Why Investors Shouldn't Fear High Stock Market Valuations: A BofA Perspective

Table of Contents

Understanding the Nuances of "High" Valuations

The Importance of Context

Valuation metrics like Price-to-Earnings (P/E) ratios, while useful, are not standalone indicators of market health. Interpreting them requires a broader economic context, considering several crucial factors:

- Interest Rates: Lower interest rates generally support higher valuations, as the cost of borrowing is lower, stimulating investment and growth. Conversely, higher interest rates can compress valuations as the opportunity cost of investing in equities increases.

- Inflation: High inflation erodes purchasing power and increases uncertainty, potentially impacting corporate earnings and investor sentiment, thus influencing valuations. Conversely, controlled inflation can support moderate growth and higher valuations.

- Growth Prospects: Strong projected economic growth and corporate earnings growth can justify higher valuations, even if they appear historically elevated. Conversely, weak growth prospects can lead to lower valuations, even with historically low interest rates.

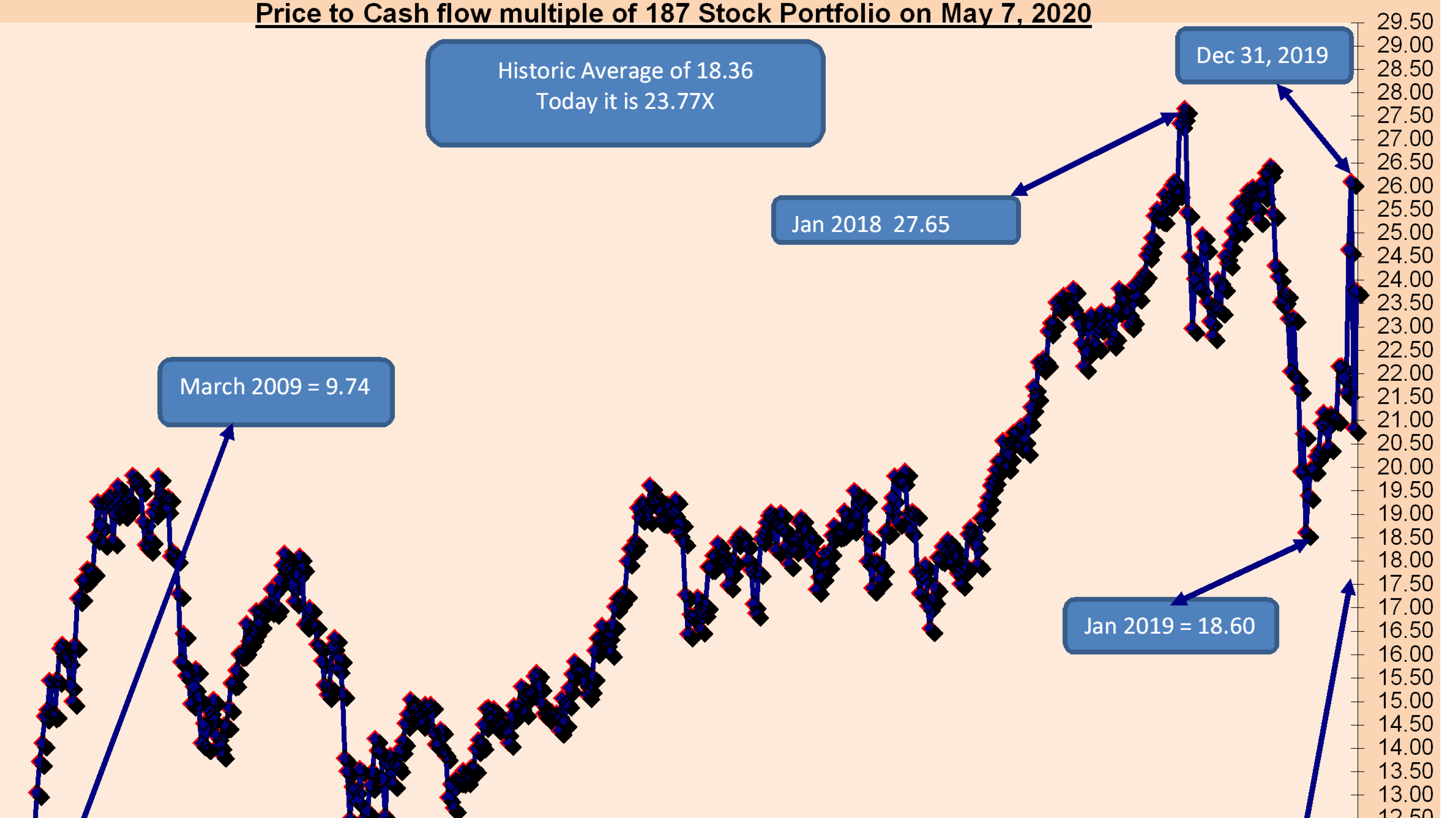

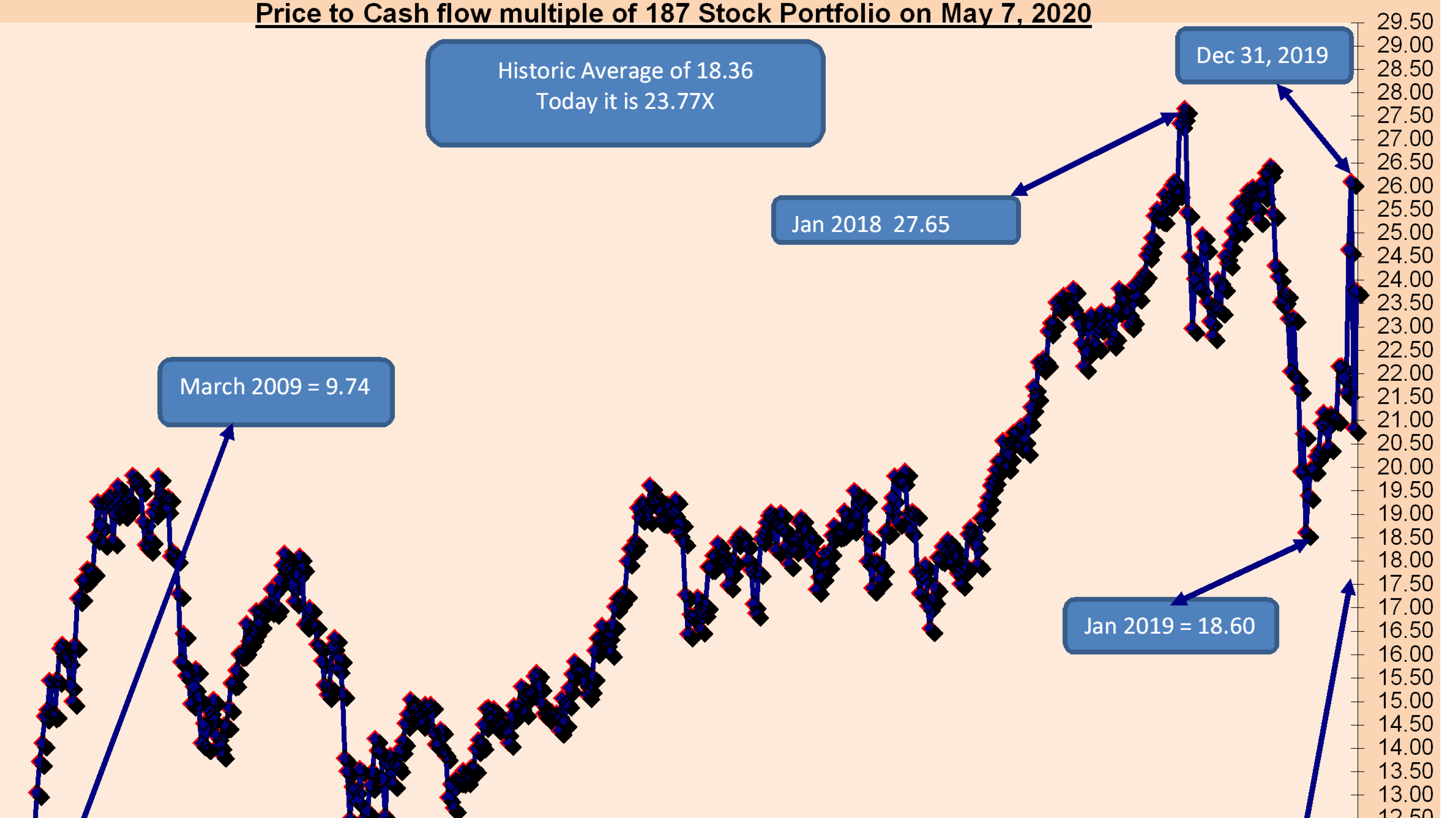

Using historical average P/E ratios as a benchmark can be misleading. The economic landscape is constantly evolving, and comparing current valuations to past averages without considering these contextual factors can lead to inaccurate conclusions.

