Land Your Dream Private Credit Job: 5 Crucial Do's & Don'ts

Table of Contents

5 Crucial Do's to Land Your Dream Private Credit Job

Do Your Research: Understand the Private Credit Landscape

Before even thinking about applying for a private credit job, you need a deep understanding of the market. This goes beyond simply knowing what private credit is.

- Thoroughly research different private credit firms: Investigate various types of firms, including hedge funds specializing in distressed debt, private equity firms with dedicated credit arms, and independent credit funds. Understand their investment strategies, sizes, and cultures.

- Understand investment strategies, deal flow, and target asset classes: Familiarize yourself with different strategies like direct lending, mezzanine financing, and distressed debt investing. Analyze the typical deal flow within these strategies and the types of assets they target (e.g., real estate, infrastructure, corporate debt).

- Identify your ideal firm culture and career progression path within private credit: Different firms have vastly different cultures. Some are highly entrepreneurial, while others are more corporate. Research career paths to determine if a firm offers opportunities for growth that align with your ambitions. Use resources like Glassdoor and LinkedIn to gain insights into firm culture.

- Keywords: private credit firms, private credit investment strategies, private credit career path, private credit fund.

Network Strategically: Build Connections in Private Credit

Networking is paramount in the private credit industry. It's not just about who you know; it's about building genuine relationships.

- Attend industry events and conferences: Participate in events like the SuperReturn conferences, industry-specific workshops, and local networking events. These provide excellent opportunities to connect with professionals and learn about new trends.

- Leverage LinkedIn: Optimize your LinkedIn profile to highlight your skills and experience relevant to private credit. Actively connect with professionals in the industry, engage in relevant groups, and participate in discussions.

- Informational interviews: Reach out to people working in private credit for informational interviews. This allows you to learn about their roles, companies, and the industry in general, while making valuable connections.

- Keywords: private credit networking, private credit industry events, LinkedIn private credit, private credit connections.

Tailor Your Resume and Cover Letter: Highlight Relevant Skills

Generic applications won't cut it in the competitive private credit job market. Every application needs to be tailored to the specific firm and role.

- Customize your resume and cover letter: Don't just change the company name; rewrite your resume and cover letter to emphasize the skills and experiences most relevant to the specific job description.

- Showcase relevant skills using quantifiable results: Instead of simply stating you have experience in financial modeling, quantify your achievements. For example, "Developed financial models resulting in a 15% improvement in deal valuation accuracy."

- Emphasize experience related to private credit, even if from other sectors: Any experience in finance, accounting, credit analysis, or even related fields (e.g., real estate, legal) can be relevant. Highlight transferable skills.

- Keywords: private credit resume, private credit cover letter, financial modeling private credit, credit analysis, valuation techniques.

Master the Interview Process: Prepare for Technical and Behavioral Questions

The interview process for private credit jobs is rigorous, testing your technical skills and your personality.

- Practice answering common private credit interview questions: Prepare for both technical questions (e.g., DCF modeling, LBO modeling, credit analysis) and behavioral questions (e.g., "Tell me about a time you failed," "Why private credit?").

- Demonstrate strong analytical skills, problem-solving abilities, and understanding of financial markets: Private credit requires a strong analytical mind. Be prepared to showcase your ability to think critically and solve complex problems.

- Prepare insightful questions to ask the interviewer: Asking thoughtful questions shows your genuine interest and engagement.

- Keywords: private credit interview questions, private credit interview tips, private credit interview preparation.

Follow Up Effectively: Show Your Continued Interest

Following up demonstrates your persistence and genuine interest.

- Send a thank-you note after each interview: A personalized thank-you note reiterates your interest and allows you to highlight key points from the conversation.

- Follow up with the recruiter or hiring manager after a reasonable timeframe: Don't be overly persistent, but a follow-up email a week or two after the interview is appropriate.

- Demonstrate your persistence and genuine interest in the private credit job: Your enthusiasm should be evident throughout the process.

- Keywords: private credit interview follow up, private credit job application.

5 Crucial Don'ts to Avoid When Seeking a Private Credit Job

Don't Neglect the Fundamentals: Mastering Core Financial Concepts

A strong foundation in finance is non-negotiable.

- Lacking a strong foundation in accounting, finance, and valuation techniques: Ensure you understand core financial statements, valuation methodologies (DCF, precedent transactions, etc.), and credit analysis techniques.

- Not understanding different credit instruments and risk assessment methodologies: Familiarize yourself with different types of debt instruments, credit ratings, and risk assessment frameworks.

- Keywords: financial modeling, credit analysis, valuation techniques, discounted cash flow (DCF).

Don't Underestimate the Importance of Networking

Relying solely on online job boards significantly limits your chances.

- Relying solely on online job boards: While job boards can be helpful, networking significantly increases your chances of finding hidden opportunities.

- Failing to build relationships within the private credit community: Actively network and build relationships with professionals in the field.

- Keywords: private credit networking, private credit connections.

Don't Submit Generic Applications: Tailor Your Materials

A cookie-cutter approach won't impress anyone.

- Submitting the same resume and cover letter for every application: Each application should be tailored to the specific firm and role.

- Not researching the specific firm and role: Understand the firm's investment strategy, portfolio, and the specific responsibilities of the role you're applying for.

- Keywords: private credit resume, private credit cover letter, tailored application.

Don't Be Unprepared for the Interview: Practice Makes Perfect

Thorough preparation is key to success.

- Insufficient preparation for technical and behavioral questions: Practice answering common interview questions and prepare for technical challenges.

- Lacking understanding of the firm's investment strategy and portfolio: Research the firm thoroughly before the interview.

- Keywords: private credit interview preparation, private credit interview questions.

