Strong Emerging Market Performance: A Sharp Contrast To The US Stock Market Decline

Table of Contents

Factors Driving Strong Emerging Market Performance

Several key factors contribute to the robust growth observed in emerging markets, creating a compelling narrative for investors seeking higher returns.

Economic Growth in Emerging Markets

Many emerging economies are experiencing impressive economic growth, fueled by various factors.

- India's Tech Boom: India's burgeoning technology sector is a major driver of its economic expansion, attracting significant foreign investment and creating numerous high-paying jobs. GDP growth consistently outpaces many developed nations.

- China's Post-Pandemic Recovery: China's reopening after strict COVID-19 lockdowns has spurred a significant rebound in its economy, boosting manufacturing and consumer spending. While facing headwinds, the sheer size of the Chinese economy ensures its impact on global markets.

- Brazil's Commodity Exports: Brazil, a major exporter of commodities like soybeans and iron ore, has benefited from high global demand, driving significant economic growth and strengthening its currency.

These examples illustrate a broader trend: strong GDP growth, coupled with increasing consumer spending and favorable inflation rates (relative to the US), are key drivers of strong emerging market performance.

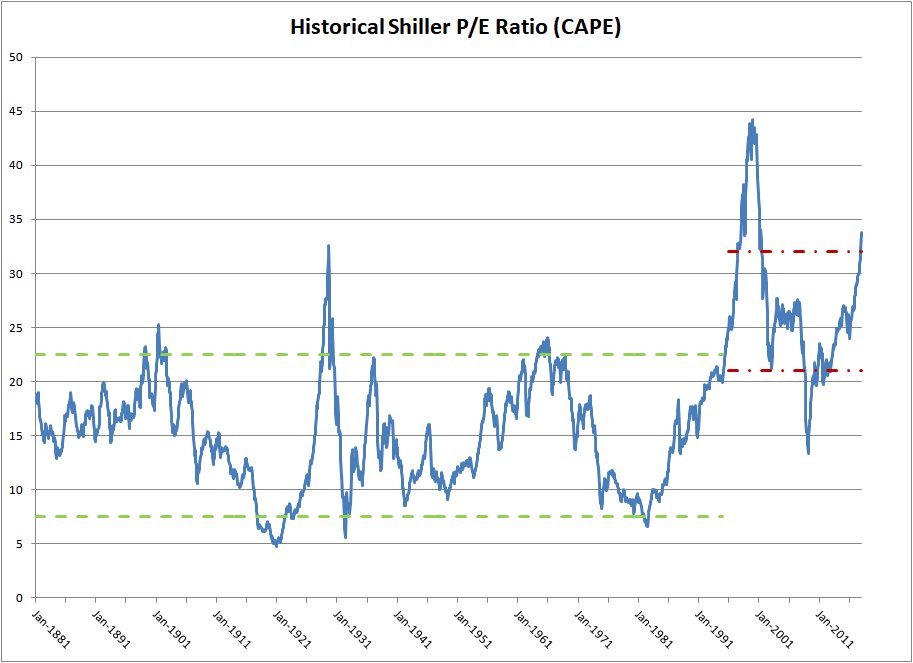

Attractive Valuations in Emerging Markets

Compared to their developed market counterparts, many emerging market stocks offer significantly more attractive valuations.

- Lower Price-to-Earnings Ratios: Price-to-earnings (P/E) ratios in emerging markets are often considerably lower than those in the US, suggesting that these stocks may be undervalued.

- Higher Potential Returns: This undervaluation translates to potentially higher returns for investors willing to take on the associated risks.

- Currency Fluctuations: While currency fluctuations can introduce volatility, strategic currency hedging can mitigate risks and even enhance returns for savvy investors.

These attractive valuations make emerging market stocks a compelling proposition for investors seeking long-term capital appreciation.

Increased Foreign Investment in Emerging Markets

The inflow of foreign capital into emerging markets is another significant factor driving their success.

