US Tariffs Weigh On Copper: Tongling's Outlook

Table of Contents

The Impact of US Tariffs on Global Copper Prices

US tariffs on imported goods have significantly impacted global copper prices. The mechanism is relatively straightforward: tariffs increase the cost of copper imported into the US, reducing demand. This reduced demand, coupled with the complexities of global supply chains, ripples through the entire market, affecting supply and demand dynamics globally. The effect isn't limited to the US; it influences prices everywhere.

Statistics highlight the severity of the situation. While precise figures fluctuate based on the specific tariff schedules and periods, data shows a marked decrease in US copper imports since the imposition of various tariffs. This reduction in demand directly impacts copper prices worldwide, creating uncertainty for producers like Tongling.

- Impact on US Construction and Manufacturing: Increased copper costs due to tariffs lead to higher production costs for US businesses, potentially slowing down construction and manufacturing activities. This further reduces copper demand.

- Shift in Copper Trade Routes: Tariffs have forced a shift in global copper trade routes, with some countries finding alternative suppliers to avoid higher costs. This creates both opportunities and challenges for copper producers.

- Price Volatility: The instability caused by tariffs has contributed to significant price volatility in the copper market, making it challenging for producers to plan for the future and manage their finances effectively.

Tongling Nonferrous Metals Group's Exposure to US Tariffs

Tongling Nonferrous Metals Group, a significant player in the global copper market, is not immune to the effects of US tariffs. While the exact percentage of Tongling's revenue directly derived from US exports might not be publicly available, any reliance on the US market makes the company vulnerable to trade disruptions caused by tariffs.

Tongling, however, has demonstrated proactive strategies to mitigate these risks. Diversification into other markets is a key component of their strategy. This includes exploring alternative markets and strengthening existing relationships in regions less impacted by US trade policies.

- Revenue Diversification: While specific figures on US export revenue are unavailable, Tongling's focus on diversification suggests a deliberate effort to reduce its dependence on the US market.

- Market Response: Tongling's response to tariffs may include price adjustments to remain competitive and exploring new market opportunities. This could involve strategic partnerships with companies in other regions.

- Financial Performance: Analyzing Tongling's financial performance since the imposition of tariffs can offer insights into the effectiveness of their mitigation strategies. This requires careful examination of their financial reports and industry analyses.

Alternative Market Opportunities for Tongling

To lessen its dependence on the US market, Tongling is actively pursuing alternative market opportunities. The growing economies of Asia, particularly Southeast Asia and India, present significant potential for expansion. Similarly, European markets, with their focus on sustainable infrastructure and renewable energy, offer another avenue for growth.

- Asian Market Growth: Rapid industrialization and infrastructure development in Asian countries are driving strong demand for copper, creating attractive opportunities for Tongling.

- European Market Potential: The European Union's emphasis on sustainable development and the energy transition offers significant demand for copper in renewable energy projects and electric vehicle infrastructure.

- Strategic Investments: Tongling's strategic investments and partnerships in these alternative markets signal a commitment to reducing its exposure to US tariff-related risks.

The Role of Technological Advancements in Copper Production and Demand

Technological advancements are playing a crucial role in shaping both the supply and demand sides of the copper market. The burgeoning electric vehicle (EV) sector and the global push towards renewable energy are significant drivers of copper demand. This increased demand offers a counterbalance to the challenges posed by US tariffs.

Technological innovation also offers opportunities for increased efficiency in copper production. This can help companies like Tongling reduce their costs and improve their competitiveness, regardless of trade barriers.

- EVs and Renewables: The electric vehicle revolution and the increasing adoption of renewable energy technologies are boosting global copper demand considerably.

- Production Efficiency: Advancements in mining and processing technologies can help Tongling increase efficiency and reduce production costs.

- R&D Investments: Tongling's investments in research and development highlight a commitment to innovation and leveraging technology to overcome market challenges.

Navigating the Challenges: Tongling's Future in a Tariff-Affected Copper Market

US tariffs undeniably weigh on the copper market, presenting challenges for producers like Tongling. However, Tongling’s proactive strategies – focusing on market diversification and leveraging technological advancements – position it well to navigate these turbulent waters. Its commitment to expanding into new markets and investing in R&D are key to its long-term success.

The future of Tongling, and indeed the entire copper industry, will depend significantly on the evolution of global trade relations and the ongoing impact of US tariffs. However, Tongling's adaptability and focus on innovation offer a strong foundation for navigating this complex landscape.

To learn more about the complex interplay of "US Tariffs Weigh on Copper" and its impact on global copper producers, explore further resources on international trade and the copper market. Stay informed on industry trends and government policies to better understand the dynamics of this crucial metal's future.

