BofA Says: Don't Worry About Stretched Stock Market Valuations

Table of Contents

BofA's Rationale for Dismissing Valuation Concerns

BofA's analysis suggests that current stretched valuations are not necessarily a cause for immediate alarm. Their argument rests on several key pillars, incorporating various stock valuation metrics and an assessment of the broader economic landscape.

-

Strong Corporate Earnings Growth Projections: BofA's argument centers on the expectation of robust corporate earnings growth in the coming years. This projected growth, they contend, justifies the current elevated price-to-earnings (P/E) and price-to-sales (P/S) ratios. The bank likely factored in industry-specific growth forecasts and macroeconomic trends to arrive at these projections. Companies demonstrating strong innovation and efficient operations are particularly highlighted as key drivers of this growth.

-

Interest Rate Hikes and Valuation Impact: BofA's analysis likely factored in the potential impact of future interest rate hikes by the Federal Reserve. While higher interest rates typically increase borrowing costs for companies and can dampen economic growth, potentially affecting stock valuations, BofA might argue that the anticipated rate hikes are already priced into the market. Furthermore, they may contend that the positive effects of controlled inflation outweigh the negative effects of slightly higher rates.

-

Inflation and Stock Valuations: The relationship between inflation and stock valuations is complex. While high and uncontrolled inflation can erode purchasing power and negatively impact corporate profits, leading to market corrections, BofA's assessment probably considers the current inflation rate to be manageable. They might argue that the current levels of inflation are anticipated and already factored into market prices, or that the benefits of economic growth and corporate earnings outweigh the inflationary pressures.

