Building A Fiscally Responsible Canada: Beyond Liberal Spending

Table of Contents

Curbing Inefficient Government Spending

Excessive government spending strains public resources and hinders long-term economic growth. Addressing this requires a multi-pronged approach focused on identifying and eliminating inefficiencies.

Identifying Areas for Spending Cuts

A thorough review of departmental budgets is crucial to identify redundancies, inefficiencies, and programs with minimal impact. This necessitates a shift from simply increasing budgets annually to a more strategic, performance-based approach.

- Conduct comprehensive audits of government programs: Regular audits, utilizing both internal and external expertise, can pinpoint areas ripe for improvement or elimination. These audits should assess program effectiveness, cost-efficiency, and alignment with overall government objectives.

- Implement performance-based budgeting: Shifting from line-item budgeting to performance-based budgeting allows for a more results-oriented approach. Funding decisions are based on demonstrable outcomes and the achievement of pre-defined goals.

- Prioritize essential services and eliminate non-essential programs: A difficult but necessary step is to prioritize core government functions, such as healthcare and education, while phasing out or consolidating less critical programs that don't deliver a significant return on investment.

- Utilize technology to improve efficiency and reduce administrative costs: Investing in modern technology can streamline administrative processes, reduce paperwork, and enhance service delivery, leading to substantial cost savings. This includes leveraging automation and data analytics.

Strengthening Procurement Processes

Government procurement is a significant area where cost overruns and inefficiencies frequently occur. Strengthening these processes is vital for responsible fiscal management.

- Increase transparency in government procurement: Open and transparent bidding processes ensure fairness and competition, minimizing the risk of favoritism and corruption. Publicly accessible records of contracts awarded can increase accountability.

- Implement robust anti-corruption measures: Stricter regulations and enhanced oversight mechanisms are necessary to prevent corruption and ensure that public funds are used ethically and efficiently. This includes independent audits and investigations.

- Prioritize domestic suppliers while ensuring competitive pricing: Supporting domestic businesses can stimulate the Canadian economy. However, it's essential to balance this with the need for competitive pricing to avoid inflating costs.

- Regularly review and update procurement policies: Government procurement policies must remain dynamic and adapt to evolving needs and best practices. Regular reviews are crucial to ensure that these policies remain efficient and effective.

Promoting Fiscal Transparency and Accountability

Openness and accountability are cornerstones of responsible government. Increased transparency allows citizens to monitor how their tax dollars are used.

Open Data Initiatives

Making government budget information easily accessible to the public is crucial for informed public discourse and holding the government accountable.

- Publish detailed budget breakdowns online: Detailed, easily understandable budget breakdowns should be available online for public scrutiny. This includes detailed explanations of expenditures and justifications for funding allocations.

- Develop user-friendly data visualization tools: Presenting complex budgetary data in a user-friendly format, such as interactive charts and graphs, enhances public understanding and engagement.

- Facilitate independent analysis of government spending data: Allowing independent researchers and organizations to access and analyze government spending data promotes critical assessment and identification of potential problems.

- Encourage citizen participation in budget discussions: Providing opportunities for public input and engagement in budget processes promotes transparency and accountability and ensures that government spending aligns with the needs and priorities of the citizenry.

Strengthening Parliamentary Oversight

Parliamentary committees play a critical role in overseeing government spending. Empowering these committees is crucial for effective accountability.

- Increase the resources allocated to parliamentary committees: Adequate resources, including staffing and expertise, are essential for committees to effectively scrutinize government spending and conduct thorough investigations.

- Enhance the independence of parliamentary committees: Ensuring the independence of parliamentary committees from executive influence is vital for unbiased and effective oversight.

- Strengthen the powers of parliamentary committees to investigate government spending: Parliamentary committees should have the power to compel witnesses, demand documents, and conduct thorough investigations into allegations of waste or mismanagement.

- Implement mechanisms for public input into parliamentary oversight: Providing mechanisms for the public to submit information and concerns to parliamentary committees improves accountability and ensures that the voices of citizens are heard.

Investing in Long-Term Economic Growth

Responsible fiscal management isn't just about cutting spending; it's also about strategic investment in areas that drive long-term economic growth and prosperity.

Strategic Infrastructure Investments

Investing in essential infrastructure is crucial for long-term economic growth and competitiveness.

- Conduct cost-benefit analyses of infrastructure projects: Rigorous cost-benefit analyses ensure that infrastructure investments deliver a strong return on investment and align with national priorities.

