Tech Sector Propels US Stock Market Higher: Tesla's Impact

Table of Contents

Tesla's Contribution to Market Growth

Tesla's influence on the US stock market is undeniable. Its soaring stock price and massive market capitalization have significantly contributed to the growth of major market indices like the S&P 500.

-

Tesla's Stock Price Surge: Tesla's stock price has experienced dramatic increases, reflecting investor confidence in the company's future. This growth directly impacts major market indices, boosting overall market value.

-

Market Capitalization and Global Standing: Tesla's market capitalization now places it among the world's largest companies, highlighting its significant influence on global market dynamics. Its substantial valuation reflects investor belief in the company’s long-term prospects and its leadership in the electric vehicle market.

-

EV Production and Investor Confidence: Tesla's impressive electric vehicle (EV) production and sales figures continuously bolster investor confidence. Strong sales demonstrate market demand for its products and showcase the company’s ability to execute its business strategy effectively. This positive feedback loop drives further stock price appreciation.

-

Technological Advancements and Valuation: Tesla's continuous technological advancements, from battery technology to autonomous driving capabilities, significantly impact its market valuation. Investors reward innovation, and Tesla's consistent breakthroughs solidify its position as a leader in the EV sector and beyond.

-

Investor Sentiment and Market Sentiment: Positive investor sentiment towards Tesla often spills over into the broader market, creating a ripple effect that influences other tech stocks and boosts overall market confidence.

The Broader Tech Sector's Influence

While Tesla's impact is significant, the broader tech sector's performance is a crucial driver of US stock market growth. Many factors contribute to this influence.

-

FAANG Stocks and Market Gains: The strong performance of FAANG stocks (Facebook, Apple, Amazon, Netflix, Google) has been a key factor in driving overall market gains. These tech giants represent substantial portions of major market indices, making their performance crucial.

-

Performance of Key Tech Sectors: Growth across various tech sectors, including semiconductors, software development, and cloud computing, reinforces the overall positive trend. The strength of these sub-sectors reflects the pervasive influence of technology in the modern economy.

-

Innovation and Stock Market Valuation: Technological innovation is intrinsically linked to stock market valuation within the tech sector. Companies that consistently introduce groundbreaking technologies often see their stock prices appreciate as investors anticipate future growth.

