Emerging Market Stock Rebound: Overcoming Losses While US Stocks Struggle

Table of Contents

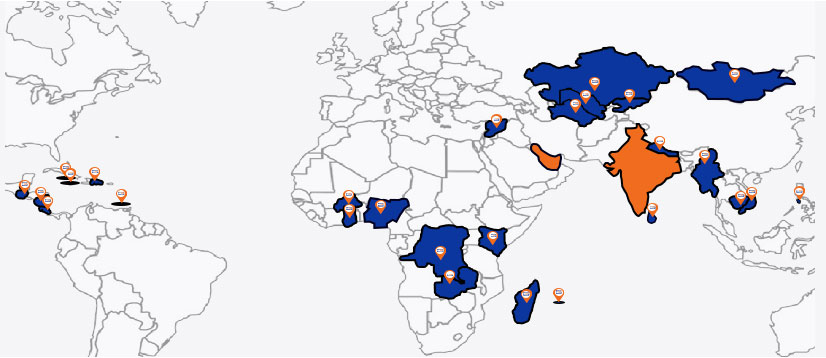

Why Emerging Markets Are Outperforming Developed Markets

While US stock market performance remains sluggish, several factors contribute to the relative strength and potential rebound of emerging market stocks:

Diversification Benefits

Emerging markets offer significant diversification advantages for investors. Their performance is often less correlated with the US market, meaning they can act as a buffer during periods of US market downturn.

- Reduced portfolio volatility: Diversifying into emerging markets can help smooth out the ups and downs of your investment portfolio.

- Less dependence on US economic cycles: Emerging markets are driven by their own unique economic forces, reducing reliance on the US economy's performance.

- Access to different growth drivers: Emerging economies offer exposure to diverse growth sectors and industries, not always present in developed markets.

Stronger Growth Prospects

Many emerging economies boast higher growth potential than their developed counterparts. This potential fuels the emerging market stock rebound narrative.

- Rapid urbanization: Massive population shifts to urban centers create significant demand for housing, infrastructure, and consumer goods.

- Rising middle classes: A growing middle class in many emerging markets fuels increased consumer spending and economic activity.

- Technological advancements: Rapid adoption of technology and digitalization creates new opportunities for innovation and growth.

- Government investments in infrastructure: Significant government investment in infrastructure projects drives economic expansion and creates opportunities for related businesses.

Valuation Advantages

Some analysts argue that emerging market stocks are currently undervalued compared to their US counterparts.

- Price-to-earnings ratios: Lower P/E ratios in some emerging markets may suggest attractive valuations.

- Dividend yields: Higher dividend yields in certain emerging markets can offer attractive income streams for investors.

- Potential for future earnings growth: The high growth potential of many emerging economies suggests strong future earnings potential for their associated companies.

Resilience Against Certain Global Challenges

Interestingly, some emerging markets are showing resilience to global challenges that are impacting developed markets.

- Specific examples of countries demonstrating strong resilience: Certain countries have demonstrated surprisingly strong economic performance despite global headwinds (research specific examples for your article).

- Reasons for their strength: Factors such as strong domestic demand, strategic government policies, or less exposure to certain global supply chains contribute to this resilience.

Risks and Challenges in Emerging Market Investments

While the potential rewards are significant, investing in emerging markets carries inherent risks:

Geopolitical Instability

Political and economic instability is a significant risk factor in many emerging markets.

- Examples of geopolitical risks: Political upheaval, civil unrest, and conflicts can negatively impact stock market performance.

- Impact on stock markets: Geopolitical instability can cause significant volatility and potential losses.

- Strategies for mitigating these risks: Diversification across multiple countries and regions is crucial, alongside thorough due diligence on individual markets.

Currency Fluctuations

Exchange rate volatility between the investor's home currency and the currencies of emerging markets can significantly impact returns.

- Hedging strategies: Investors can use hedging strategies to mitigate currency risk, but these strategies come with their own costs.

- Understanding currency risks: A deep understanding of currency movements and potential risks is essential.

