Tesla Earnings Plunge: 71% Decline In Q1 Net Income Explained

Table of Contents

Aggressive Price Cuts: A Double-Edged Sword

Tesla's aggressive price cuts across its vehicle lineup proved to be a double-edged sword, significantly impacting its profitability. While boosting sales volume, the strategy led to a substantial decrease in net income.

Impact on Profit Margins

The price reductions directly impacted Tesla's profit margins.

- Specific examples: The Model 3 saw a price cut of approximately 6%, while the Model Y experienced a reduction of around 5%. These cuts, along with others across the Tesla vehicle range, resulted in a substantial decrease in the average selling price (ASP).

- Percentage decrease in ASP: Sources suggest an overall ASP reduction of approximately 4%, directly impacting gross margin. Precise figures require examination of the official Tesla Q1 2024 financial statement.

- Effect on gross margin: This decrease in ASP translates to a considerable reduction in gross profit per vehicle, significantly affecting the overall gross margin.

The data clearly shows a trade-off between increased sales volume and profitability. While the exact numbers need to be confirmed from the official financial reports, the impact on the gross margin is undeniable.

Boosting Sales Volume vs. Profitability

Tesla's strategy behind the price cuts remains a subject of debate. It likely aimed at several objectives simultaneously:

- Increasing market share: Facing increasing competition, price cuts could be a strategic move to maintain or grow market share in a rapidly expanding EV market.

- Clearing inventory: Lowering prices could help reduce excess inventory, which could be costly to hold.

- Responding to competition: Competitors are releasing increasingly competitive EVs, forcing Tesla to adjust its pricing strategy.

Despite increased sales volume (which requires confirmation from official data in the Q1 2024 report), the lower prices outweighed the gains from increased units sold, leading to the significant net income decline.

Intensifying Competition in the EV Market

The EV market is experiencing explosive growth, leading to increased competition for Tesla. This heightened competition puts pressure on pricing and overall demand.

Rising Competition from Established and New Players

Tesla is facing increasing competition from both established automakers and new EV startups.

- Key competitors: Companies like BYD, Volkswagen, Ford, and Rivian are aggressively expanding their EV portfolios, putting pressure on Tesla's market dominance. Other established automakers are also rapidly increasing their EV production capacity.

- Market share changes: While precise market share figures require detailed analysis of industry reports, it's evident that Tesla's market share is facing challenges from the surge in competition.

Pressure on Pricing and Demand

The influx of new players and their aggressive pricing strategies directly impacts Tesla's pricing power and demand.

- Impact of new entrants: Many new entrants are offering competitive EVs at similar or even lower price points, thereby increasing competitive pressure on Tesla.

Macroeconomic Headwinds and Supply Chain Challenges

Tesla also grapples with several macroeconomic challenges that negatively affect its performance.

Global Economic Slowdown

The global economic slowdown significantly impacts consumer spending, especially for luxury goods such as Tesla vehicles.

- Effects of inflation and interest rate hikes: Inflation and rising interest rates reduce consumer purchasing power, impacting demand for high-priced items.

Ongoing Supply Chain Disruptions

Lingering supply chain disruptions continue to increase Tesla's production costs and limit efficiency.

- Specific component shortages: While the severity has decreased since the height of the pandemic, certain components may still experience occasional shortages, affecting production timelines and costs.

Increased Production Costs and Investments

Rising production costs and significant investments further contribute to Tesla's reduced profitability.

Raw Material Prices

Fluctuations in raw material prices, crucial for EV battery production, directly affect Tesla's manufacturing costs.

- Examples of specific materials: Lithium, nickel, and cobalt are key components in EV batteries, and their prices significantly influence manufacturing costs.

Investments in New Technologies and Infrastructure

Tesla's substantial investments in R&D, new factories (Gigafactories), and charging infrastructure impact its short-term profitability.

- Long-term strategic implications: These investments are vital for Tesla's long-term growth and competitiveness, but they significantly affect its immediate financial performance.

