Where To Invest: Mapping The Country's Top New Business Areas

Table of Contents

Booming Tech Hubs: Investing in Innovation

The technology sector continues to be a powerhouse for investment, and understanding where to invest within this landscape is crucial. We'll examine both emerging tech clusters and specific high-growth niches.

Silicon Valley South? Identifying Emerging Tech Clusters

Several cities across the country are experiencing explosive growth in tech startups and related industries, creating exciting opportunities for investors. These "Silicon Valleys" offer a unique blend of factors driving their success.

- Austin, TX: Boasting a vibrant startup ecosystem, a strong university presence (University of Texas at Austin), and a relatively low cost of living compared to California, Austin attracts both talent and investment.

- Raleigh-Durham, NC (Research Triangle Park): This region benefits from a strong research infrastructure, a highly educated workforce, and proximity to major universities like Duke and UNC-Chapel Hill.

- Boulder, CO: Known for its outdoor lifestyle and a strong focus on sustainable technologies, Boulder attracts a skilled workforce and significant venture capital.

Several key factors contribute to the success of these emerging tech clusters:

- Strong university presence leading to a skilled workforce: Universities act as incubators, providing a constant stream of talent for tech companies.

- Attractive tax incentives for businesses: Government policies often incentivize businesses to locate in these areas.

- High concentration of venture capital funding: Venture capitalists are actively seeking out promising startups in these burgeoning hubs.

- Growing demand for tech-related services: The constant evolution of technology drives consistent demand for skilled professionals and innovative solutions.

Investing in Specific Tech Niches

While the overall tech sector is promising, certain niches offer particularly high growth potential.