- Diversification across multiple currencies: Investing in companies across different emerging markets with various currencies can help to diversify currency risk.

Regulatory Uncertainty

Differing regulations and legal frameworks in emerging markets can present challenges for investors.

- Due diligence: Thorough due diligence is crucial to understand the regulatory environment in each market.

- Understanding the regulatory environment of individual countries: This requires dedicated research and potentially professional advice.

- Professional advice: Consulting with experts familiar with the regulatory landscapes of specific emerging markets is strongly recommended.

Liquidity Concerns

Accessing liquidity in certain emerging markets can be more challenging compared to developed markets.

- Strategies for managing liquidity risk: Careful selection of liquid assets and diversification are key.

- Selecting liquid assets: Focus on larger, more established companies with greater trading volume.

- Professional fund management: Utilizing professional fund managers experienced in emerging markets can provide better liquidity management.

Strategic Approaches to Emerging Market Stock Investing

To successfully navigate the emerging market landscape, investors should adopt strategic approaches:

Diversification Strategies

Diversification is paramount to mitigate the inherent risks of emerging market investing.

- Geographic diversification: Spread investments across multiple countries and regions to reduce country-specific risk.

- Sector diversification: Invest in a variety of sectors to minimize reliance on any single industry.

- Asset class diversification: Consider diversifying beyond stocks to include bonds, real estate, or other asset classes within emerging markets.

Long-Term Investment Horizon

Emerging markets are inherently volatile. A long-term investment perspective is crucial.

- Advantages of a long-term approach: Long-term investing allows for weathering short-term market fluctuations and benefiting from long-term growth.

- Emotional discipline: Avoid impulsive reactions to short-term market volatility.

- Avoiding short-term market reactions: Focus on the long-term growth potential rather than daily price movements.

Professional Advice

Seeking expert advice is highly recommended before investing in emerging market stocks.

- Financial advisors: Consult with financial advisors specializing in international investments.

- Investment managers: Consider investing through experienced emerging market investment managers.

- Research reports: Utilize reputable research reports to inform investment decisions.

- Due diligence: Always conduct thorough due diligence before investing in any specific company or market.

Conclusion: Capitalizing on the Emerging Market Stock Rebound

Emerging market stocks offer potentially high returns but come with inherent risks. The potential for a significant emerging market stock rebound exists, driven by factors like diversification benefits, stronger growth prospects, and potentially attractive valuations. However, investors must acknowledge and manage risks such as geopolitical instability, currency fluctuations, regulatory uncertainty, and liquidity concerns. Diversification, a long-term outlook, and professional guidance are crucial. Explore emerging market investment opportunities, diversify your portfolio with emerging market stocks, and consider adding emerging market stocks to your investment strategy after thorough research and consultation with a financial professional. Remember, this article is for informational purposes only and does not constitute financial advice. Always conduct your own due diligence and consult with a financial advisor before making any investment decisions.

Featured Posts

-

Mapping The Countrys Hottest New Business Locations

Apr 24, 2025

Mapping The Countrys Hottest New Business Locations

Apr 24, 2025 -

The Bold And The Beautiful Wednesday April 9 Recap Steffys Accusations And Liams Plea For Secrecy

Apr 24, 2025

The Bold And The Beautiful Wednesday April 9 Recap Steffys Accusations And Liams Plea For Secrecy

Apr 24, 2025 -

The Bold And The Beautiful Liams Fight For Survival

Apr 24, 2025

The Bold And The Beautiful Liams Fight For Survival

Apr 24, 2025 -

The Chinese Automotive Market Challenges And Opportunities For Global Brands Like Bmw And Porsche

Apr 24, 2025

The Chinese Automotive Market Challenges And Opportunities For Global Brands Like Bmw And Porsche

Apr 24, 2025 -

Trump On Powell Confirmation Of Continued Fed Chairmanship

Apr 24, 2025

Trump On Powell Confirmation Of Continued Fed Chairmanship

Apr 24, 2025