As Markets Swooned, Pros Sold—and Individuals Pounced: A Market Analysis

Table of Contents

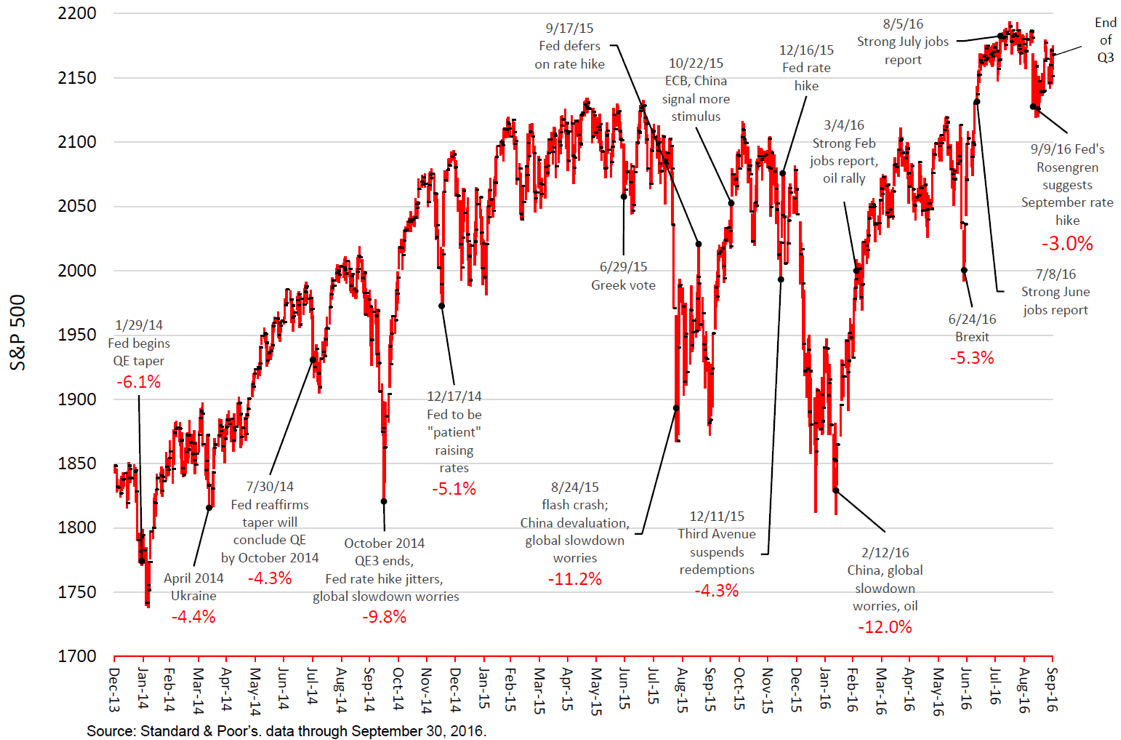

Professional Investor Behavior During Market Downturns

Professional investors, such as institutional fund managers and hedge fund managers, generally approach market downturns with a calculated and strategic mindset. Their actions are driven by sophisticated risk management techniques and a long-term perspective.

Risk Management Strategies

Professionals prioritize risk management above all else. They employ a range of strategies to mitigate potential losses during periods of market volatility.

- Hedging Strategies: These involve using financial instruments like options and futures contracts to offset potential losses in other investments. For example, a fund manager might buy put options on a stock they hold to protect against a price decline.

- Portfolio Diversification: Professionals meticulously diversify their portfolios across different asset classes (stocks, bonds, real estate, etc.), sectors, and geographies. This reduces the impact of a downturn in any single area. Asset allocation models are carefully constructed to achieve the desired risk-return profile.

- Stress Testing Portfolios: Sophisticated models are used to simulate various market scenarios (e.g., recession, inflation spike) to assess the resilience of their portfolios under adverse conditions. This allows for proactive adjustments to reduce vulnerability.

Keywords: Risk management, hedging strategies, portfolio diversification, asset allocation, institutional investors

Short-Term vs. Long-Term Outlook

While acknowledging short-term market fluctuations, professional investors maintain a long-term investment horizon. They understand that market corrections are a normal part of the economic cycle and focus on the long-term growth potential of their investments.

- Long-Term Investment Horizons: Their investment decisions are guided by long-term goals, such as achieving specific returns over 5, 10, or even 20 years. Short-term volatility is viewed as noise rather than a signal to change course.

- Distinguishing Short-Term Fluctuations from Long-Term Trends: Professionals possess the expertise to differentiate between temporary market downturns and fundamental shifts in the economy or a particular sector. This enables them to make informed decisions about whether to hold, buy, or sell.

Keywords: Long-term investment, short-term market volatility, long-term investment strategy

Selling to Secure Profits or Limit Losses

Even with a long-term outlook, professionals might sell assets during a downturn. This is often a strategic decision driven by risk management principles.

- Profit Taking: If an asset has significantly appreciated, selling might lock in substantial profits, reducing exposure to potential future losses.

- Loss Limitation: Selling a poorly performing asset can prevent further losses, freeing up capital for more promising opportunities.

Keywords: Profit taking, loss limitation, risk aversion, strategic selling

Individual Investor Behavior During Market Downturns

Individual investors often react to market downturns very differently from their professional counterparts, frequently driven by emotions rather than a calculated strategy.