-

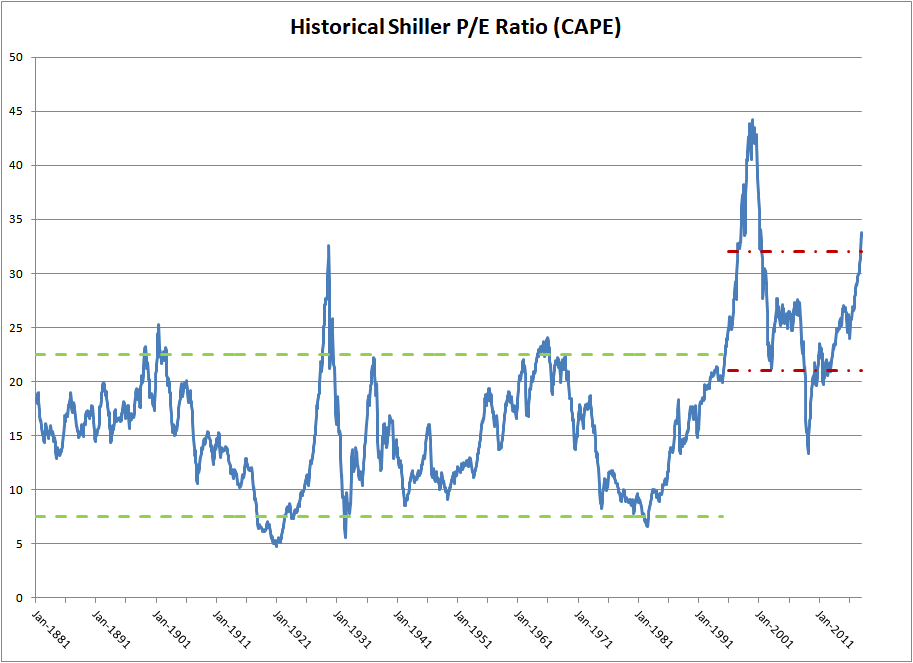

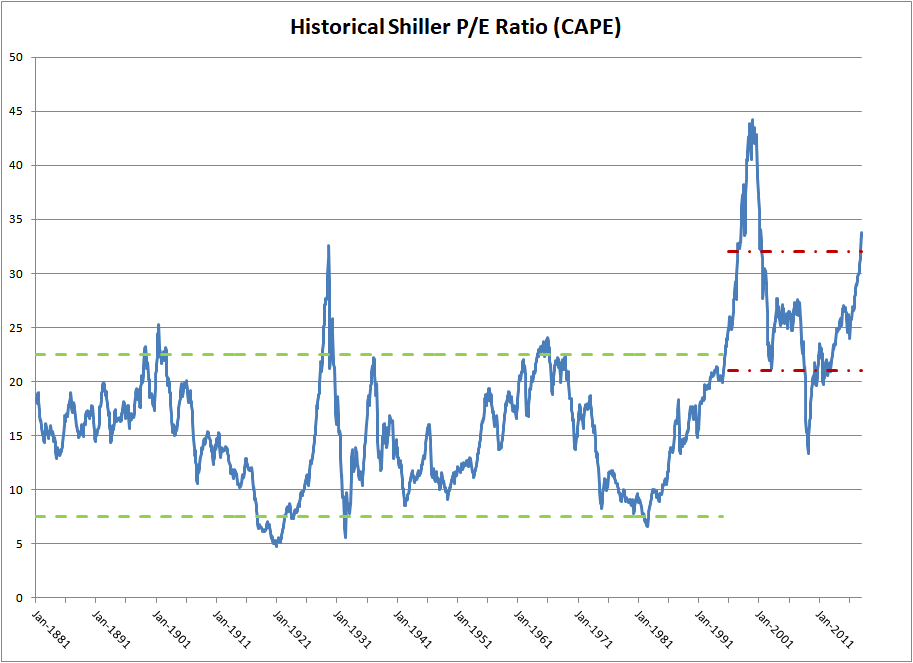

Valuation Metrics and Interpretation: BofA likely employed various valuation metrics, including the P/E ratio, P/S ratio, and potentially others like PEG ratio (Price/Earnings to Growth ratio) and dividend yield, to assess the market's overall valuation. Their interpretation of these metrics, in light of projected earnings growth and inflation, likely informs their less-pessimistic outlook.

-

Limitations and Counterarguments: It's important to acknowledge that BofA's analysis, like any market forecast, has limitations. Unforeseen economic shocks, geopolitical events, or changes in investor sentiment could easily impact the market, irrespective of strong earnings projections.

Counterarguments and Potential Risks

While BofA presents a relatively optimistic view, it's crucial to consider counterarguments and potential risks.

-

Market Correction Potential: Even with strong earnings growth, a market correction remains a possibility. Overvalued sectors might experience significant price drops, and investor sentiment can shift rapidly, triggering a sell-off regardless of fundamental valuations.

-

Recession Risk and Geopolitical Uncertainty: The risk of a recession, fueled by persistent inflation or geopolitical instability (like the ongoing war in Ukraine or tensions with China), could significantly impact corporate earnings and stock prices, undermining BofA's positive outlook. These external factors are often difficult to predict and can dramatically influence market trends.

-

Inflation Risk: While BofA may consider current inflation levels manageable, unexpected surges in inflation could significantly alter the economic landscape and negatively impact stock valuations. Uncontrolled inflation erodes purchasing power and can lead to significant market volatility.

-

Valuation Bubble Concerns: Some analysts argue that the current valuations reflect a speculative bubble, where prices are detached from underlying fundamentals. This suggests a potential for a sharp correction once investor confidence wanes.

-

Investment Risks: Investing in a seemingly overvalued market inherently carries significant risk. The potential for losses is higher than in a more moderately valued market, and investors need to carefully assess their risk tolerance. Alternative strategies like focusing on undervalued companies or diversifying into less market-sensitive assets could be considered.

BofA's Investment Recommendations (if any)

While this article does not detail specific BofA investment recommendations, based on their analysis, the bank likely advocates for a long-term investment strategy. This would likely involve focusing on companies with strong earnings growth potential and diversification across different sectors and asset classes. Risk management is paramount. They may suggest a focus on sectors less sensitive to macroeconomic fluctuations, or emphasize the importance of a well-diversified portfolio to mitigate potential losses.

Conclusion

BofA's assessment of current stock market valuations offers a relatively reassuring perspective, emphasizing strong corporate earnings growth projections and a considered view of inflation's impact. However, it's crucial to acknowledge the counterarguments and potential risks inherent in a seemingly overvalued market. Factors like recession risk, geopolitical uncertainty, and the possibility of a valuation bubble must be carefully considered. While BofA's analysis provides valuable insight, it shouldn't be the sole basis for investment decisions. Conduct thorough due diligence, assess your risk tolerance, diversify your portfolio, and consider seeking professional financial advice before making any investment decisions related to stock market valuations. Remember to research BofA's full report on stock market valuations for a deeper understanding and a more comprehensive picture before formulating your investment strategy.

