Replacing US LPG: China's Reliance On Middle Eastern Suppliers

Table of Contents

The Decline of US LPG Exports to China

The decline in US LPG exports to China is a complex issue stemming from a confluence of factors. While the US was once a significant player in the global LPG market, several developments have curtailed its ability to maintain its position as a leading supplier to China.

-

Increased US Domestic Demand: The surge in US shale gas production, while boosting overall energy independence, has also led to a significant increase in domestic demand for natural gas liquids (NGLs), including propane and butane. This increased domestic consumption has reduced the volume of LPG available for export, directly impacting the supply available to international markets, including China.

-

The Impact of the US-China Trade War: The trade war between the US and China, characterized by tariffs and trade restrictions, created significant uncertainty and instability in bilateral trade relations. This uncertainty discouraged long-term contracts and reduced the overall volume of LPG shipments from the US to China. The fluctuating political climate added to the risk profile, making US LPG a less attractive option for Chinese importers.

-

LPG Pricing Dynamics: Fluctuations in US LPG pricing, often influenced by domestic market dynamics and global energy prices, have made it less competitive compared to Middle Eastern suppliers. The price volatility, combined with the uncertainties mentioned above, has driven Chinese buyers to seek more stable and predictable supply sources.

-

Shift in US Energy Policy: A shift in US energy policy towards prioritizing domestic consumption and energy independence has inadvertently reduced the emphasis on promoting LPG exports. This policy shift, along with increased domestic demand, has further constricted the supply available for the international market.

The Rise of Middle Eastern LPG Suppliers

The decline in US LPG exports has created a vacuum, which has been rapidly filled by Middle Eastern suppliers. Several factors contribute to the rise of the Middle East as a dominant force in China's LPG imports.

-

Increased LPG Production Capacity: Significant investments in oil and gas infrastructure across the Middle East have resulted in a substantial increase in LPG production capacity. This enhanced capacity allows Middle Eastern nations to meet the growing global demand for LPG, including China's substantial needs.

-

Competitive Pricing and Favorable Contracts: Middle Eastern suppliers have offered competitive pricing and attractive long-term contracts, providing Chinese importers with greater price stability and supply security compared to the more volatile US market. These long-term agreements reduce risk and provide predictability for Chinese energy companies.

-

Strategic Geographic Location: The Middle East's geographic proximity to China facilitates efficient and cost-effective shipping routes. Shorter shipping distances translate to lower transportation costs and quicker delivery times, making Middle Eastern LPG a more attractive proposition.

-

Growing Partnerships and Trade Agreements: China has actively cultivated stronger partnerships and trade agreements with Middle Eastern countries to secure stable LPG supplies. These strategic alliances strengthen energy cooperation and ensure a reliable flow of LPG to meet China's energy demands.

Specific Examples of Middle Eastern LPG Involvement

Several key partnerships illustrate the growing dominance of Middle Eastern LPG in the Chinese market.

-

Saudi Aramco: Saudi Aramco, the world's largest oil company, has significantly increased its LPG exports to China, capitalizing on the increased demand. Long-term contracts and strategic partnerships have solidified Saudi Arabia's position as a major LPG supplier to China.

-

Qatar Petroleum: Qatar Petroleum, another leading global energy player, has also strengthened its ties with China through major LPG supply agreements. Qatar's substantial LPG production capacity and efficient logistics have made it a vital player in supplying China's energy needs.

-

ADGAS (Abu Dhabi Gas Industries): ADGAS, based in the UAE, has also contributed to the increased supply of LPG to China, further solidifying the Middle East's role in China's energy security. These agreements often involve long-term contracts, ensuring a steady supply of LPG for years to come.

Geopolitical Implications of China's LPG Supply Shift

China's increased reliance on Middle Eastern LPG suppliers has significant geopolitical implications.

-

Increased Reliance on a Single Region: Concentrating LPG imports from a single region (the Middle East) introduces potential vulnerabilities to China's energy security. Geopolitical instability in the region could disrupt supply chains and impact China's energy access.

-

Political Risks: The shift presents political risks associated with dependence on specific Middle Eastern suppliers. Any political tensions or conflicts in the region could directly affect the flow of LPG to China. This highlights the need for diversification strategies.

-

Impact on the Global LPG Market: This shift significantly alters the global LPG market landscape, with the Middle East gaining greater dominance and the US losing market share. This impacts pricing, competition, and trade relationships worldwide.

-

Future Diversification Strategies: To mitigate these geopolitical risks, China is likely to pursue diversification strategies, exploring alternative LPG sources and strengthening relationships with other key global suppliers to reduce reliance on any single region.

