Tether And SoftBank Partner With Cantor In Potential $3 Billion Crypto SPAC

Table of Contents

The Players Involved: A Deep Dive

This ambitious $3 billion crypto SPAC hinges on the combined strengths of three major players, each bringing unique expertise and resources to the table. Let's examine their individual roles and motivations.

Tether's Strategic Move

Tether, the issuer of the USDT stablecoin, holds a dominant position in the cryptocurrency market. Its involvement in this SPAC represents a significant strategic move.

- Market Dominance: Tether's USDT is the most widely traded stablecoin globally, boasting a massive market capitalization. This provides a strong foundation for attracting further investment.

- Addressing Regulatory Concerns: Tether has faced scrutiny and legal battles regarding its reserves. This partnership could help enhance its regulatory compliance and public image, potentially leading to greater institutional adoption.

- Expanding Influence: By participating in a major crypto SPAC, Tether aims to expand its influence within the broader financial ecosystem and further solidify its position as a key player in the digital currency space. This move signifies its confidence in the future of the crypto market.

SoftBank's Investment Strategy

SoftBank, a Japanese multinational conglomerate, has a history of significant investments in high-growth technology and fintech companies. Its involvement underscores the growing interest of major institutional investors in the cryptocurrency sector.

- Fintech Focus: SoftBank's investment portfolio includes numerous successful fintech ventures, demonstrating their keen eye for identifying disruptive technologies.

- High-Risk, High-Reward Approach: SoftBank is known for its aggressive investment strategy, often targeting companies with high-growth potential, even if it involves higher risk. The crypto market aligns perfectly with this approach.

- Diversification: This investment in a crypto SPAC allows SoftBank to diversify its portfolio and gain exposure to the rapidly evolving cryptocurrency market, potentially yielding substantial returns.

Cantor Fitzgerald's Expertise

Cantor Fitzgerald, a leading global financial services firm, brings its extensive experience in investment banking and mergers and acquisitions to the table. Their expertise is crucial in structuring and executing the SPAC.

- M&A Prowess: Cantor Fitzgerald has a proven track record of successfully navigating complex M&A transactions, providing the necessary expertise to manage the intricacies of a crypto SPAC.

- SPAC Experience: Cantor Fitzgerald possesses substantial experience in the SPAC market, offering valuable guidance and navigating the regulatory requirements involved.

- Network and Resources: Their extensive network of contacts within the financial industry will be invaluable in attracting potential target companies and investors to the SPAC.

The Potential Impact of the $3 Billion Crypto SPAC

The creation of this $3 billion crypto SPAC has the potential to significantly impact the cryptocurrency market in several ways.

Reshaping the Crypto Investment Landscape

This SPAC could act as a catalyst, attracting a wave of institutional investors who have previously been hesitant to enter the crypto market due to its perceived volatility and regulatory uncertainty.

- Reduced Barriers to Entry: SPACs provide a relatively streamlined and less risky entry point for institutional investors, compared to direct investments in cryptocurrencies.

- Increased Liquidity: The influx of capital could significantly increase liquidity within the crypto market, making it more attractive to a wider range of participants.

- Enhanced Credibility: The involvement of reputable firms like Tether, SoftBank, and Cantor Fitzgerald lends credibility to the crypto market, helping to allay concerns among institutional investors.

Driving Innovation in the Crypto Industry

The substantial capital injection from this $3 billion crypto SPAC has the potential to fuel innovation and accelerate development across various areas of the crypto ecosystem.

- DeFi Expansion: A significant portion of the funds could be directed towards decentralized finance (DeFi) projects, fostering further growth in this rapidly expanding sector.

- NFT Market Development: The funds may also support the growth of the non-fungible token (NFT) market, potentially leading to new use cases and applications.

- Web3 Infrastructure: Investment could also be channeled towards building the infrastructure for Web3, the next generation of the internet, which relies heavily on blockchain technology.

Potential Challenges and Risks

Despite the significant potential, the partnership faces several challenges and risks.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains uncertain in many jurisdictions, potentially creating obstacles for the SPAC. Navigating regulatory hurdles will be crucial for the success of this venture.

- Market Volatility: The cryptocurrency market is known for its volatility, posing inherent risks to any investment. Effective risk management will be essential.

- Due Diligence: Thorough due diligence will be required to identify and assess potential acquisition targets, mitigating the risk of investing in projects with questionable viability.

Conclusion

The partnership between Tether, SoftBank, and Cantor Fitzgerald to create a $3 billion crypto SPAC represents a significant development in the cryptocurrency industry. This collaboration has the potential to attract substantial investment, accelerate innovation, and reshape the crypto investment landscape. However, it's crucial to acknowledge the inherent risks associated with such ventures.

