Tongling's Warning: US Tariffs Impact Copper Market

Table of Contents

2. Tongling's Financial Performance and the Tariff Impact:

Declining Profits and Reduced Production

Tongling Nonferrous Metals Group, a leading player in the global copper market, has felt the sting of US tariffs acutely. Analysis of their financial reports reveals a clear correlation between the implementation of tariffs and a decline in profitability. Reduced exports to the US, a key market for Tongling, have directly impacted their revenue streams. Visual representations, like charts demonstrating year-on-year revenue decline post-tariff implementation, would clearly illustrate this impact.

- Specific examples of decreased revenue: Data showcasing a quantifiable reduction in US-bound copper exports, perhaps comparing figures from before and after tariff introduction, would strengthen this point.

- Impact on stock prices and investor confidence: A decrease in stock price following the tariff announcements signifies the market's negative reaction and the uncertainty created by the new trade policy.

- Production strategy adjustments: Tongling may have responded by reducing production, diverting exports to other markets, or seeking alternative raw material sources, all strategies influenced by the imposition of tariffs.

Supply Chain Disruptions

The impact extends beyond simple revenue reduction. US tariffs have created significant disruptions to Tongling's supply chain, leading to added complexity and costs.

- Increased costs: navigating the increased paperwork, inspections, and legal complexities associated with exporting under tariff conditions adds significant overhead.

- Delivery time delays: Customs delays and bureaucratic hurdles contribute to longer lead times, impacting contract fulfillment and customer relations.

- Challenges in securing raw materials: Tariffs may have ripple effects, impacting the cost and availability of raw materials needed for copper production, further squeezing profit margins.

2. Global Copper Market Volatility and US Tariffs:

Price Fluctuations and Market Uncertainty

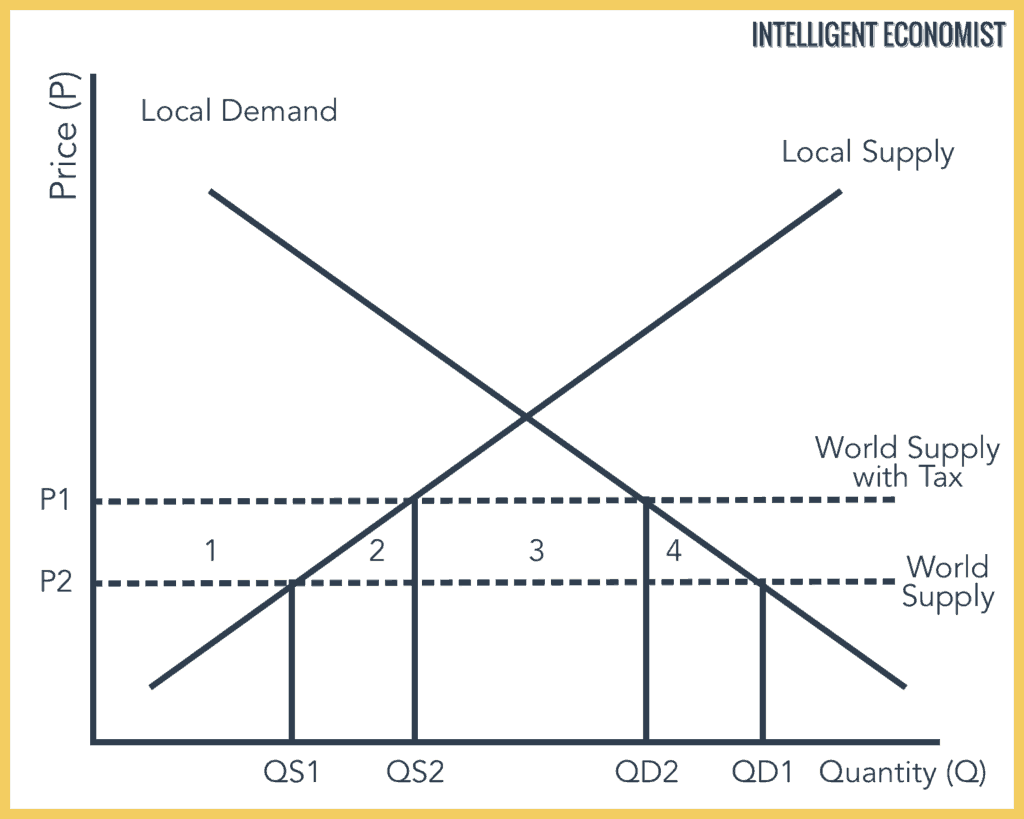

The imposition of US tariffs has not only affected specific companies but also created significant volatility in global copper prices. Demand in the US, a major consumer of copper, is directly impacted by tariffs, affecting pricing across the entire global market.

