5 Key Dos And Don'ts To Secure A Role In The Private Credit Boom

Table of Contents

Do: Network Strategically in the Private Credit Industry

Networking is paramount when pursuing private credit jobs. Building relationships within the industry significantly increases your chances of discovering hidden opportunities and gaining a competitive edge.

-

Attend industry conferences and events: Participation in events like the Private Debt Investor Forum or SuperReturn provides invaluable networking opportunities. These events offer chances to connect with professionals, learn about emerging trends, and make crucial connections.

-

Leverage LinkedIn effectively: Optimize your LinkedIn profile with relevant keywords like "private debt," "credit analysis," and "financial modeling." Actively engage with industry leaders, participate in relevant groups, and connect with recruiters specializing in finance and private credit.

-

Join relevant professional organizations: Membership in organizations such as the Alternative Credit Council or the Loan Syndications and Trading Association (LSTA) provides access to a network of professionals and industry insights.

-

Informational interviews: Reaching out to professionals for informational interviews allows you to gain valuable insights, learn about career paths, and potentially uncover unadvertised opportunities within private credit firms.

-

Cultivate relationships with recruiters specializing in finance and private credit: Building rapport with recruiters who focus on the private credit sector can significantly boost your chances of hearing about relevant job openings before they are publicly advertised. Keywords: private credit networking, finance networking, industry events.

Don't: Neglect Your Online Presence

In today's digital age, your online presence is often the first impression you make on potential employers. A strong online profile is crucial for securing a private credit role.

-

Optimize your LinkedIn profile with relevant keywords: Include keywords such as "private debt," "direct lending," "due diligence," and "credit analysis" in your profile summary and experience sections. Showcase your expertise effectively.

-

Create a professional website or portfolio: A personal website or portfolio demonstrates your expertise and professionalism. It allows you to showcase your accomplishments, projects, and skills in a more comprehensive and engaging manner than a resume alone.

-

Be active on relevant social media platforms: Engage thoughtfully on platforms like LinkedIn and Twitter, sharing insightful comments and demonstrating your knowledge of industry trends. Avoid posting anything that could negatively impact your professional image.

-

Ensure your online presence reflects positively on your professional image: Regularly review and update your online profiles to ensure they accurately reflect your current skills and experience and maintain a consistent professional tone. Keywords: online presence, LinkedIn profile optimization, digital footprint, professional branding.

Do: Highlight Relevant Skills and Experience

Tailoring your application materials to demonstrate your relevant skills and experience is vital for success in securing a private credit role.

-

Tailor your resume and cover letter to each specific job description: Highlight the skills and experiences most relevant to each specific role, demonstrating your understanding of the employer's needs.

-

Quantify achievements whenever possible: Instead of simply stating your responsibilities, quantify your achievements with specific numbers and data to illustrate your impact. For example, "Increased portfolio returns by 15%."

-

Emphasize skills in financial modeling, credit analysis, and due diligence: These are fundamental skills in private credit, and you should prominently display your proficiency in these areas.

-

Showcase experience in areas like portfolio management, deal structuring, or fundraising: Relevant experience in these areas significantly enhances your candidacy. Keywords: credit analysis skills, financial modeling, due diligence, portfolio management, private debt experience.

Don't: Underestimate the Importance of Soft Skills

While technical skills are crucial, soft skills are equally important for success in private credit roles, which often involve significant teamwork and client interaction.

-

Communication skills (written and verbal): Clear and effective communication is vital for interacting with colleagues, clients, and investors.

-

Teamwork and collaboration: Private credit often involves working collaboratively in teams on complex transactions.

-

Problem-solving and critical thinking: Analyzing complex financial situations and finding creative solutions is essential.

-

Negotiation and influencing: Effective negotiation skills are crucial for securing favorable terms and building relationships.

-

Adaptability and resilience: The private credit market is dynamic, requiring adaptability to changing circumstances and resilience in facing challenges. Keywords: soft skills, communication skills, teamwork, problem-solving, adaptability.

Do: Prepare for the Interview Process

Thorough preparation is key to success in the private credit job interview process.

-

Research the firm and the interviewers: Understanding the firm's investment strategy, recent deals, and the interviewers' backgrounds demonstrates your genuine interest and preparedness.

-

Practice behavioral interview questions: Prepare for questions like "Tell me about a time you failed" or "Describe a challenging situation and how you overcame it." Practice articulating your responses clearly and concisely.

-

Prepare insightful questions to ask the interviewers: Asking thoughtful questions demonstrates your engagement and initiative. Prepare questions related to the firm's culture, investment strategy, and future plans.

-

Dress professionally and maintain good body language: Project confidence and professionalism through your appearance and demeanor.