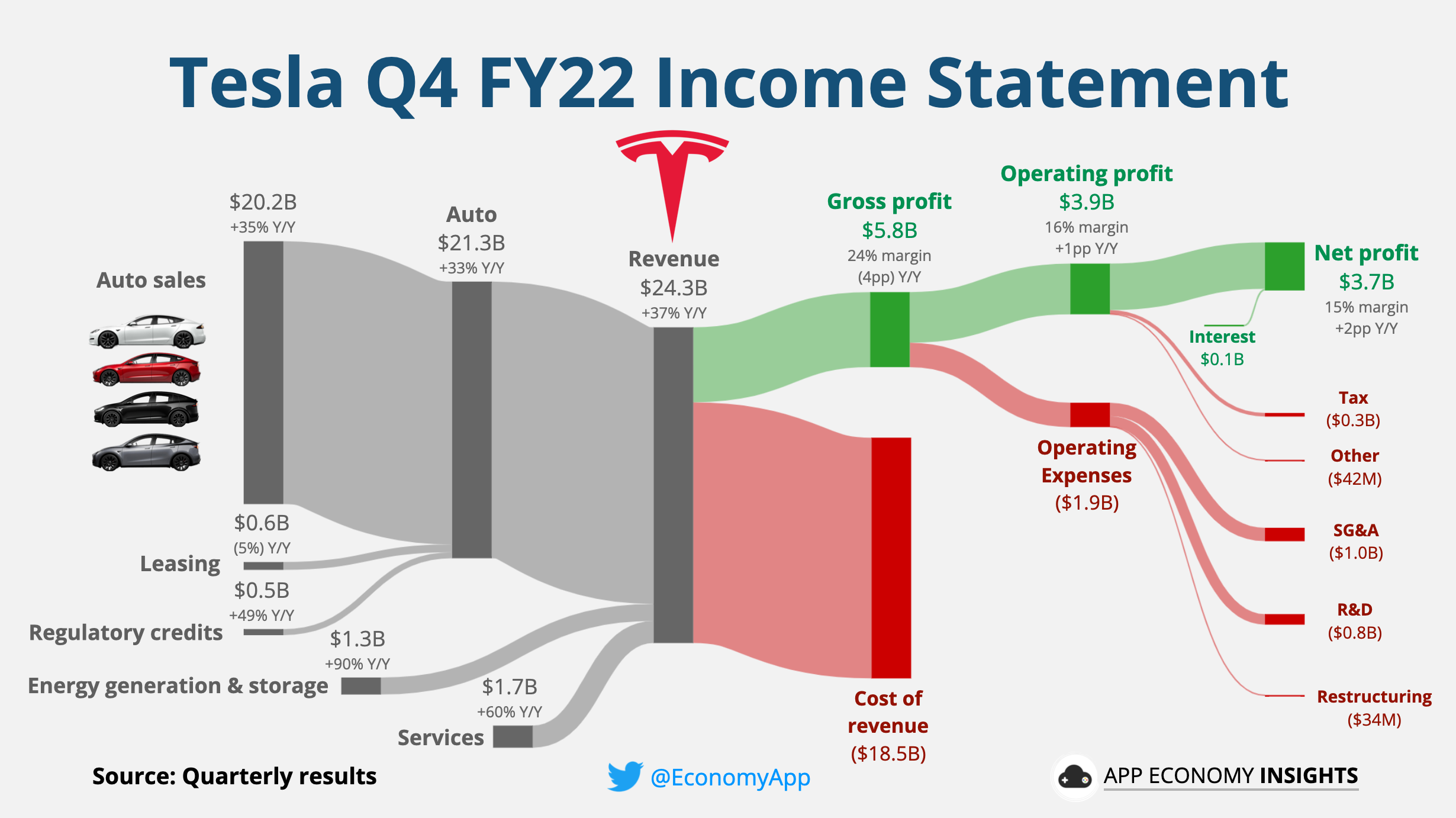

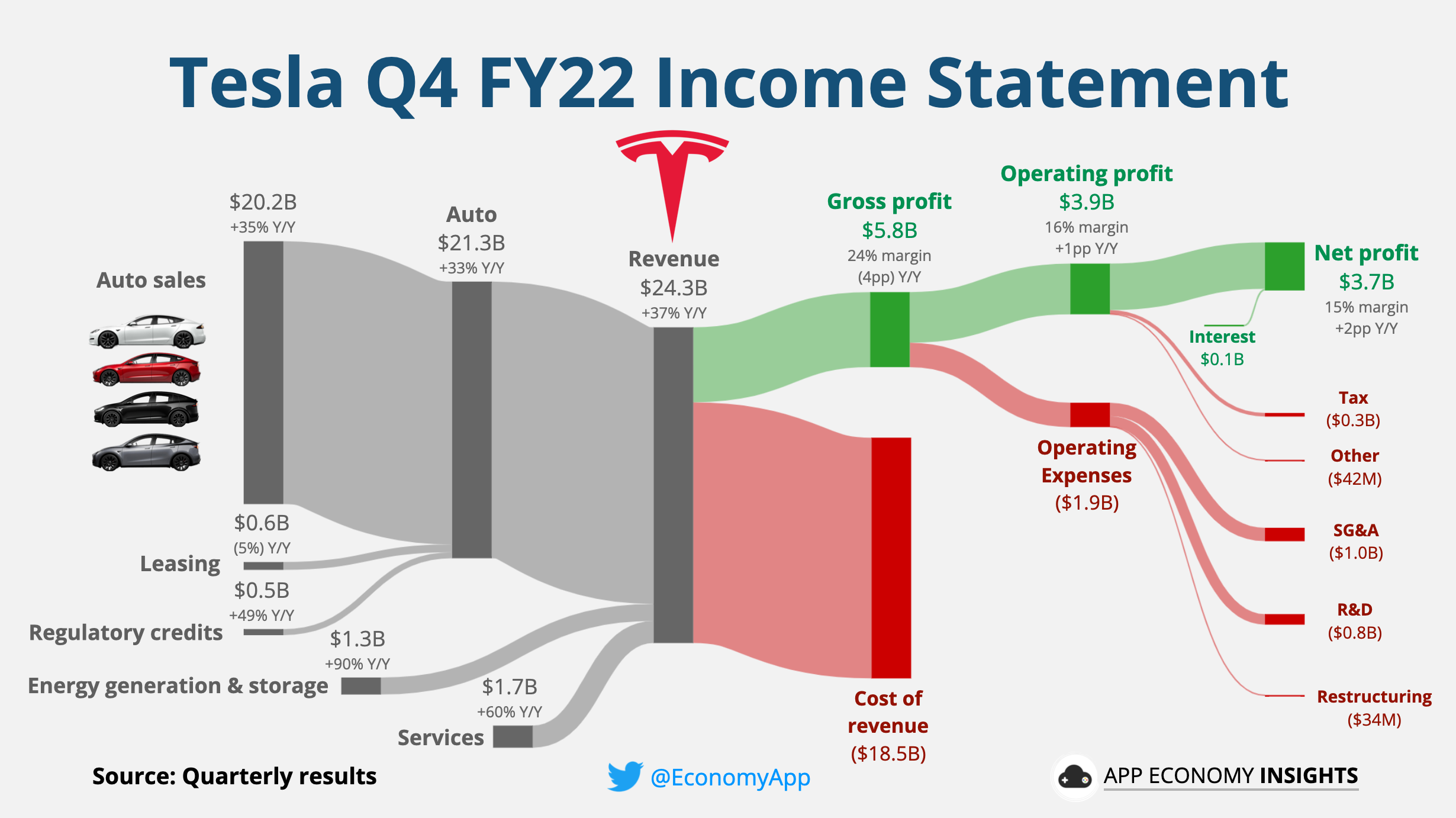

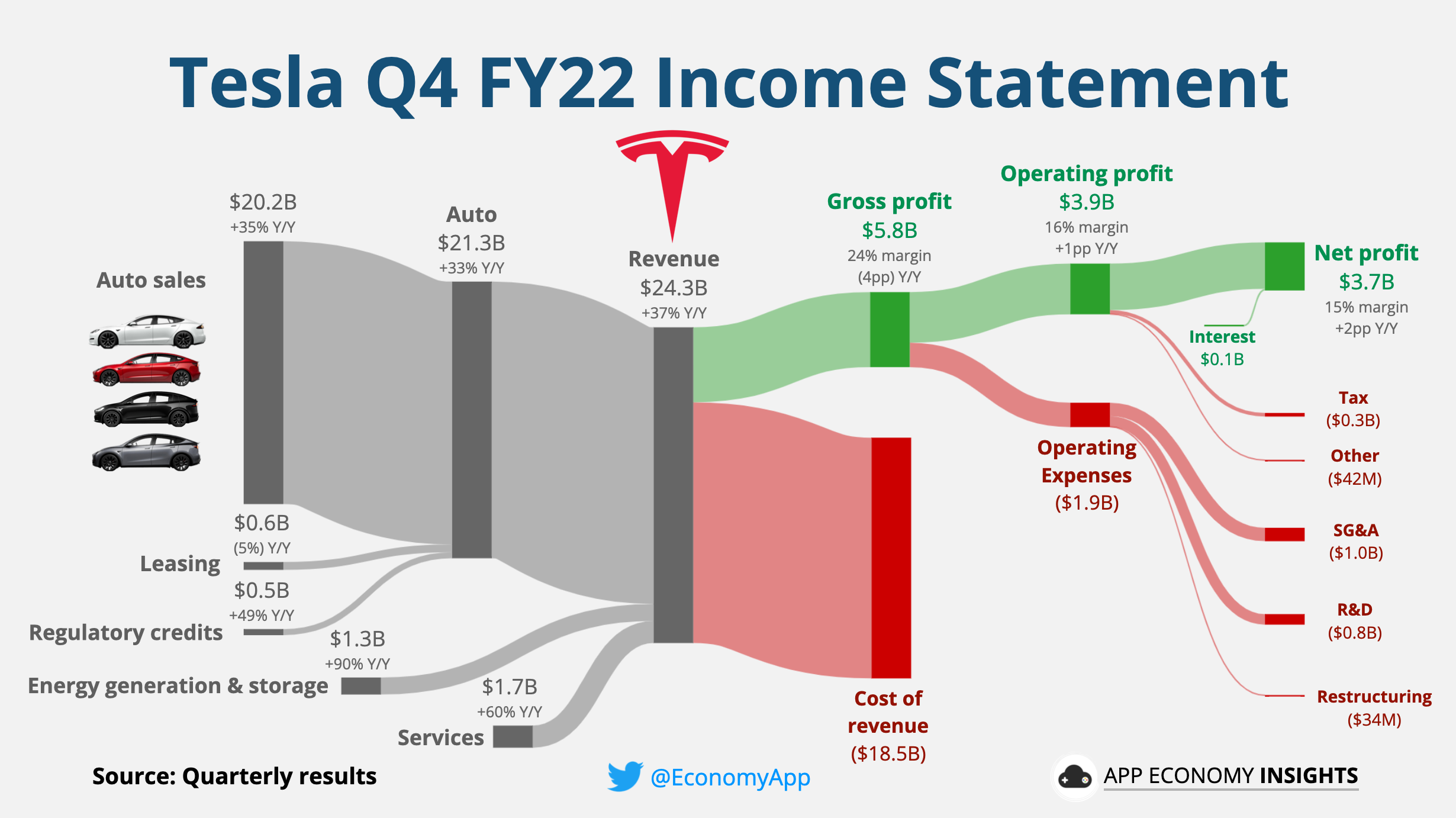

Analysis of Tesla's Q1 2024 Financial Statements

A detailed analysis of Tesla's Q1 2024 financial statements, including revenue, cost of goods sold (COGS), operating expenses, and net income, is crucial for a thorough understanding of the earnings plunge. (Insert link to the official Tesla Q1 2024 financial report here). Key metrics like gross margin and operating margin should be closely examined to gauge the impact of the aforementioned factors.

Investor Reactions and Stock Performance

The market reacted negatively to the announcement of Tesla's Q1 2024 earnings, leading to significant stock price fluctuations. Analyst predictions and forecasts for Tesla's future performance vary widely, reflecting the uncertainty surrounding the company's prospects.

Looking Ahead: Tesla's Strategy for Recovery

Tesla will need to implement strategic adjustments to improve profitability and regain market share. Potential strategies include:

- Further innovation in battery technology and vehicle design.

- More aggressive cost-cutting measures.

- Expansion into new markets.

- Optimization of its manufacturing processes.

Conclusion

Tesla's 71% decline in Q1 net income is attributable to a confluence of factors: aggressive price cuts impacting profit margins, intensifying competition in the EV market, macroeconomic headwinds, and increased production costs and investments. While the price cuts boosted sales volume, the resulting decrease in profitability significantly outweighed the benefits. The challenges highlight the complexities of maintaining profitability in a rapidly growing and competitive EV market.

Key Takeaways: Tesla's Q1 results underscore the challenges of balancing sales growth with profitability in a rapidly evolving industry. The company's response to the current market conditions will be crucial in determining its future success.

Call to Action: Understanding the intricacies of Tesla earnings is crucial for any investor in the electric vehicle sector. Stay informed by regularly checking back for future analyses of Tesla earnings and the latest industry news on our blog, or subscribe to our newsletter for updates on Tesla's performance and the evolving dynamics of the EV market.

Featured Posts

-

Tesla Earnings Plunge 71 Decline In Q1 Net Income Explained

Apr 24, 2025

Tesla Earnings Plunge 71 Decline In Q1 Net Income Explained

Apr 24, 2025 -

Zuckerberg In The Age Of Trump Challenges And Opportunities

Apr 24, 2025

Zuckerberg In The Age Of Trump Challenges And Opportunities

Apr 24, 2025 -

Trump Administration Open To Talks Following Harvards Legal Challenge

Apr 24, 2025

Trump Administration Open To Talks Following Harvards Legal Challenge

Apr 24, 2025 -

The Financial Future Of Elite Universities Navigating Political Headwinds

Apr 24, 2025

The Financial Future Of Elite Universities Navigating Political Headwinds

Apr 24, 2025 -

Chinas Impact On Bmw And Porsche Sales Are Other Automakers Facing Similar Issues

Apr 24, 2025

Chinas Impact On Bmw And Porsche Sales Are Other Automakers Facing Similar Issues

Apr 24, 2025