Stock Market Valuations: BofA's Rationale For Investor Calm

Table of Contents

BofA's Current Market Valuation Assessment

BofA, in several recent reports, has expressed a view that current stock market valuations are, while not necessarily cheap, not excessively overvalued either. They suggest a relatively balanced perspective, considering a variety of economic indicators. Their assessment differs from some analysts who predict a significant market downturn.

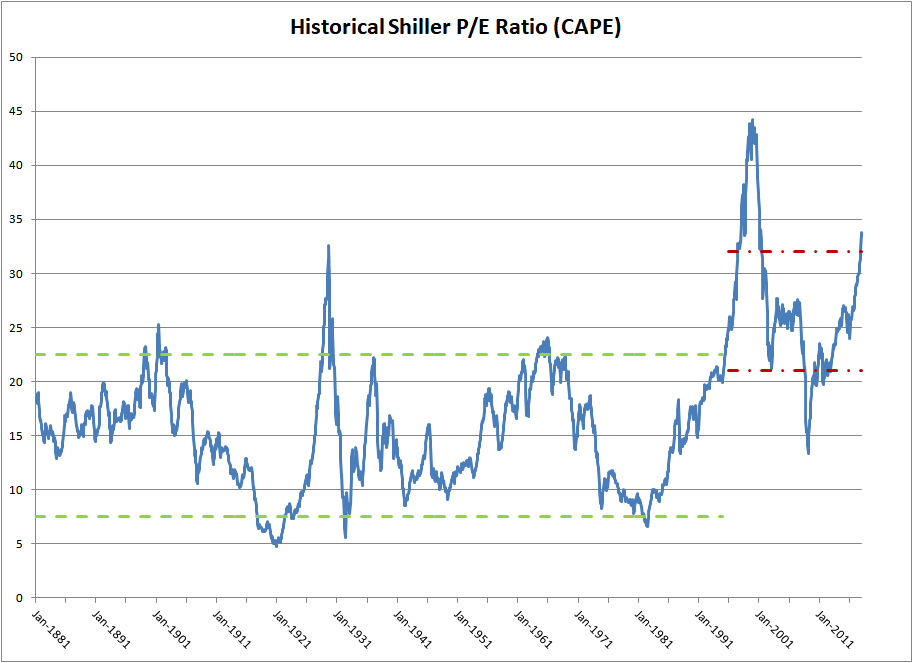

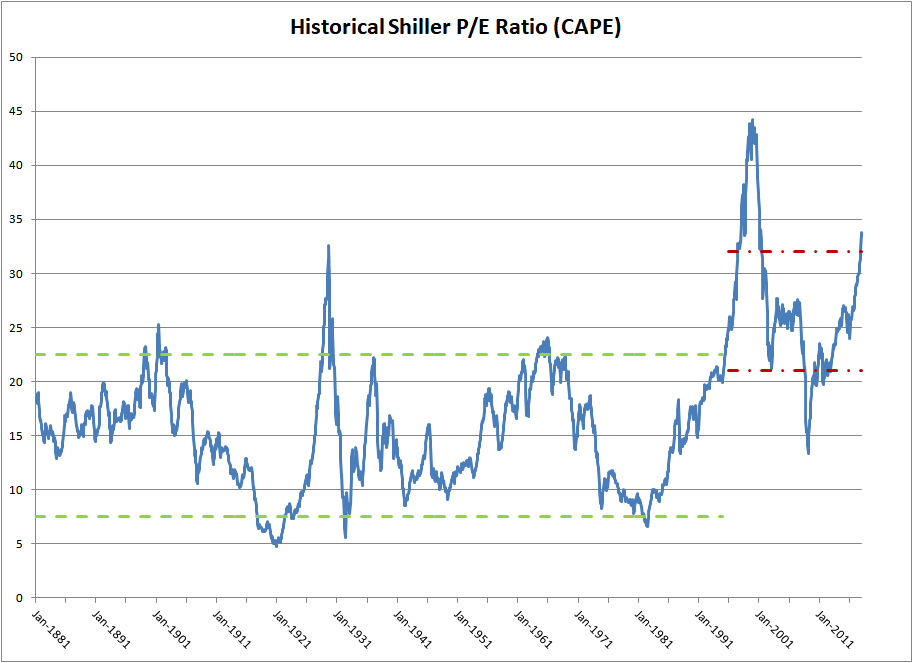

- Key Valuation Metrics: BofA's analysis incorporates various metrics, including Price-to-Earnings ratios (P/E), the cyclically adjusted price-to-earnings ratio (CAPE, or Shiller PE), and other fundamental analyses. Their interpretation suggests that while some sectors show higher valuations, overall, the market isn't drastically overpriced compared to historical averages, considering current earnings growth projections.

- Sectoral Outlook: While BofA sees potential in various sectors, they may highlight specific areas like technology or healthcare as particularly attractive, while perhaps expressing some caution regarding sectors heavily impacted by interest rate hikes, such as real estate. Their reports often specify these details.

