Trump's Attack On Jerome Powell: Calls For Fed Chair's Termination

Table of Contents

Jerome Powell, as the head of the Federal Reserve (the Fed), is responsible for overseeing US monetary policy, including setting interest rates and managing the money supply. The Fed's decisions directly influence inflation, employment, and overall economic growth, making its actions crucial for the nation's financial health and global market stability. Therefore, Trump's unprecedented attacks on the Fed chair held significant implications. This article will analyze the reasons behind these attacks, their consequences, and the lasting impact on the US economy and the Federal Reserve's independence.

Trump's Criticisms of Powell's Monetary Policy

Trump's frustration with Powell stemmed primarily from disagreements over monetary policy.

Interest Rate Hikes

Trump consistently condemned Powell's decision to raise interest rates. He viewed these hikes as detrimental to economic growth, hindering his administration's efforts to boost the economy.

- Trump's Public Statements: Trump frequently labeled rate hikes as "crazy" and "insensitive," publicly criticizing the Fed's actions on multiple occasions via tweets and press conferences.

- Economic Data: While the US economy experienced robust growth under Trump, inflation remained relatively low, arguably refuting some of Trump's claims. However, some economists argued that rate hikes could have slowed down the growth trajectory.

- Expert Opinions: Economists remain divided on the effectiveness of Powell's interest rate policy. Some praised the Fed's cautious approach in managing inflation risks, while others argued for more aggressive stimulus measures.

Inflation and Economic Slowdown

Trump also blamed Powell for rising inflation and the threat of an economic slowdown, directly linking the Fed's actions to these negative economic indicators.

- Inflation and Growth Statistics: Inflation remained relatively low during much of Trump's presidency, although it did increase towards the end of his term. Economic growth, while strong, began to decelerate in the later years.

- Trump's Statements: Trump directly accused Powell of deliberately stifling economic progress, publicly blaming the Fed chair for any signs of economic weakness.

- Counterarguments: Other factors such as trade wars and global economic uncertainties also played a significant role in influencing inflation and economic growth, factors outside the Fed's direct control.

Political Motivations Behind Trump's Attacks

Beyond economic disagreements, Trump's attacks on Powell were heavily influenced by political considerations.

Impact on 2020 Election

Trump's criticism of Powell intensified as the 2020 election approached. Many observers viewed the attacks as an attempt to shift blame for economic challenges away from the administration and onto an independent agency.

- Scapegoating: Trump frequently used Powell as a scapegoat for economic slowdowns or market volatility, deflecting responsibility from his own economic policies.

- Public Opinion: Public opinion on Powell and the Fed was mixed during this period, with some supporting the Fed's actions and others echoing Trump's criticism.

- Expert Analysis: Political analysts widely interpreted Trump's actions as an attempt to manipulate economic narratives for political gain.

Independence of the Federal Reserve

Trump's relentless attacks on Powell threatened the critical independence of the Federal Reserve. The Fed's autonomy from political influence is essential for its credibility and effectiveness in managing the economy.

- Legal and Historical Context: The Federal Reserve Act of 1913 established the Fed's independence to protect it from short-term political pressures.

- Arguments for and Against Interference: While some argue for greater political accountability, most economists agree that political interference undermines the Fed's ability to make objective decisions in the best interests of the economy.

- Consequences of Undermining Independence: Undermining the Fed's independence could damage its credibility, leading to market instability and potentially hindering its ability to effectively manage future economic crises.

Consequences of Trump's Actions

Trump's attacks on Powell had tangible consequences for the US economy and the Federal Reserve.

Market Volatility

Trump's public criticisms of the Fed often led to immediate market reactions, creating uncertainty and volatility.

- Market Reactions: Stock markets frequently experienced fluctuations following Trump's comments on Powell and the Fed's policies.

- Expert Analysis: Financial experts warned that Trump's actions increased market uncertainty and eroded investor confidence.

- Long-Term Implications: The repeated attacks raised concerns about the long-term stability of the financial markets.

Damage to the Fed's Reputation

Trump's actions potentially damaged the Federal Reserve's reputation and credibility, undermining public trust in the institution.

- Erosion of Public Trust: Trump's attacks contributed to a climate of distrust towards the Fed amongst some segments of the population.

- Long-Term Consequences: The long-term effects of this erosion of trust could hinder the Fed's effectiveness in managing future economic challenges.

- Potential Reforms: The incident highlights the need for ongoing discussions about safeguarding the Fed's independence and ensuring public understanding of its crucial role.

Conclusion: Trump's Attack on Jerome Powell: A Lasting Impact

Trump's repeated attacks on Jerome Powell represent a significant challenge to the independence and credibility of the Federal Reserve. His criticisms, driven by both economic disagreements and political motivations, resulted in market volatility and potentially damaged the Fed's reputation. The long-term implications of this episode remain to be seen, but it underscores the importance of protecting the Fed's autonomy from political interference. Further research into Trump's attack on Jerome Powell and the broader implications for the US economy and the Federal Reserve's independence is crucial. Engage in discussions about preserving the Fed's crucial role in maintaining a stable economy. Understanding the dynamics of this conflict helps inform future policy debates and safeguards the integrity of this vital institution.

