The Bundestag Elections And Their Impact On The German Dax

Table of Contents

Historical Analysis: How Past Bundestag Elections Affected the DAX

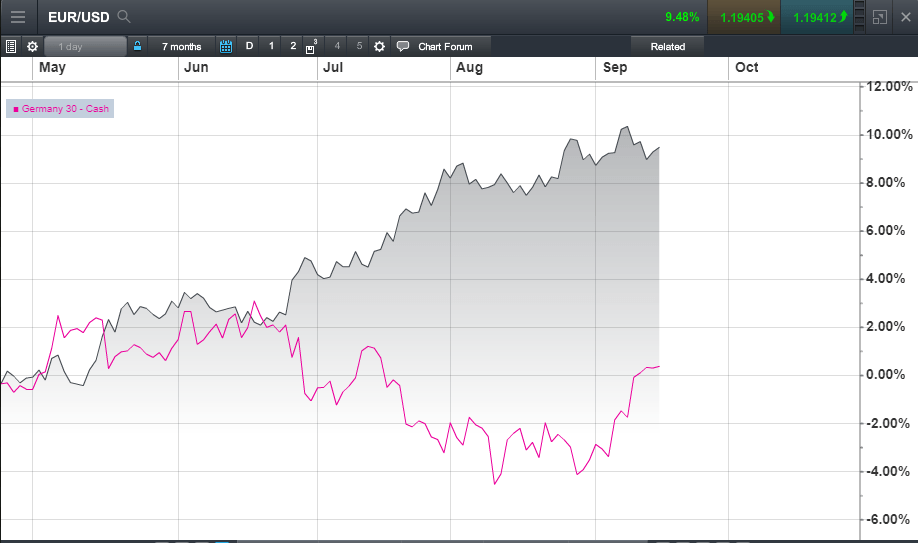

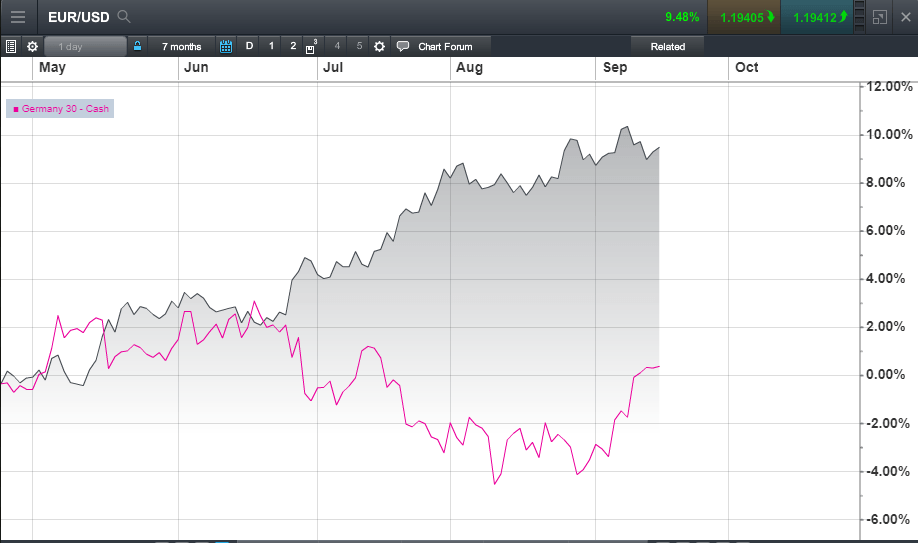

H3: Pre-Election Volatility: The period leading up to a Bundestagswahl is typically characterized by increased uncertainty in the German stock market. Election polls, policy pronouncements, and the inherent unpredictability of the electoral outcome all contribute to price fluctuations in the DAX.

- 2017 Bundestag Election: The months leading up to the 2017 election saw considerable volatility in the DAX, partly driven by concerns about the potential rise of the Alternative for Germany (AfD) party.

- 2013 Bundestag Election: Similar uncertainty marked the 2013 election, with the DAX reacting to shifting poll numbers and debates about fiscal policy.

This pre-election volatility is largely attributed to policy uncertainty surrounding potential changes in fiscal policy, taxation, and economic regulations. Coalition negotiations after close elections further amplify this uncertainty. Historically, the DAX has shown a tendency to experience higher standard deviations in the months directly preceding the election.

H3: Post-Election Market Reactions: The DAX's reaction to election results is often swift and depends heavily on the outcome. The formation of a coalition government generally leads to less volatility than a single-party majority, as coalition negotiations can prolong uncertainty.

- Coalition Governments: The formation of a stable coalition government usually results in a calmer market, as investors gain more clarity on the likely direction of future policies.