Conclusion

China's reduced reliance on US LPG imports and increased dependence on Middle Eastern suppliers represents a pivotal moment in global energy markets. While this shift offers benefits such as competitive pricing and access to secure supply contracts, it also introduces potential geopolitical risks. China's future energy security will hinge on navigating these complexities, diversifying its LPG sourcing strategies, and building resilient partnerships with its Middle Eastern energy partners. Understanding the dynamics of China LPG imports and the expanding role of Middle East LPG suppliers is crucial for comprehending the future of this vital commodity market. Further research into the intricacies of China’s energy diversification strategies is essential for predicting the trajectory of this critical sector. Continue learning about the intricacies of China LPG imports and the growing influence of Middle East LPG in shaping the global energy landscape.

Featured Posts

-

Mark Zuckerberg And The Trump Era A New Phase For Meta

Apr 24, 2025

Mark Zuckerberg And The Trump Era A New Phase For Meta

Apr 24, 2025 -

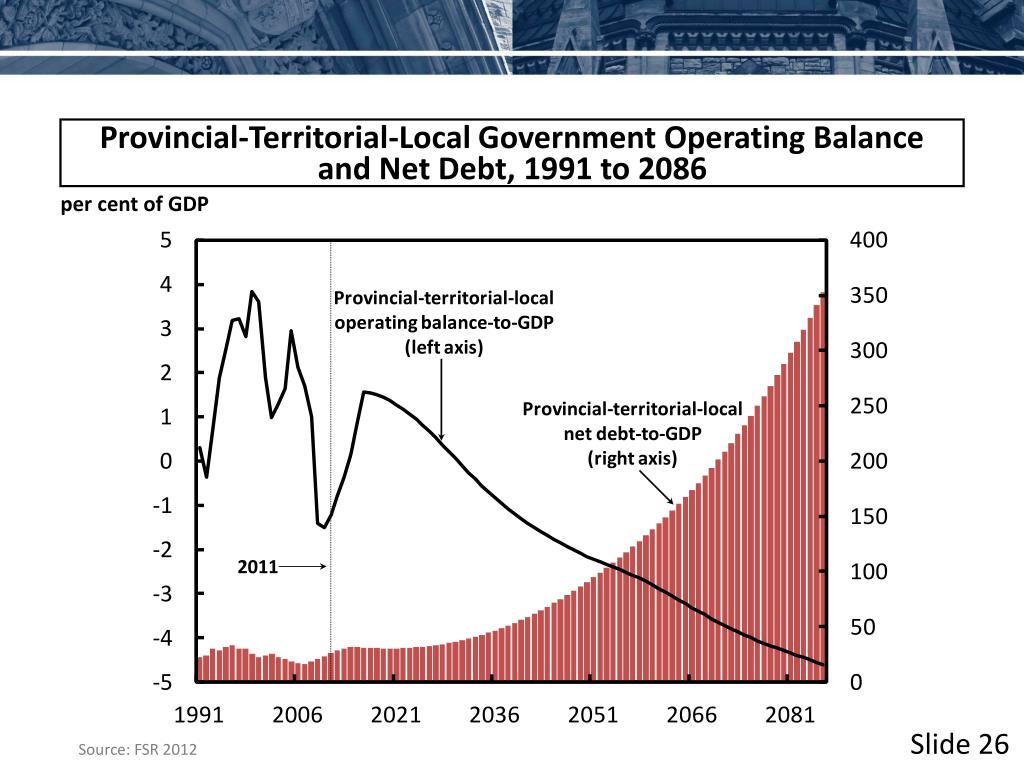

Canadas Fiscal Challenges The Case For Responsible Governance

Apr 24, 2025

Canadas Fiscal Challenges The Case For Responsible Governance

Apr 24, 2025 -

Canadian Auto Dealers Propose Five Point Plan Amidst Us Trade War

Apr 24, 2025

Canadian Auto Dealers Propose Five Point Plan Amidst Us Trade War

Apr 24, 2025 -

The Bold And The Beautiful April 9 Recap Steffy Blames Bill Finn Rushes To The Icu

Apr 24, 2025

The Bold And The Beautiful April 9 Recap Steffy Blames Bill Finn Rushes To The Icu

Apr 24, 2025 -

The Auto Industrys Standoff Dealers Reject Ev Mandate Requirements

Apr 24, 2025

The Auto Industrys Standoff Dealers Reject Ev Mandate Requirements

Apr 24, 2025