Navigate The Private Credit Boom: 5 Key Do's And Don'ts For Job Seekers

Table of Contents

Do: Network Strategically within the Private Credit Industry

Building a strong network is crucial for securing a private credit job. The industry is relationship-driven, and knowing the right people can significantly improve your chances.

Leverage LinkedIn:

Optimize your LinkedIn profile to become a magnet for recruiters seeking private credit professionals. Include keywords like "private credit," "debt financing," "alternative lending," "credit analysis," "fund manager," "portfolio manager," "underwriting," "structured finance," and other relevant industry terms.

- Connect with recruiters specializing in private credit placements: Many recruitment firms focus solely on the private credit sector. Identify these firms and actively connect with their recruiters on LinkedIn.

- Attend industry conferences and webinars: These events provide excellent networking opportunities to meet potential employers and learn about the latest trends in private credit investing. Look for events focusing on areas like direct lending, distressed debt, or mezzanine financing.

- Follow key players and companies in the private credit space on social media: Staying updated on industry news and engaging with thought leaders builds awareness and can lead to unexpected connections.

Utilize Your Existing Network:

Don't underestimate the power of your existing network. Let your contacts know you're seeking private credit jobs. Word-of-mouth referrals are incredibly valuable.

- Inform your former colleagues, professors, and mentors of your job search: They might have connections within the private credit industry or know someone who does.

- Attend industry-related alumni events: Networking with alumni from your university can unlock hidden opportunities within the private credit sector.

Do: Highlight Relevant Skills and Experience

Your resume and cover letter are your first impression. Make them count by showcasing your skills and experience in a way that resonates with private credit employers.

Tailor Your Resume and Cover Letter:

Don't use a generic resume. Customize each application to match the specific requirements and keywords mentioned in the job description.

- Emphasize experience in financial analysis, underwriting, portfolio management, or related fields: Highlight any relevant experience, even if from seemingly unrelated sectors.

- Quantify your achievements whenever possible: Instead of saying "Improved efficiency," say "Increased portfolio returns by 15% through improved risk assessment and portfolio diversification."

- Showcase your knowledge of relevant financial modeling software: Mention proficiency in Excel, Bloomberg Terminal, Argus, and other industry-standard tools.

Showcase Your Understanding of Private Credit:

Demonstrate your knowledge of different private credit strategies to show you're not just applying for any finance job.

- Clearly articulate your understanding of direct lending, mezzanine financing, distressed debt, and other private credit strategies.

- Show you understand the nuances of different capital structures and risk profiles.

Do: Prepare for Behavioral and Technical Interviews

Private credit interviews are rigorous. Preparation is key to success.

Practice Common Interview Questions:

Anticipate questions about your experience, skills, and understanding of the private credit market. Use the STAR method (Situation, Task, Action, Result) to structure your responses.

- Research the firm and interviewer beforehand: Demonstrate your interest by understanding their investment strategy and recent deals.

- Practice your responses to behavioral questions: Be prepared to answer questions about your strengths, weaknesses, teamwork abilities, and how you handle pressure.

- Be ready to discuss your salary expectations and career goals: Research industry salary ranges to ensure you're prepared to negotiate effectively.

Master Technical Interview Skills:

Private credit interviews often include technical questions to assess your financial acumen.

- Brush up on your accounting, finance, and valuation knowledge: Review concepts like discounted cash flow (DCF) analysis, leveraged buyouts (LBOs), and credit risk assessment.

- Practice case studies related to private credit investments: Prepare for case studies that assess your analytical and problem-solving skills.

Don't: Neglect Due Diligence on Potential Employers

Before accepting a job offer, thoroughly research the firm.

Research Firm Reputation and Culture:

A good fit is crucial for long-term success.

- Review the firm's website and recent news articles: Understand their investment strategy and recent performance.

- Check employee reviews on platforms like Glassdoor: Get an insider's perspective on the company culture and work environment.

- Network with current or former employees: Reach out to people who work or have worked at the firm to gather firsthand information.

Rush into Accepting a Job Offer:

Take your time to evaluate each offer carefully. Don't let pressure influence your decision.

- Compare offers based on compensation, benefits, career growth potential, and overall company culture.