- Market Sentiment Divergence: BofA's relatively sanguine view often contrasts with prevailing market sentiment, which can be more bearish at times of uncertainty. This divergence underscores the importance of independent analysis and considering multiple viewpoints when assessing stock market valuations.

Factors Contributing to BofA's Calm Assessment

BofA's positive outlook is underpinned by several key factors:

Strong Corporate Earnings

Robust corporate earnings play a significant role in supporting current valuations. Many companies have reported strong results, demonstrating resilience in the face of economic headwinds.

- High-Performing Sectors: Sectors like technology, despite recent setbacks, and healthcare have shown consistent strength, buoyed by innovation and robust demand. Specific companies within these sectors often feature in BofA's analysis.

- Projected Earnings Growth: BofA’s models often incorporate projected earnings growth for the coming quarters and years. These projections, although subject to uncertainty, contribute significantly to their valuation assessments. Positive revisions to earnings estimates often lead to higher valuations.

- Earnings Revisions: Positive earnings revisions—when companies outperform expectations—have a direct impact on stock market valuations, influencing P/E ratios and other valuation metrics used by BofA and other analysts in evaluating stock market valuations.

Interest Rate Expectations and Their Impact

BofA’s view on interest rates significantly influences their assessment of stock market valuations.

- Interest Rate Predictions: BofA's economists regularly publish predictions for future interest rate hikes or cuts by central banks. These predictions directly impact their valuation models, as higher rates typically depress valuations.

- Rate Predictions and Valuation Models: The predicted trajectory of interest rates is a crucial input in discounted cash flow models and other valuation methods used by BofA. Their models attempt to account for the impact of different rate scenarios on future company earnings and thus, stock prices.

- Inflation's Impact: Inflation is a key consideration. BofA's analysis considers the impact of inflation on corporate profitability and the overall economy, influencing their assessment of fair stock market valuations. High inflation can erode earnings and increase borrowing costs.

Geopolitical and Macroeconomic Factors

BofA's valuation analysis carefully weighs geopolitical risks and macroeconomic uncertainties.

- Geopolitical Events: Events like the war in Ukraine and ongoing trade tensions are considered for their potential impact on global markets and company earnings. These geopolitical risks are factored into the overall assessment of stock market valuations.

- Macroeconomic Factors: Macroeconomic factors, such as inflation, recession risks, and potential supply chain disruptions, are all integral parts of BofA’s assessment. These factors influence their long-term predictions and therefore their view on current stock market valuations.

- Uncertainty Incorporation: BofA's models attempt to incorporate these uncertainties through sensitivity analysis and scenario planning. They acknowledge the inherent risks associated with these factors, but their overall assessment might reflect a belief that these risks are already largely priced into the market.

Potential Risks and Cautions from BofA

While BofA maintains a relatively calm outlook, they acknowledge potential risks.

- Identified Risks: These could include persistent high inflation, a deeper-than-expected recession, or weaknesses in specific sectors. BofA typically highlights these in their reports.

- Risk Incorporation in Models: These risks are often incorporated into their valuation models through various methods, including stress testing and scenario analysis.

- Risk Mitigation Strategies: BofA might suggest strategies for mitigating these risks, such as diversifying investments or adjusting portfolio allocations based on changing economic conditions. This is generally advice rather than a prediction concerning stock market valuations.

Conclusion

BofA's rationale for investor calm rests on several pillars: strong corporate earnings, a considered view of interest rate expectations, and a measured assessment of geopolitical and macroeconomic factors impacting stock market valuations. Their analysis suggests that, despite market volatility, current valuations are not excessively high when taking these factors into account. However, while BofA's analysis provides a perspective, it's crucial to remember that the stock market is inherently unpredictable.

While BofA's analysis suggests a reason for calm, thorough due diligence is always recommended. Conduct your own research and understand the intricacies of stock market valuations before making any investment decisions. Stay informed about evolving market conditions and regularly review your investment strategy to ensure it aligns with your risk tolerance and financial goals. Remember to carefully consider your personal circumstances when evaluating stock market valuations.

Featured Posts

-

Navigate The Private Credit Boom 5 Key Dos And Don Ts For Job Seekers

Apr 24, 2025

Navigate The Private Credit Boom 5 Key Dos And Don Ts For Job Seekers

Apr 24, 2025 -

Lab Owners Guilty Plea Faked Covid Test Results During Pandemic

Apr 24, 2025

Lab Owners Guilty Plea Faked Covid Test Results During Pandemic

Apr 24, 2025 -

Turning Poop Into Podcast Gold An Ai Powered Solution For Repetitive Documents

Apr 24, 2025

Turning Poop Into Podcast Gold An Ai Powered Solution For Repetitive Documents

Apr 24, 2025 -

Microsoft Activision Deal Ftc Files Appeal

Apr 24, 2025

Microsoft Activision Deal Ftc Files Appeal

Apr 24, 2025 -

Canadian Auto Dealers Propose Five Point Plan Amidst Us Trade War

Apr 24, 2025

Canadian Auto Dealers Propose Five Point Plan Amidst Us Trade War

Apr 24, 2025