Chinese Stocks Listed In Hong Kong Show Strong Growth

Table of Contents

Economic Factors Driving Growth of Hong Kong-Listed Chinese Companies

Several significant economic factors contribute to the robust performance of Chinese companies listed on the Hong Kong Stock Exchange. Understanding these fundamentals is key to assessing the long-term viability of this investment opportunity.

Robust Chinese Economic Growth

China's consistent economic growth remains a primary driver. The country's expanding middle class, fueled by rising disposable incomes, creates immense demand for goods and services. This robust consumer spending powers the growth of numerous sectors.

- Strong GDP Growth: China consistently records impressive GDP growth, exceeding many other major economies. This translates to increased corporate profits and higher valuations for listed companies.

- Expanding Middle Class: The burgeoning middle class represents a massive consumer base, driving demand across diverse sectors, from technology and consumer goods to financial services.

- Government Infrastructure Investments: Massive government investments in infrastructure projects – from high-speed rail to 5G networks – stimulate economic activity and benefit related companies.

- Technological Advancements: China's rapid technological advancements, particularly in areas like fintech and artificial intelligence, create innovative companies with significant growth potential. This has resulted in a surge in tech stocks listed in Hong Kong.

Government Support and Policies

The Chinese government plays a crucial role in fostering the growth of its companies. Strategic policies and initiatives create a supportive environment for business expansion and innovation.

- Initiatives to Support Specific Sectors: The government actively supports key sectors like technology, renewable energy, and healthcare through targeted subsidies, tax breaks, and regulatory reforms.

- Easing of Regulations: Recent efforts to streamline regulations and improve the ease of doing business have made China a more attractive destination for investment.

- Market Liberalization Efforts: Gradual market liberalization, while still ongoing, allows for increased participation from foreign investors and promotes greater competition and efficiency. This is reflected in the increasing number of Chinese companies seeking listings in Hong Kong.

Increased Foreign Investment

The attractiveness of Hong Kong-listed Chinese companies is also attracting significant foreign investment. This influx of capital further fuels the market's growth.

- Reasons for Increased Foreign Investment: Higher potential returns compared to other markets, coupled with opportunities for diversification, draw substantial international capital.

- Major Foreign Investors Involved: Many global investment firms and sovereign wealth funds are actively investing in Hong Kong-listed Chinese stocks, underscoring their confidence in the market's growth potential.

- Data on Foreign Investment Flows into Hong Kong: Statistics reveal a steady and substantial increase in foreign direct investment (FDI) into Hong Kong, indicating growing international confidence.

Top Performing Sectors in Hong Kong-Listed Chinese Stocks

Several sectors within the Hong Kong-listed Chinese stock market have shown exceptional performance. These high-growth areas offer potentially lucrative investment opportunities.

Technology Sector Boom

The technology sector is a standout performer. Innovative Chinese tech companies are rapidly expanding their market share both domestically and internationally.

- Examples of Leading Tech Companies: Companies like Tencent, Alibaba, and Meituan have become global giants, driving significant market capitalization growth.

- Their Market Capitalization: The combined market capitalization of these leading technology companies represents a substantial portion of the overall Hong Kong stock market.

- Key Innovations Driving Growth: These companies' innovative products and services, from mobile payments to e-commerce and cloud computing, are key drivers of their success.

Financial Services Strength

The financial services sector also exhibits remarkable strength, with leading institutions showing consistent profitability and expansion.

- Examples of Successful Financial Companies: Major banks and insurance companies listed in Hong Kong are showing solid financial performance and are well-positioned for future growth.

- Their Contributions to the Market: These companies contribute significantly to the overall market capitalization and liquidity of the Hong Kong Stock Exchange.

- Future Growth Prospects: The ongoing growth of the Chinese economy and the expanding financial sector create favorable conditions for continued expansion.

Consumer Goods and Retail Sector Growth

The rising middle class fuels strong growth in the consumer goods and retail sector, with companies benefitting from increased consumer spending.

- Examples of Prominent Companies: Leading brands in apparel, food and beverage, and other consumer goods are enjoying substantial sales growth.

- Growth Fueled by Increasing Consumer Spending: As disposable incomes rise, consumers are spending more on a wider range of goods and services, supporting the growth of these companies.

Investment Opportunities and Risks in Hong Kong-Listed Chinese Stocks

Investing in Hong Kong-listed Chinese stocks offers significant potential returns, but understanding the associated risks is crucial for informed decision-making.

Potential Returns and Diversification Benefits

This market offers potentially high returns compared to other established markets. Diversification into this market can enhance an investor's overall portfolio performance.

- Higher Potential Returns Compared to Other Markets: Historical data suggests potentially higher returns in this market, although past performance is not indicative of future results.

- Risk Mitigation through Diversification: Including Hong Kong-listed Chinese stocks in a diversified portfolio can help reduce overall risk.

Understanding the Risks

Several factors can influence the performance of these stocks, and investors need to carefully assess these risks.

- Geopolitical Risks: Geopolitical events and international relations can significantly impact market sentiment and valuations.

- Currency Fluctuations: Fluctuations in the value of the Chinese Yuan (RMB) against other currencies can impact returns for foreign investors.

- Regulatory Changes: Changes in Chinese government regulations can affect the performance of specific companies or sectors.

- Market Volatility: The Hong Kong stock market can experience periods of significant volatility, requiring investors to have a long-term perspective.

