VMware Costs To Skyrocket 1050%: AT&T's Concerns Over Broadcom's Acquisition

Table of Contents

AT&T's Concerns and the VMware Price Hike Prediction

AT&T's Public Statement and its Implications

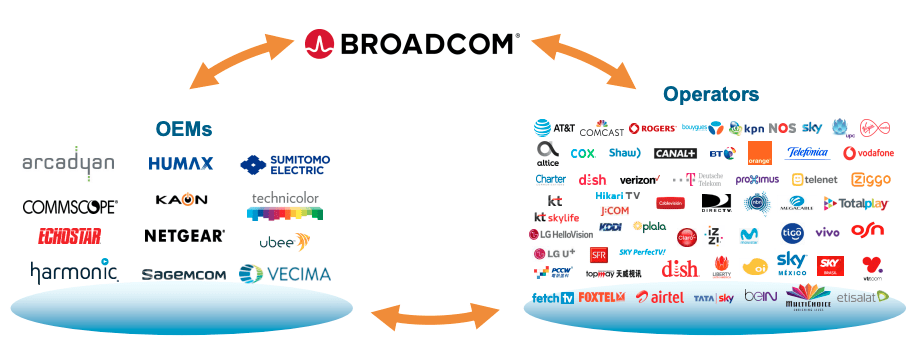

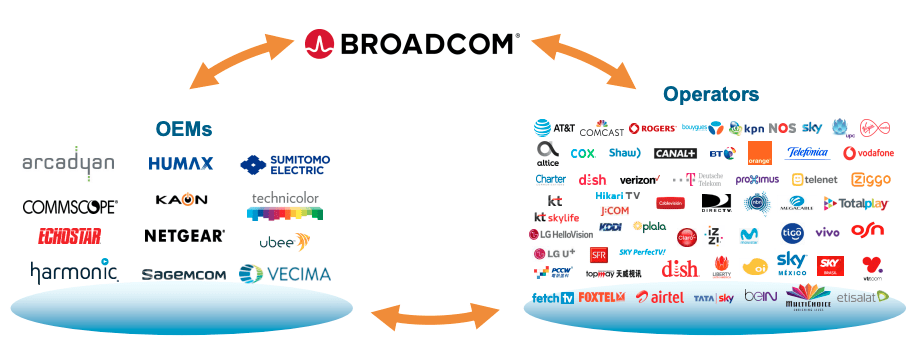

AT&T, a major user of VMware technologies, has publicly expressed serious reservations about the potential for substantial price increases following the Broadcom acquisition. Their concerns are not to be dismissed lightly; as a significant player in the telecom industry, AT&T's reliance on VMware solutions for its infrastructure and operations is substantial. Their voice carries significant weight in this debate. The company's worries stem from the potential for reduced competition and the emergence of monopolistic practices post-acquisition.

- Specific concerns raised by AT&T: Reduced competition leading to unchecked price increases, potential limitations on innovation due to a lack of competitive pressure, and concerns about the long-term accessibility and affordability of VMware products and services.

- AT&T's reliance on VMware technologies: AT&T utilizes VMware across its vast network infrastructure, virtualizing servers, networking equipment, and potentially cloud services. Any significant increase in VMware costs would directly translate into higher operational expenses for the company.

- Potential impact on AT&T's operational costs: A 1050% increase, as projected by some analysts, would represent a massive financial burden, potentially impacting their profitability and competitiveness.

Analyzing the 1050% VMware Cost Increase Projection

The 1050% projection, while seemingly extreme, is based on analyses that consider Broadcom's historical pricing strategies following past acquisitions. The analysis suggests a significant reduction in competition post-acquisition, potentially leading to significant increases in licensing fees, support contracts, and other VMware-related expenses. This is further exacerbated by the anticipated decrease in innovation driven by reduced competitive pressure.

- Breakdown of potential cost increases: The projected increase doesn't necessarily affect all VMware products uniformly. Some niche services or enterprise-level solutions could experience far more dramatic price hikes than others.

- Impact on different sized businesses: Smaller businesses may be disproportionately affected, potentially forcing them to seek out significantly more expensive alternatives or even face considerable operational challenges. Larger enterprises might absorb the increased costs better, but it would still significantly impact budgets.

- Comparison to historical VMware pricing trends: Historically, VMware's pricing has been relatively stable; however, the Broadcom acquisition is a unique situation that dramatically alters the competitive landscape.

Regulatory Scrutiny and its Impact on VMware Pricing

The Broadcom-VMware merger is under intense regulatory scrutiny globally. Antitrust concerns are paramount, with regulatory bodies examining the potential for reduced competition and the creation of a monopolistic entity within the virtualization market. The outcome of these reviews will significantly influence VMware's future pricing strategies.

- Key regulatory bodies involved: Agencies like the FTC in the US and similar bodies in Europe and other regions are closely examining the deal.