Featured Posts

-

Mlb Investigating Plate Umpires Controversial Call Against Detroit Tigers

Apr 23, 2025

Mlb Investigating Plate Umpires Controversial Call Against Detroit Tigers

Apr 23, 2025 -

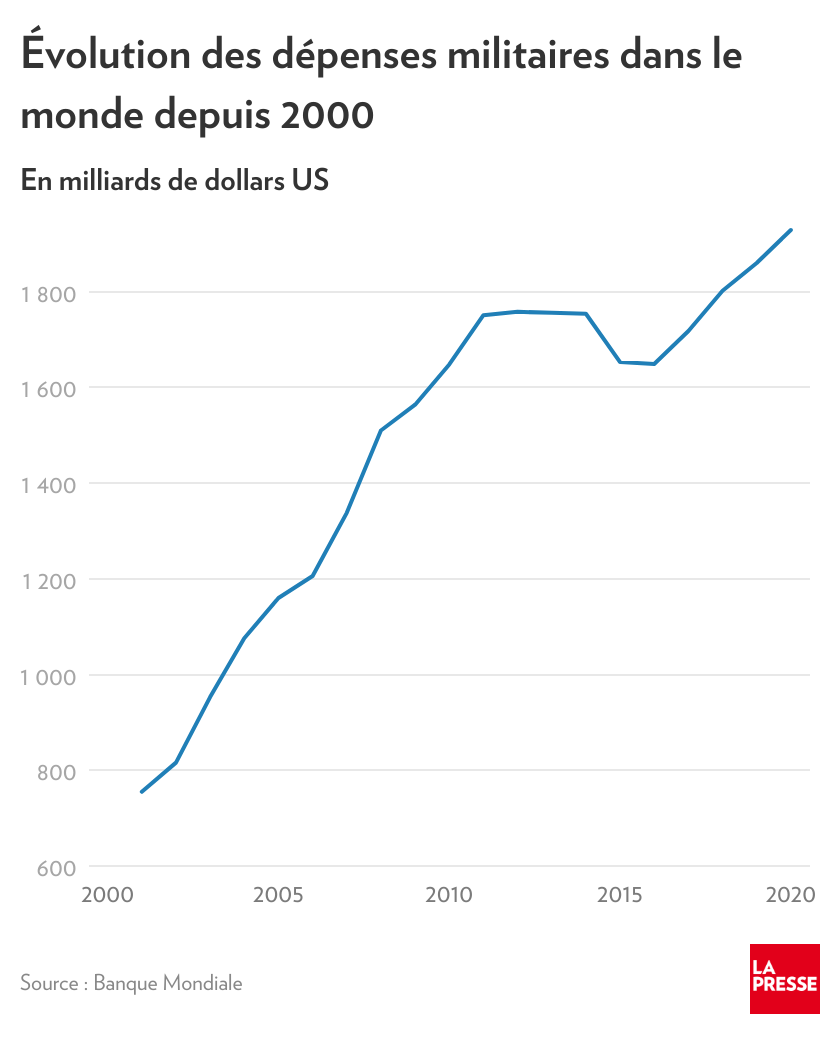

Montee Des Depenses De Defense Usa Vs Russie Analyse De John Plassard

Apr 23, 2025

Montee Des Depenses De Defense Usa Vs Russie Analyse De John Plassard

Apr 23, 2025 -

Key Economic Insights An Analysis Of The English Language Leaders Debate

Apr 23, 2025

Key Economic Insights An Analysis Of The English Language Leaders Debate

Apr 23, 2025 -

Detained Father Mahmoud Khalil Misses Newborn Sons Birth Due To Ice

Apr 23, 2025

Detained Father Mahmoud Khalil Misses Newborn Sons Birth Due To Ice

Apr 23, 2025 -

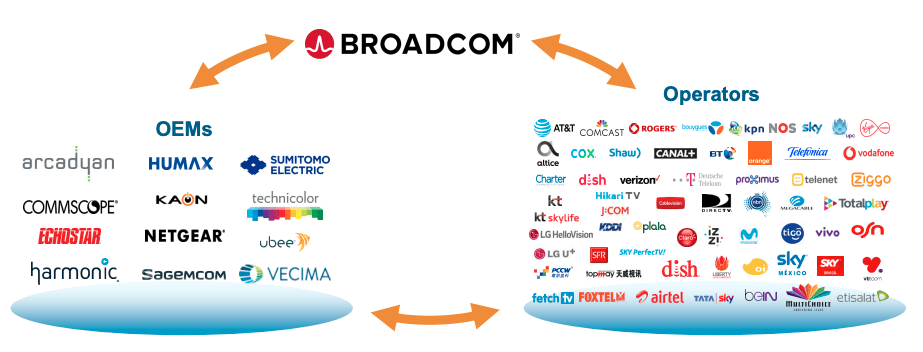

V Mware Costs To Skyrocket 1050 At And Ts Concerns Over Broadcoms Acquisition

Apr 23, 2025

V Mware Costs To Skyrocket 1050 At And Ts Concerns Over Broadcoms Acquisition

Apr 23, 2025