Understanding High Stock Market Valuations: A BofA Perspective

Table of Contents

Factors Contributing to High Stock Market Valuations

Several interconnected factors contribute to the current high stock market valuations. Analyzing these from a BofA perspective provides a comprehensive understanding of the current market dynamics.

Low Interest Rates

Historically low interest rates have significantly impacted stock market valuations. These low rates make bonds less attractive, pushing investors towards equities seeking higher returns.

- Reduced Bond Yields: Lower interest rates directly decrease bond yields, making them less appealing compared to the potential returns from stocks.

- Increased Corporate Borrowing: Companies can borrow money at cheaper rates, fueling investments and potentially boosting earnings, thus supporting higher stock prices.

- Investor Behavior Shift: Low-interest environments encourage investors to take on more risk, leading to increased demand for equities and driving up prices. BofA's research has consistently highlighted this shift in investor behavior in recent reports.

Strong Corporate Earnings

Robust corporate earnings are another key driver of high stock market valuations. Many companies have reported impressive growth, bolstering investor confidence.

- Sector-Specific Strength: Technology, healthcare, and certain consumer staples sectors have shown particularly strong earnings, contributing significantly to overall market valuation.

- Company-Specific Performance: Several individual companies have exceeded expectations, driving up their stock prices and impacting the broader market indices.

- Future Risks: While current earnings are strong, future uncertainties remain. BofA analysts caution against overlooking potential headwinds, such as supply chain disruptions or inflationary pressures, which could impact future earnings.

Technological Advancements and Innovation

The relentless pace of technological advancement and innovation continues to propel stock prices higher. Investors are betting on the future potential of disruptive technologies.

- Tech Giants' Dominance: Large technology companies continue to dominate market capitalization, fueled by their innovative products and services.

- Disruptive Technologies: Emerging technologies like artificial intelligence, biotechnology, and renewable energy are attracting significant investment, driving valuations in related sectors.

- Future Growth Expectations: Investor sentiment is heavily influenced by expectations of future growth driven by technological innovation. BofA's analysts emphasize the need to assess the realism of these growth projections.

Government Stimulus and Fiscal Policies

Government intervention, particularly in the form of fiscal stimulus packages, has played a significant role in influencing stock market valuations.

- Increased Government Spending: Significant government spending aimed at boosting economic growth directly and indirectly inflates asset prices, including stocks.

- Market Sentiment Boost: Government support measures often create a sense of optimism and stability, leading to increased investor confidence and higher stock valuations.

- Long-Term Consequences: BofA’s economists warn about the potential long-term consequences of increased government debt and inflation associated with these policies, which could ultimately impact market valuations negatively.

BofA's Perspective on Current High Valuations

BofA Global Research offers a nuanced perspective on the current high stock market valuations, carefully weighing the positives against potential risks.

Risk Assessment

BofA acknowledges the risks associated with the current high valuations.

