BofA's Reassuring View On Current Stock Market Valuations

Table of Contents

BofA's Valuation Metrics and Methodology

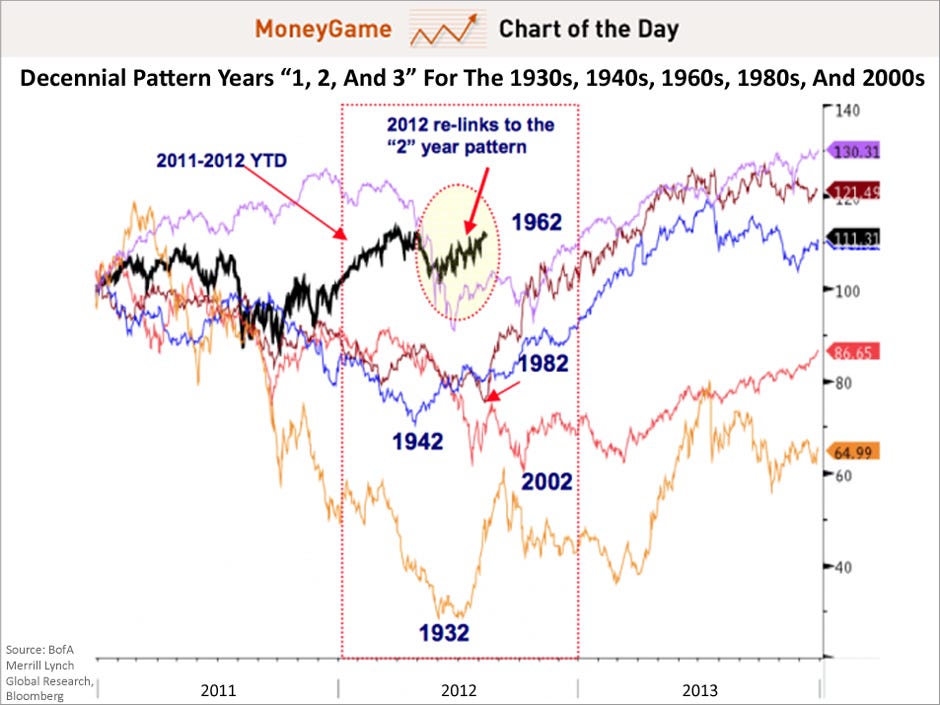

BofA's analysis of current stock market valuations relies on a comprehensive methodology incorporating several key valuation metrics and a robust comparative analysis. They utilize traditional metrics such as the price-to-earnings ratio (P/E), price-to-sales ratio (P/S), and dividend yield to assess the attractiveness of various sectors and individual stocks. Their methodology involves comparing current valuation multiples to historical averages, accounting for sector-specific factors, and projecting future earnings growth. This multifaceted approach provides a nuanced perspective on market valuations.

- Key Findings from BofA's Analysis:

- BofA finds current P/E ratios for many sectors to be below historical averages, suggesting potential undervaluation relative to long-term growth prospects. This is particularly true in certain growth sectors showing resilience despite market uncertainty.

- Their analysis shows strong earnings growth potential in specific sectors, highlighting opportunities for strategic investment. They identify technology and healthcare as potentially undervalued sectors ripe for growth.

- The report emphasizes the crucial role of considering long-term growth prospects when evaluating current valuations. Short-term market fluctuations should not overshadow the potential for long-term value creation.

Factors Contributing to BofA's Optimism

BofA's positive outlook is underpinned by several key macroeconomic factors and their assessment of corporate performance. While acknowledging the challenges, BofA identifies positive trends that outweigh the negative pressures impacting the stock market.

- Supporting Factors:

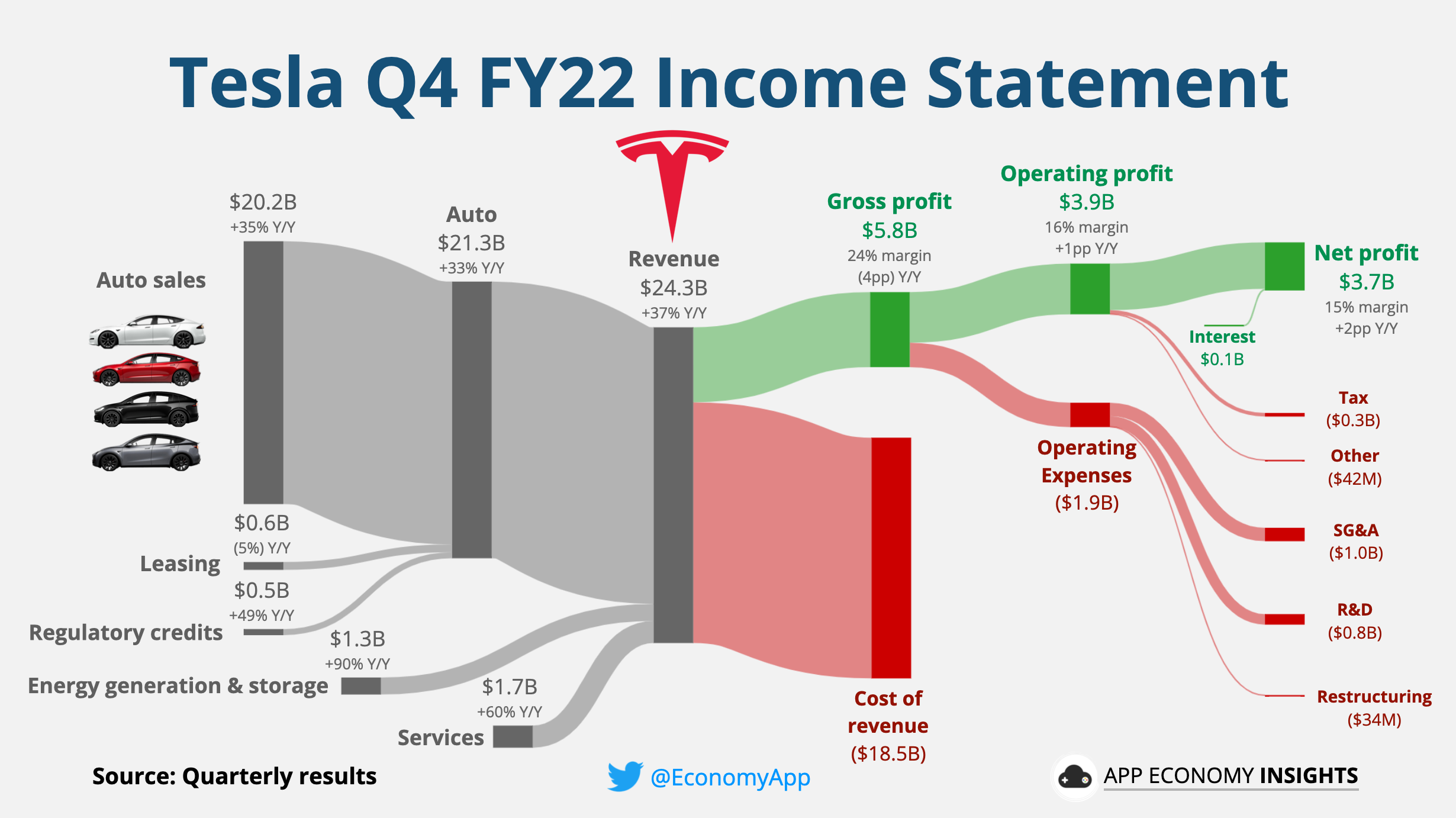

- Strong Corporate Earnings: Despite recessionary fears, numerous companies have reported robust earnings, demonstrating resilience and underlying economic strength. This positive earnings momentum suggests that fears of a significant downturn may be overblown.

- Moderate Inflation Easing: BofA forecasts a gradual easing of inflation, reducing pressure on corporate margins and consumer spending. While inflation remains a concern, the projected moderation contributes to their optimistic view.

- Positive Sectoral Projections: BofA's analysis highlights positive projections for specific economic sectors, indicating opportunities for selective investment strategies. Sectors with strong growth potential despite macroeconomic headwinds are emphasized.

Investment Strategies Based on BofA's Analysis

BofA's assessment provides valuable insights for investors seeking to navigate the current market climate. Their analysis suggests a strategic approach to portfolio management, focusing on specific opportunities.

- Actionable Investment Strategies:

- Strategic Sector Rotation: Investors can consider increasing exposure to undervalued sectors identified by BofA's analysis, potentially capitalizing on their growth potential. This involves shifting investments from overvalued sectors to those demonstrating better value.

- Focus on Earnings Growth: Prioritize companies with strong earnings growth potential and a solid track record, even if their current valuations appear slightly higher than average. This approach emphasizes long-term value creation.

- Maintain Diversification: Despite the positive outlook, maintaining a diversified portfolio remains crucial to mitigate risk and protect against unforeseen market fluctuations. Diversification across sectors and asset classes is key.

