The Trump FDA's Impact On Biotech Investment And Innovation

Table of Contents

Accelerated Drug Approvals and Their Implications

The Trump FDA prioritized accelerated drug approvals, leading to both opportunities and challenges for the biotech industry. This section will explore two key aspects of this approach: Right to Try initiatives and streamlined regulatory processes.

Right to Try Initiatives

The expansion of "Right to Try" initiatives allowed terminally ill patients access to experimental drugs outside of traditional clinical trials.

- Increased access to experimental drugs: This potentially offered hope to patients with limited treatment options.

- Potential benefits and drawbacks: While offering potential benefits, this also raised ethical concerns regarding patient safety and informed consent.

- Ethical considerations: The lack of rigorous data collection in Right to Try programs limited the ability to assess efficacy and safety, potentially hindering future drug development.

This policy shift affected investment strategies. Smaller biotech firms focusing on niche treatments might have seen increased investor interest, driven by the potential for faster patient access and quicker revenue streams. However, the ethical complexities and lack of robust data could also have deterred some investors.

Streamlined Regulatory Processes

The Trump FDA implemented expedited review processes, such as Breakthrough Therapy designation and Accelerated Approval pathways, aiming to shorten drug approval timelines.

- Faster approval times: This led to increased market entry speed for innovative drugs.

- Increased market entry speed: This fostered investor confidence, leading to increased investment in promising drug candidates.

- Potential risks associated with accelerated approvals: Faster approvals, however, came with increased post-market surveillance requirements to monitor for unforeseen side effects.

Examples include the accelerated approval of several cancer immunotherapies. While these expedited processes undoubtedly sped up access to potentially life-saving treatments, they also introduced increased risks, requiring robust post-market monitoring. This impacted investment decisions, as companies weighed the potential rewards of faster approval against the added costs and responsibilities of enhanced surveillance.

Changes in Funding and Research Priorities

The Trump administration's policies significantly impacted funding and research priorities within the biotech sector, affecting both early-stage startups and established pharmaceutical companies.

Budgetary Allocations to Research and Development

Changes in FDA budgetary allocations directly influenced research and development (R&D) in the biotech sector.

- Funding increases or decreases in specific areas: Some areas might have seen increased funding, while others experienced cuts, leading to shifts in investment priorities.

- Impact on grant availability: The availability of research grants shifted, impacting the ability of early-stage biotech startups to secure funding.

- Effects on early-stage biotech startups: Early-stage companies were particularly vulnerable to these funding shifts, potentially hindering innovation in certain therapeutic areas.

Analyzing specific budget items affected reveals a clear picture of how these changes might have shifted investment priorities. Did increased funding for, say, cancer research, lead to a disproportionate increase in investment in oncology compared to other areas? Understanding these budgetary shifts is critical to understanding their ripple effects on biotech investment and innovation.

Shifting Focus on Specific Therapeutic Areas

The Trump FDA exhibited shifts in its focus on specific therapeutic areas.

- Increased emphasis on certain areas: Increased emphasis on specific disease areas, like opioid addiction or Alzheimer's disease, redirected investment towards those areas.

- Decreased focus on others: Conversely, a decreased focus on other therapeutic areas might have resulted in reduced investment and slower progress.

- Resulting investment shifts: This led to considerable shifts in investment patterns, impacting the pace of drug development across various therapeutic areas.

- Consequences for unmet medical needs: These shifts could have had major consequences for unmet medical needs in areas that received less attention and funding.

For instance, a renewed focus on infectious diseases might have led to increased investment in antiviral drug development. Conversely, a reduced emphasis on rare diseases could have slowed down research in that area, impacting patients with these conditions.

Impact on Biotech Company Valuation and Stock Performance

The Trump FDA's policies significantly influenced biotech company valuations and stock performance.

Market Reaction to FDA Policy Changes

The stock market reacted dynamically to the various policy changes introduced by the Trump FDA.

- Stock price fluctuations: Announcements regarding new regulations, approvals, or funding decisions caused significant fluctuations in biotech stock prices.

- Investor sentiment: Investor sentiment towards specific companies and the sector as a whole was directly influenced by FDA actions.

- Impact on company valuations: These fluctuations had a direct impact on company valuations, affecting funding rounds and initial public offerings (IPOs).

Analyzing the correlation between specific FDA actions and subsequent stock price movements provides valuable insights into the market's reaction to these policies.

Mergers and Acquisitions in the Biotech Industry

The regulatory environment shaped mergers and acquisitions (M&A) activity within the biotech sector.

- Increased or decreased M&A activity: Changes in regulations might have either stimulated or inhibited M&A activity.

- Reasons for changes: This could be attributed to shifts in company valuations, changes in the regulatory landscape, or other economic factors.

- Effects on competition and innovation: The resultant changes in market consolidation affected competition and potentially influenced the pace of innovation.

Did changes in the speed of regulatory approval increase the attractiveness of certain biotech companies as acquisition targets? Examining M&A activity during this period reveals the impact of the Trump FDA's policies on market dynamics and company strategies.

