Lumina Gold Sold To China's CMOC For $581 Million: Analysis Of The Transaction

Table of Contents

CMOC's Strategic Rationale Behind the Lumina Gold Acquisition

CMOC's decision to acquire Lumina Gold reflects a strategic ambition to expand its presence in the gold mining sector and diversify its portfolio. The Lumina Gold acquisition by CMOC offers access to high-quality gold assets, enhancing CMOC’s existing mining operations. CMOC, primarily known for its molybdenum and copper mining activities, is clearly seeking to strengthen its position in the precious metals market. This move strategically positions CMOC for growth in a volatile market, reducing its reliance on other commodities.

- Access to Lumina Gold's key assets: This includes valuable projects and mines, potentially adding significant gold reserves to CMOC's portfolio. Specific details regarding the assets involved will likely be released as the acquisition process progresses.

- Expansion of CMOC's gold production capacity and market share: The Lumina Gold acquisition significantly boosts CMOC's gold production capabilities, giving them a larger slice of the global gold market.

- Potential synergies with CMOC's existing operations: This acquisition could lead to operational efficiencies and cost savings through shared resources and expertise. Combining expertise and infrastructure could offer significant cost advantages.

- Securing a reliable source of gold in a volatile market: In an environment of fluctuating gold prices, having secured access to significant gold reserves offers CMOC greater stability and predictability.

Financial Aspects and Valuation of the Lumina Gold Transaction

The $581 million price tag for the Lumina Gold acquisition by CMOC represents a significant investment. A detailed analysis of whether this represents a premium or discount compared to Lumina Gold's market valuation at the time of the announcement is needed to fully understand the deal’s financial implications. Further investigation into the transaction's structure (cash, stock, or a combination) will also provide critical insights into the overall financial strategy.

- Transaction price breakdown: A thorough breakdown of how the $581 million is allocated across different aspects of the acquisition is crucial for a complete understanding.

- Key valuation metrics used: Understanding the valuation metrics employed to arrive at the $581 million figure is essential for evaluating the deal's fairness and potential profitability.

- Potential impact on CMOC's credit rating: Such a substantial acquisition will undoubtedly have an impact on CMOC's financial leverage and potentially its credit rating.

- Return on investment projections for CMOC: The long-term profitability of this investment will depend on various factors, including gold prices, operational efficiency, and regulatory approvals.

Impact on the Gold Mining Industry and Global Markets

The Lumina Gold acquisition by CMOC is not an isolated event; it carries significant implications for the global gold market. The deal represents a further consolidation within the gold mining industry. This increased consolidation may influence market dynamics, gold prices, and competitive landscapes. The acquisition also highlights the growing influence of Chinese companies in the global mining sector.

- Increased market consolidation in the gold mining sector: This acquisition will likely encourage further mergers and acquisitions within the industry.

- Potential shifts in gold production capacity and geographic distribution: CMOC's acquisition significantly alters the geographical distribution of gold production.

- Impact on employment within Lumina Gold: The impact on Lumina Gold's employees requires careful consideration. CMOC's plans for integration and workforce management will be crucial.

- Geopolitical implications of Chinese ownership of a significant gold asset: The increasing involvement of Chinese companies in global gold reserves has geopolitical ramifications that warrant further analysis.

Regulatory and Legal Considerations of the Lumina Gold Sale to CMOC

The completion of the Lumina Gold acquisition by CMOC is subject to various regulatory approvals and legal considerations. These factors could impact the timeline and the overall success of the transaction. Antitrust concerns and potential legal challenges are key elements that need to be carefully navigated.

- Regulatory bodies involved in the approval process: Identifying the relevant regulatory bodies and their approval processes is crucial for understanding the timeline.

- Timeline for obtaining necessary approvals: The timeframe for obtaining the required approvals from all relevant jurisdictions will directly impact the acquisition's completion date.

- Potential legal risks associated with the transaction: Any potential legal challenges or lawsuits related to the transaction could significantly delay or even derail the process.

Conclusion: The Future of Lumina Gold Under CMOC Ownership

The Lumina Gold acquisition by CMOC represents a significant strategic shift for both companies. CMOC gains access to valuable gold assets, enhancing its portfolio diversity and market presence. The long-term success of the integration will depend on various factors, including gold price movements, efficient operational integration, and favorable regulatory environments. The impact on the gold market and broader geopolitical landscape will unfold over time. The Lumina Gold acquisition by CMOC will be a case study in international mining deals for years to come.

