Tesla's Q1 Earnings Decline: Musk's Political Involvement Takes A Toll

Table of Contents

Q1 Earnings Report: A Detailed Look at the Numbers

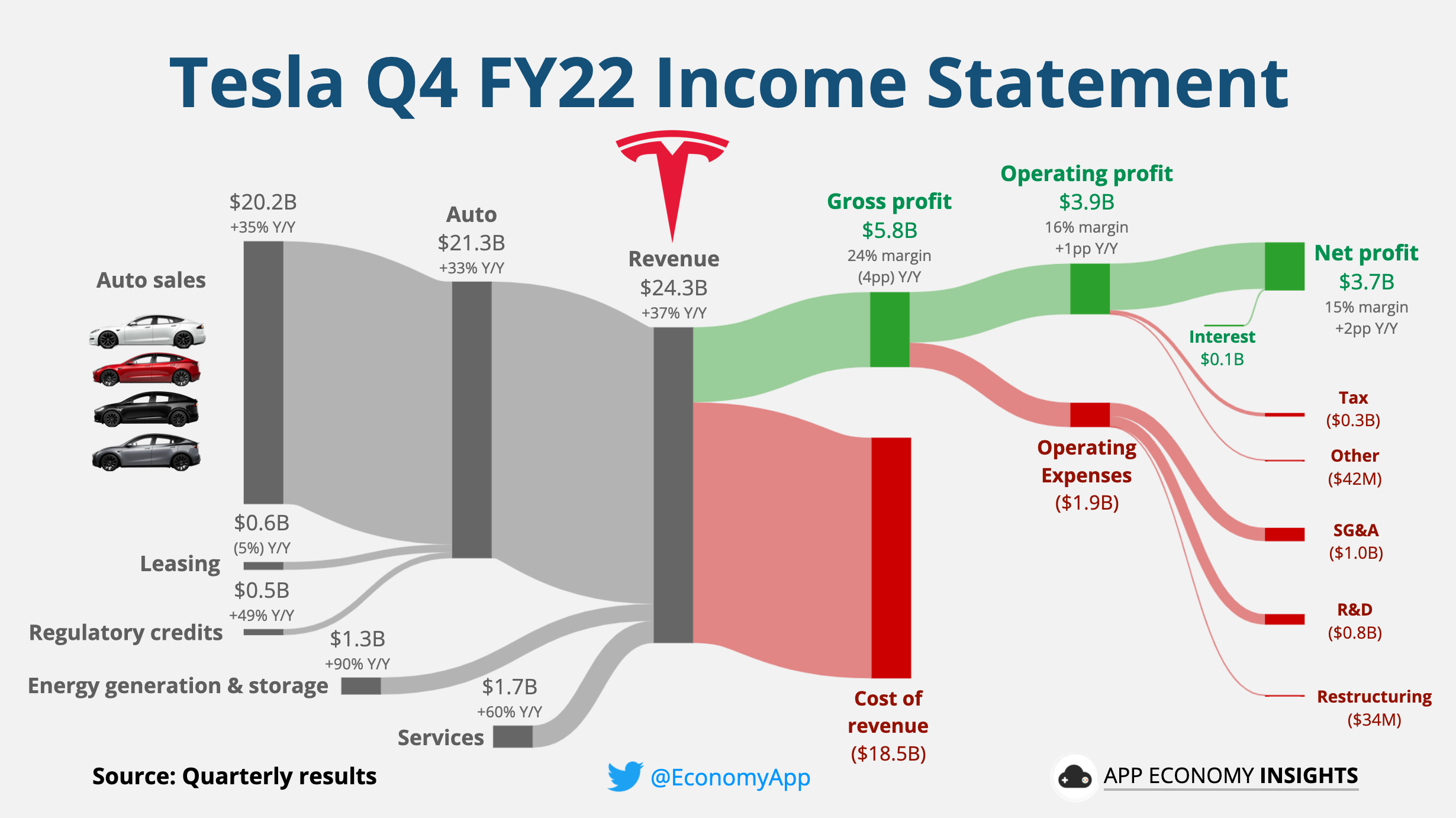

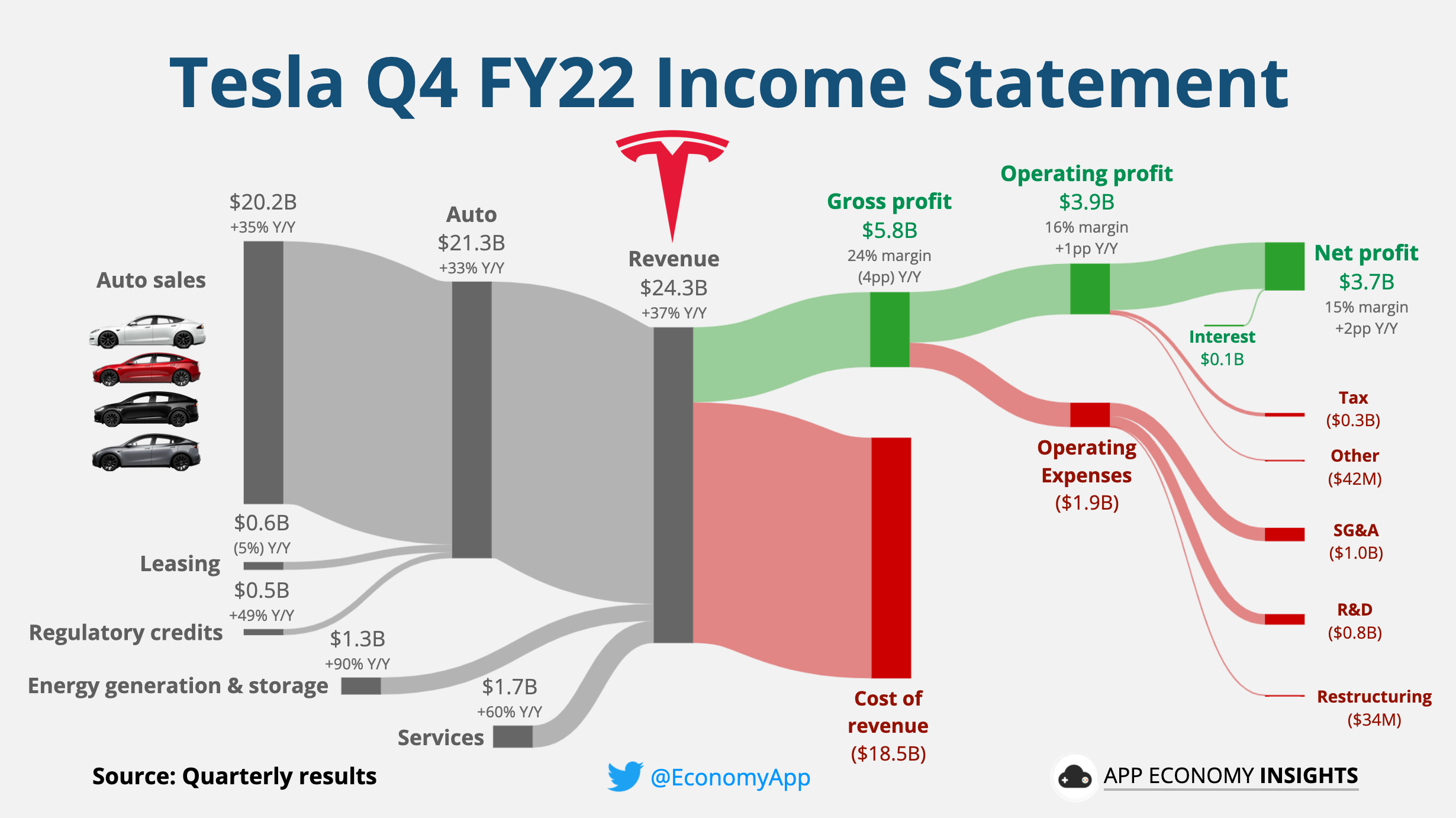

Tesla's Q1 2024 financial report painted a mixed picture. While the company delivered a respectable number of vehicles, exceeding expectations in some areas, the overall financial performance fell short of analysts' predictions. Key data points revealed several concerning trends impacting Tesla’s financial health:

- Revenue: A year-over-year decrease of X% in revenue was reported, significantly lower than projected growth rates. This drop was attributed to [cite specific reasons given by Tesla in their report, e.g., pricing adjustments, increased competition].

- Profit Margins: Tesla experienced a compression of profit margins, dropping from Y% to Z%, primarily due to [cite specific reasons, e.g., increased raw material costs, factory production inefficiencies].

- Production Numbers: While production numbers increased compared to the previous quarter, they fell short of the anticipated growth trajectory, hindered by [cite specific challenges, e.g., supply chain disruptions, factory upgrades].

- Delivery Figures: Although delivery numbers remained strong, they were not sufficient to offset the negative impact of reduced margins and increased costs.

These numbers, when compared to previous quarters and year-over-year performance, clearly indicate a slowdown in Tesla's growth trajectory, raising concerns among investors. The context is further complicated by the performance of competing electric vehicle manufacturers, who are increasingly gaining market share.

The Impact of Elon Musk's Political Controversies

Elon Musk's significant and often controversial public pronouncements throughout Q1 2024 undoubtedly played a role in the decline of investor confidence and Tesla's stock price. His actions, often dominating headlines, created significant uncertainty surrounding the company:

- Twitter Acquisition and Management: The ongoing saga of Musk's Twitter acquisition and subsequent management changes generated considerable negative press, diverting attention away from Tesla and raising concerns about his focus and priorities.