Sector-Specific Variations

It's crucial to understand that valuations vary considerably across different sectors. What might be considered "high" for one sector could be entirely reasonable for another, reflecting differences in growth potential and cyclical factors.

- Higher Valuations: Sectors like technology, often characterized by high growth potential and innovation, frequently command higher valuations than more mature, established industries. BofA's sector-specific analysis often highlights these variations.

- Lower Valuations: Cyclical sectors, such as energy or materials, may exhibit lower valuations during periods of economic uncertainty, despite possessing strong fundamentals. BofA's research can identify these opportunities.

Ignoring sector-specific differences and focusing solely on overall market valuations can lead to missed investment opportunities.

The Role of Interest Rates and Inflation

Interest Rates as a Balancing Factor

Higher interest rates, while initially perceived negatively, can act as a balancing factor in a high-valuation environment. They curb inflation, increase the opportunity cost of holding cash, and can thus support higher valuations in a stable economy. This is because:

- Discount Rates: Higher interest rates increase the discount rate used in present value calculations, which affects how future earnings are valued. However, this impact is often offset by higher expected future earnings in a growing economy.

Inflation's Impact on Earnings Growth

Inflation affects corporate earnings differently across sectors. Some companies can successfully pass on increased costs to consumers, maintaining healthy profit margins. Others struggle, leading to compressed earnings and lower valuations. BofA's analysis helps identify companies best positioned to navigate inflationary pressures.

- Pricing Power: Companies with strong brands and pricing power are better equipped to handle inflation and maintain earnings growth, supporting higher valuations.

BofA's Perspective on Long-Term Growth

BofA maintains a positive outlook on long-term economic growth, despite current market volatility. Their analysis suggests that sustained innovation, technological advancements, and global economic expansion will continue to drive corporate earnings and justify current stock market valuations, at least in specific sectors. BofA's investment strategies often reflect this long-term perspective, focusing on companies poised for sustained growth. Specific data points and projections supporting this outlook are readily available through BofA's research publications.

Managing Risk in a High-Valuation Environment

Diversification Strategies

Diversification remains a crucial risk management tool, even in a high-valuation market. A well-diversified portfolio reduces exposure to specific sectors or asset classes that might be overvalued:

- Asset Allocation: Diversifying across different asset classes (stocks, bonds, real estate) can help mitigate overall portfolio risk.

- Geographic Diversification: Investing in companies across different geographies reduces dependence on a single economy's performance.

- Sector Diversification: Spreading investments across various sectors mitigates the risk associated with overvaluation in a specific industry.

Focus on Fundamental Analysis

Relying solely on valuation metrics is insufficient. Thorough due diligence and a focus on strong fundamentals are essential for informed investment decisions:

- Revenue Growth: Consistent and sustainable revenue growth is a key indicator of a company's long-term health.

- Profitability: Strong profit margins suggest a company's ability to generate profits and withstand economic challenges.

- Debt Levels: Low levels of debt indicate financial stability and resilience.

By focusing on fundamental analysis alongside valuation metrics, investors can make more informed decisions and mitigate risks associated with high stock market valuations.

Conclusion

High stock market valuations, while seemingly daunting, don't automatically signal an impending market crash. Understanding the nuances of valuation, considering the broader economic context, and employing appropriate risk management strategies are crucial. BofA's research supports a positive long-term outlook, emphasizing the importance of diversification and focusing on strong company fundamentals. Investors should consult with financial professionals and conduct thorough research before making investment decisions. Learn more about BofA's perspective on managing high stock market valuations and explore their investment resources to make informed decisions in this dynamic market environment. Understanding high stock valuations and investing in a high-valuation market requires careful consideration and a long-term perspective.

Featured Posts

-

Secret Service Investigation Concludes Cocaine Found At White House

Apr 22, 2025

Secret Service Investigation Concludes Cocaine Found At White House

Apr 22, 2025 -

Papal Conclaves Explained The Process Of Selecting A New Pope

Apr 22, 2025

Papal Conclaves Explained The Process Of Selecting A New Pope

Apr 22, 2025 -

Analyzing The Costs Of Trumps Economic Vision

Apr 22, 2025

Analyzing The Costs Of Trumps Economic Vision

Apr 22, 2025 -

Trumps Trade War A Threat To Us Financial Leadership

Apr 22, 2025

Trumps Trade War A Threat To Us Financial Leadership

Apr 22, 2025 -

Kyivs Dilemma Evaluating Trumps Plan To End The Ukraine War

Apr 22, 2025

Kyivs Dilemma Evaluating Trumps Plan To End The Ukraine War

Apr 22, 2025