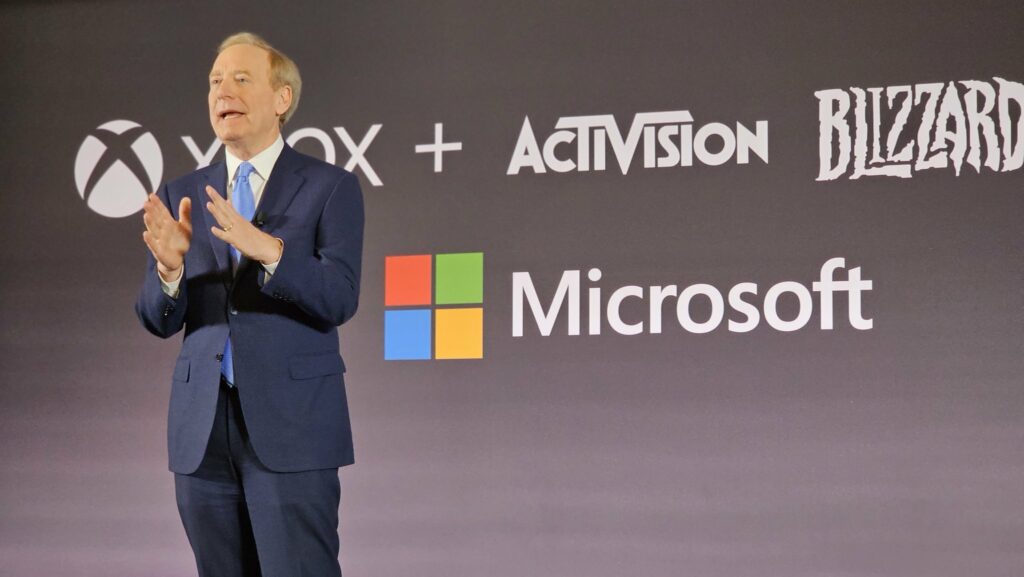

FTC To Appeal Activision Blizzard Acquisition Decision

Table of Contents

The FTC's Case Against the Activision Blizzard Acquisition

The FTC's lawsuit aimed to prevent the merger, arguing it would create an anti-competitive environment within the gaming industry, granting Microsoft an unfair advantage.

Concerns Regarding Anti-Competitive Practices

The FTC argued the merger would harm competition in several ways:

- Call of Duty Exclusivity: Microsoft's potential to make Call of Duty exclusive to its Xbox ecosystem, significantly harming PlayStation players and potentially other platforms. This would give Xbox a considerable competitive edge.

- Impact on Subscription Services: The merger's impact on subscription services like Xbox Game Pass. The FTC worried that bundling Activision Blizzard's titles exclusively with Game Pass would create an insurmountable barrier for competitors.

- Reduced Competition for Game Developers: The acquisition could reduce competition for game developers, potentially leading to lower salaries and fewer opportunities. The merger could stifle innovation by consolidating power in the hands of one company.

- Harm to Consumers: Ultimately, the FTC argued the merger would harm consumers through higher prices, reduced choice, and a less innovative gaming market. This could manifest in less variety, fewer competitive pricing strategies, and a decrease in overall quality.

The Judge's Ruling and its Implications

A judge dismissed the FTC's lawsuit, ruling that the evidence presented was insufficient to prove anti-competitive behavior.

- Analysis of the Judge's Reasoning: The judge's reasoning focused on the lack of concrete evidence demonstrating Microsoft's intent to stifle competition, particularly regarding Call of Duty.

- Key Arguments: Microsoft argued that making Call of Duty exclusive would be financially damaging, and they committed to keeping it multi-platform. The FTC, however, countered that such commitments were unreliable and easily reversed.

- Legal Precedents: The ruling’s interpretation of antitrust laws in the context of the gaming industry sets a significant precedent for future merger cases. The legal community will scrutinize this decision carefully.

The FTC's Appeal and its Potential Outcomes

The FTC's appeal challenges the judge's interpretation of the evidence and the application of antitrust laws to the gaming industry.

The Grounds for Appeal

The FTC's appeal is likely to focus on:

- Specific Points of Contention: The FTC will likely challenge the judge's assessment of the evidence, especially regarding the potential for anti-competitive behavior surrounding Call of Duty.

- New Evidence: The appeal process might include presenting new evidence or arguments not included in the original lawsuit, further strengthening their case.

- Appeal Timeline: The appeal process could take months or even years, significantly delaying or even preventing the acquisition's completion.

Potential Impacts on the Acquisition

The appeal could have several significant impacts:

- Settlement: Microsoft and the FTC might reach a settlement, involving concessions from Microsoft to address the FTC's concerns.

- Financial Implications: The legal battle incurs substantial financial costs for both companies, potentially influencing their future strategies.

- Impact on Activision Blizzard: The uncertainty affects Activision Blizzard's employees and shareholders, creating instability within the company.

Broader Implications for the Gaming Industry

The FTC's appeal has far-reaching implications for the future of gaming.

The Future of Gaming Mergers and Acquisitions

This appeal sets a precedent for future mergers and acquisitions:

- Regulatory Oversight: The case intensifies scrutiny on regulatory bodies' roles in overseeing large-scale gaming mergers. This will influence how future deals are assessed and approved.

- Investor Confidence: The appeal's outcome impacts investor confidence in the gaming sector, potentially influencing future investment decisions.

- Increased Scrutiny: Other major acquisitions in the gaming industry will likely face increased regulatory scrutiny in the wake of this case.

The Impact on Gamers

The appeal's outcome directly impacts millions of gamers:

- Game Pricing and Availability: The outcome could affect game pricing and availability across different platforms.

- Subscription Services: Changes in subscription services and access to games are possible outcomes of this legal battle.

- Competition and Innovation: The long-term effects on competition and innovation in the gaming market are significant and still uncertain.

Conclusion

The FTC's appeal of the Activision Blizzard acquisition is a watershed moment. The outcome will significantly shape the future of gaming mergers, regulatory oversight, and the competitive landscape for years. This landmark FTC appeal of the Activision Blizzard acquisition highlights the critical need for constant monitoring of large-scale mergers to maintain competition and a vibrant gaming environment for all. Stay informed about further developments in this important case.

Featured Posts

-

Exclusive Examining The Leadership Of Klaus Schwab At The World Economic Forum

Apr 24, 2025

Exclusive Examining The Leadership Of Klaus Schwab At The World Economic Forum

Apr 24, 2025 -

Cantors 3 Billion Crypto Spac Deal Tether And Soft Bank Involvement

Apr 24, 2025

Cantors 3 Billion Crypto Spac Deal Tether And Soft Bank Involvement

Apr 24, 2025 -

Five Point Plan Unveiled Canadian Auto Dealers Respond To Us Trade War

Apr 24, 2025

Five Point Plan Unveiled Canadian Auto Dealers Respond To Us Trade War

Apr 24, 2025 -

Liams Uncharacteristic Actions And Bridgets Shocking Find The Bold And The Beautiful April 16 Recap

Apr 24, 2025

Liams Uncharacteristic Actions And Bridgets Shocking Find The Bold And The Beautiful April 16 Recap

Apr 24, 2025 -

Stonewalling Ends Judge Abrego Garcias Ruling Against Us Lawyers

Apr 24, 2025

Stonewalling Ends Judge Abrego Garcias Ruling Against Us Lawyers

Apr 24, 2025