Conclusion

The Trump FDA's policies profoundly impacted biotech investment and innovation. While accelerated approvals fostered faster market entry for some drugs, they also introduced increased post-market surveillance needs and ethical considerations regarding "Right to Try" initiatives. Changes in budgetary allocations and research priorities shifted investment patterns across different therapeutic areas. These policies influenced biotech company valuations, stock performance, and merger and acquisition activity. Understanding the long-term effects of these policies on Trump FDA regulation of biotech innovation and biotech investment is crucial. We encourage further research into how these policies continue to shape the future of the pharmaceutical industry. Analyzing the interplay between regulatory changes, investor confidence, and subsequent advancements in biotech will provide a comprehensive understanding of this complex relationship.

Featured Posts

-

Suriye De Ramazan Bayrami Kutlamalari Pazartesi Basliyor Tuem Bilgiler

Apr 23, 2025

Suriye De Ramazan Bayrami Kutlamalari Pazartesi Basliyor Tuem Bilgiler

Apr 23, 2025 -

Ramazan Bayrami Suriye Pazartesi Guenue Bayram Coskusu

Apr 23, 2025

Ramazan Bayrami Suriye Pazartesi Guenue Bayram Coskusu

Apr 23, 2025 -

Analyzing Warren Buffetts Apple Exit Implications For Investors

Apr 23, 2025

Analyzing Warren Buffetts Apple Exit Implications For Investors

Apr 23, 2025 -

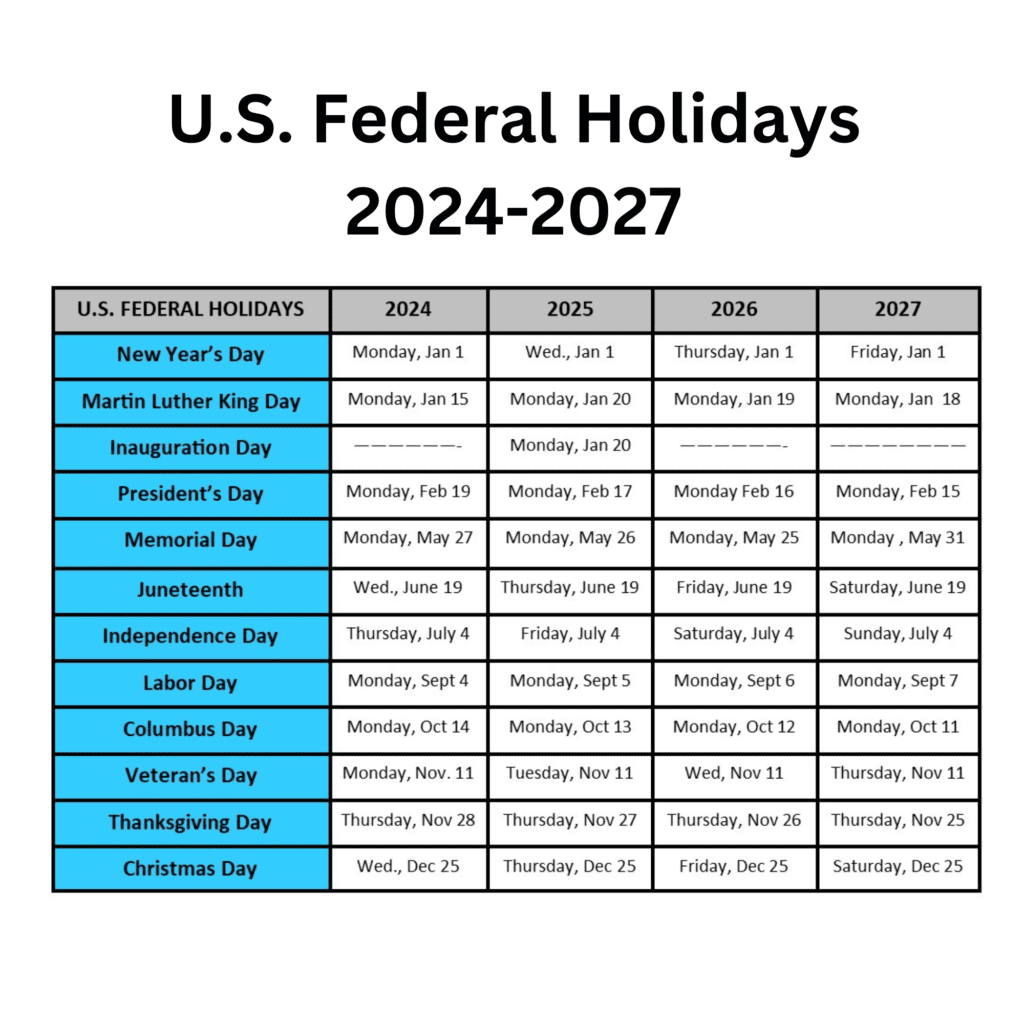

Us Holiday Calendar 2025 Complete Guide To Federal And Non Federal Holidays

Apr 23, 2025

Us Holiday Calendar 2025 Complete Guide To Federal And Non Federal Holidays

Apr 23, 2025 -

Mahmoud Khalils Wife Gives Birth As Ice Blocks Fathers Visit

Apr 23, 2025

Mahmoud Khalils Wife Gives Birth As Ice Blocks Fathers Visit

Apr 23, 2025