-

Follow up with a thank-you note: Expressing gratitude reinforces your interest and leaves a positive lasting impression. Keywords: private credit interview, job interview tips, behavioral questions, interview preparation.

Capitalize on the Private Credit Boom: Secure Your Role Today!

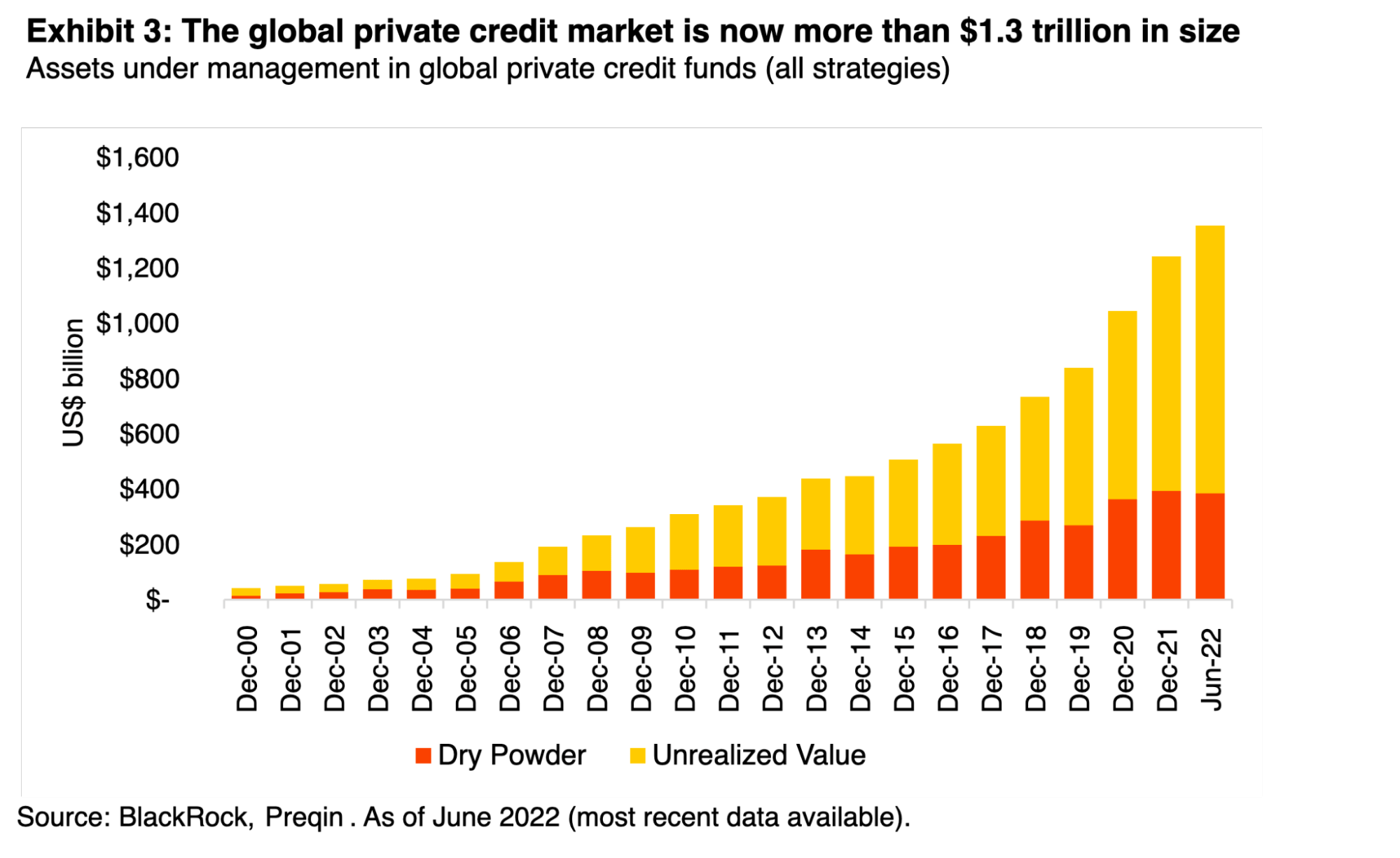

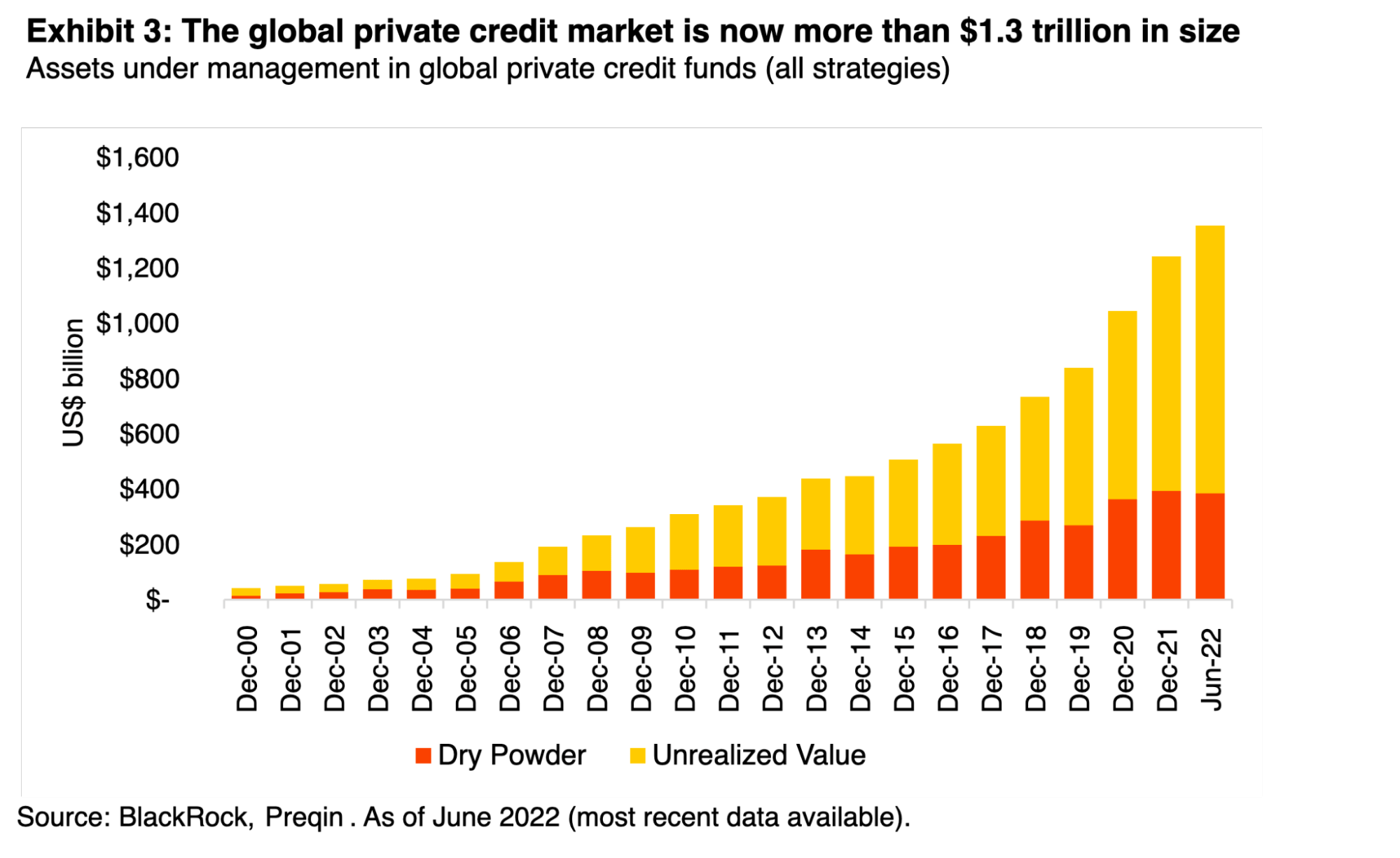

Securing a role in the thriving private credit market requires a strategic approach encompassing strong networking, a compelling online presence, showcasing relevant skills and experience, developing strong soft skills, and meticulous interview preparation. By diligently applying the "dos" and avoiding the "don'ts" outlined in this article, you can significantly increase your chances of landing your dream job in this exciting and rapidly expanding sector of finance. Start applying these strategies today to advance your career in the exciting world of private credit!

Featured Posts

-

Closure Of Point72s Emerging Markets Trading Unit

Apr 26, 2025

Closure Of Point72s Emerging Markets Trading Unit

Apr 26, 2025 -

Trump On Ukraine And Nato Assessing The Political Landscape

Apr 26, 2025

Trump On Ukraine And Nato Assessing The Political Landscape

Apr 26, 2025 -

Ftc Challenges Microsofts Activision Blizzard Buyout A Legal Battle

Apr 26, 2025

Ftc Challenges Microsofts Activision Blizzard Buyout A Legal Battle

Apr 26, 2025 -

Hollywood Production Halted The Combined Writers And Actors Strike

Apr 26, 2025

Hollywood Production Halted The Combined Writers And Actors Strike

Apr 26, 2025 -

Should You Return To A Company That Laid You Off

Apr 26, 2025

Should You Return To A Company That Laid You Off

Apr 26, 2025