Ignoring High Stock Market Valuations: A BofA Analysis

Table of Contents

BofA's Key Concerns Regarding High Stock Market Valuations

BofA's analysis raises several significant concerns about the current state of the stock market, primarily focusing on the sustainability of these high stock market valuations. Let's examine their key worries:

Elevated Price-to-Earnings Ratios (P/E):

BofA points to historically high Price-to-Earnings (P/E) ratios across various sectors as a major red flag. This metric indicates how much investors are willing to pay for each dollar of a company's earnings. A high P/E ratio suggests that investors are paying a premium, potentially indicating overvaluation.

- Calculation of P/E Ratios: The P/E ratio is calculated by dividing a company's stock price by its earnings per share (EPS). A higher P/E ratio generally signifies higher investor expectations for future growth.

- Examples of High P/E Sectors: BofA's report likely highlights specific sectors with particularly high P/E ratios, potentially including technology, consumer discretionary, or other growth-oriented sectors. These sectors often command higher valuations due to anticipated future growth, but high P/E ratios can also signal vulnerability to market corrections.

- Implications for Future Returns: High P/E ratios can suggest lower potential future returns. If earnings growth doesn't meet investor expectations, the stock price could decline, leading to potential losses. This risk is amplified during periods of economic uncertainty or rising interest rates.

Impact of Rising Interest Rates:

The analysis likely emphasizes the significant effect of rising interest rates on stock valuations. Higher interest rates increase the discount rate used in discounted cash flow (DCF) models to value future earnings, making those future earnings worth less in present value terms. This can lead to lower stock valuations.

- Interest Rates and Stock Valuations: Higher interest rates make bonds more attractive, diverting investment away from stocks and potentially reducing demand for equities. This decrease in demand can push stock prices down.

- The Federal Reserve's Role: The Federal Reserve's monetary policy plays a crucial role in influencing interest rates. The Fed's decisions regarding interest rate hikes or cuts directly affect borrowing costs and investor sentiment, significantly influencing stock market valuations.

- BofA's Interest Rate Predictions: BofA's report likely includes predictions regarding future interest rate hikes and their potential impact on stock market valuations. Understanding these predictions is crucial for investors assessing the risks associated with high stock market valuations.

Geopolitical and Economic Uncertainty:

BofA's report undoubtedly acknowledges the significant impact of global uncertainties on stock market valuations. Factors like inflation, supply chain disruptions, geopolitical tensions, and recessionary fears all contribute to market volatility and investor uncertainty.

- Specific Geopolitical/Economic Factors: The BofA analysis likely cites specific geopolitical events (e.g., the war in Ukraine) or economic headwinds (e.g., persistent inflation) that influence investor sentiment and market behavior.

- Impact on Market Volatility: These uncertainties contribute to increased market volatility, making it harder to predict future stock prices and increasing the risk associated with maintaining high stock market valuations.

- Effect on Valuation Models: Geopolitical and economic uncertainties complicate valuation models, making it more challenging to accurately assess the intrinsic value of assets and increasing the margin of error in predicting future returns.

Potential Opportunities Despite High Valuations

Despite the concerns raised regarding high stock market valuations, BofA's analysis may also identify potential opportunities for discerning investors:

Identifying Undervalued Assets:

Even within a high-valuation market, some sectors or individual stocks may be undervalued relative to their fundamentals. BofA may have pinpointed such opportunities through rigorous analysis.

- Methodology for Identifying Undervalued Assets: BofA likely employs a combination of quantitative and qualitative methods to identify undervalued assets. This might involve analyzing financial statements, assessing future growth potential, and comparing valuations to historical averages or peer companies.

- Potential Undervalued Sectors/Stocks: The report may highlight specific sectors or companies that, despite the overall high market valuations, present attractive investment opportunities due to their relative undervaluation or strong fundamentals.

- Rationale for Undervaluation: BofA's rationale for considering these assets undervalued may be due to temporary market sentiment, overlooked growth potential, or other factors not fully reflected in the current stock price.