Emotional Investing and Fear

Fear and panic can lead individual investors to make impulsive, often detrimental decisions during market drops.

- Panic Selling: The fear of further losses can trigger panic selling, often at the worst possible time, locking in losses and missing potential recovery.

- Fear of Missing Out (FOMO): Conversely, FOMO can lead individuals to chase rising assets even during a downturn, potentially increasing their risk exposure.

- Behavioral Biases: Herd behavior and confirmation bias (seeking information that confirms pre-existing beliefs) can exacerbate emotional responses and lead to poor investment decisions.

Keywords: Emotional investing, panic selling, behavioral finance, fear, greed, FOMO

Opportunistic Buying

While many individuals react with fear, others view market downturns as buying opportunities.

- Value Investing: They see the decline as a chance to acquire undervalued assets at discounted prices, potentially reaping significant gains when the market recovers.

- Bargain Hunting: This approach requires careful research and due diligence to identify fundamentally sound companies whose stock prices have fallen disproportionately to their intrinsic value.

Keywords: Value investing, bargain hunting, undervalued assets, opportunity buying

Lack of Diversification & Risk Tolerance

Individual investors often lack the diversification and risk management expertise of professionals, leading to greater vulnerability during market downturns.

- Concentrated Holdings: Many individuals hold a concentrated portfolio, increasing their risk exposure to a single stock or sector.

- Inappropriate Risk Tolerance: Individuals may take on more risk than is appropriate for their financial circumstances and investment goals.

Keywords: Portfolio diversification, risk tolerance, individual investors, risk management

Analyzing the Discrepancy: Why the Difference?

The contrasting behaviors stem from several key factors.

Access to Information and Expertise

Professional investors have access to superior information, sophisticated analytical tools, and experienced teams. Individuals often lack these resources, making it harder to make informed decisions during times of uncertainty.

Different Investment Time Horizons

Professionals typically have longer-term investment horizons, allowing them to weather short-term volatility. Many individual investors focus on shorter-term gains or are more sensitive to immediate market fluctuations.

Regulatory Considerations

Regulations and fiduciary responsibilities place constraints on professional investors' actions, encouraging a more cautious and risk-averse approach. Individuals face fewer such constraints.

As Markets Swooned, Pros Sold—and Individuals Pounced: Key Takeaways and Call to Action

The contrasting behaviors of professional and individual investors during market swoons highlight the importance of understanding market dynamics and managing risk effectively. Professionals utilize sophisticated strategies and a long-term perspective, while individuals are often driven by emotions. Understanding these differences is crucial. Learn more about developing a robust investment strategy by [link to relevant resource/further reading]. Don't let market volatility dictate your financial future; make informed decisions based on a solid understanding of market analysis and risk management tailored to your individual needs.

Featured Posts

-

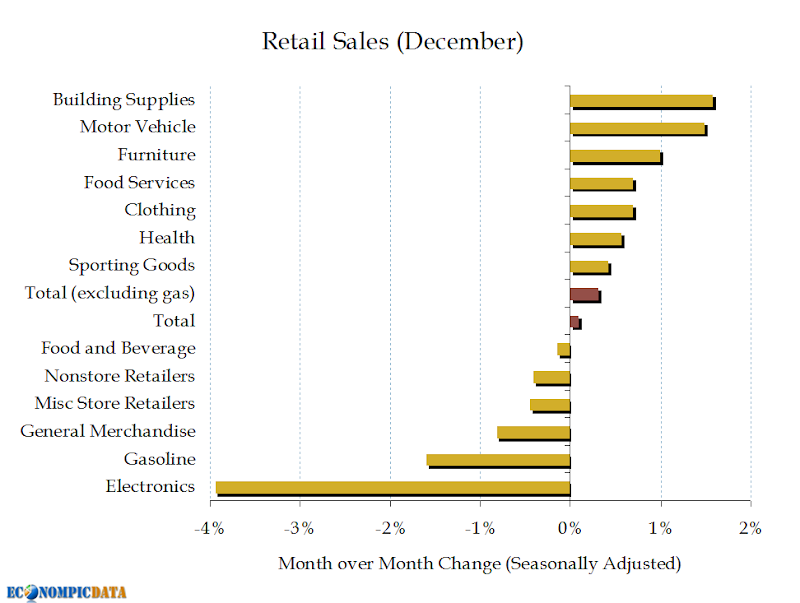

Economists Predict Rate Cuts Following Weak Retail Sales Figures

Apr 28, 2025

Economists Predict Rate Cuts Following Weak Retail Sales Figures

Apr 28, 2025 -

Tech Sector Propels Us Stock Market Higher Teslas Impact

Apr 28, 2025

Tech Sector Propels Us Stock Market Higher Teslas Impact

Apr 28, 2025 -

Walk Off Win For Pirates Yankees Fall In Extra Innings

Apr 28, 2025

Walk Off Win For Pirates Yankees Fall In Extra Innings

Apr 28, 2025 -

Martinsville Speedway Hamlins Triumph Ends Long Drought

Apr 28, 2025

Martinsville Speedway Hamlins Triumph Ends Long Drought

Apr 28, 2025 -

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 28, 2025

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 28, 2025