The Trump-Powell Feud Intensifies: President Calls For Fed Chair's Termination

Table of Contents

The Roots of the Trump-Powell Conflict

The Trump-Powell conflict isn't a sudden eruption; it's the culmination of months of simmering tension stemming from fundamental disagreements over economic policy. President Trump, prioritizing rapid economic growth and lower unemployment, has consistently clashed with Powell's more cautious approach. Their differing economic philosophies have led to repeated public criticisms and accusations.

-

Trump's criticism of interest rate hikes: The President repeatedly criticized the Fed's interest rate increases in 2018 and 2019, arguing they were stifling economic growth and hurting businesses. He publicly called for interest rate cuts, even going so far as to label the Fed as his "biggest threat."

-

Disagreements over quantitative easing: The debate extended to quantitative easing (QE), a monetary policy tool used to stimulate the economy. Trump’s preference for continued QE clashed with Powell's measured approach to winding down these programs.

-

Trump's belief that the Fed is hindering economic growth: The President consistently blamed the Fed for slowing economic growth, arguing its policies were counterproductive to his administration's objectives. This belief fueled his calls for Powell's dismissal.

-

Powell's defense of the Fed's independence: Throughout these criticisms, Powell staunchly defended the Fed's independence, emphasizing its crucial role in maintaining price stability and managing inflation. He consistently refrained from engaging in direct political responses to Trump's attacks, prioritizing the Fed's non-partisan mandate.

The President's Call for Termination: Legal and Political Ramifications

The President's call for Powell's removal raises significant legal and political questions. While the President can appoint the Fed Chair, removing them is a far more complex process. The Fed's independence is constitutionally protected, designed to shield monetary policy from short-term political pressures.

-

The independence of the Federal Reserve: The Fed's independence is a cornerstone of the US financial system, ensuring its decisions are based on economic data and not political expediency. Removing Powell could severely damage this independence, potentially leading to global market instability.

-

Potential legal challenges to removal: Attempting to remove Powell outside the established legal framework could face significant legal challenges. The process for removing a Fed Chair is intricate and unlikely to be easily circumvented.

-

Political fallout for the Trump administration: Such a move would likely draw intense criticism from both Democrats and some Republicans, potentially triggering a major political crisis. It could also severely damage the international perception of US economic stability.

-

Impact on investor confidence: A forced removal of the Fed Chair would dramatically undermine investor confidence, potentially leading to capital flight and a weakening of the dollar.

Market Reactions and Economic Uncertainty

The President's call has already triggered significant market reactions. Stock markets experienced immediate volatility, reflecting investor anxieties about the future direction of monetary policy and the stability of the US economy.

-

Stock market fluctuations: Following the news, stock indices displayed significant fluctuations, with investors uncertain about the potential long-term consequences of the feud.

-

Changes in interest rates and bond yields: The uncertainty surrounding the Fed's leadership has led to shifts in interest rates and bond yields, impacting borrowing costs for businesses and consumers.

-

Impact on consumer confidence: The political turmoil surrounding the Fed is likely to negatively affect consumer confidence, potentially dampening spending and slowing economic growth.

-

Potential for increased economic uncertainty: The ongoing conflict creates a climate of uncertainty, making it difficult for businesses to plan for the future and potentially hindering investment and job creation.

Expert Opinions and Analyses

Economists, political analysts, and financial experts offer diverse perspectives on the situation. Some warn of the potential for a significant economic downturn if the Fed's independence is compromised. Others believe the market will eventually stabilize, while acknowledging the short-term volatility. The consensus, however, points towards heightened economic uncertainty and potential negative consequences for global markets.

-

Economists' views on the impact of the feud: Many economists express deep concerns about the potential damage to the US and global economies, emphasizing the importance of maintaining the Fed's independence.

-

Political analysts' assessments of the political ramifications: Political analysts predict significant political fallout, irrespective of the outcome of the feud, with potential long-term consequences for the US political landscape.

-

Financial experts' predictions for the market: Financial experts generally predict continued market volatility in the short-term, with the long-term outlook heavily dependent on the resolution of the conflict and the subsequent actions of the Fed.

Conclusion: The Future of the Trump-Powell Feud and its Impact on the US Economy

The Trump-Powell feud represents a grave threat to the stability of the US economy and global markets. The President's call for the Fed Chair's termination is an unprecedented challenge to the independence of the central bank, with potentially devastating consequences. Understanding the ramifications of this conflict is crucial for navigating the current period of heightened market volatility. The resulting economic uncertainty underscores the importance of closely following developments in this ongoing saga. Stay tuned for further updates on the intensifying Trump-Powell feud and its impact on the US economy. Understanding this ongoing conflict is crucial to navigating the current market volatility and making informed financial decisions.

