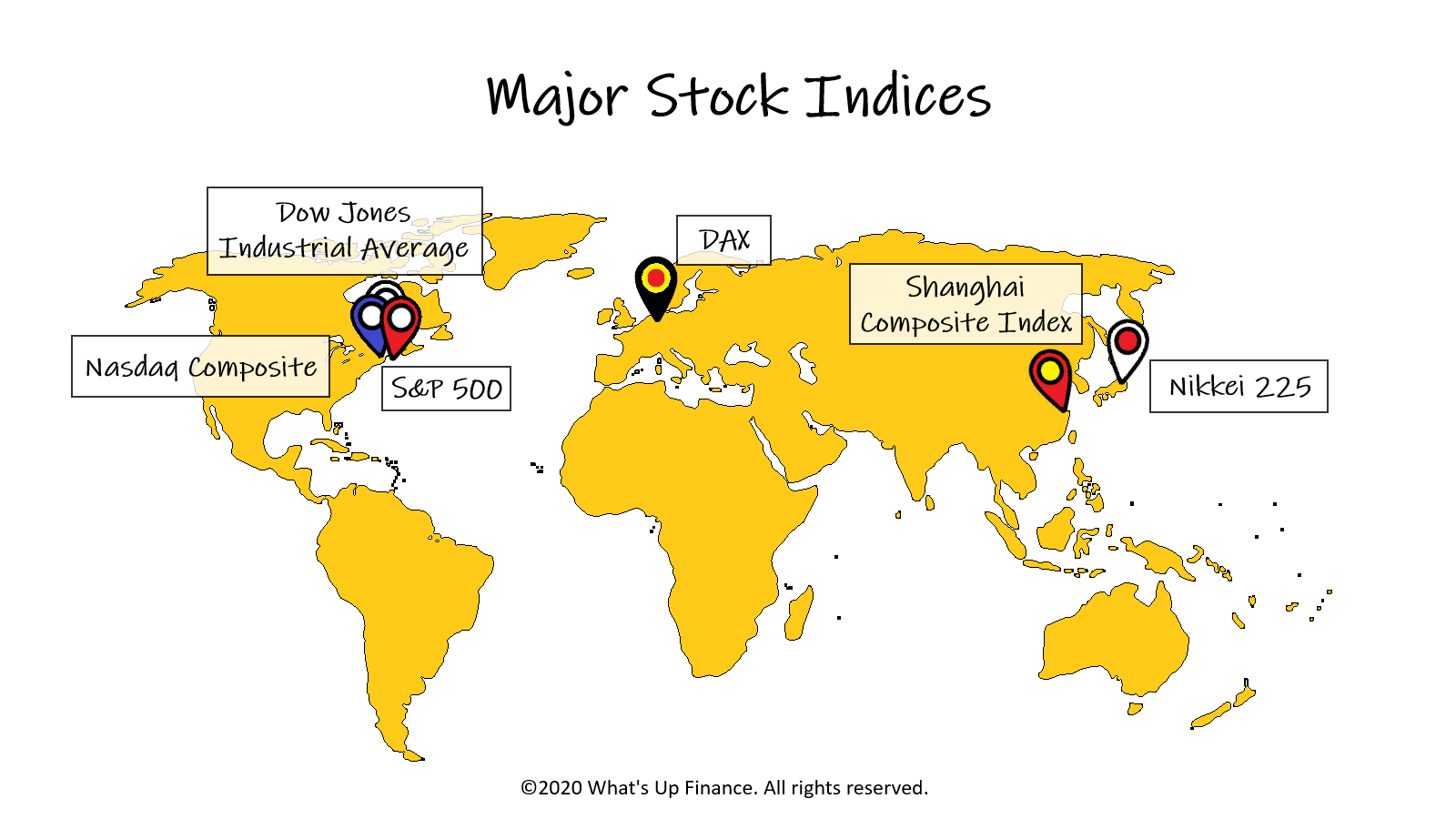

Stock Market Today: Significant Gains Across Major Indices

Table of Contents

Dow Jones Industrial Average Soars

The Dow Jones Industrial Average (DJIA) saw a substantial percentage increase today, closing significantly higher than yesterday's close. This impressive performance is a testament to the overall positive sentiment in the market.

-

Contributing Sectors: The tech, finance, and energy sectors were particularly strong contributors to the DJIA's performance. Strong earnings reports and positive outlooks from major companies within these sectors fueled the rally. The increased market volume in these sectors further indicates strong investor confidence.

-

Company-Specific News: Several major companies announced better-than-expected earnings results, boosting investor confidence and driving up stock prices. Positive outlook statements from key players also contributed significantly to the DJIA's gains. This positive news flow helped to overshadow any negative market sentiment.