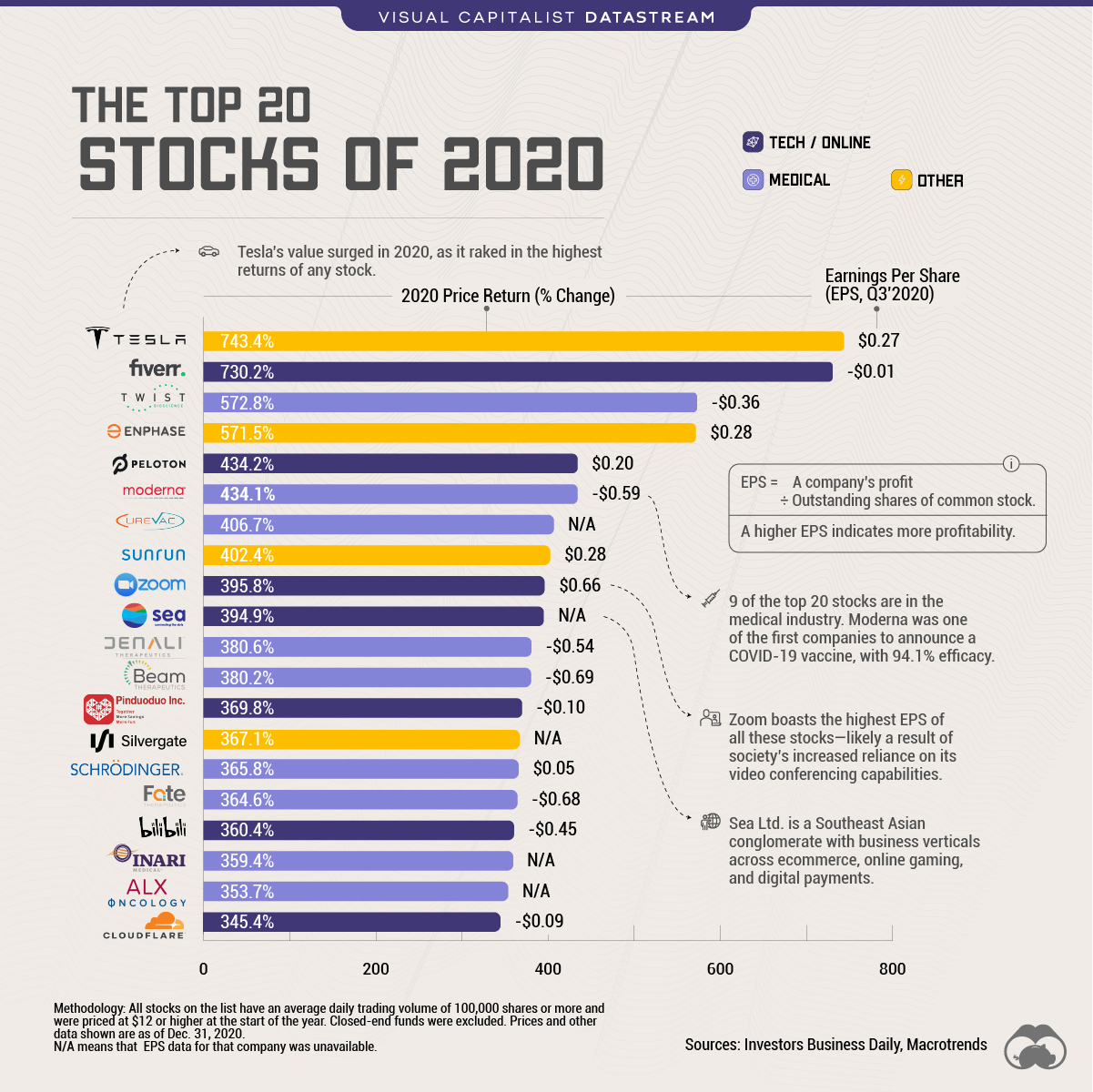

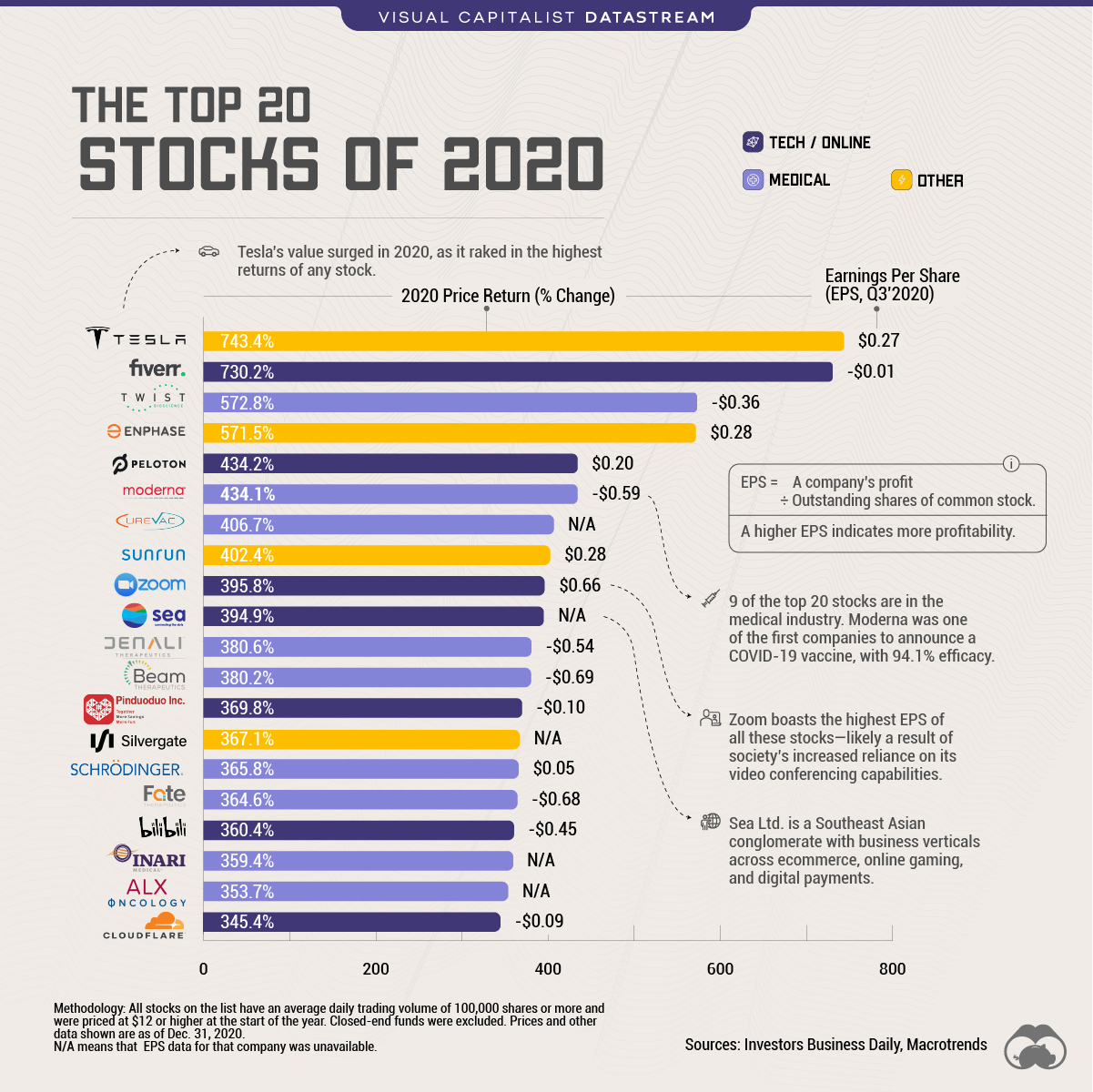

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are transforming numerous industries, from healthcare to finance. While this sector requires specialized expertise, the potential returns are substantial. Companies specializing in AI-powered solutions are attracting significant investment.

