Auto Carrier Faces $70 Million Loss Due To US Port Fee Increases

Table of Contents

The $70 Million Loss: A Detailed Breakdown

The $70 million loss projection represents a severe blow to the auto carrier's bottom line. This substantial figure stems from a combination of sharply increased port fees imposed on imported vehicles. The breakdown reveals a complex interplay of various charges contributing to this financial crisis:

- Container Handling Fees: These fees, covering the loading and unloading of vehicles from ships, have seen a dramatic increase of approximately 25%, significantly impacting the carrier's operational costs.

- Chassis Rental: The cost of renting chassis – the wheeled undercarriages used to transport vehicles within port facilities – has risen by 15%, adding another layer to the escalating expenses.

- Terminal Handling Charges: These charges, levied for the storage and handling of vehicles at the terminal, experienced a 20% increase, further squeezing the carrier's profit margins.

Bullet Points:

- Specific Fee Increases: Container handling fees increased by 25%, chassis rental by 15%, and terminal handling charges by 20%.

- Number of Vehicles Affected: The fee hikes impacted over 50,000 imported vehicles, exacerbating the financial burden.

- Projected Revenue Loss per Vehicle: The estimated revenue loss per vehicle is approximately $1,400.

Impact of US Port Congestion and Delays

Beyond the increased US port fees themselves, port congestion significantly exacerbates the financial losses. Extended waiting times for ships to dock and unload contribute substantial additional costs:

- Fuel Costs: Idling ships consume vast amounts of fuel, leading to considerable expense during delays.

- Labor Costs: Crew wages and associated expenses continue to accrue during extended waiting periods.

- Storage Costs: Delays necessitate extended storage of vehicles at the port, incurring further storage fees.

These delays also ripple through the supply chain, impacting vehicle delivery schedules and potentially leading to penalties for late deliveries to dealerships and customers.

Bullet Points:

- Average Waiting Time: Average waiting times at affected ports have increased to over 7 days, significantly impacting operational efficiency.

- Additional Costs Due to Delays: Estimated additional costs due to delays are approximately $500 per vehicle.

- Impact on Delivery Schedules: Delays caused significant disruption to delivery schedules, leading to customer dissatisfaction and potential financial penalties.

Industry-Wide Implications: Ripple Effect of Increased Port Fees

The impact of these increased US port fees extends far beyond a single auto carrier. The entire automotive industry faces a significant challenge:

- Price Increases for Consumers: The increased costs are likely to be passed on to consumers, resulting in higher prices for new and used vehicles.

- Reduced Vehicle Imports: The higher shipping costs may lead to a reduction in the number of vehicles imported into the US, potentially affecting market availability.

- Supply Chain Disruptions: The instability caused by rising costs and port congestion creates further supply chain vulnerabilities, hindering the industry's ability to meet consumer demand.

Bullet Points:

- Predictions for Price Increases: Industry analysts predict a potential price increase of 5-10% on new vehicles and 3-5% on used vehicles.

- Potential Impact on Employment: Reduced imports and potential factory slowdowns could lead to job losses within the auto industry.

- Concerns Regarding Supply Chain Resilience: The current situation highlights the fragility of the automotive supply chain and the need for improved resilience.

Potential Solutions and Mitigation Strategies

Addressing the rising US port fees and congestion requires a multi-pronged approach:

- Negotiating Better Rates: Auto carriers need to actively negotiate with port authorities to secure more favorable rates.

- Alternative Shipping Routes: Exploring alternative shipping routes, including rail or inland waterways, could help mitigate reliance on congested ports.

- Technological Investment: Investing in technology to optimize logistics and improve port efficiency is crucial.

- Governmental Intervention: Governmental intervention, including infrastructure improvements and policy changes, could alleviate congestion and reduce fees.

Bullet Points:

- Negotiating Better Rates: Collaborative efforts between auto carriers and port authorities are crucial for achieving fairer pricing structures.

- Exploring Alternative Shipping Routes: Diversifying shipping routes can help reduce reliance on congested ports.

- Investing in Technology: Utilizing technology such as predictive analytics and optimized route planning can improve efficiency and reduce costs.

Conclusion: Navigating the Rising Tide of US Port Fees

The $70 million loss projected by this auto carrier serves as a stark warning of the significant financial burden imposed by increased US port fees. The impact extends far beyond a single company, affecting the entire automotive industry and potentially consumers through higher prices and reduced vehicle availability. The industry must actively pursue solutions, including negotiations with port authorities, exploration of alternative shipping methods, and investment in technology, to navigate this challenging landscape. Learn more about how rising US port fees are affecting the automotive industry by subscribing to our newsletter for updates and insights. Stay informed about the latest developments regarding US port fees and their impact on the auto industry and the broader economy.