-

Trading Activity and Volume: Today's significant price increase in the DJIA was accompanied by high trading volume, indicating strong investor participation and conviction in the upward trend. This high market volume suggests a robust and sustained rally, rather than a short-lived spike. Analyzing the trading activity across different sectors reveals the driving forces behind the DJIA's surge.

The DJIA's robust performance reflects a broader sense of investor confidence and optimism about the overall economic outlook. The surge in stock prices indicates a positive market sentiment and an expectation of continued growth.

S&P 500 and Nasdaq Composite Follow Suit

The positive trend observed in the Dow Jones wasn't isolated; the S&P 500 and Nasdaq Composite indices also experienced parallel upward movements, mirroring the broader market enthusiasm.

-

Sector Performance: The technology sector, a major component of both the S&P 500 and Nasdaq Composite, performed exceptionally well, driving a significant portion of the gains. Consumer discretionary stocks also saw strong performance, reflecting increasing consumer confidence. This strong S&P 500 performance, coupled with Nasdaq growth, paints a picture of broad-based market strength.

-

Broader Economic Indicators: The gains across these indices can be linked to positive economic indicators, such as encouraging employment data and easing concerns about inflation. Positive job growth and a slowing inflation rate have contributed to a more optimistic outlook among investors.

-

Catalysts for Growth: Several factors contributed to this synchronized growth. Positive earnings season, coupled with positive economic data, created a perfect storm for a market rally. The easing of geopolitical tensions also played a role in bolstering investor confidence.

Analyzing the Drivers of Today's Market Rally

Several underlying factors contributed to the significant gains observed across all major indices today. Understanding these factors is crucial for navigating the complexities of the stock market.

-

Positive Earnings Reports: Strong earnings reports from major corporations across various sectors provided a significant boost to investor confidence and fueled buying activity. These positive results reassured investors about the overall health of the economy.

-

Geopolitical Events and Policy Announcements: Favorable geopolitical developments and positive policy announcements played a supporting role in the market rally. Reduced uncertainty often leads to increased investor risk appetite.

-

Investor Sentiment and Risk Appetite: Improved investor sentiment and a higher risk appetite contributed to the upward trend. Investors were more willing to take on risk, leading to increased investment in equities. This shift in investor sentiment is reflected in the increased market volatility.

-

Interest Rate Decisions and Expectations: The prevailing interest rate environment and expectations regarding future monetary policy also played a role. Stable or even slightly lower interest rates can stimulate economic activity and investment.

Potential Implications and Future Outlook

While today's market performance is positive, it's crucial to maintain a cautious outlook and acknowledge the inherent volatility of the stock market.

-

Portfolio Diversification: Investors should maintain a well-diversified portfolio to mitigate risk and protect against potential market downturns. Proper risk management is crucial for long-term investment success.

-

Thorough Research: Before making any investment decisions, conducting thorough research is paramount. Understanding the financial health and future prospects of a company is vital.

-

Long-Term Investment Goals: Focusing on long-term investment goals and maintaining a disciplined investment strategy is crucial for weathering market fluctuations. Short-term market volatility should not derail your long-term plans.

Conclusion

Today's stock market witnessed significant gains across major indices like the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite. These gains reflect a combination of positive earnings, improved economic indicators, and positive investor sentiment. However, it’s crucial to remember the inherent volatility of the market.

Call to Action: Stay informed about the Stock Market Today and its fluctuations by regularly checking reputable financial news sources. Understanding the factors influencing the stock market today will help you make informed investment decisions and navigate the market effectively. Continue monitoring the stock market today for further updates.

Featured Posts

-

Cantors 3 Billion Crypto Spac Deal Tether And Soft Bank Involvement

Apr 24, 2025

Cantors 3 Billion Crypto Spac Deal Tether And Soft Bank Involvement

Apr 24, 2025 -

Living With A 77 Inch Lg C3 Oled Pros And Cons

Apr 24, 2025

Living With A 77 Inch Lg C3 Oled Pros And Cons

Apr 24, 2025 -

Private Credit Jobs 5 Dos And Don Ts To Increase Your Chances

Apr 24, 2025

Private Credit Jobs 5 Dos And Don Ts To Increase Your Chances

Apr 24, 2025 -

The Chinese Automotive Market Challenges And Opportunities For Global Brands Like Bmw And Porsche

Apr 24, 2025

The Chinese Automotive Market Challenges And Opportunities For Global Brands Like Bmw And Porsche

Apr 24, 2025 -

Securing Funding For Elite Universities In A Changing Political Landscape

Apr 24, 2025

Securing Funding For Elite Universities In A Changing Political Landscape

Apr 24, 2025