- Single-Party Governments: A clear mandate for a single party can lead to sharper, more decisive market movements, depending on the party's platform and announced policies.

Specific policy announcements have a significant impact. For instance, announcements regarding tax changes or substantial fiscal stimulus packages can trigger notable shifts in the DAX. Visual representations, such as charts comparing DAX performance in the weeks following elections with different government formations, would further illustrate these effects.

H3: Long-Term Effects: The long-term impact of a Bundestagswahl on the DAX is multifaceted. Government stability plays a crucial role. A stable government with a clear mandate tends to foster investor confidence and contribute to sustained economic growth, positively impacting the DAX over the longer term.

- Government Stability: Periods of political stability generally correlate with stronger DAX performance. Conversely, prolonged coalition negotiations or political instability can negatively impact investor confidence and long-term economic growth.

- Policy Impacts: The long-term effects depend on the specifics of the implemented policies. Pro-business policies often lead to a positive impact on the DAX, while policies perceived as hindering business growth may have a negative effect.

- Global Economic Factors: It is important to note that the impact of domestic policy is not isolated. Global economic conditions significantly influence the DAX, alongside domestic political developments.

Key Policy Areas Influencing the DAX

H3: Fiscal Policy: Government spending, taxation, and debt management are pivotal factors influencing investor confidence and the DAX. Different political parties exhibit varying approaches: some prioritize fiscal consolidation, while others favor expansionary fiscal policies. These approaches directly influence market expectations and investment decisions.

- Tax Policies: Changes in corporate tax rates, personal income taxes, and consumption taxes can significantly affect corporate profitability and consumer spending, thus influencing the DAX.

- Government Spending: Increased government spending on infrastructure projects or social programs can stimulate economic activity but may also raise concerns about increased national debt.

H3: Economic Regulations: Regulations impacting sectors like the automotive industry (a cornerstone of the German economy), renewable energy, and finance deeply influence DAX-listed companies. The impact of these regulations on profitability and competitiveness plays a significant role in market performance.

- Auto Industry Regulations: Environmental regulations and trade policies directly influence German automakers, major components of the DAX.

- Renewable Energy Policies: Government support for renewable energy sources, such as solar and wind power, can create opportunities for related companies listed on the DAX.

H3: Social Policies: Minimum wage adjustments, labor market reforms, and social welfare programs can affect business costs and investor sentiment. Political parties differ significantly in their approach to these social policies.

- Minimum Wage: Increases in the minimum wage can impact labor costs for businesses, potentially affecting profitability and the DAX.

- Labor Market Reforms: Reforms aimed at increasing labor market flexibility can have a positive effect on business investment and economic growth.

Predicting the Impact of the Upcoming Bundestag Elections on the DAX

The current political landscape is complex, with various parties vying for power. Analyzing the manifestos and platforms of the leading parties is crucial to understanding their potential economic and policy implications. Different election outcomes will significantly affect the DAX.

- Potential Outcomes: Scenario planning, considering various coalition possibilities and their respective policy priorities, is essential for assessing potential impacts on the DAX.

- Short-term vs. Long-term Effects: The short-term impact might involve immediate market reactions to election results. The long-term effects would depend on the implementation of government policies and their overall impact on economic growth.

It is crucial to emphasize that market prediction is inherently uncertain, and these are educated estimations based on historical data and current political analysis.

Conclusion: Understanding the Bundestag Elections' Influence on the German DAX

The Bundestagswahl exerts significant influence on the German DAX, influencing both short-term volatility and long-term performance. Understanding the political risk associated with the election and its potential policy implications is critical for investors in the German market. Staying informed about political developments and their potential market impact is crucial for navigating this dynamic environment. Stay tuned for further analysis on the Bundestagswahl and its impact on the DAX-Index! Follow us for updates and insights on how the German stock market will react.

Featured Posts

-

Us China Trade War Bill Ackmans Time Based Analysis

Apr 27, 2025

Us China Trade War Bill Ackmans Time Based Analysis

Apr 27, 2025 -

Nfl Players Find Second Chances With Mc Cook Jewelers Help

Apr 27, 2025

Nfl Players Find Second Chances With Mc Cook Jewelers Help

Apr 27, 2025 -

2025 Cannes Film Festival Binoches Presidency Announced

Apr 27, 2025

2025 Cannes Film Festival Binoches Presidency Announced

Apr 27, 2025 -

Real Time Analysis The Impact Of Reduced Canadian Travel On The American Economy

Apr 27, 2025

Real Time Analysis The Impact Of Reduced Canadian Travel On The American Economy

Apr 27, 2025 -

Sorpresa En Indian Wells Caida De Una Favorita

Apr 27, 2025

Sorpresa En Indian Wells Caida De Una Favorita

Apr 27, 2025