- Potential outcomes of the regulatory review: The merger could be approved without conditions, approved with conditions (such as divestments of certain VMware assets), or blocked entirely.

- Impact of different regulatory decisions on VMware costs: Regulatory approvals without conditions could lead to more aggressive pricing strategies. Conversely, conditions imposed might mitigate potential price hikes.

The Broader Impact on the Enterprise IT Landscape

Implications for Other VMware Customers

The potential VMware price hike is not just an AT&T problem. Many other large enterprises that heavily rely on VMware for their core IT infrastructure will be affected. Switching to alternative solutions is a complex and costly undertaking, leading to potential vendor lock-in.

- Examples of other large companies potentially affected: Numerous Fortune 500 companies and significant players across various industries depend on VMware virtualization solutions.

- Challenges involved in migrating from VMware to alternative solutions: Migrating from VMware requires substantial time, resources, and expertise, potentially causing disruption and downtime.

- Potential for market consolidation and reduced choice for enterprises: The acquisition could lead to less choice and potentially less innovation in the virtualization market.

Long-Term Effects on Cloud Computing and Virtualization

The acquisition has significant long-term implications for the entire cloud computing and virtualization landscape. The potential for increased vendor lock-in and reduced innovation are serious concerns.

- Potential impact on cloud adoption rates: Increased VMware costs could make cloud adoption more expensive, potentially slowing down market growth.

- Concerns about vendor lock-in and reduced flexibility: Businesses could become heavily reliant on a single vendor, losing flexibility and bargaining power.

- Potential for decreased innovation due to reduced competition: Reduced competition could stifle innovation and lead to slower development of new virtualization technologies and services.

Conclusion: Navigating the Future of VMware Costs

AT&T's concerns regarding the potential 1050% increase in VMware costs due to the Broadcom acquisition reflect a broader industry apprehension. The potential for dramatic price increases, reduced competition, and vendor lock-in are significant challenges for businesses of all sizes. The regulatory review's outcome will play a crucial role in determining the final impact on VMware costs. Proactive planning, including detailed budget analysis and exploration of alternative solutions, is crucial for enterprises to navigate the potential price increases. Stay informed about the latest developments by subscribing to industry newsletters and following the regulatory proceedings to effectively manage your VMware costs and ensure business continuity. Understanding the evolving dynamics surrounding "VMware Costs" is essential for mitigating the risks associated with the Broadcom acquisition.

Featured Posts

-

Karen Reads Second Murder Trial Opening Statements Begin

Apr 23, 2025

Karen Reads Second Murder Trial Opening Statements Begin

Apr 23, 2025 -

Chalet Girls Unveiling The Reality Of Luxury Ski Season Work

Apr 23, 2025

Chalet Girls Unveiling The Reality Of Luxury Ski Season Work

Apr 23, 2025 -

M3 As Autopalya Forgalomkorlatozasok Utlezarasok Es Elorejelzesek

Apr 23, 2025

M3 As Autopalya Forgalomkorlatozasok Utlezarasok Es Elorejelzesek

Apr 23, 2025 -

Uk Diy Retailers The Best And Worst Revealed

Apr 23, 2025

Uk Diy Retailers The Best And Worst Revealed

Apr 23, 2025 -

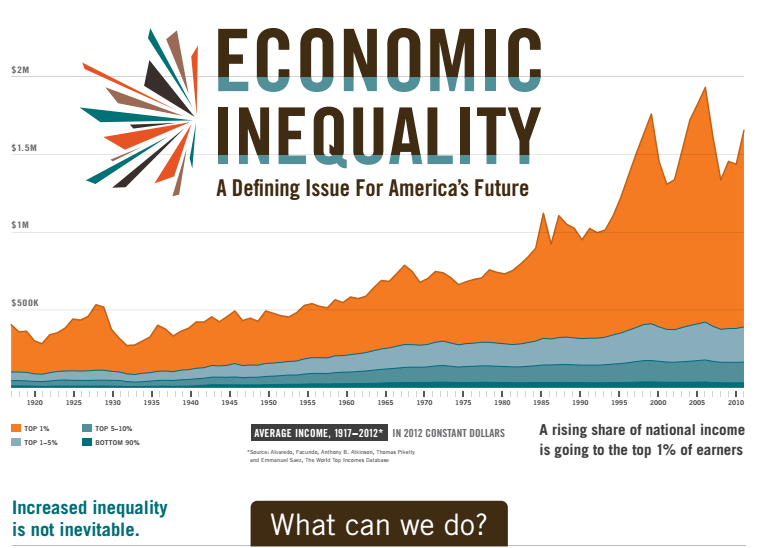

Analyzing The Economic Data Wheres The Trump Effect

Apr 23, 2025

Analyzing The Economic Data Wheres The Trump Effect

Apr 23, 2025