Long-Term Growth Potential:

BofA might argue that despite current high valuations, the long-term growth prospects for certain companies or sectors justify current prices. Identifying these companies requires careful analysis and a long-term investment horizon.

- Companies with Strong Long-Term Growth: The report may feature companies or sectors with robust long-term growth potential, driven by technological innovation, expanding market share, or other positive factors.

- Drivers of Long-Term Growth: Understanding the drivers of long-term growth is critical in assessing the sustainability of current valuations and the potential for future returns.

- Risks and Rewards: Investing in these assets carries both risks and rewards. While the potential for high long-term returns exists, investors should carefully assess potential risks, such as competition, technological disruption, or economic downturns.

Conclusion: Navigating High Stock Market Valuations

This article examined BofA's analysis of high stock market valuations, highlighting key concerns such as elevated P/E ratios, rising interest rates, and geopolitical uncertainties. While the report underscores potential risks, it also suggests opportunities for investors to identify undervalued assets and capitalize on long-term growth potential. Understanding and carefully considering these high stock market valuations is crucial for informed investment decisions. Don't ignore the potential risks. Conduct thorough due diligence and seek professional advice before making any investment choices based on current high stock market valuations. A well-diversified portfolio and a long-term investment strategy are essential to mitigate the risks associated with elevated market valuations.