Featured Posts

-

Dodgers Roberts Admits One Hit Changed The World Series Outcome

Apr 23, 2025

Dodgers Roberts Admits One Hit Changed The World Series Outcome

Apr 23, 2025 -

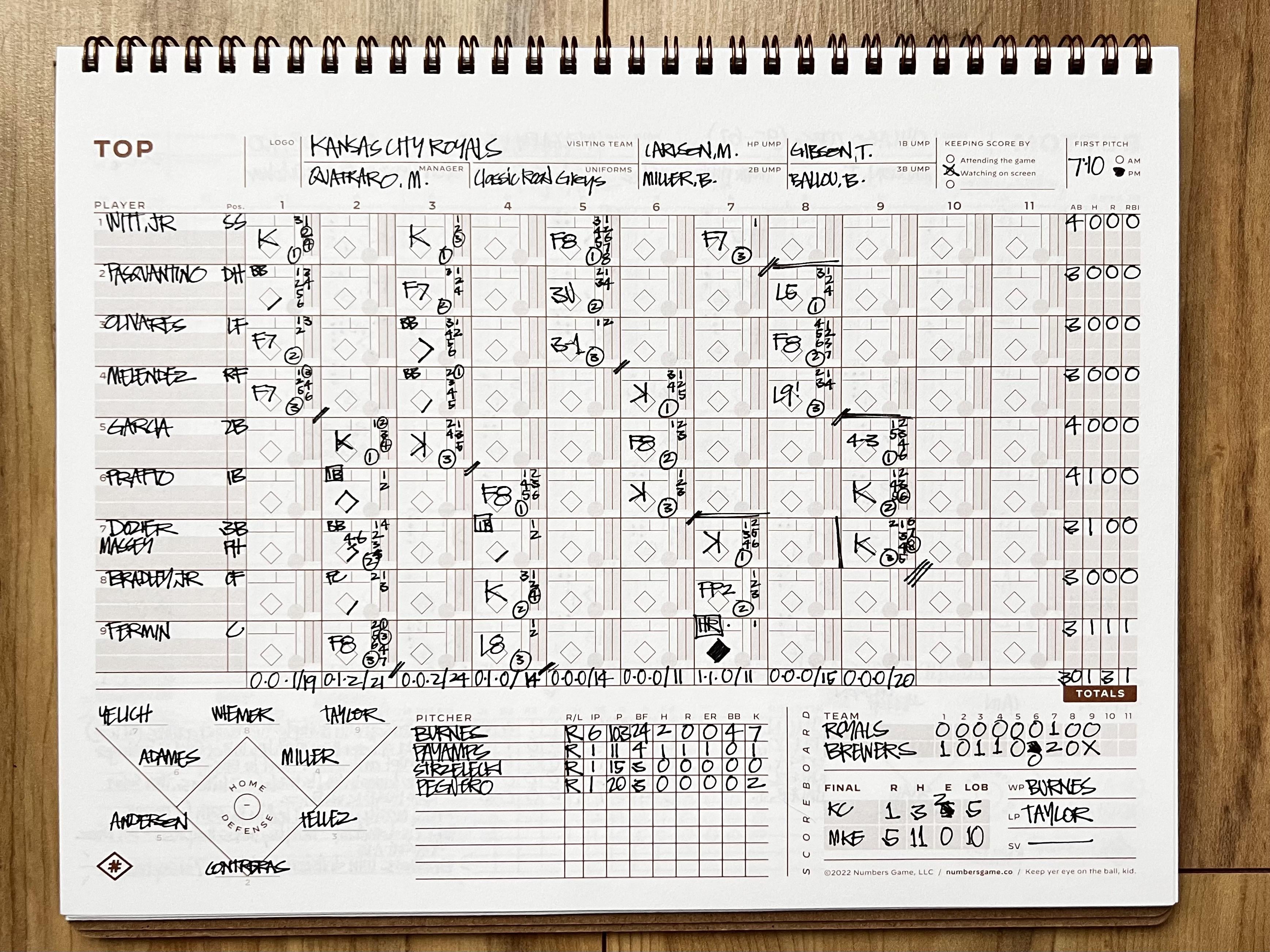

Royals Strong Performance Leads To 11 1 Win Over Brewers

Apr 23, 2025

Royals Strong Performance Leads To 11 1 Win Over Brewers

Apr 23, 2025 -

Ankara Iftar Sahur Vakitleri 3 Mart 2024 Pazartesi

Apr 23, 2025

Ankara Iftar Sahur Vakitleri 3 Mart 2024 Pazartesi

Apr 23, 2025 -

Reds 1 0 Losing Streak Reaches Three Games

Apr 23, 2025

Reds 1 0 Losing Streak Reaches Three Games

Apr 23, 2025 -

Impact Of Trump Administration On Canadian Immigration To The United States

Apr 23, 2025

Impact Of Trump Administration On Canadian Immigration To The United States

Apr 23, 2025