Featured Posts

-

Will Liam Survive His Collapse On The Bold And The Beautiful

Apr 24, 2025

Will Liam Survive His Collapse On The Bold And The Beautiful

Apr 24, 2025 -

Securing Funding For Elite Universities In A Changing Political Landscape

Apr 24, 2025

Securing Funding For Elite Universities In A Changing Political Landscape

Apr 24, 2025 -

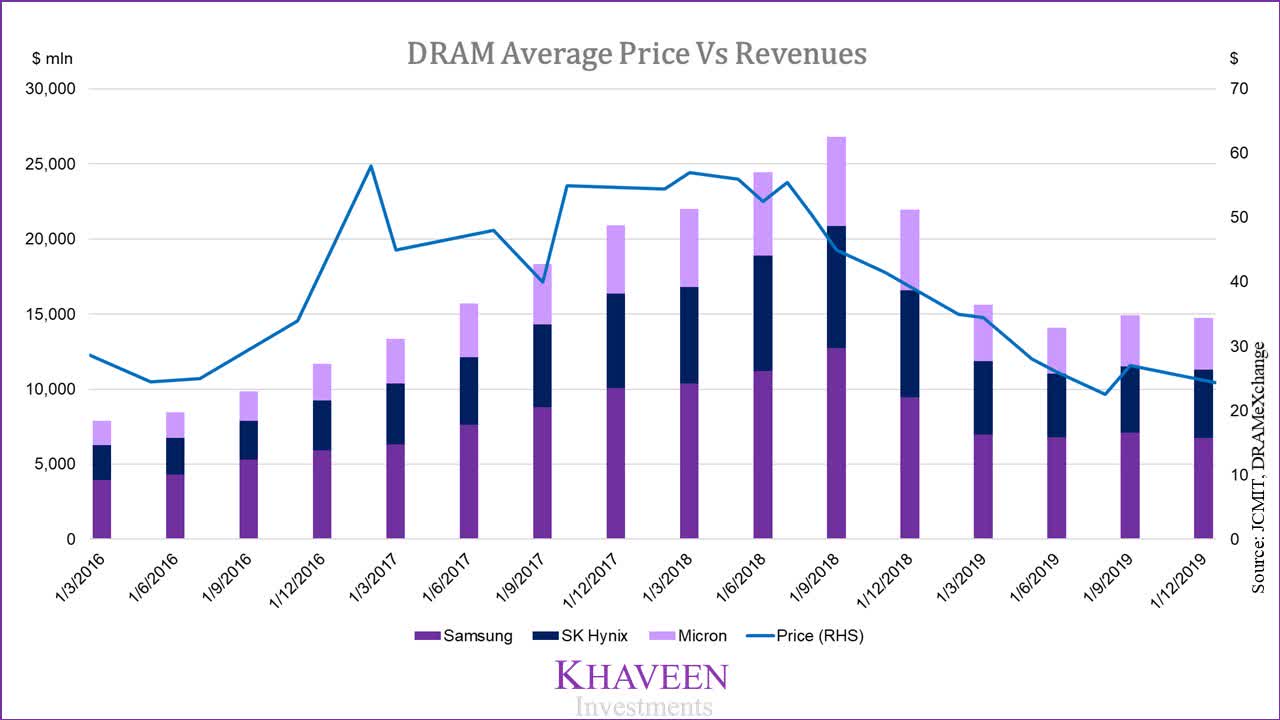

Sk Hynix Overtakes Samsung In Dram Market Ais Role

Apr 24, 2025

Sk Hynix Overtakes Samsung In Dram Market Ais Role

Apr 24, 2025 -

Teslas Q1 Earnings Decline Musks Political Involvement Takes A Toll

Apr 24, 2025

Teslas Q1 Earnings Decline Musks Political Involvement Takes A Toll

Apr 24, 2025 -

Elite Universities Under Trump Administration Scrutiny A Funding Fight

Apr 24, 2025

Elite Universities Under Trump Administration Scrutiny A Funding Fight

Apr 24, 2025