Don't Neglect to Follow Up: Stay Top of Mind

Following up shows your continued interest and professionalism.

- Failing to send thank-you notes after interviews: Always send a personalized thank-you note after each interview.

- Not following up after the interview process: A polite follow-up email can help keep your application top-of-mind.

- Keywords: private credit job application, follow-up.

Conclusion: Secure Your Dream Private Credit Job

Securing your dream private credit job requires a multifaceted approach. By diligently following the "do's" and avoiding the "don'ts" outlined above – focusing on thorough research, strategic networking, tailored applications, meticulous interview preparation, and consistent follow-up – you significantly increase your chances of landing your ideal private credit position. Implement these strategies, actively pursue your goals, and you’ll be well on your way to securing your dream private credit career and landing your private credit dream job. Don't delay; start building your private credit career today!

Featured Posts

-

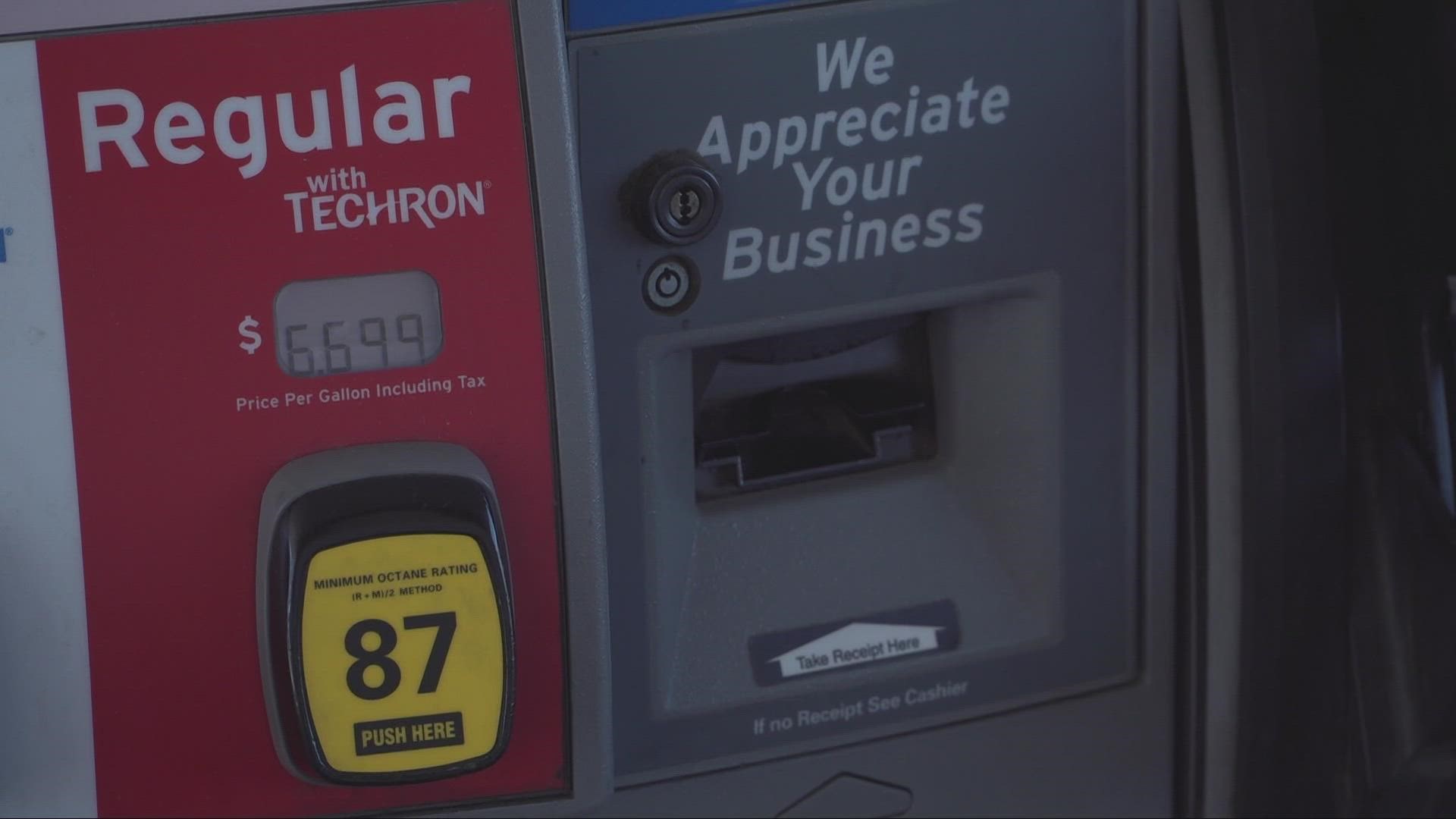

California Gas Prices Soar Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025

California Gas Prices Soar Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025 -

Bold And The Beautiful Liam And Steffys Future Hopes Double Trouble Lunas Game Plan

Apr 24, 2025

Bold And The Beautiful Liam And Steffys Future Hopes Double Trouble Lunas Game Plan

Apr 24, 2025 -

Village Roadshows 417 5 Million Deal Approved Alcons Stalking Horse Bid Wins

Apr 24, 2025

Village Roadshows 417 5 Million Deal Approved Alcons Stalking Horse Bid Wins

Apr 24, 2025 -

Startup Airlines Controversial Use Of Deportation Flights

Apr 24, 2025

Startup Airlines Controversial Use Of Deportation Flights

Apr 24, 2025 -

Compare Google Fis 35 Unlimited Plan To Competitors

Apr 24, 2025

Compare Google Fis 35 Unlimited Plan To Competitors

Apr 24, 2025