US Stock Futures Surge On Trump's Powell Remarks

Table of Contents

Trump's Criticism of Powell and its Market Impact

Former President Trump's outspoken criticism of Jerome Powell and the Federal Reserve's monetary policy is well-documented. Throughout his presidency, Trump frequently expressed his displeasure with interest rate hikes, viewing them as detrimental to economic growth. This tension between the executive branch and the independent central bank is not unprecedented, but the intensity and frequency of Trump's pronouncements were notable.

- Specific examples of Trump's previous statements on interest rates: Trump repeatedly labeled interest rate increases as "crazy" and "ridiculous," arguing that they hindered economic expansion and job creation. He even publicly called for lower interest rates, exerting significant pressure on the Federal Reserve.

- How these statements have historically affected market sentiment: Trump's past pronouncements often caused short-term market fluctuations. While the market sometimes initially reacted negatively to his criticisms, it sometimes experienced rallies based on the expectation of potential policy changes, even if those changes were unlikely or ultimately didn’t materialize.

- Analysis of the potential reasons behind Trump's renewed comments: The precise reasons behind any renewed criticism are often speculative, but possible motivations include a desire to influence market behavior or simply to maintain his public stance against the perceived economic policies of his successors.

The historical context of this tension emphasizes the delicate balance between political influence and the independence of the Federal Reserve. The market’s reaction demonstrates its sensitivity to perceived political interference in monetary policy.

Analysis of the Stock Futures Surge

The surge in US stock futures following Trump's latest comments was substantial. While precise figures vary depending on the index and timing of the observation, significant gains were recorded across major indices.

- Specific indices impacted (e.g., Dow Jones, S&P 500, Nasdaq): The Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite all experienced noticeable increases in futures trading.

- Percentage changes observed: Reports indicated percentage increases ranging from a few tenths of a percent to over one percent, depending on the index and the specific timeframe considered. This represents a significant move in a short period, demonstrating the market’s immediate reaction.

- Mention any unusual trading activity: While the precise details would require further investigation, the rapidity and scale of the movement could be indicative of increased trading volume, potentially reflecting a wave of buying spurred by the news.

This substantial and rapid increase in US stock futures highlights the market's immediate interpretation of Trump’s statements as potentially positive for economic growth, despite the potentially inflationary implications.

Economic Implications and Future Market Outlook

The economic implications of this market movement are complex and far-reaching. While the short-term impact might seem positive due to the surge in stock futures, the long-term consequences remain uncertain.

- Potential impact on inflation: The possibility of lower interest rates, even if only implied by Trump's comments, could fuel inflation. This is a significant concern as persistently high inflation can erode purchasing power and destabilize the economy.

- Possible effects on consumer spending: Increased investor confidence could stimulate consumer spending, but this depends on various factors, including overall economic conditions and consumer sentiment.

- Predictions for future interest rate decisions by the Federal Reserve: The Federal Reserve's response to these market fluctuations will be crucial. While unlikely to be directly swayed by political pressure, any future interest rate decisions will need to consider the inflationary pressures and market sentiment arising from this event.

- Discussion of risks and uncertainties in the market: The inherent uncertainty in global markets, coupled with the unpredictable nature of political pronouncements, creates a high degree of risk. Investors need to carefully assess their risk tolerance and adjust their investment strategies accordingly.

The Role of Trade War Concerns

Lingering concerns about trade wars could have subtly influenced the market volatility. While not directly linked to Trump's comments on Powell, unresolved trade disputes contribute to a climate of geopolitical uncertainty that can affect investor sentiment.

- Details about ongoing trade disputes: Various trade disputes continue to simmer globally, creating ongoing uncertainties for businesses and investors.

- How these disputes affect market sentiment: Uncertainty associated with trade disputes can create volatility as investors react to potential shifts in global trade patterns and tariffs.

- Analysis of the interaction between trade concerns and Trump’s comments on Powell: The interplay between these factors is complex, but it's plausible that easing trade tensions (or at least a pause in escalating them) could have compounded the positive market effect of the implied expectation of lower interest rates.