Featured Posts

-

A Conservative Harvard Professor On Reforming Higher Education

Apr 26, 2025

A Conservative Harvard Professor On Reforming Higher Education

Apr 26, 2025 -

The Importance Of Middle Managers Bridging The Gap Between Leadership And Employees

Apr 26, 2025

The Importance Of Middle Managers Bridging The Gap Between Leadership And Employees

Apr 26, 2025 -

2700 Miles From Dc A Rural Schools Experience Of Trumps First 100 Days

Apr 26, 2025

2700 Miles From Dc A Rural Schools Experience Of Trumps First 100 Days

Apr 26, 2025 -

Transatlantic Ai Divide Trump Administration Vs European Ai Rulebook

Apr 26, 2025

Transatlantic Ai Divide Trump Administration Vs European Ai Rulebook

Apr 26, 2025 -

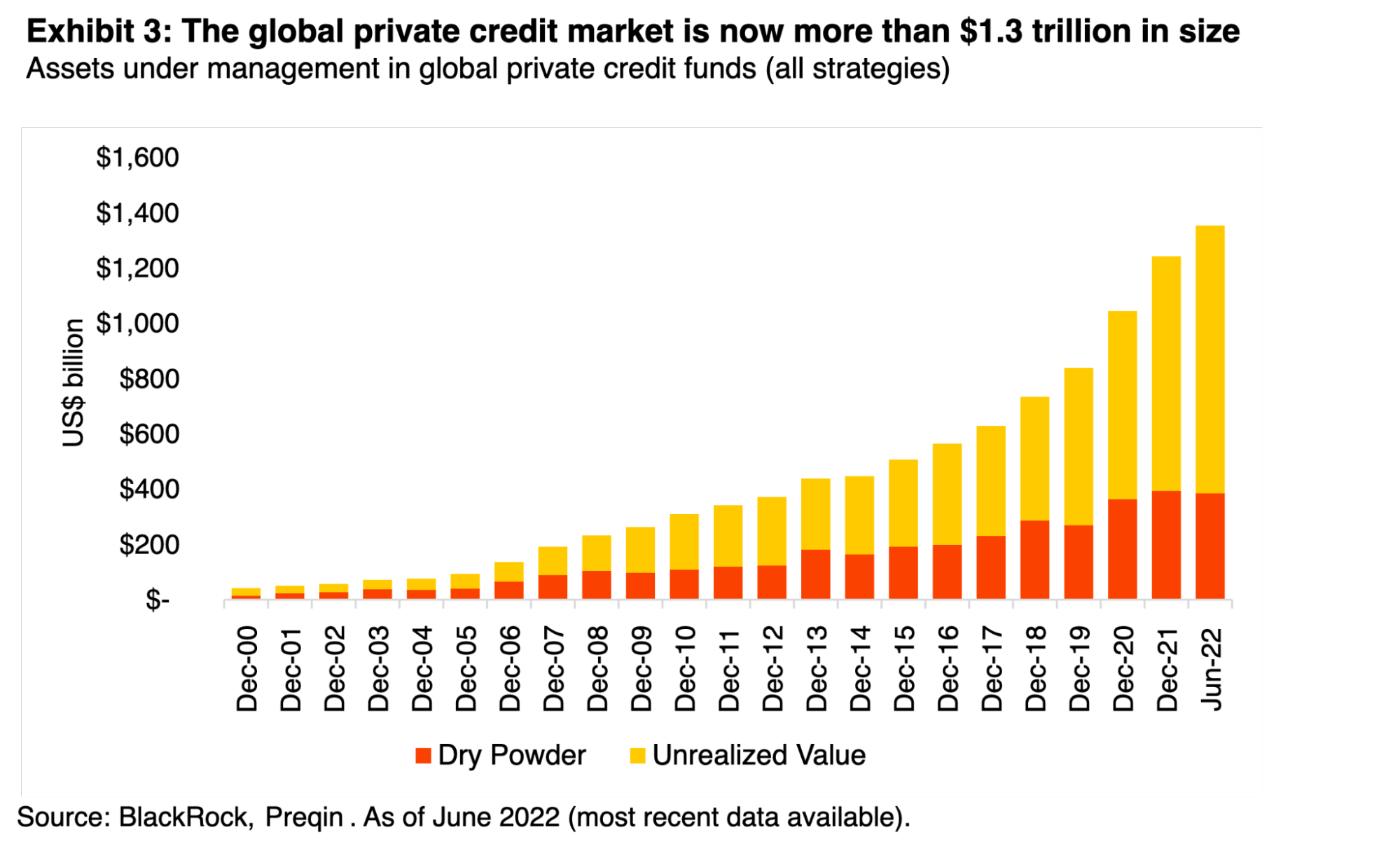

5 Key Dos And Don Ts To Secure A Role In The Private Credit Boom

Apr 26, 2025

5 Key Dos And Don Ts To Secure A Role In The Private Credit Boom

Apr 26, 2025