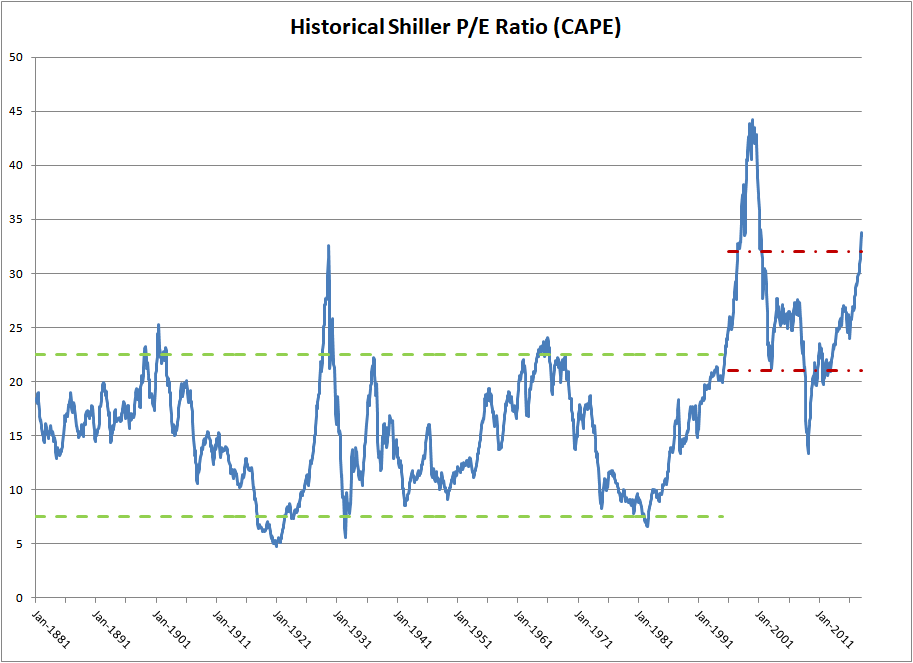

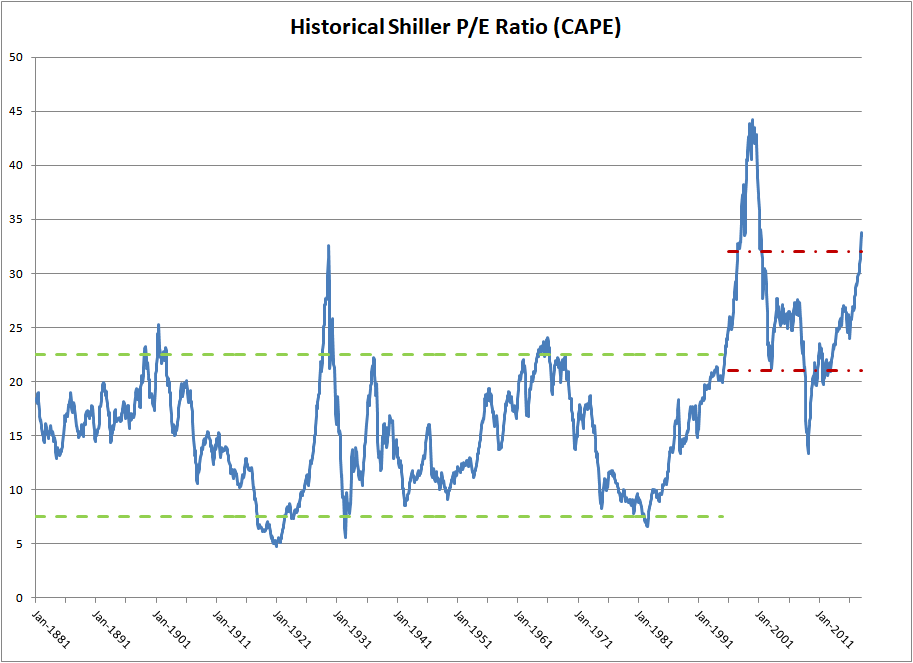

- Overvaluation Concerns: BofA analysts warn about the possibility of certain sectors or individual stocks being overvalued relative to their fundamentals.

- Market Corrections: The possibility of a market correction or even a more significant downturn cannot be ruled out. BofA's research provides scenarios outlining potential market corrections and their impact.

- Economic Downturns: While the current economic outlook appears positive, potential economic downturns remain a key risk factor to consider.

Investment Strategies

Given the current market conditions, BofA suggests several investment strategies:

- Diversification: A well-diversified portfolio across different asset classes and sectors is crucial to mitigate risk.

- Sector-Specific Allocation: Strategic allocation to sectors exhibiting strong fundamentals and growth potential is recommended.

- Hedging Strategies: Employing hedging strategies can help protect portfolios against potential market downturns. BofA offers specific recommendations based on risk tolerance.

Future Outlook

BofA's outlook on future stock market performance is cautious yet optimistic.

- Interest Rate Projections: BofA analysts provide projections on future interest rate movements and their potential impact on stock valuations.

- Economic Growth Predictions: Their economic forecasts influence predictions for corporate earnings and overall market performance.

- Potential Catalysts: BofA identifies potential catalysts, both positive and negative, that could significantly impact future stock market valuations.

Conclusion: Navigating High Stock Market Valuations – A BofA Perspective

High stock market valuations are driven by a complex interplay of low interest rates, strong corporate earnings, technological innovation, and government stimulus. BofA's perspective highlights both the potential opportunities and the inherent risks associated with these high valuations. Understanding these factors and considering BofA's risk assessment and investment strategies are crucial for navigating the current market environment. Learn more about BofA's perspective on high valuations and make informed investment decisions using BofA's resources. Understand high stock market valuations with BofA for a clearer understanding of the current market landscape.

Featured Posts

-

Trump Denies Intentions To Fire Federal Reserve Chair Jerome Powell

Apr 24, 2025

Trump Denies Intentions To Fire Federal Reserve Chair Jerome Powell

Apr 24, 2025 -

Building A Fiscally Responsible Canada Beyond Liberal Spending

Apr 24, 2025

Building A Fiscally Responsible Canada Beyond Liberal Spending

Apr 24, 2025 -

Analyzing The India Market Whats Driving The Niftys Rise

Apr 24, 2025

Analyzing The India Market Whats Driving The Niftys Rise

Apr 24, 2025 -

Btc Price Increase Impact Of Trumps Actions On Market Sentiment

Apr 24, 2025

Btc Price Increase Impact Of Trumps Actions On Market Sentiment

Apr 24, 2025 -

Wildfires And Wagers The Growing Market For Betting On Natural Disasters Los Angeles Case Study

Apr 24, 2025

Wildfires And Wagers The Growing Market For Betting On Natural Disasters Los Angeles Case Study

Apr 24, 2025