US Economic Growth To Slow Considerably: Deloitte Forecast

Table of Contents

Key Factors Contributing to Slower US Economic Growth

Several interconnected factors are contributing to the anticipated slowdown in US economic growth. These include persistent inflationary pressures, weakening consumer spending, and significant global economic uncertainty.

Inflationary Pressures and Interest Rate Hikes

Persistent inflation remains a major headwind for US economic growth. The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, are having a significant impact on economic activity. This monetary policy, while intended to cool down the economy and prevent an inflationary spiral, carries recessionary risks.

- Rising borrowing costs: Higher interest rates increase borrowing costs for consumers and businesses, impacting consumer spending on big-ticket items like houses and cars, and reducing business investment in expansion and new equipment.

- Reduced consumer confidence: High prices and economic uncertainty are eroding consumer confidence, leading to more cautious spending habits. This decreased consumer sentiment directly impacts retail sales and overall economic activity.

- Potential for a slowdown in the housing market: Higher mortgage rates are already cooling the once-hot housing market, potentially leading to a significant slowdown in construction and related industries.

Weakening Consumer Spending

Consumer spending is a significant driver of US economic growth. However, reduced consumer confidence and purchasing power are contributing to a weakening in this crucial sector. This decline in consumer spending is further dampening overall economic activity.

- High inflation eroding real wages: While nominal wages may be increasing, the impact of high inflation is eroding real wages, leaving consumers with less disposable income.

- Increased debt burden impacting consumer finances: Many consumers are already carrying significant debt, and rising interest rates are increasing the burden of servicing that debt, leaving less money for discretionary spending.

- Shifting consumer priorities toward essential goods and services: Facing higher prices, consumers are prioritizing essential goods and services, reducing spending on non-essential items.