- Impact of tariffs on US copper demand: Tariffs increase the cost of copper imports, potentially reducing demand and impacting pricing globally.

- Global price effects: Reduced US demand creates a ripple effect, impacting prices worldwide as supply surpasses demand, potentially pushing copper prices downward.

- Other factors: Geopolitical instability, economic slowdowns (especially in major economies like China and the EU), and fluctuating currency exchange rates further complicate the already unstable market landscape.

Impact on Other Copper Producers

Tongling's experience is not unique. Many other major copper producers worldwide, from Chile to Peru and Zambia, have felt the negative impacts of US tariffs, highlighting the interconnectedness and fragility of the global copper market.

- Examples of other companies: Mentioning specific examples of other large copper producers facing similar challenges underscores the widespread impact of US tariffs.

- Industry restructuring: The increased pressure on profitability might lead to industry consolidation, mergers, and acquisitions as weaker players struggle to survive.

2.3 Future Outlook and Potential Mitigation Strategies:

Predicting the Long-Term Impact of Tariffs

Predicting the long-term impact of US tariffs on the copper market is challenging, given the ever-changing landscape of international trade relations. However, several potential scenarios exist.

- Long-term consequences for producers: Persistent tariffs could lead to long-term reductions in profitability, potentially forcing some companies to restructure or even exit the market.

- Tariff reductions or eliminations: A shift in US trade policy, leading to tariff reductions or even elimination, would significantly impact the market.

- Alternative markets: Diversification of export markets away from US reliance is crucial for mitigating future risk and creating resilience against trade-related disruptions.

Adaptation and Resilience in the Copper Industry

Copper producers are actively seeking strategies to adapt to the shifting landscape.

- Market diversification: Expanding into new markets reduces reliance on any single country and mitigates the risk of trade restrictions.

- Technological advancements: Investments in automation, improved extraction techniques, and environmentally friendly production methods are essential for improving efficiency and lowering production costs.

- Lobbying efforts: Influencing trade policy through industry lobbying groups is crucial to advocate for favorable trade conditions.

3. Conclusion: Navigating the Complexities of the Copper Market in the Age of US Tariffs

In conclusion, the impact of US tariffs on the copper market is undeniable. Tongling's case study powerfully illustrates the financial strain, supply chain disruptions, and increased market volatility experienced by key players in the industry. The ripple effects extend far beyond a single company, affecting global copper prices and the overall health of the industry. Understanding how US tariffs impact the copper market is crucial for investors, producers, and policymakers alike. To stay informed on the evolving global copper market and the effects of trade policies, we encourage further research into recent trade agreements and industry reports. Share your thoughts and opinions – how do you think the copper market will adapt to the ongoing challenges posed by trade policies?

Featured Posts

-

Brewers Home Opener Spoiled By Royals 11 1 Rout

Apr 23, 2025

Brewers Home Opener Spoiled By Royals 11 1 Rout

Apr 23, 2025 -

Arbitrage Et Gestion De Portefeuille Bfm Analyse Hebdomadaire Du 17 Fevrier

Apr 23, 2025

Arbitrage Et Gestion De Portefeuille Bfm Analyse Hebdomadaire Du 17 Fevrier

Apr 23, 2025 -

Comprendre La Carte Blanche De Marc Fiorentino

Apr 23, 2025

Comprendre La Carte Blanche De Marc Fiorentino

Apr 23, 2025 -

Ontarios Plan To Improve Internal Trade Addressing Alcohol And Labour Restrictions

Apr 23, 2025

Ontarios Plan To Improve Internal Trade Addressing Alcohol And Labour Restrictions

Apr 23, 2025 -

The Truth About The Trump Economy What The Data Reveals

Apr 23, 2025

The Truth About The Trump Economy What The Data Reveals

Apr 23, 2025