Trump's Trade War: A Threat To US Financial Leadership

Table of Contents

Increased Uncertainty and Market Volatility

The unpredictable nature of tariffs and trade disputes implemented during the Trump trade war created significant market instability. This uncertainty directly impacted investor confidence and global capital flows, leading to several negative consequences.

-

Increased volatility in the stock market: The constant threat of new tariffs and retaliatory measures created a climate of fear and uncertainty, leading to significant swings in stock market indices. Investors, unsure of the future direction of trade policy, became hesitant to invest, leading to reduced market liquidity.

-

Reduced foreign investment in US assets: The trade war fostered a perception of increased risk in the US market, deterring foreign investors from committing capital. Concerns about potential future trade restrictions made US assets less attractive compared to investments in other countries with more stable trade environments.

-

Heightened uncertainty for multinational corporations: Businesses operating internationally faced difficulties in planning and forecasting due to the unpredictable nature of tariffs and trade restrictions. This uncertainty impacted supply chains, production decisions, and overall profitability.

-

Negative impact on consumer confidence due to increased prices: Tariffs on imported goods led to higher prices for consumers, negatively impacting consumer confidence and reducing purchasing power. This had a knock-on effect on domestic economic growth.

-

Example: The escalation of the trade war with China in 2018 coincided with a significant downturn in the US stock market, highlighting the direct link between trade disputes and market volatility.

Damage to International Relations and Alliances

The Trump administration's aggressive trade tactics significantly damaged relationships with key trading partners, leading to decreased cooperation on crucial financial matters, including regulations and sanctions.

-

Strained relationships with China, the European Union, and other nations: The imposition of tariffs and the use of strong rhetoric strained diplomatic ties with major economic powers, undermining trust and cooperation.

-

Reduced effectiveness of international financial institutions: The lack of cooperation and trust among nations hampered the effectiveness of international financial institutions like the World Trade Organization (WTO) and the International Monetary Fund (IMF) in addressing global financial challenges.

-

Difficulty in coordinating responses to global financial crises: The fractured relationships made it harder to coordinate responses to potential future economic crises, potentially worsening their impact.

-

Loss of US influence in shaping global trade rules and agreements: The unilateral approach to trade adopted during the trade war diminished US influence in shaping global trade norms and agreements, potentially leading to a less favorable international trade environment for US businesses.

-

Example: The breakdown of negotiations with China over trade imbalances and intellectual property rights exemplifies the damage to international relations caused by the trade war.

Impact on the US Dollar's Global Dominance

The trade war's consequences raised questions about the potential weakening of the US dollar's position as the world's reserve currency.

-

Reduced demand for US Treasury bonds: Uncertainty about the future of the US economy and its trade policies led to reduced demand for US Treasury bonds, potentially threatening the dollar's dominance.

-

Increased use of alternative currencies in international trade: Some countries began exploring alternative currencies for international transactions, reducing reliance on the US dollar. This shift, while gradual, signals a potential long-term challenge to the dollar's hegemony.

-

Concerns about the stability and predictability of the US economy: The trade war's unpredictability and negative impact on economic growth raised concerns about the stability and predictability of the US economy, impacting the dollar's attractiveness as a reserve currency.

-

Potential for a shift in global financial power dynamics: The trade war accelerated discussions about a potential shift in global financial power dynamics, with some suggesting that China’s growing economic influence might lead to a reduced reliance on the US dollar.

-

Example: Fluctuations in the US dollar's exchange rate following escalations in the trade war reflect the impact of trade policy uncertainty on the currency's value.

The Rise of Protectionism and its Impact on Free Markets

The Trump administration's protectionist measures fundamentally undermined the principles of free markets and hindered global economic growth.

-

Higher prices for consumers due to tariffs: Tariffs on imported goods increased prices for consumers, reducing their purchasing power and lowering overall economic welfare.

-

Reduced efficiency and competitiveness for US businesses: Protectionist measures shielded inefficient US businesses from foreign competition, reducing their incentive to innovate and improve efficiency.

-

Negative impact on global supply chains: The trade war disrupted global supply chains, leading to increased costs and delays for businesses worldwide.

-

Increased barriers to trade and investment: The trade war created higher barriers to trade and investment, hindering global economic integration and growth.

-

Example: The agricultural sector experienced significant hardship due to retaliatory tariffs imposed by other countries on US agricultural exports.