- Diversification Strategies: Global investors are increasingly seeking to diversify their portfolios away from the US market, given the current economic climate. Emerging markets offer a unique opportunity for this diversification.

- Search for Higher Yields: Emerging markets often provide higher yields than developed markets, making them attractive to investors seeking to maximize returns.

- Geopolitical Events: While geopolitical events can negatively impact investment, some investors view emerging markets as offering resilience or even opportunities amidst global uncertainty. For example, certain emerging markets might benefit from reduced reliance on specific global supply chains.

Reasons for the US Stock Market Decline

The underperformance of the US stock market is attributable to several interconnected factors.

Inflation and Interest Rate Hikes

The aggressive interest rate hikes implemented by the Federal Reserve to combat inflation have significantly impacted US stock valuations.

- Higher Discount Rates: Higher interest rates increase the discount rate used in valuing future cash flows, leading to lower valuations for stocks.

- Impact on Tech Stocks: The technology sector, particularly growth stocks, has been particularly hard hit, as higher interest rates reduce the present value of future earnings.

- Correlation with Bond Yields: The rise in bond yields offers a competitive alternative to stocks, leading some investors to shift their allocations.

Geopolitical Uncertainty

Geopolitical risks, including the war in Ukraine and heightened US-China tensions, have created significant uncertainty in the US stock market.

- Investor Sentiment: Geopolitical uncertainty negatively impacts investor sentiment and risk appetite, leading to market volatility and declines.

- Supply Chain Disruptions: The war in Ukraine and other geopolitical events have disrupted global supply chains, contributing to inflationary pressures and impacting corporate earnings.

Recessionary Fears

Growing concerns about a potential recession in the US further weigh on market sentiment.

- Leading Economic Indicators: Indicators like the inverted yield curve and declining consumer confidence point to a potential economic slowdown.

- Impact on Corporate Earnings: A recession would likely lead to a decline in corporate earnings, further depressing stock prices.

Comparing Risk and Reward in Emerging vs. Developed Markets

Investing in emerging markets carries inherent risks, including political instability, currency volatility, and regulatory uncertainty. However, these risks are often accompanied by the potential for significantly higher rewards.

- Risk Assessment: A thorough risk assessment is crucial before investing in emerging markets. Understanding the political and economic landscape of each country is vital.

- Risk Mitigation: Diversification across multiple emerging markets and employing appropriate risk management strategies can help mitigate these risks.

- Reward Potential: The potential for higher returns in emerging markets must be weighed against the inherent risks.

Compared to the relatively lower risk but also lower potential returns of developed markets, emerging markets present a risk-reward profile that appeals to certain investor profiles.

Strong Emerging Market Performance – A Diversification Opportunity?

In summary, the strong emerging market performance stands in stark contrast to the decline in the US stock market. Factors like robust economic growth, attractive valuations, and increased foreign investment in emerging markets contribute to their success. Conversely, inflation, interest rate hikes, geopolitical uncertainty, and recessionary fears weigh on the US market.

Given the compelling reasons outlined above, consider exploring the opportunities presented by strong emerging market performance to potentially enhance your portfolio's growth and diversification. Diversifying into emerging markets investment can offer a compelling counterbalance to the risks associated with solely focusing on developed markets. Thorough research and a well-defined investment strategy are essential for maximizing the potential benefits of strong emerging market performance opportunities.

Featured Posts

-

Stock Market Valuations Bof As Rationale For Investor Calm

Apr 24, 2025

Stock Market Valuations Bof As Rationale For Investor Calm

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Wednesday April 23 Finns Vow To Liam