Global Economic Uncertainty

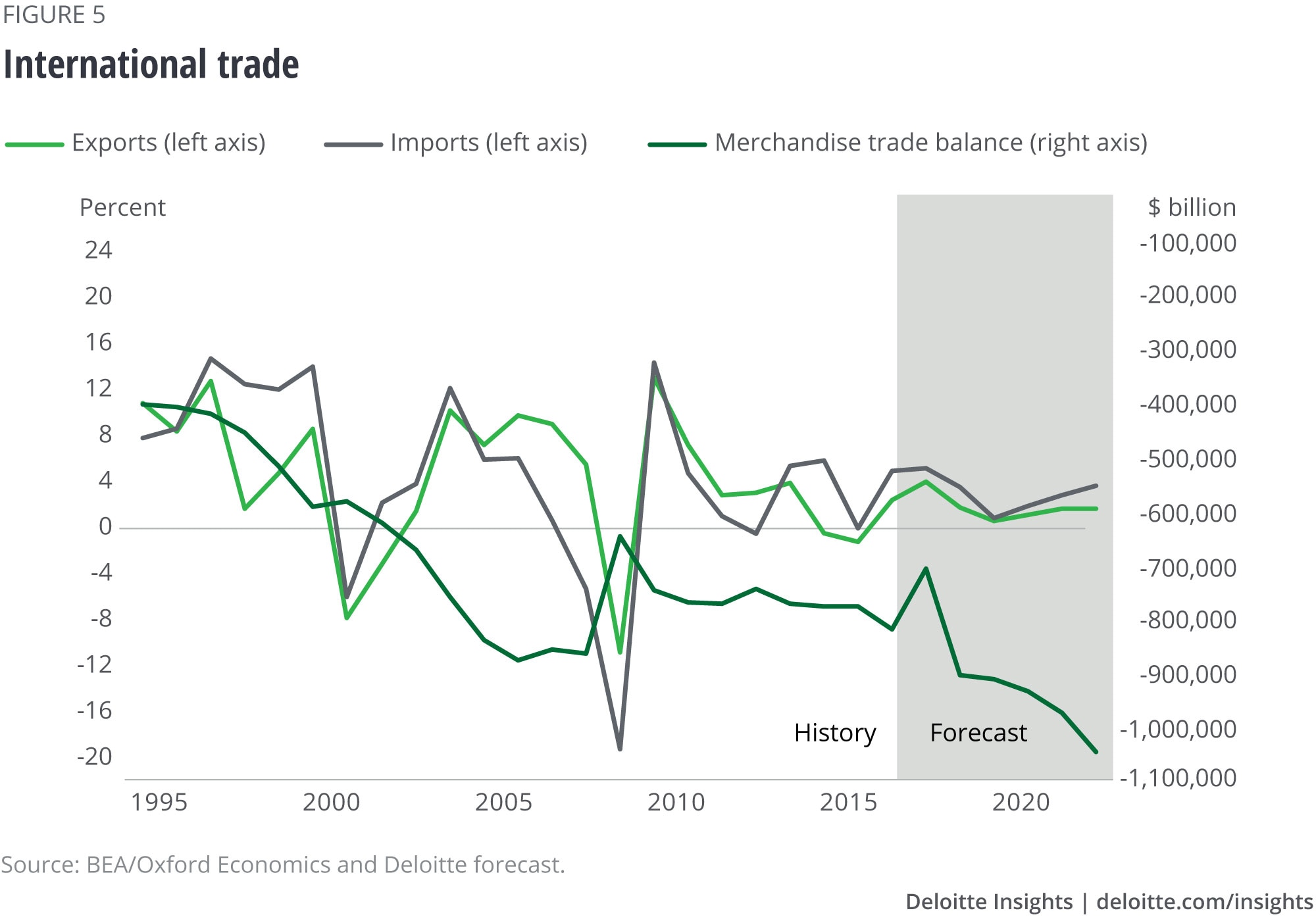

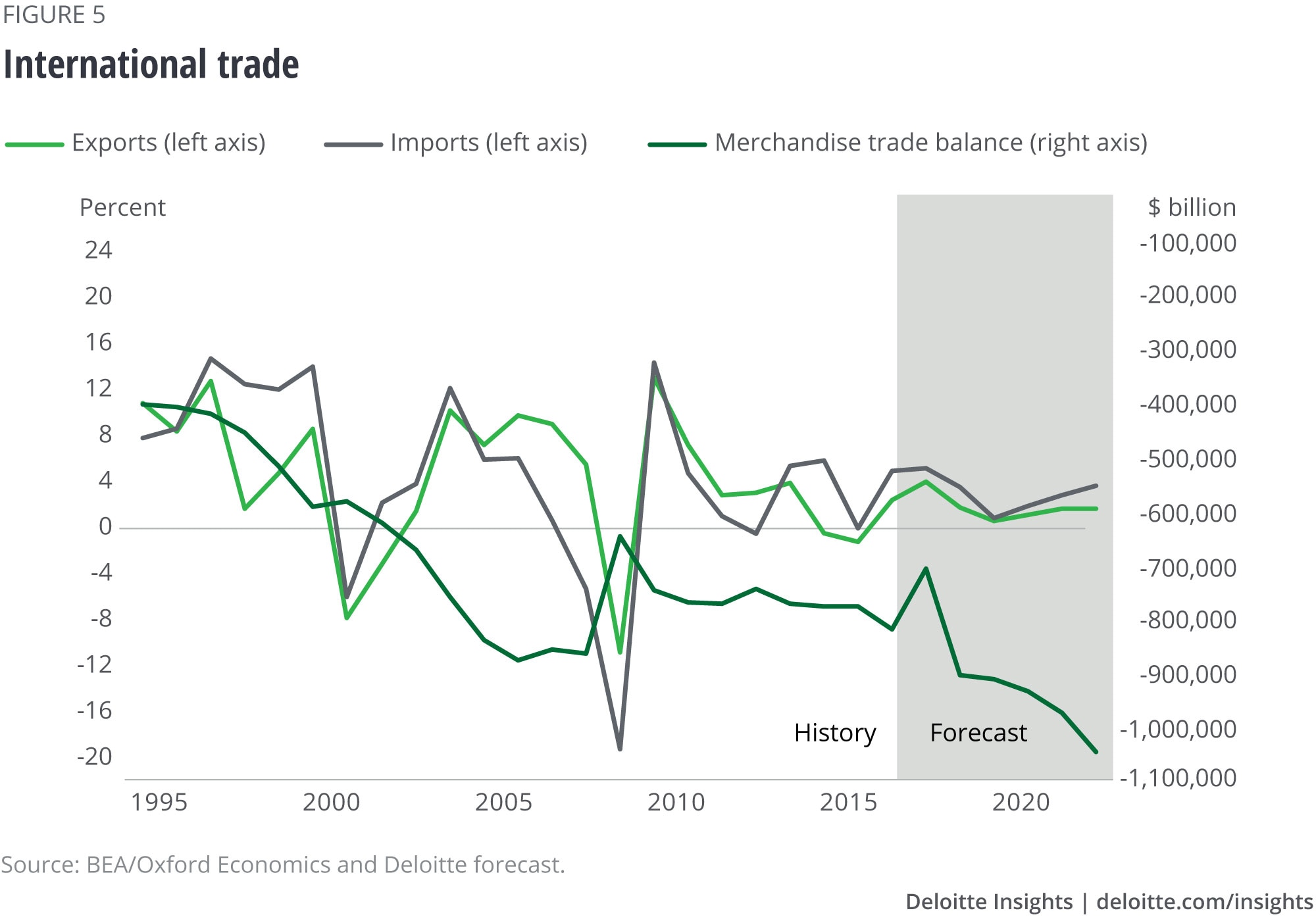

Global events are also playing a significant role in the projected slowdown of US economic growth. Geopolitical instability and ongoing supply chain disruptions are creating uncertainty and impacting various sectors of the US economy.

- Impact of the war in Ukraine on energy prices and global trade: The war in Ukraine has significantly disrupted global energy markets, leading to higher energy prices and impacting global trade flows.

- Ongoing supply chain issues impacting manufacturing and production: Supply chain bottlenecks continue to affect manufacturing and production, leading to delays and higher costs for businesses.

- Uncertainty surrounding global economic outlook impacting investor confidence: The uncertain global economic outlook is impacting investor confidence, leading to reduced investment and potentially hindering economic growth.

Implications for Businesses and Consumers

The anticipated slowdown in US economic growth has significant implications for both businesses and consumers.

Impact on Businesses

Businesses are facing a challenging environment with reduced demand, increased operating costs, and uncertainty about the future.

- Decreased demand for goods and services: Slower economic growth translates into decreased demand for many goods and services, impacting businesses' revenues and profitability.

- Increased operating costs impacting profitability: Rising inflation and interest rates are increasing operating costs for businesses, squeezing profit margins.

- Challenges in attracting and retaining talent: In a potentially slowing economy, businesses may face challenges in attracting and retaining talent, impacting productivity and competitiveness.

Impact on Consumers

Consumers are also feeling the pinch, facing reduced purchasing power, job security concerns, and increased debt.

- Increased cost of living squeezing household budgets: The rising cost of essential goods and services is squeezing household budgets, leaving less money for discretionary spending.

- Potential job losses impacting income security: A slowing economy can lead to job losses, impacting income security and consumer confidence.