Conclusion

The Trump administration's trade war introduced significant uncertainty into the global financial system, potentially damaging the US's long-standing position of financial leadership. The increased market volatility, strained international relations, and challenges to the US dollar's dominance all contributed to this risk. While the full long-term effects are still unfolding, the trade war serves as a cautionary tale about the potential consequences of aggressive protectionist policies. The impact of this trade war on US financial leadership is a complex issue requiring ongoing study and analysis.

Call to Action: Understanding the implications of trade wars and their impact on US financial leadership is crucial. Further research and analysis are needed to fully grasp the long-term effects and develop strategies to mitigate future risks to US financial dominance. Let's continue the conversation about the lasting impacts of Trump's trade war and work towards a more stable and collaborative global financial system, minimizing the risks of future trade disputes.

Featured Posts

-

Ryujinx Emulator Development Halted Nintendos Impact

Apr 22, 2025

Ryujinx Emulator Development Halted Nintendos Impact

Apr 22, 2025 -

Ftc Investigates Open Ais Chat Gpt What It Means For Ai

Apr 22, 2025

Ftc Investigates Open Ais Chat Gpt What It Means For Ai

Apr 22, 2025 -

Middle Managers The Unsung Heroes Of A Thriving Workplace And Productive Teams

Apr 22, 2025

Middle Managers The Unsung Heroes Of A Thriving Workplace And Productive Teams

Apr 22, 2025 -

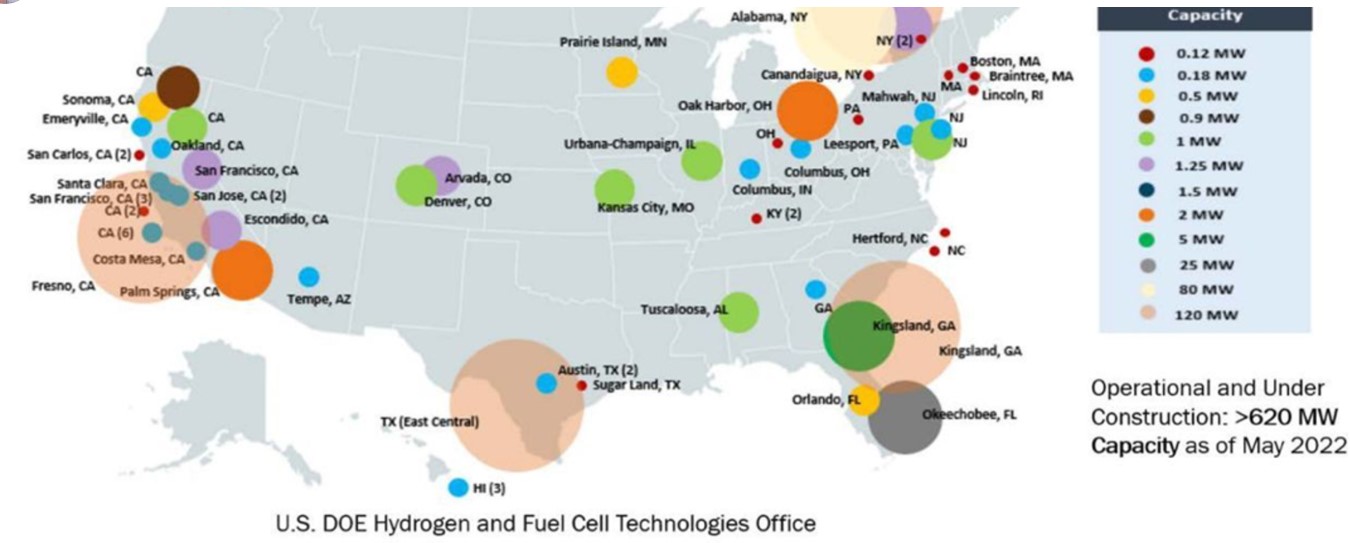

Identifying Emerging Business Hubs A Nationwide Overview

Apr 22, 2025

Identifying Emerging Business Hubs A Nationwide Overview

Apr 22, 2025 -

Cassidy Hutchinsons January 6th Memoir What To Expect This Fall

Apr 22, 2025

Cassidy Hutchinsons January 6th Memoir What To Expect This Fall

Apr 22, 2025