Apr 24, 2025

The Bold And The Beautiful Spoilers Wednesday April 23 Finns Vow To Liam

Apr 24, 2025 -

Land Your Dream Private Credit Job 5 Crucial Dos And Don Ts

Apr 24, 2025

Land Your Dream Private Credit Job 5 Crucial Dos And Don Ts

Apr 24, 2025 -

The Bold And The Beautiful April 23 Finn Vows To Liam Spoilers Revealed

Apr 24, 2025

The Bold And The Beautiful April 23 Finn Vows To Liam Spoilers Revealed

Apr 24, 2025 -

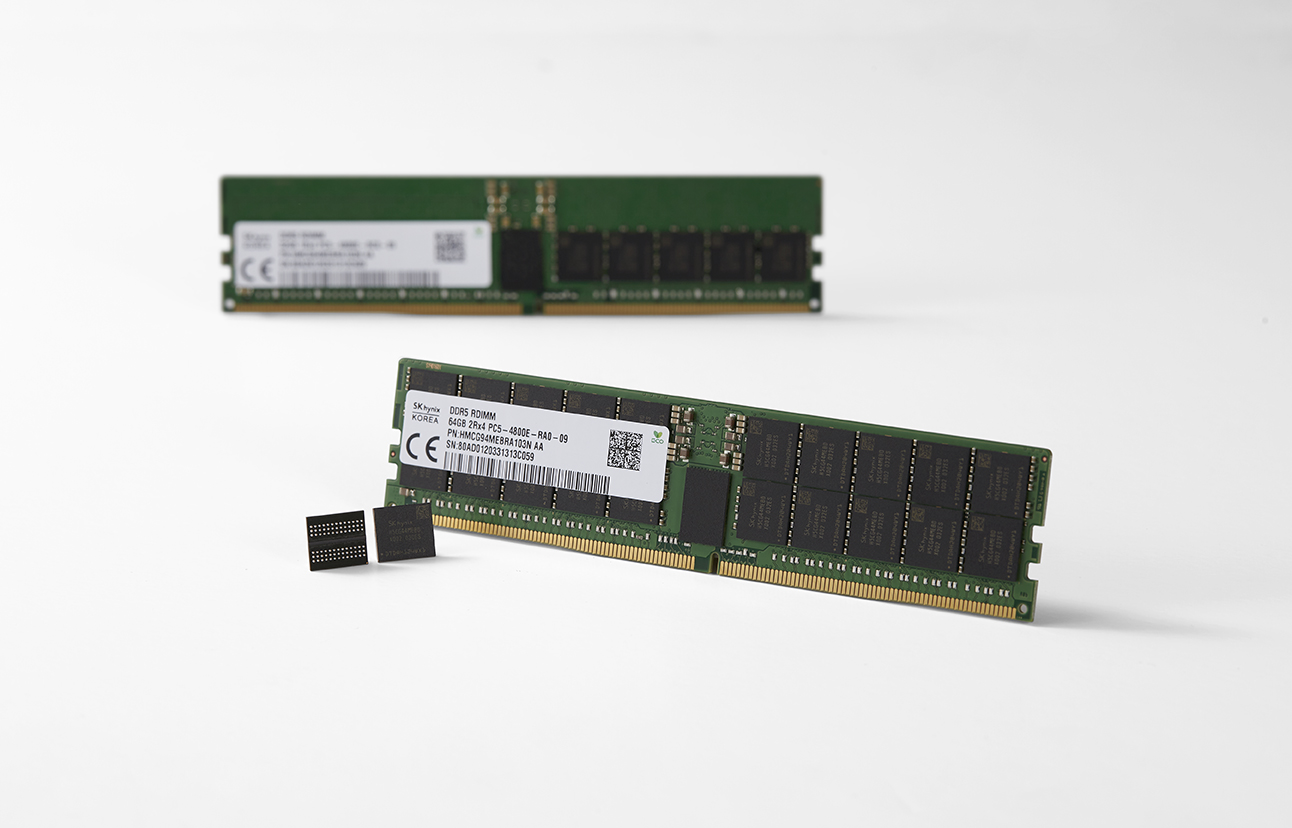

Sk Hynix Emerges As Dram Leader The Impact Of Artificial Intelligence

Apr 24, 2025

Sk Hynix Emerges As Dram Leader The Impact Of Artificial Intelligence

Apr 24, 2025