-

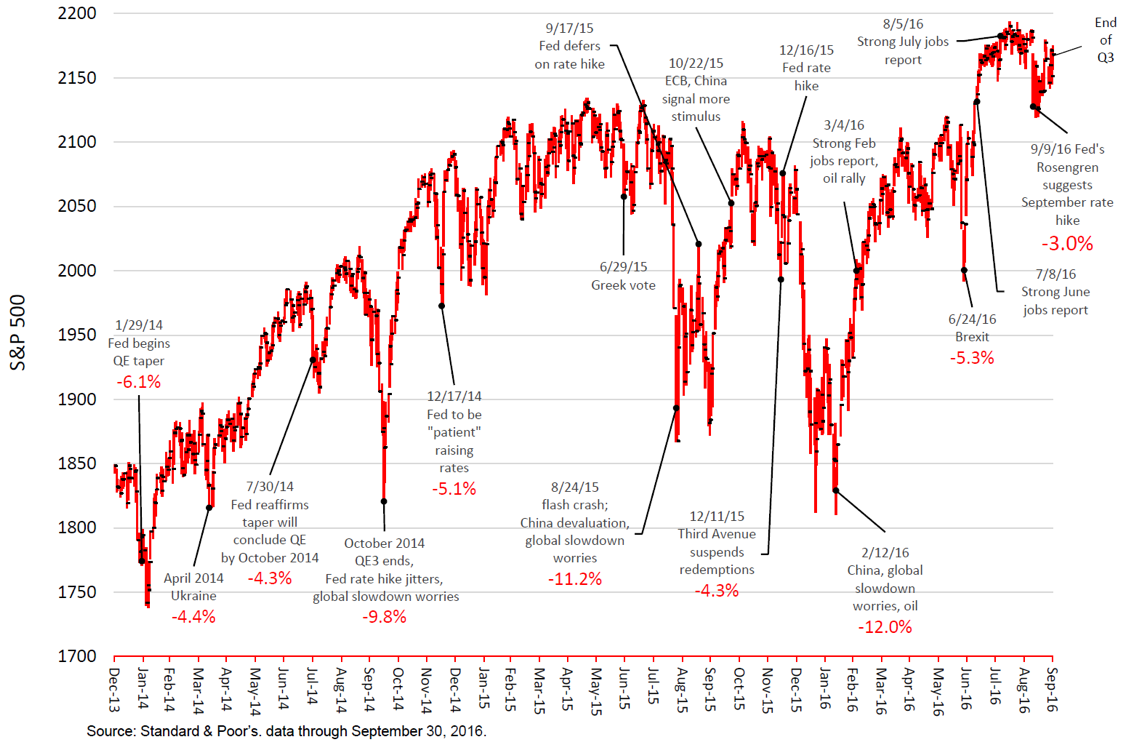

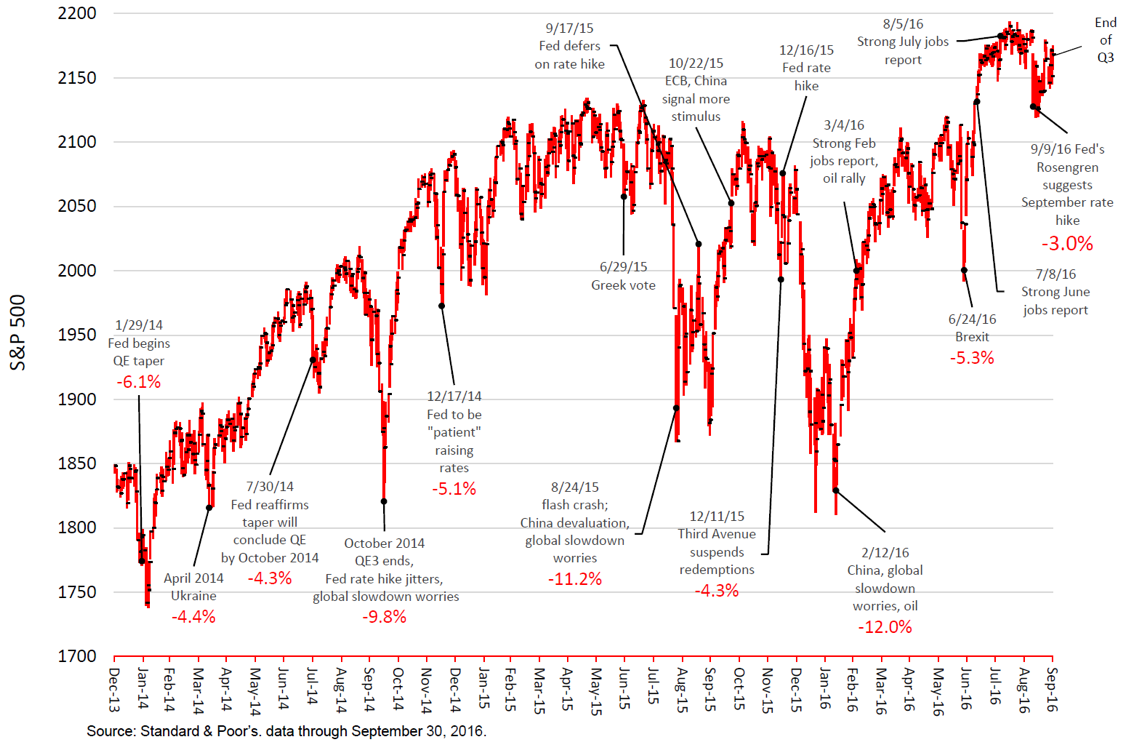

Market Volatility and Tech Stocks: Although tech stocks can be susceptible to market volatility, their overall resilience and growth potential make them attractive to investors seeking long-term gains. Understanding the cyclical nature of the market is crucial for effective investment in this space.

-

Technological Disruptions and Market Impact: Technological disruptions, while potentially risky for some businesses, overall fuel innovation and drive market growth. Companies adapting to and driving these disruptions often experience significant gains, leading to a positive impact on the broader market.

Impact of Innovation and Future Outlook

The future of the US stock market is closely tied to the continued innovation within the tech sector.

-

Continued Innovation Driving Growth: Continuous technological advancements will be the key driver of future growth in the tech sector and the overall market. Companies that stay ahead of the curve and innovate effectively are likely to see continued success.