Conclusion

The strong growth of Chinese stocks listed in Hong Kong is driven by robust economic growth in China, supportive government policies, and increasing foreign investment. Several sectors, particularly technology, financial services, and consumer goods, show exceptional performance, creating attractive investment opportunities. While potential returns are significant, investors must carefully consider the geopolitical risks, currency fluctuations, regulatory changes, and market volatility. Explore the exciting world of Chinese stocks listed in Hong Kong and unlock significant growth opportunities today!

Featured Posts

-

Liams Fate On The Bold And The Beautiful Will He Survive

Apr 24, 2025

Liams Fate On The Bold And The Beautiful Will He Survive

Apr 24, 2025 -

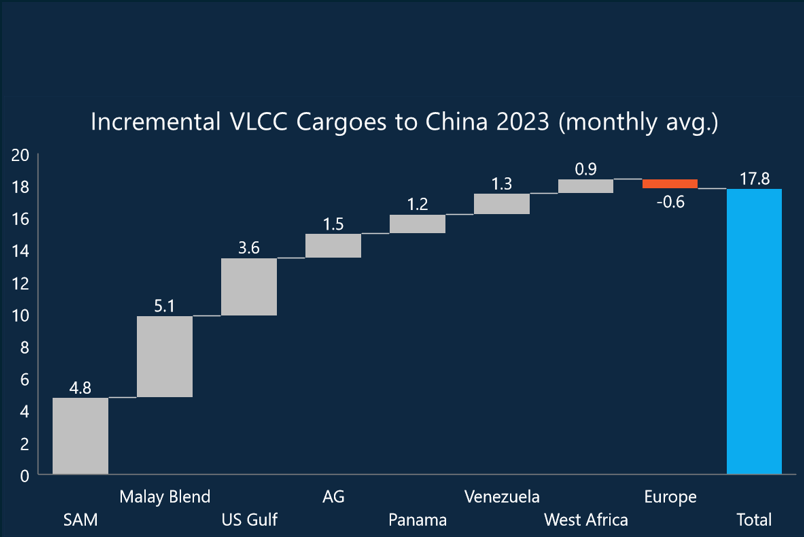

Replacing Us Lpg Chinas Reliance On Middle Eastern Suppliers

Apr 24, 2025

Replacing Us Lpg Chinas Reliance On Middle Eastern Suppliers

Apr 24, 2025 -

Understanding Google Fis New 35 Unlimited Data Plan

Apr 24, 2025

Understanding Google Fis New 35 Unlimited Data Plan

Apr 24, 2025 -

Hopes New Home Liams Crisis The Bold And The Beautiful April 3 Recap

Apr 24, 2025

Hopes New Home Liams Crisis The Bold And The Beautiful April 3 Recap

Apr 24, 2025 -

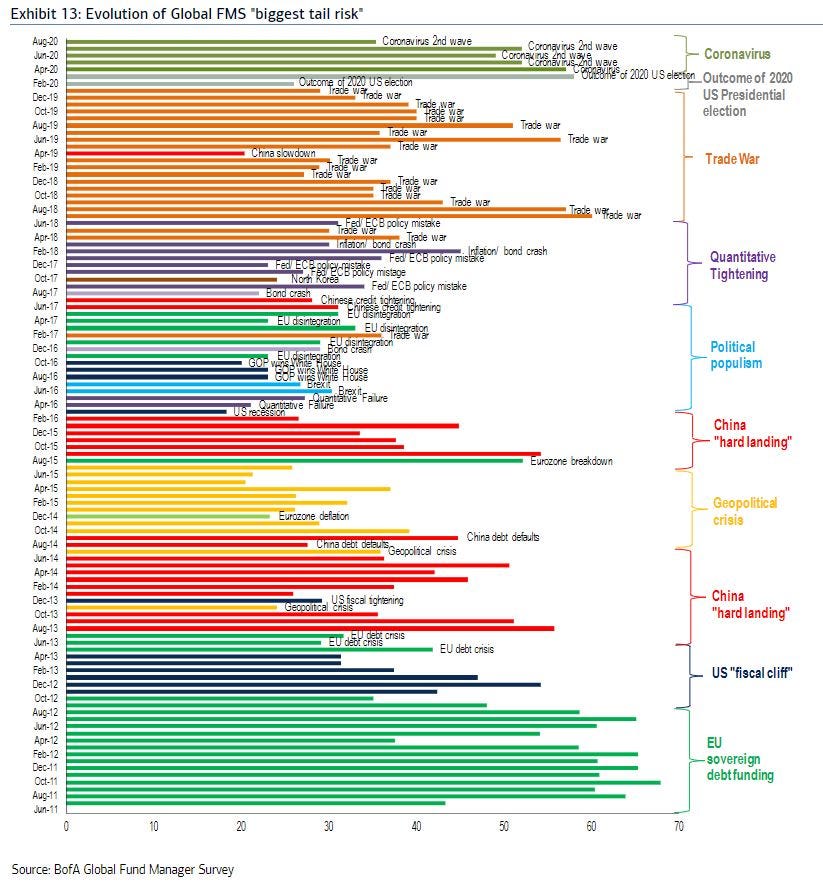

Bof As Reassuring View On Current Stock Market Valuations

Apr 24, 2025

Bof As Reassuring View On Current Stock Market Valuations

Apr 24, 2025