- Reduced access to credit and increased borrowing costs: Higher interest rates make it more difficult and expensive to access credit, further limiting consumer spending.

Deloitte's Forecast and Potential Scenarios

Deloitte's forecast, while specific details may vary depending on the exact report, generally projects a significant slowing of US economic growth over the next year. The report likely includes specific data points on projected GDP growth, indicating a considerable deceleration compared to previous years. Deloitte likely explores potential scenarios, including the possibility of a mild recession or a soft landing. The ultimate outcome will depend on various factors, including the effectiveness of the Federal Reserve's monetary policy, the evolution of global economic conditions, and the resilience of the US consumer.

Conclusion

Deloitte's forecast underscores a significant slowing of US economic growth, driven by a confluence of factors including persistent inflation, weakening consumer spending, and global economic uncertainty. Businesses and consumers alike face challenges stemming from this projected slowdown. Understanding these factors and the implications for your business or personal finances is crucial. Staying informed about the evolving situation regarding US economic growth and proactively adapting your strategies is essential for navigating this period of economic uncertainty. Continue to research and analyze the latest developments concerning US economic growth to make informed decisions.

Featured Posts

-

Is Professional Help Essential For Dramatic Image Changes Ariana Grande Example

Apr 27, 2025

Is Professional Help Essential For Dramatic Image Changes Ariana Grande Example

Apr 27, 2025 -

Belinda Bencic Claims First Wta Win After Motherhood

Apr 27, 2025

Belinda Bencic Claims First Wta Win After Motherhood

Apr 27, 2025 -

The Bundestag Elections And Their Impact On The German Dax

Apr 27, 2025

The Bundestag Elections And Their Impact On The German Dax

Apr 27, 2025 -

Wichtige Mitteilung Von Pne Ag Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025

Wichtige Mitteilung Von Pne Ag Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025 -

February 20 2025 Ideas For A Happy Day

Apr 27, 2025

February 20 2025 Ideas For A Happy Day

Apr 27, 2025