- Political Endorsements and Statements: Musk's outspoken political views and endorsements elicited strong reactions, alienating segments of the consumer base and raising concerns about potential brand damage.

- Social Media Activity: Musk's frequent and often controversial use of social media has become a major source of uncertainty for investors and analysts.

The correlation between these controversies and Tesla's stock performance is undeniable. Numerous news articles and expert opinions link Musk's actions to a decline in investor sentiment, negatively impacting Tesla's market capitalization and share price. The uncertainty created by his unpredictable behavior has undoubtedly shaken investor confidence.

The Broader Economic Landscape and its Effect on Tesla

Beyond Musk's political involvements, Tesla also faced challenges stemming from the broader macroeconomic environment. These external factors contributed significantly to the company's Q1 earnings decline:

- Economic Downturn: A potential global economic slowdown impacted consumer spending, reducing demand for luxury goods, such as Tesla vehicles, in certain markets.

- Inflation and Rising Costs: Increased raw material prices, particularly for battery components and other crucial inputs, significantly impacted Tesla's production costs and profit margins.

- Supply Chain Issues: Ongoing disruptions in global supply chains continued to pose challenges to Tesla's production capacity and efficiency.

- Increased Competition in the EV Market: The electric vehicle market is becoming increasingly competitive, with established automakers and new entrants launching innovative models and aggressively vying for market share.

These macroeconomic factors played a substantial role in Tesla's Q1 underperformance, potentially exceeding the impact of Musk's actions in certain areas. The interplay of these factors and Musk's behaviour presents a complex picture to analyze.

Competition in the EV Market: Catching Up and Overtaking

Tesla's dominance in the EV market is facing increasing pressure. Competitors like Ford, GM, Rivian, BYD, and Volkswagen are rapidly scaling up production, releasing competitive models, and aggressively pursuing market share:

- Ford and GM: These legacy automakers are investing heavily in electric vehicle technology and are making inroads into Tesla's traditional customer base.

- Rivian and BYD: These emerging players are challenging Tesla with innovative designs and advanced technologies, appealing to a growing segment of EV consumers.

- Volkswagen: Volkswagen's significant investments in EV infrastructure and production are positioning it as a major competitor in the coming years.

This intensified competition is impacting Tesla's sales and market share, adding to the pressure on profitability.

Investor Sentiment and Stock Price Volatility

The combined impact of the Q1 earnings report and Musk's actions has created significant volatility in Tesla's stock price. Investor confidence has been shaken, leading to fluctuations in market capitalization:

- Stock Price Fluctuations: [Include a chart or graph visually depicting the fluctuation of Tesla’s stock price during the period]. The graph would clearly show the correlation between negative news (earnings report, Musk's controversies) and stock price drops.

- Market Capitalization: Tesla's market capitalization has experienced significant swings, reflecting the uncertainty surrounding the company's future performance and Musk’s leadership.

The volatility underscores the interconnectedness of Tesla's financial performance, Musk’s behavior, and investor sentiment.

Conclusion

Tesla's Q1 2024 earnings decline is a complex issue stemming from a confluence of factors. While the broader economic landscape and increasing competition in the EV market certainly played a role, the significant impact of Elon Musk's political involvement and controversial actions cannot be ignored. The resulting uncertainty has negatively affected investor confidence, leading to substantial stock price volatility. The interplay of these elements highlights the significant risks associated with the unpredictable nature of Musk's leadership and its influence on Tesla's financial trajectory. Stay tuned for further analysis of Tesla's performance and the continuing evolution of Elon Musk's influence on the company’s future earnings.

Featured Posts

-

What Happens To The Popes Signet Ring After He Dies

Apr 24, 2025

What Happens To The Popes Signet Ring After He Dies

Apr 24, 2025 -

Trump Immigration Policies A Wave Of Legal Opposition

Apr 24, 2025

Trump Immigration Policies A Wave Of Legal Opposition

Apr 24, 2025 -

Draymond Green Moses Moody And Buddy Hield Join 2024 Nba All Star Festivities

Apr 24, 2025

Draymond Green Moses Moody And Buddy Hield Join 2024 Nba All Star Festivities

Apr 24, 2025 -

Judge Abrego Garcia Condemns Stonewalling Tactics By Us Lawyers

Apr 24, 2025

Judge Abrego Garcia Condemns Stonewalling Tactics By Us Lawyers

Apr 24, 2025 -

Tesla Q1 Profit Plunge Impact Of Musks Trump Ties

Apr 24, 2025

Tesla Q1 Profit Plunge Impact Of Musks Trump Ties

Apr 24, 2025