We encourage you to share your thoughts and insights on the Lumina Gold acquisition by CMOC in the comments section below. For further reading, explore articles on CMOC's other acquisitions and analyses of the gold market outlook.

Featured Posts

-

Retail Shakeup Brands Scramble For New Homes After Hudsons Bay Departures

Apr 23, 2025

Retail Shakeup Brands Scramble For New Homes After Hudsons Bay Departures

Apr 23, 2025 -

Bed Akhr Ankhfad Asear Aldhhb Alywm Fy Mhlat Alsaght

Apr 23, 2025

Bed Akhr Ankhfad Asear Aldhhb Alywm Fy Mhlat Alsaght

Apr 23, 2025 -

Morning Retail Nutriscore Quels Industriels Jouent Le Jeu

Apr 23, 2025

Morning Retail Nutriscore Quels Industriels Jouent Le Jeu

Apr 23, 2025 -

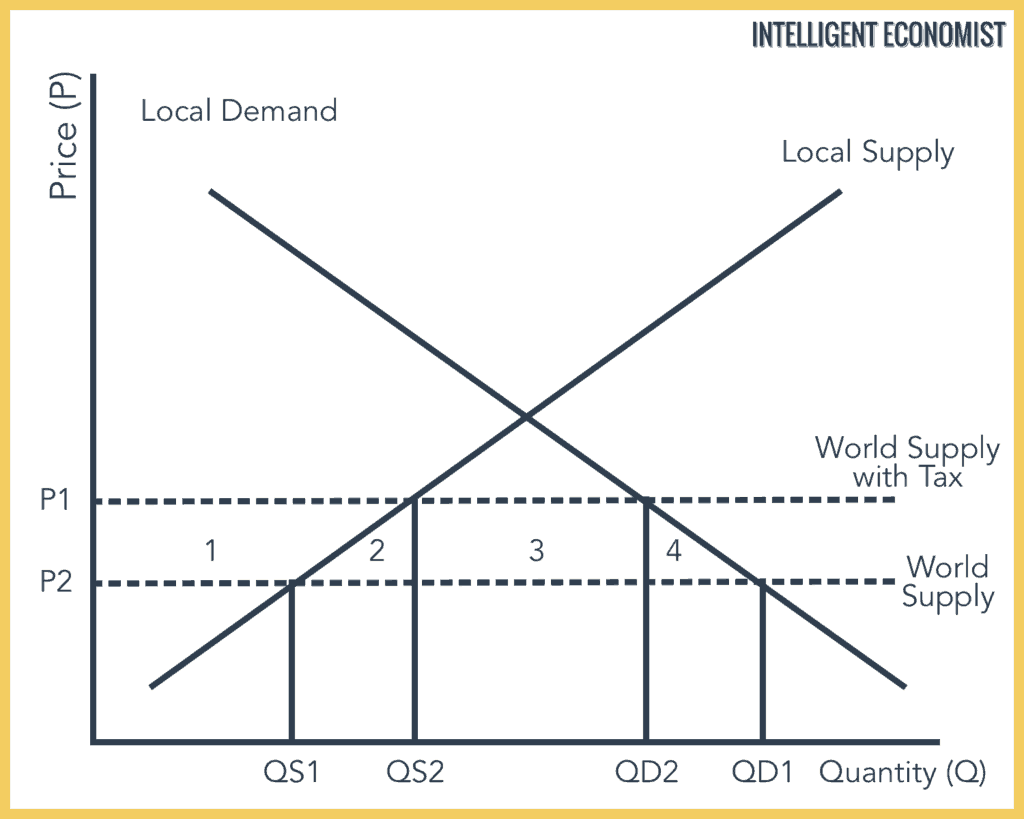

Tonglings Warning Us Tariffs Impact Copper Market

Apr 23, 2025

Tonglings Warning Us Tariffs Impact Copper Market

Apr 23, 2025 -

Us Tariffs Weigh On Copper Tonglings Outlook

Apr 23, 2025

Us Tariffs Weigh On Copper Tonglings Outlook

Apr 23, 2025