-

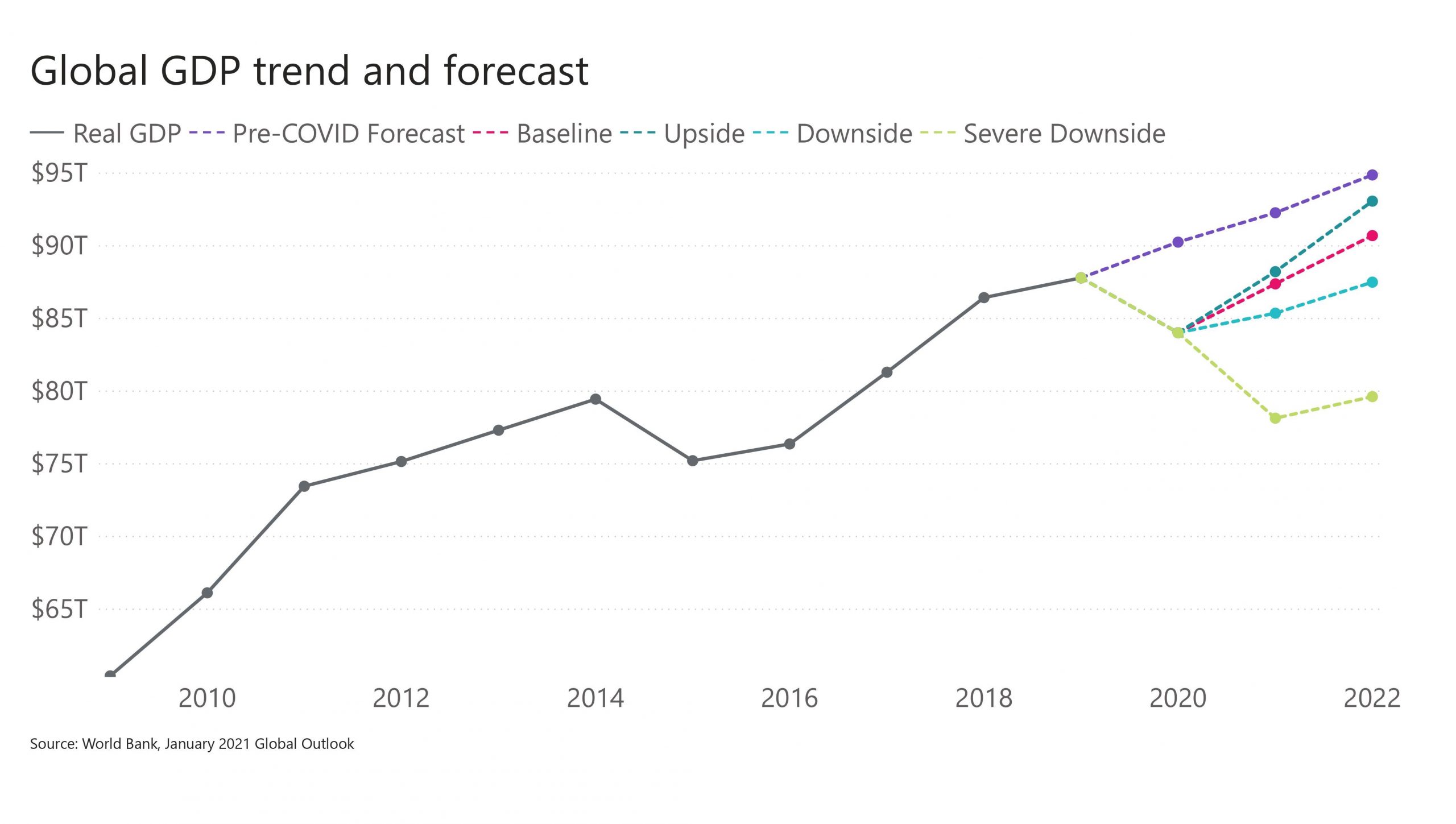

Emerging Technologies and Market Impact: Emerging technologies like artificial intelligence (AI) and sustainable energy solutions are poised to have a transformative impact on various industries, leading to significant market opportunities. Early investors in these areas may see substantial returns.

-

Future Trends and Their Influence: Understanding future market trends, such as the increasing demand for cloud computing services or the growth of the metaverse, is essential for informed investment decisions in the tech sector.

-

Long-Term Investment Strategies: A long-term investment approach within the tech sector is often recommended, acknowledging that periods of volatility are inherent to the market. Consistent investment and a focus on innovation can yield substantial returns.

Conclusion

The strong performance of the tech sector, significantly propelled by Tesla's remarkable success, has been a primary driver of the recent growth in the US stock market. Tesla's innovative spirit and considerable market capitalization have significantly influenced investor sentiment and key market indices. The broader tech sector’s ongoing innovation across diverse fields suggests continued positive momentum.

Understanding the influence of the tech sector, particularly Tesla's considerable impact, is crucial for effective navigation of the US stock market. Stay informed about the latest developments in the tech sector and consider incorporating these insights into your investment strategy. Learn more about investing in the tech sector and Tesla's continued influence on the market.

Featured Posts

-

Yankee Star Aaron Judge And Samantha Bracksieck Welcome Baby

Apr 28, 2025

Yankee Star Aaron Judge And Samantha Bracksieck Welcome Baby

Apr 28, 2025 -

Red Sox Manager Cora Makes Lineup Adjustments For Doubleheader

Apr 28, 2025

Red Sox Manager Cora Makes Lineup Adjustments For Doubleheader

Apr 28, 2025 -

Alberta Faces Economic Blow From Dows Delayed Megaproject

Apr 28, 2025

Alberta Faces Economic Blow From Dows Delayed Megaproject

Apr 28, 2025 -

International Figures Attend Pope Francis Funeral Mass

Apr 28, 2025

International Figures Attend Pope Francis Funeral Mass

Apr 28, 2025 -

X Corp Financials Post Debt Sale Key Insights And Analysis

Apr 28, 2025

X Corp Financials Post Debt Sale Key Insights And Analysis

Apr 28, 2025