Featured Posts

-

The Crucial Role Of Middle Managers In Todays Workplace

Apr 24, 2025

The Crucial Role Of Middle Managers In Todays Workplace

Apr 24, 2025 -

Hollywood Shutdown Actors And Writers On Strike What It Means For Film And Tv

Apr 24, 2025

Hollywood Shutdown Actors And Writers On Strike What It Means For Film And Tv

Apr 24, 2025 -

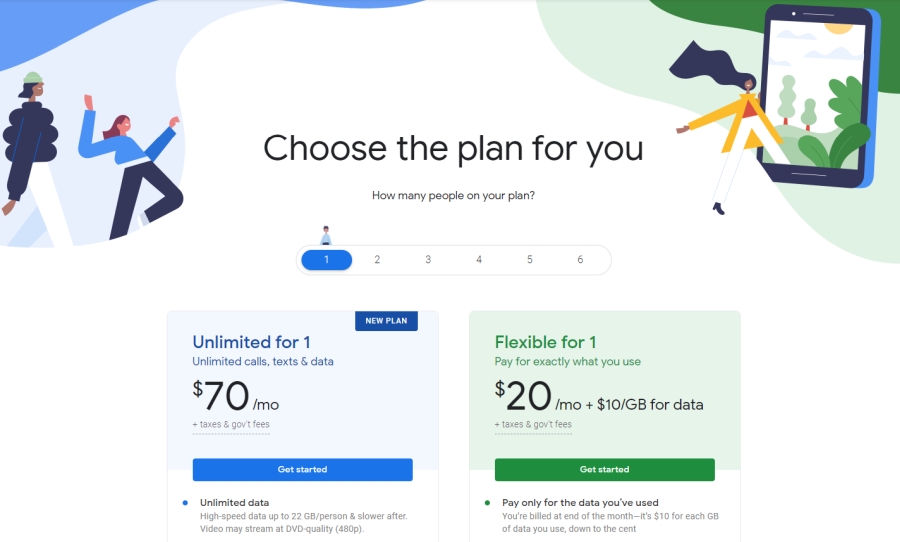

35 Unlimited Google Fis Latest Mobile Plan Offering

Apr 24, 2025

35 Unlimited Google Fis Latest Mobile Plan Offering

Apr 24, 2025 -

Tyler Herro Wins Nba 3 Point Contest Defeats Buddy Hield

Apr 24, 2025

Tyler Herro Wins Nba 3 Point Contest Defeats Buddy Hield

Apr 24, 2025 -

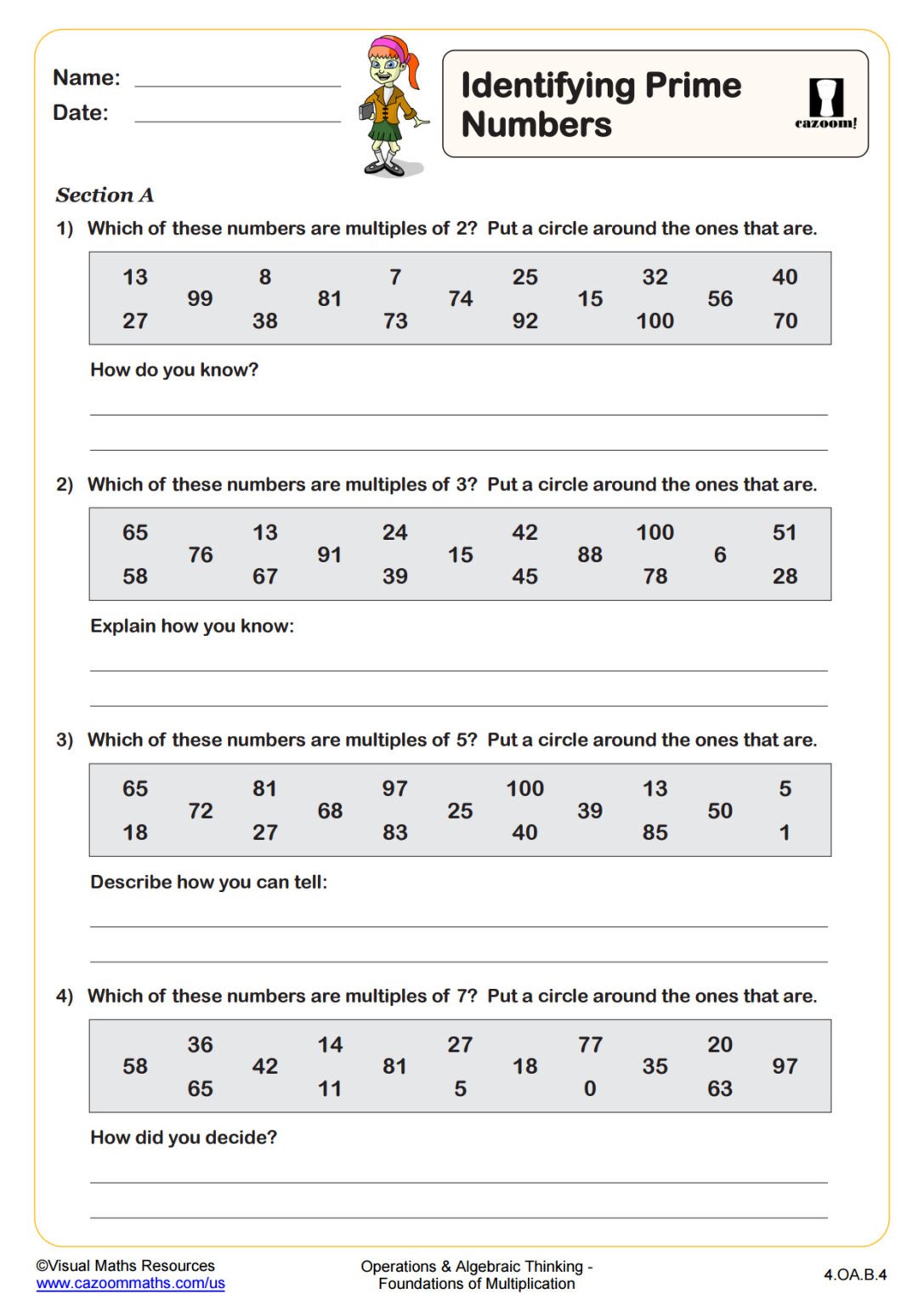

Identifying Prime Business Locations A Map Of The Countrys New Hot Spots

Apr 24, 2025

Identifying Prime Business Locations A Map Of The Countrys New Hot Spots

Apr 24, 2025