rise is not solely driven by macroeconomic factors and global trends; sector-specific performance is also playing a vital role.

IT Sector's Strong Performance

The Indian IT sector has been a major contributor to the Nifty's bullish run. Increased demand for technology services globally and technological advancements are driving the sector's strong performance.

- Increased Demand: Growing demand for IT services from global clients is boosting revenue and profitability for Indian IT companies.

- Technological Advancements: Continuous innovation and adaptation to emerging technologies are placing Indian IT companies at the forefront of the global tech landscape.

- Key Players: Leading Indian IT companies are consistently exceeding expectations, contributing significantly to the overall market performance. Keywords like "IT sector," "technology stocks," "software companies," and "tech growth" are central here.

Other High-Performing Sectors

Besides the IT sector, other sectors are contributing to the Nifty's positive trajectory. Strong performance in these sectors indicates a broad-based economic expansion.

- Banking Sector: The banking sector is witnessing improved asset quality and increased lending activity, indicating a healthier financial system.

- Pharmaceutical Stocks: The pharmaceutical sector is benefitting from increased demand both domestically and internationally.

- Consumer Goods: The consumer goods sector is showing positive growth, reflecting robust consumer spending and increased purchasing power. Keywords such as "banking sector," "pharmaceutical stocks," "consumer goods," and "sectoral analysis" are relevant to this section.

Conclusion: Understanding India Market Buzz: Nifty's Bullish Run and its Implications

The Nifty 50's bullish run is a result of a powerful combination of strong macroeconomic fundamentals, favorable global trends, and robust sector-specific performance. India's impressive GDP growth, improving corporate earnings, positive FII flows, a recovering global economy, and favorable geopolitical developments all contribute to the positive "India Market Buzz." The strong performance of the IT sector and other key sectors further solidifies this positive momentum.

Key Takeaways: Macroeconomic stability, positive global trends, and strong sector-specific growth are all crucial drivers of the Nifty's bullish run. Understanding these trends is paramount for effective navigation of the Indian stock market.

Call to Action: Stay tuned for more updates on the India Market Buzz and the Nifty’s continued bullish run. Understanding these trends is crucial for navigating the Indian stock market effectively. Consider consulting with a financial advisor to develop a personalized investment strategy tailored to your risk tolerance and financial goals.

Featured Posts

-

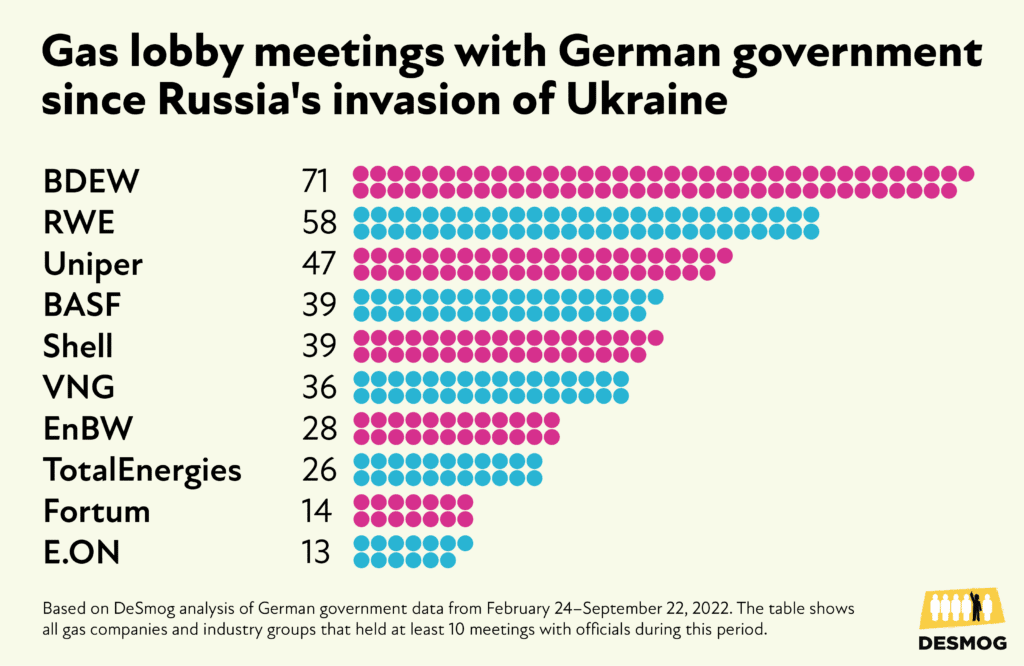

Eus Energy Strategy Addressing The Phaseout Of Russian Gas From The Spot Market

Apr 24, 2025

Eus Energy Strategy Addressing The Phaseout Of Russian Gas From The Spot Market

Apr 24, 2025 -

Elon Musks Dogecoin Strategy Following Epa Actions Against Tesla And Space X

Apr 24, 2025

Elon Musks Dogecoin Strategy Following Epa Actions Against Tesla And Space X

Apr 24, 2025 -

Instagrams Latest Move A Dedicated Video Editing App To Compete With Tik Tok

Apr 24, 2025

Instagrams Latest Move A Dedicated Video Editing App To Compete With Tik Tok

Apr 24, 2025 -

Miami Heats Herro Claims Nba 3 Point Contest Title

Apr 24, 2025

Miami Heats Herro Claims Nba 3 Point Contest Title

Apr 24, 2025 -

Instagram Challenges Tik Tok With Powerful New Video Editing App

Apr 24, 2025

Instagram Challenges Tik Tok With Powerful New Video Editing App

Apr 24, 2025