Featured Posts

-

Analyzing Michael Lorenzens Performance And Impact On The Game

Apr 23, 2025

Analyzing Michael Lorenzens Performance And Impact On The Game

Apr 23, 2025 -

Market Volatility Dow Futures And Gold Prices React To Tariffs And Fed Policy

Apr 23, 2025

Market Volatility Dow Futures And Gold Prices React To Tariffs And Fed Policy

Apr 23, 2025 -

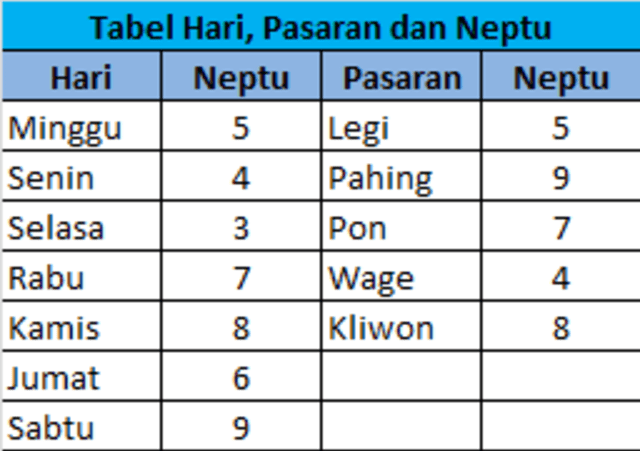

Kecocokan Jodoh Weton Senin Legi Dan Rabu Pon Panduan Primbon Jawa

Apr 23, 2025

Kecocokan Jodoh Weton Senin Legi Dan Rabu Pon Panduan Primbon Jawa

Apr 23, 2025 -

Morning Retail Nutriscore Quels Industriels Jouent Le Jeu

Apr 23, 2025

Morning Retail Nutriscore Quels Industriels Jouent Le Jeu

Apr 23, 2025 -

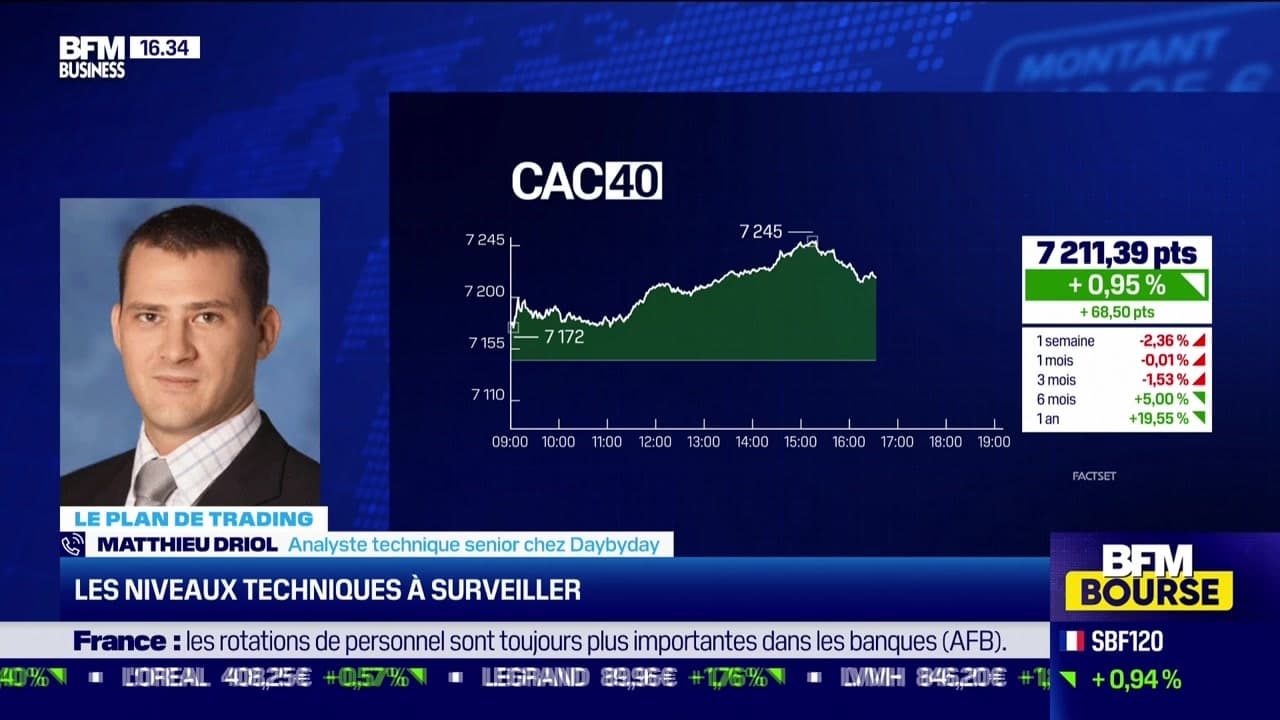

Optimiser Vos Strategies De Trading Avec Les Seuils Techniques

Apr 23, 2025

Optimiser Vos Strategies De Trading Avec Les Seuils Techniques

Apr 23, 2025