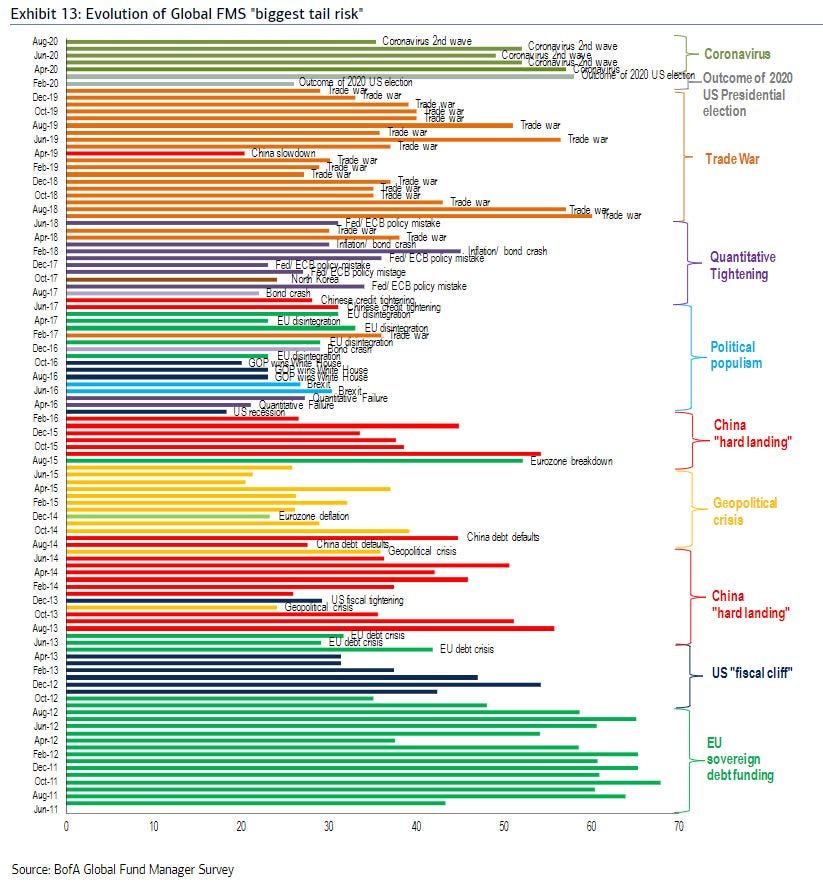

Potential Risks and Cautions

While BofA's outlook is positive, it's essential to acknowledge potential risks and uncertainties that could impact stock market valuations. Even with a positive market outlook, unforeseen events can significantly affect investor returns.

- Downside Risks:

- Persistent High Inflation: Persistently high inflation could erode corporate profits and negatively impact stock valuations, potentially undermining the positive outlook.

- Geopolitical Instability: Geopolitical events, such as unexpected conflicts or escalating tensions, can create significant market uncertainty and volatility, impacting investor sentiment.

- Unexpected Economic Slowdown: An unexpected and sharper-than-anticipated economic slowdown could dampen earnings growth, leading to downward pressure on stock prices.

Conclusion: BofA's Reassuring View on Current Stock Market Valuations – What to Do Next

BofA's analysis offers a reassuring perspective on current stock market valuations, emphasizing the potential for growth despite prevailing concerns. Their methodology highlights undervaluation in specific sectors, supported by strong corporate earnings and projected inflation easing. While acknowledging risks such as persistent inflation and geopolitical instability, BofA's assessment provides valuable insights for crafting an informed investment strategy. Use this information to conduct thorough due diligence, focusing on undervalued sectors with strong earnings growth potential. Remember to diversify your portfolio and consider consulting with a financial advisor to tailor a strategy that aligns with your risk tolerance and long-term financial goals. Don't hesitate to leverage BofA's market analysis and investment strategy suggestions to make informed decisions regarding your stock market investments.

Featured Posts

-

Ignoring High Stock Market Valuations A Bof A Analysis

Apr 24, 2025

Ignoring High Stock Market Valuations A Bof A Analysis

Apr 24, 2025 -

1050 V Mware Price Hike At And T Details Broadcoms Proposed Increase

Apr 24, 2025

1050 V Mware Price Hike At And T Details Broadcoms Proposed Increase

Apr 24, 2025 -

Anchor Brewing Company To Shutter A Legacy Concludes After 127 Years

Apr 24, 2025

Anchor Brewing Company To Shutter A Legacy Concludes After 127 Years

Apr 24, 2025 -

Tesla Earnings Plunge 71 Decline In Q1 Net Income Explained

Apr 24, 2025

Tesla Earnings Plunge 71 Decline In Q1 Net Income Explained

Apr 24, 2025 -

Bitcoin Reacts Positively To Trumps Efforts To Calm Markets

Apr 24, 2025

Bitcoin Reacts Positively To Trumps Efforts To Calm Markets

Apr 24, 2025