- Focus on projects with high economic returns: Prioritize infrastructure projects that have a demonstrable positive impact on the economy, such as transportation networks, energy infrastructure, and digital connectivity.

- Explore public-private partnerships to leverage private sector investment: Public-private partnerships can leverage private sector expertise and capital to fund and deliver large-scale infrastructure projects.

- Prioritize sustainable and resilient infrastructure development: Investing in sustainable infrastructure reduces long-term maintenance costs and enhances resilience to climate change and other environmental challenges.

Human Capital Development

Investing in education, skills training, and healthcare is essential for building a strong and productive workforce.

- Increase funding for education and skills training programs: Investing in education and training equips Canadians with the skills needed for a competitive job market and fosters innovation.

- Expand access to affordable healthcare: A healthy population is a productive population. Affordable and accessible healthcare is essential for a thriving workforce and economy.

- Invest in research and development to foster innovation: Investing in research and development fosters innovation and creates new economic opportunities.

- Promote lifelong learning and reskilling opportunities: Supporting lifelong learning initiatives allows Canadians to adapt to changing job markets and remain competitive throughout their careers.

Conclusion

Building a fiscally responsible Canada requires a fundamental shift away from excessive spending and towards prudent fiscal management. By curbing inefficient spending, promoting transparency and accountability, and investing strategically in long-term economic growth, Canada can achieve a sustainable and prosperous future. We must demand greater accountability from our government and actively participate in shaping a more fiscally responsible Canada. Let's work together to create a brighter future through responsible budgeting and effective use of taxpayer dollars; let's build a truly fiscally responsible Canada.

Featured Posts

-

Double Trouble In Hollywood Writers And Actors Strike Impacts Production

Apr 24, 2025

Double Trouble In Hollywood Writers And Actors Strike Impacts Production

Apr 24, 2025 -

Russian Natural Gas Phaseout Eus Spot Market Strategy Under Scrutiny

Apr 24, 2025

Russian Natural Gas Phaseout Eus Spot Market Strategy Under Scrutiny

Apr 24, 2025 -

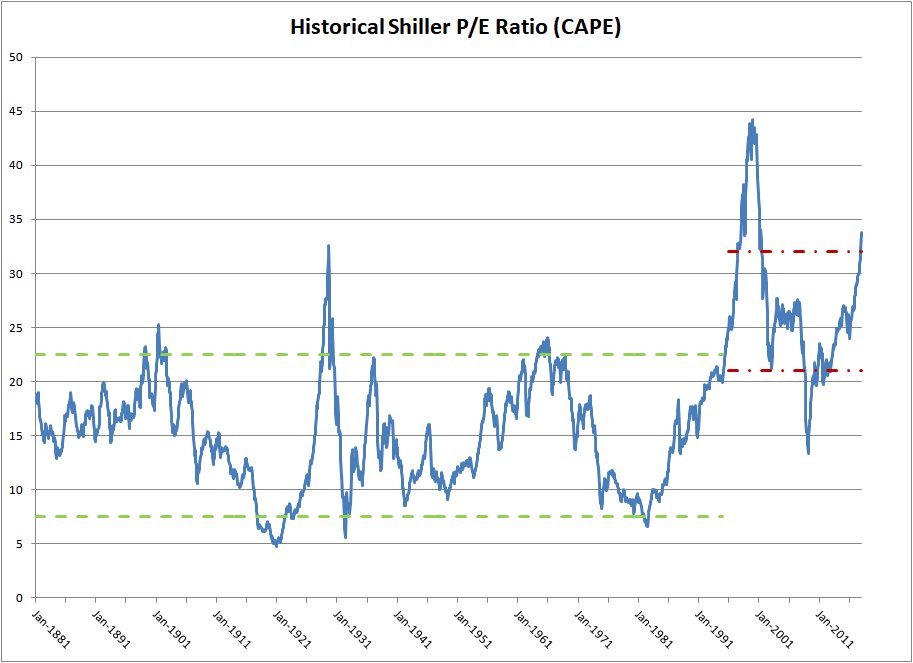

Stock Market Valuations Bof As Rationale For Investor Calm

Apr 24, 2025

Stock Market Valuations Bof As Rationale For Investor Calm

Apr 24, 2025 -

The Paradox Of Pope Francis A Globalized Church Facing Internal Divisions

Apr 24, 2025

The Paradox Of Pope Francis A Globalized Church Facing Internal Divisions

Apr 24, 2025 -

Instagrams New Video Editing App A Threat To Tik Tok

Apr 24, 2025

Instagrams New Video Editing App A Threat To Tik Tok

Apr 24, 2025