Conclusion

In summary, former President Trump's latest comments on Federal Reserve Chairman Jerome Powell triggered a substantial surge in US stock futures. This highlights the ongoing sensitivity of the market to political pronouncements and underscores the unpredictable nature of market dynamics. The potential economic consequences, ranging from inflationary pressures to shifts in consumer spending, require close monitoring. The interaction of these factors with existing geopolitical risks, particularly lingering trade war concerns, creates a complex economic landscape.

Call to Action: Stay updated on the latest developments affecting US Stock Futures by following reputable financial news sources. Understanding the interplay between political statements and market fluctuations is crucial for informed investment decisions. Closely monitoring market analysis and economic indicators will help you navigate this dynamic environment and make prudent decisions concerning your investments in US Stock Futures and other financial instruments.

Featured Posts

-

Price Gouging Allegations Against La Landlords Surface After Recent Fires

Apr 24, 2025

Price Gouging Allegations Against La Landlords Surface After Recent Fires

Apr 24, 2025 -

Bitcoin Climbs Amidst Trumps Trade And Fed Policy Moves

Apr 24, 2025

Bitcoin Climbs Amidst Trumps Trade And Fed Policy Moves

Apr 24, 2025 -

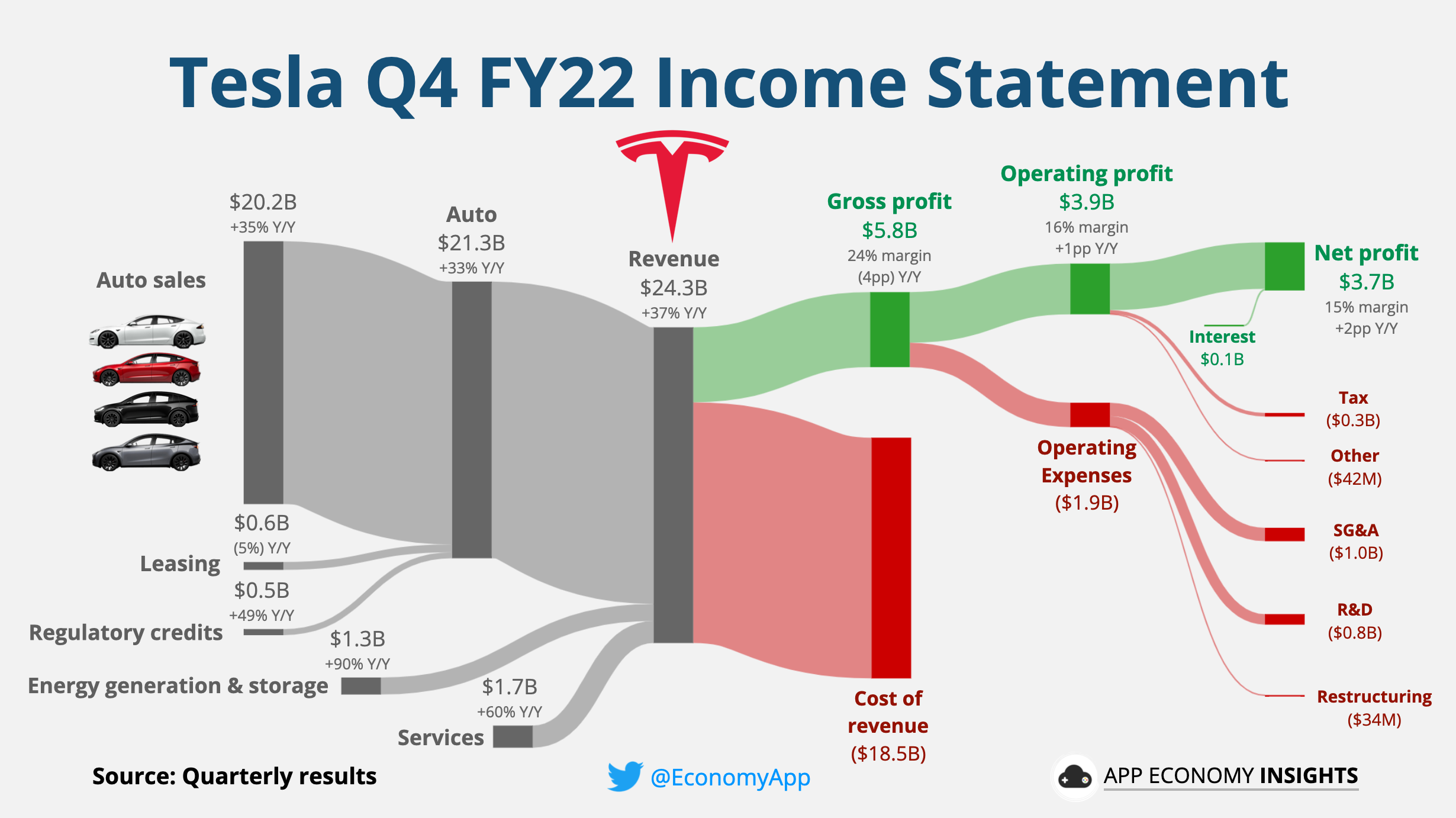

Teslas Q1 Earnings Decline Musks Political Involvement Takes A Toll

Apr 24, 2025

Teslas Q1 Earnings Decline Musks Political Involvement Takes A Toll

Apr 24, 2025 -

Exclusive High Rollers John Travolta Action Movie Poster And Photo Preview

Apr 24, 2025

Exclusive High Rollers John Travolta Action Movie Poster And Photo Preview

Apr 24, 2025 -

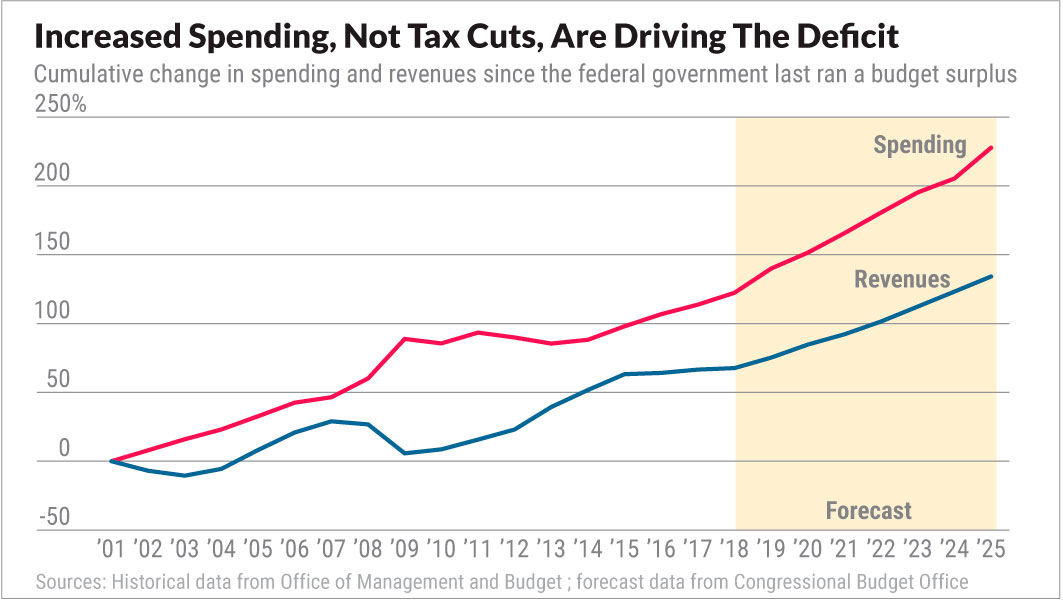

Canadas Conservatives Tax Cuts And Deficit Reduction Plan

Apr 24, 2025

Canadas Conservatives Tax Cuts And Deficit Reduction Plan

Apr 24, 2025