Call to Action: Stay tuned for further updates on this groundbreaking Tether and SoftBank-backed crypto SPAC, and continue to follow the evolution of the crypto market as it navigates this exciting new chapter. Learn more about the potential implications of this landmark crypto SPAC by exploring additional resources and expert analyses.

Featured Posts

-

Reduced Consumer Spending A Challenge For Credit Card Issuers

Apr 24, 2025

Reduced Consumer Spending A Challenge For Credit Card Issuers

Apr 24, 2025 -

Trade Deal Hopes Lift Chinese Stocks Traded In Hong Kong

Apr 24, 2025

Trade Deal Hopes Lift Chinese Stocks Traded In Hong Kong

Apr 24, 2025 -

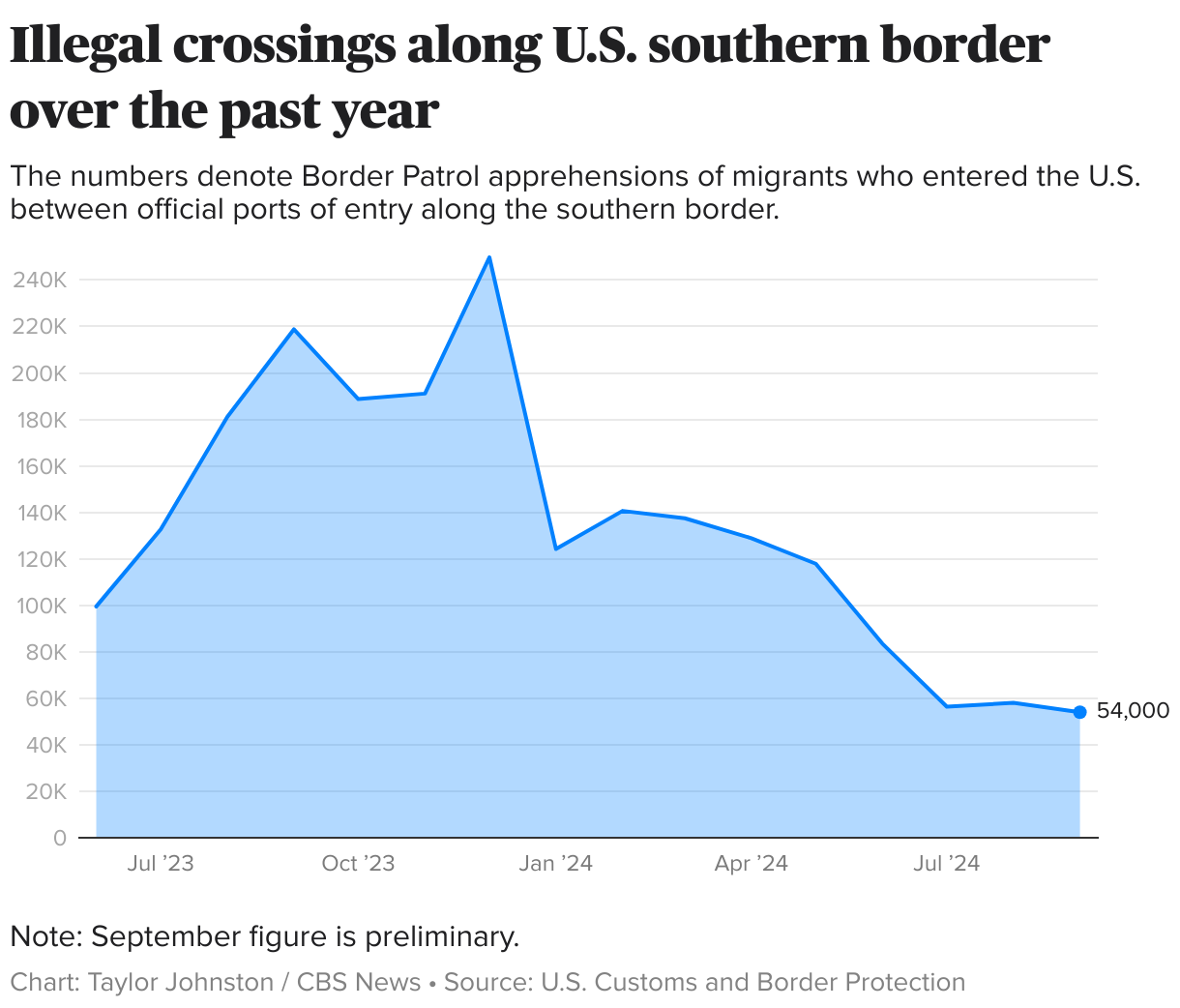

Drop In Illegal Border Crossings Between U S And Canada White House

Apr 24, 2025

Drop In Illegal Border Crossings Between U S And Canada White House

Apr 24, 2025 -

Newsom Calls On Oil Companies Amidst Soaring California Gas Prices

Apr 24, 2025

Newsom Calls On Oil Companies Amidst Soaring California Gas Prices

Apr 24, 2025 -

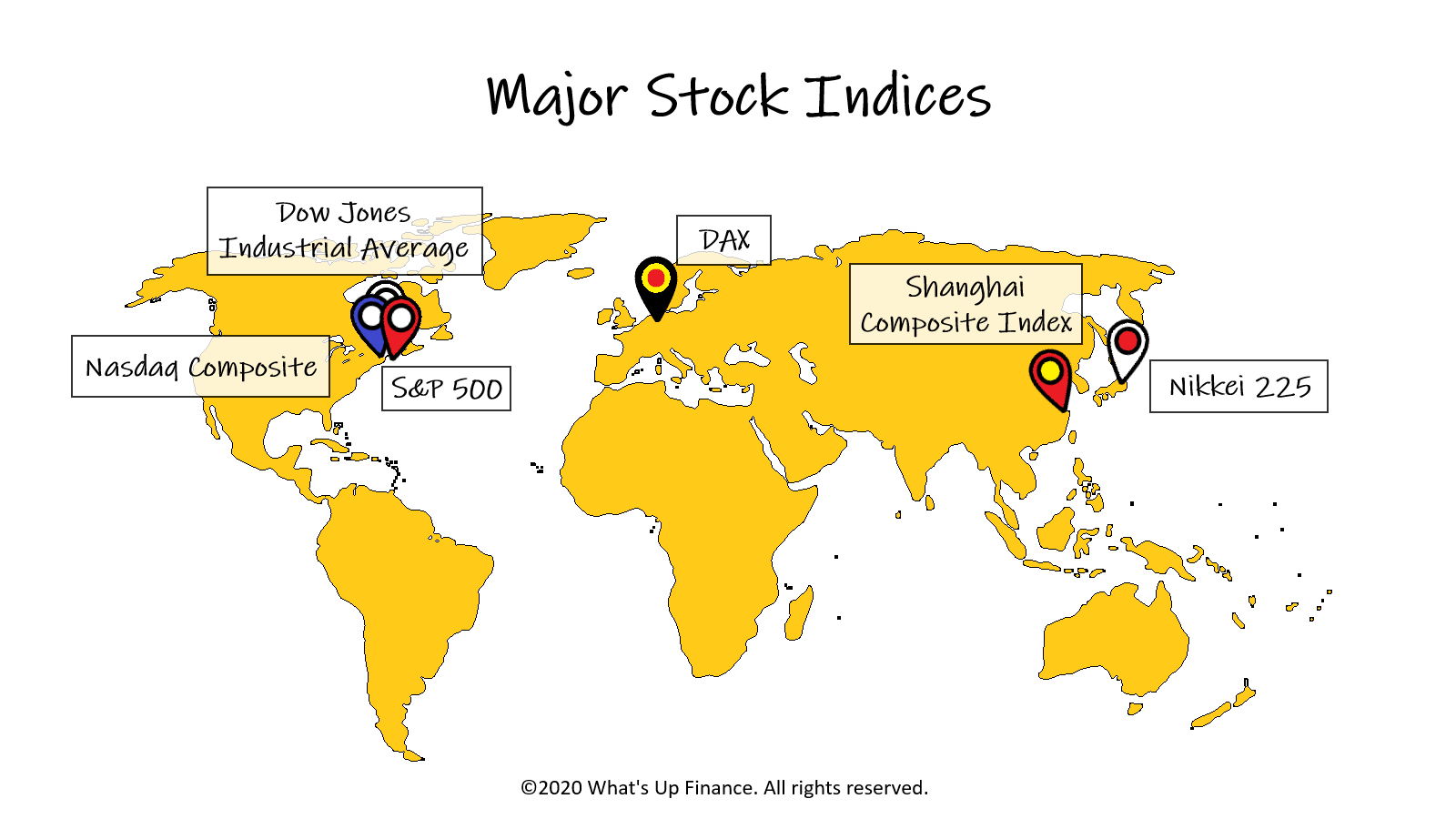

Stock Market Today Significant Gains Across Major Indices

Apr 24, 2025

Stock Market Today Significant Gains Across Major Indices

Apr 24, 2025