Analyzing Warren Buffett's Apple Exit: Implications For Investors

Table of Contents

The Rationale Behind Berkshire Hathaway's Reduced Apple Stake

Berkshire Hathaway's decision to trim its Apple stake was a significant event, prompting much speculation. Several factors could have contributed to this decision:

-

Market Timing: One possibility is that Buffett believed Apple's stock was overvalued. After years of phenomenal growth, Apple's stock price reached unprecedented levels, potentially exceeding even Buffett's famously conservative valuation metrics. He might have viewed this as an opportune time to secure profits and reduce exposure to potential market corrections.

-

Portfolio Rebalancing: Berkshire Hathaway's vast portfolio encompasses numerous sectors. The sale of Apple shares might reflect a strategic decision to rebalance the portfolio, shifting funds to other promising sectors or opportunities that Buffett and his team deemed more attractive. This is a common practice in portfolio management to mitigate risk and optimize returns.

-

Shifting Investment Strategy: Buffett's age and the succession planning at Berkshire Hathaway might also be contributing factors. A potential shift in investment philosophy or a transition in leadership could influence investment strategies, resulting in the decision to reduce exposure to a single, albeit highly successful, holding.

-

Unexpected Economic Factors: Unforeseen economic headwinds, such as rising inflation, slowing economic growth, or geopolitical instability, could have prompted a reassessment of Apple's future prospects and a subsequent decision to reduce holdings.

Berkshire Hathaway's public statements regarding the sale have been limited, adding to the mystique surrounding the decision. However, the timing of the sale, relative to market conditions and Apple's performance, offers valuable insights into potential motivations.

Apple's Current Market Position and Future Prospects

Analyzing Apple's current standing is crucial to understanding the implications of Buffett's move. Apple maintains a dominant position in the smartphone market, with a loyal customer base and a robust ecosystem of products and services. However, challenges remain:

-

Increased Competition: Intense competition from companies like Samsung, Google, and emerging Chinese smartphone manufacturers poses a threat to Apple's market share.

-

Economic Slowdown: A global economic downturn could impact consumer spending, potentially reducing demand for Apple's premium-priced products.

-

Supply Chain Disruptions: Global supply chain issues continue to present risks to Apple's manufacturing and distribution capabilities.

Despite these challenges, Apple possesses significant growth opportunities:

-

New Products and Services: Apple continues to innovate, expanding into new product categories and service offerings (e.g., augmented reality, electric vehicles).

-

Expansion into New Markets: Growing markets in developing countries present significant opportunities for future growth.

The interplay of these factors—risks and opportunities—will significantly impact Apple's future performance and the overall valuation of its stock.

Implications for Individual Investors

Buffett's decision raises a crucial question for individual investors: should you follow suit and sell your Apple shares? The answer is not a simple yes or no. Buffett's actions should be seen as one data point in your own investment analysis, not as a definitive trading signal.

-

Don't blindly follow: Buffett's investment strategy, while remarkably successful, might not align perfectly with your individual risk tolerance, financial goals, or time horizon.

-

Portfolio Diversification: This event underscores the importance of portfolio diversification. Over-reliance on a single stock, regardless of its apparent success, can be risky.

-

Risk Management: Implement appropriate risk management strategies. Consider your investment goals and time horizon before making any decisions.

Lessons Learned from Warren Buffett's Apple Investment

Buffett's Apple investment provides valuable lessons for investors:

-

Thorough Due Diligence: Thoroughly research any investment before committing significant capital.

-

Long-Term Vision: Maintain a long-term perspective and avoid short-term market fluctuations.

-

Market Cycle Understanding: Recognize that market cycles exist and that even the most successful investments can experience periods of decline.

-

Adaptability: Be prepared to adapt your investment strategies as market conditions change.