- Cybersecurity: With the increasing prevalence of cyber threats, the demand for robust cybersecurity solutions is exploding. Investing in cybersecurity firms is a relatively low-risk, high-reward opportunity.

- Renewable Energy Technologies: Driven by growing environmental concerns and government incentives, renewable energy is experiencing unprecedented growth. Investment opportunities abound in solar, wind, and other clean energy technologies.

Real Estate Renaissance: Profiting from Property Development

Real estate remains a cornerstone of investment strategies, but understanding where to invest within the sector is key. This section examines both underserved markets and opportunities in commercial real estate.

Identifying Underserved Markets

Population growth and infrastructure development are key indicators of promising real estate markets. Several regions are experiencing a housing shortage, creating significant opportunities for investors.

- Areas near major transportation hubs: Proximity to major transportation networks increases property values and demand.

- Regions with strong job growth: Areas with robust job markets attract residents, leading to increased demand for housing.

- Areas with significant government investment in infrastructure: Government investment in infrastructure often signals future growth and development.

However, it's important to consider potential risks, such as market saturation or economic downturns, before making significant investments.

Investing in Commercial Real Estate

Commercial real estate offers diverse opportunities, from office buildings to retail spaces and industrial properties. Factors like location, tenant occupancy rates, and market trends are crucial considerations.

- Demand for flexible workspaces: The rise of remote work and flexible work arrangements has increased the demand for co-working spaces and adaptable office environments.

- Growth of e-commerce and related logistics needs: The booming e-commerce sector drives the demand for warehouse and distribution facilities.

- Increasing demand for specialized commercial spaces: Sectors like healthcare and biotechnology are driving demand for specialized facilities.

Sustainable Investments: The Green Economy's Growth Potential

The growing awareness of environmental issues is driving significant investment in the green economy. This section explores opportunities in renewable energy and sustainable agriculture.

Investing in Renewable Energy Projects

Government incentives and subsidies are making renewable energy projects increasingly attractive to investors. Solar, wind, and other renewable energy sources offer long-term growth potential and contribute to a sustainable future.

- Growing demand for clean energy: The shift towards cleaner energy sources presents a significant investment opportunity.

- Government support and tax credits: Government incentives reduce the financial risk associated with renewable energy projects.

- Potential for long-term, stable returns: Renewable energy projects offer the potential for stable, long-term returns.

Sustainable Agriculture and Food Production

The demand for sustainably and ethically sourced food is growing rapidly. This presents opportunities in sustainable farming practices, vertical farming, and alternative protein sources.

- Growing market for organic and sustainable food products: Consumers are increasingly willing to pay a premium for organic and sustainably produced food.

- Increased interest in vertical farming and hydroponics: Vertical farming offers the potential to increase food production efficiency and reduce the environmental impact of agriculture.

- Demand for alternative protein sources, such as plant-based meats: The growing demand for plant-based alternatives to meat is creating significant investment opportunities.

Conclusion

Identifying where to invest requires thorough research and a keen understanding of market trends. This article highlighted promising new business areas, including burgeoning tech hubs, the real estate renaissance, and the rapidly expanding green economy. By carefully considering the factors discussed and conducting your own due diligence, you can significantly increase your chances of success. Start exploring these top new business areas today and discover the potential for lucrative investment opportunities in the country's most dynamic sectors. Remember to always conduct thorough research and seek professional financial advice before making any investment decisions. Begin your journey towards smart investing and find where to invest your capital wisely.

Featured Posts

-

Should You Vote Liberal William Watson Examines The Party Platform

Apr 24, 2025

Should You Vote Liberal William Watson Examines The Party Platform

Apr 24, 2025 -

John Travoltas 24 Year Old Daughter Ella Bleu Makes A Statement With A Breathtaking Makeover

Apr 24, 2025

John Travoltas 24 Year Old Daughter Ella Bleu Makes A Statement With A Breathtaking Makeover

Apr 24, 2025 -

Emerging Market Stock Rebound Overcoming Losses While Us Stocks Struggle

Apr 24, 2025

Emerging Market Stock Rebound Overcoming Losses While Us Stocks Struggle

Apr 24, 2025 -

High Demand For 65 Hudsons Bay Properties

Apr 24, 2025

High Demand For 65 Hudsons Bay Properties

Apr 24, 2025 -

3 Billion Crypto Spac Cantor Tether And Soft Bank Explore Merger

Apr 24, 2025

3 Billion Crypto Spac Cantor Tether And Soft Bank Explore Merger

Apr 24, 2025