- Negotiate terms if necessary.

Don't: Underestimate the Importance of Continuing Education

The private credit market is constantly evolving. Continuous learning is essential to stay competitive.

Pursue Relevant Certifications:

Relevant certifications significantly enhance your credentials and demonstrate your commitment to the field.

- Consider pursuing the Chartered Financial Analyst (CFA) charter or the Financial Risk Manager (FRM) certification.

- Attend industry-specific workshops and training programs.

- Keep your skills sharp by continually learning about new trends and developments in the private credit market through industry publications and online resources.

Conclusion

The private credit job market presents exciting opportunities, but success requires a strategic approach. By following these do's and don'ts, you can significantly increase your chances of landing your dream job in this dynamic field. Remember to network effectively, highlight your skills, prepare thoroughly for interviews, conduct due diligence on potential employers, and prioritize continued learning. Start your journey to secure your ideal position in the booming world of private credit jobs today!

Featured Posts

-

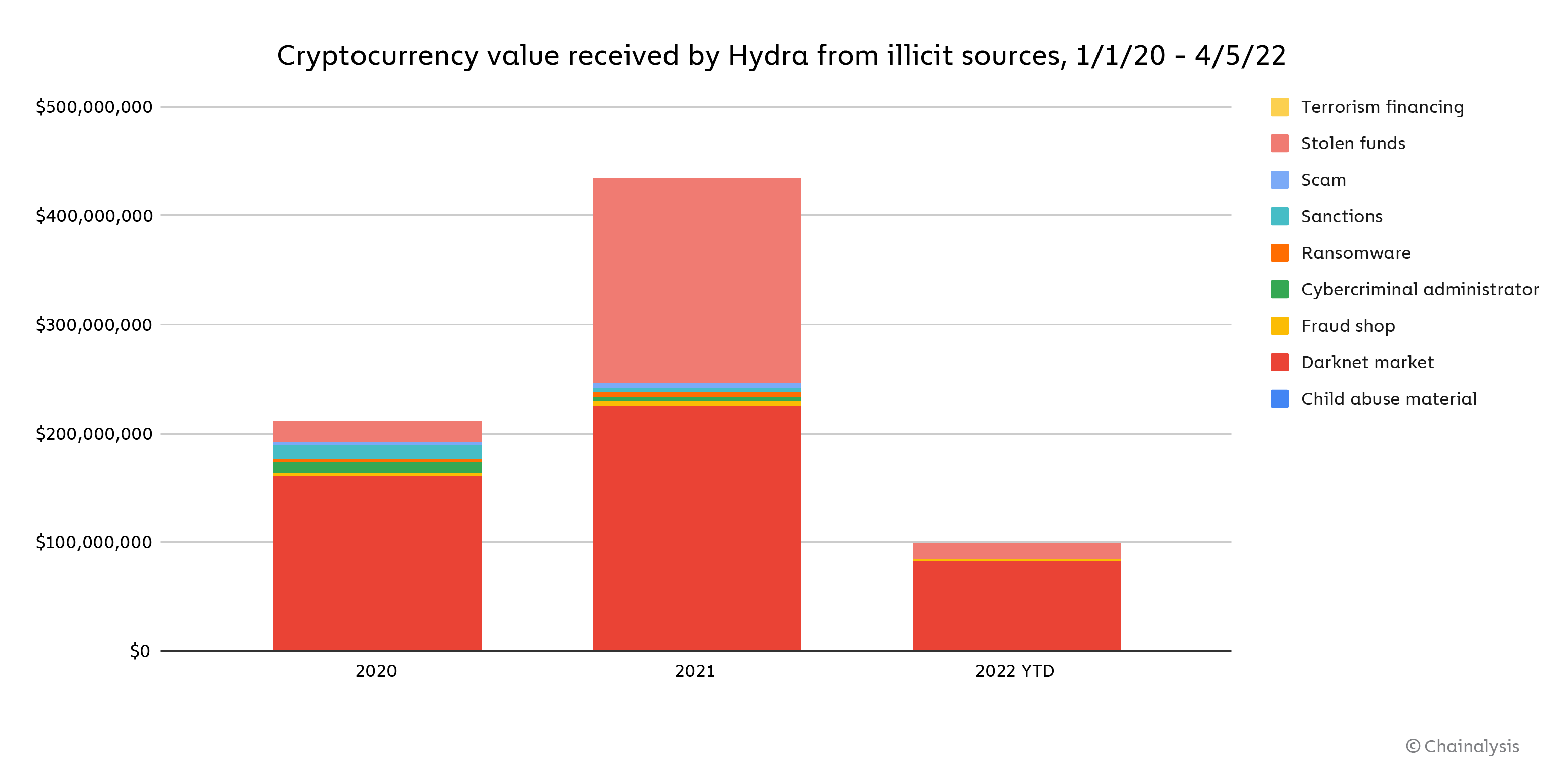

How Chainalysis Acquisition Of Alterya Will Shape The Future Of Blockchain

Apr 24, 2025

How Chainalysis Acquisition Of Alterya Will Shape The Future Of Blockchain

Apr 24, 2025 -

Ai Digest Creating A Podcast From Repetitive Scatological Documents

Apr 24, 2025

Ai Digest Creating A Podcast From Repetitive Scatological Documents

Apr 24, 2025 -

Compare Google Fis 35 Unlimited Plan To Competitors

Apr 24, 2025

Compare Google Fis 35 Unlimited Plan To Competitors

Apr 24, 2025 -

The Bold And The Beautiful Thursday April 3rd Recap Liams Collapse And Hopes New Living Situation

Apr 24, 2025

The Bold And The Beautiful Thursday April 3rd Recap Liams Collapse And Hopes New Living Situation

Apr 24, 2025 -

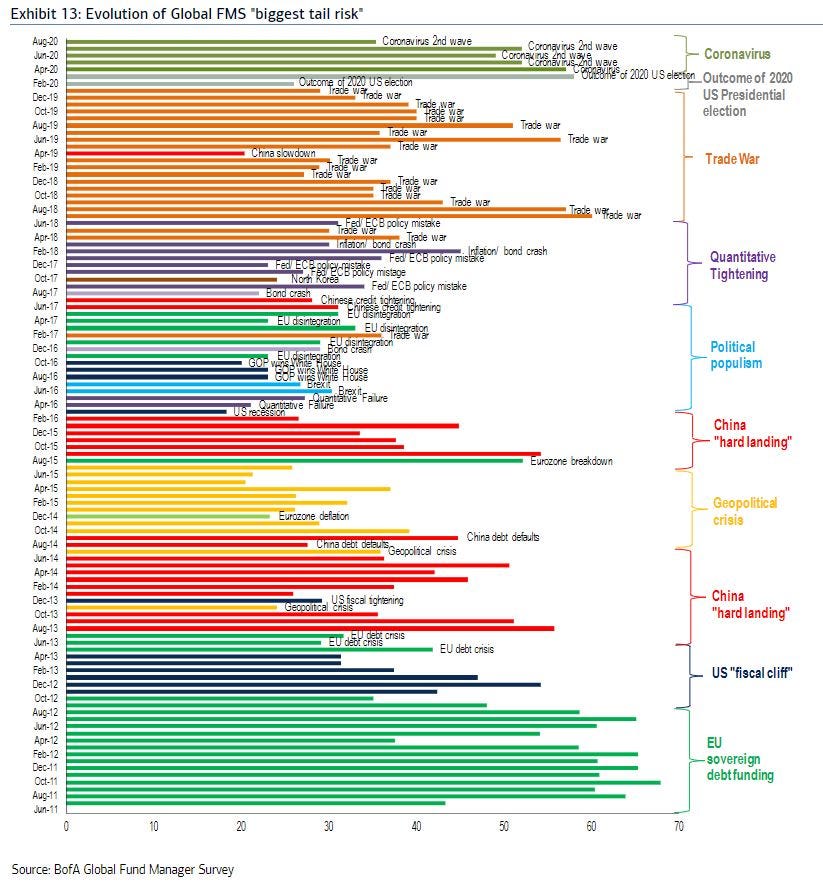

Bof As Reassuring View On Current Stock Market Valuations

Apr 24, 2025

Bof As Reassuring View On Current Stock Market Valuations

Apr 24, 2025