Conclusion: Navigating the Post-Buffett Apple Landscape

Berkshire Hathaway's reduced stake in Apple highlights the dynamic nature of the stock market and the importance of continuous monitoring and reassessment of investments. While several factors might have contributed to this decision, including potential overvaluation, portfolio rebalancing, and shifts in investment strategy, investors should not interpret this as a sell signal for Apple without conducting their own due diligence. The decision to hold, buy, or sell Apple stock ultimately depends on your personal risk tolerance, investment goals, and an independent assessment of Apple's future prospects. Conduct your own thorough research on Warren Buffett's Apple exit, understand Berkshire Hathaway's investment philosophy, and analyze Apple's long-term prospects before making any investment decisions. Remember that responsible investing involves understanding your own financial situation and making informed decisions based on your individual circumstances.

Featured Posts

-

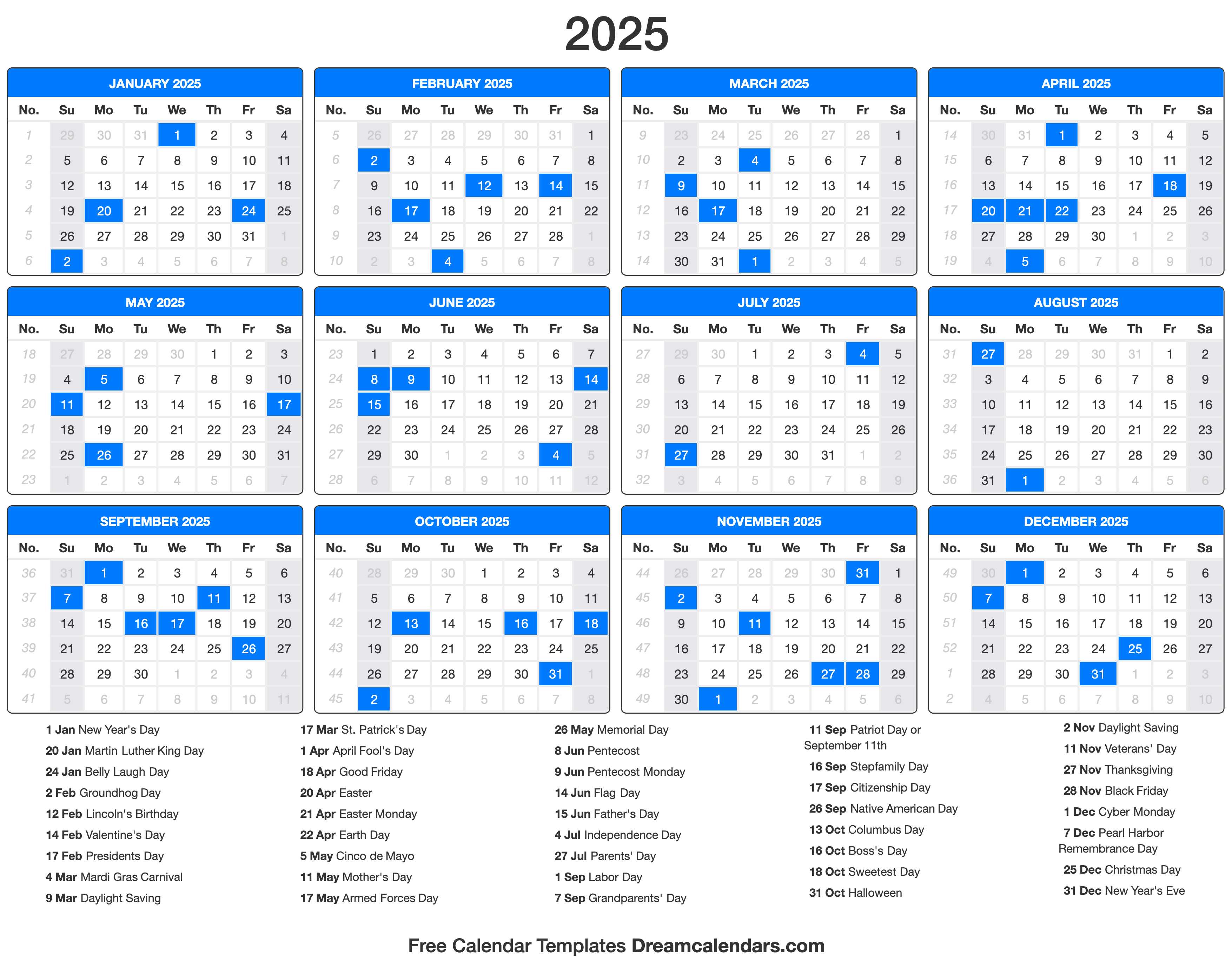

2025 Holiday Calendar All Us Federal And State Holidays

Apr 23, 2025

2025 Holiday Calendar All Us Federal And State Holidays

Apr 23, 2025 -

Podcast Creation Revolutionized Ai And The Power Of Scatological Data

Apr 23, 2025

Podcast Creation Revolutionized Ai And The Power Of Scatological Data

Apr 23, 2025 -

Amandine Gerard Je T Aime Moi Non Plus Analyse Des Relations Europe Marches

Apr 23, 2025

Amandine Gerard Je T Aime Moi Non Plus Analyse Des Relations Europe Marches

Apr 23, 2025 -

Le Sans Alcool Une Alternative Saine Et Economique Inspiree Du Dry January Et De La Tournee Minerale

Apr 23, 2025

Le Sans Alcool Une Alternative Saine Et Economique Inspiree Du Dry January Et De La Tournee Minerale

Apr 23, 2025 -

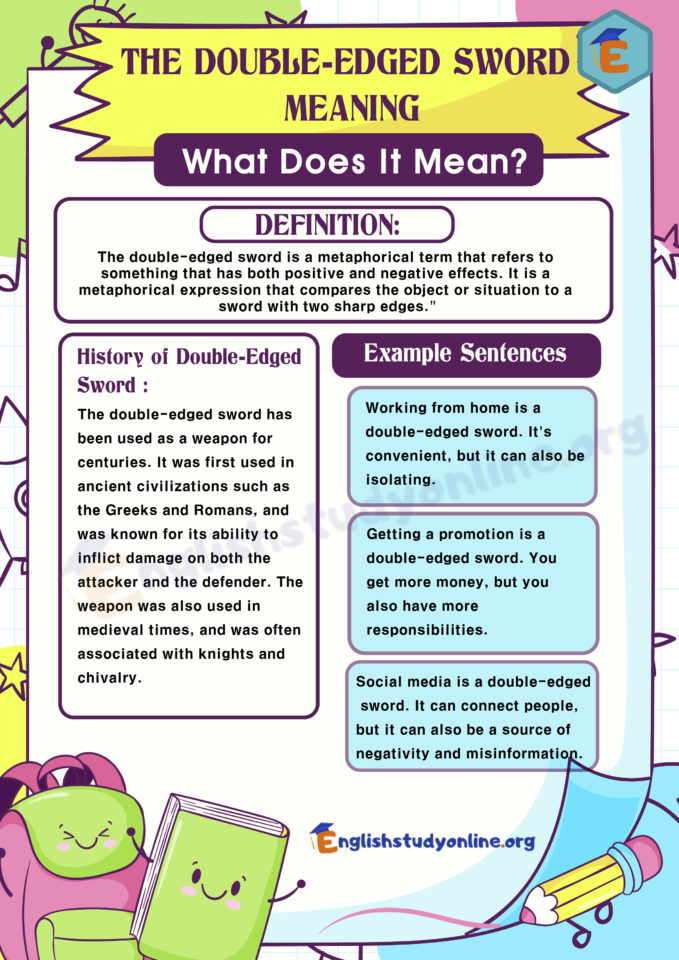

How Ai Is Reshaping Wildlife Conservation A Double Edged Sword

Apr 23, 2025

How Ai Is Reshaping Wildlife Conservation A Double Edged Sword

Apr 23, 2025