Tesla Q1 2024 Earnings: Net Income Down 71% Amidst Political Headwinds

Table of Contents

Significant Decline in Net Income: A Deep Dive into the Numbers

Tesla's Q1 2024 earnings report painted a stark picture. The company reported a net income of [Insert Actual Figure from Report], a dramatic 71% decrease compared to the [Insert Figure] reported in Q1 2023. This translates to an earnings per share (EPS) of [Insert Actual EPS Figure], significantly lower than the [Insert Figure] in Q1 2023. Revenue, while still substantial at [Insert Actual Revenue Figure], also showed a [Percentage Change]% decrease compared to the previous year's Q1.

This significant drop can be attributed to a confluence of factors:

-

Reduced Vehicle Sales: Tesla's vehicle deliveries in Q1 2024 were [Insert Actual Delivery Figures] units, representing a [Percentage Change]% decrease compared to Q1 2023. This decline can be linked to increased competition and the impact of price cuts.

-

Increased Production Costs: Rising raw material prices and supply chain disruptions contributed to higher production costs, squeezing profit margins. Specific increases in the cost of [mention specific materials, e.g., battery components, steel] impacted the bottom line.

-

Aggressive Pricing Strategies: While aimed at boosting sales volume, Tesla's price cuts, triggered in part by intensifying competition, significantly reduced the profit margin on each vehicle sold.

<br>

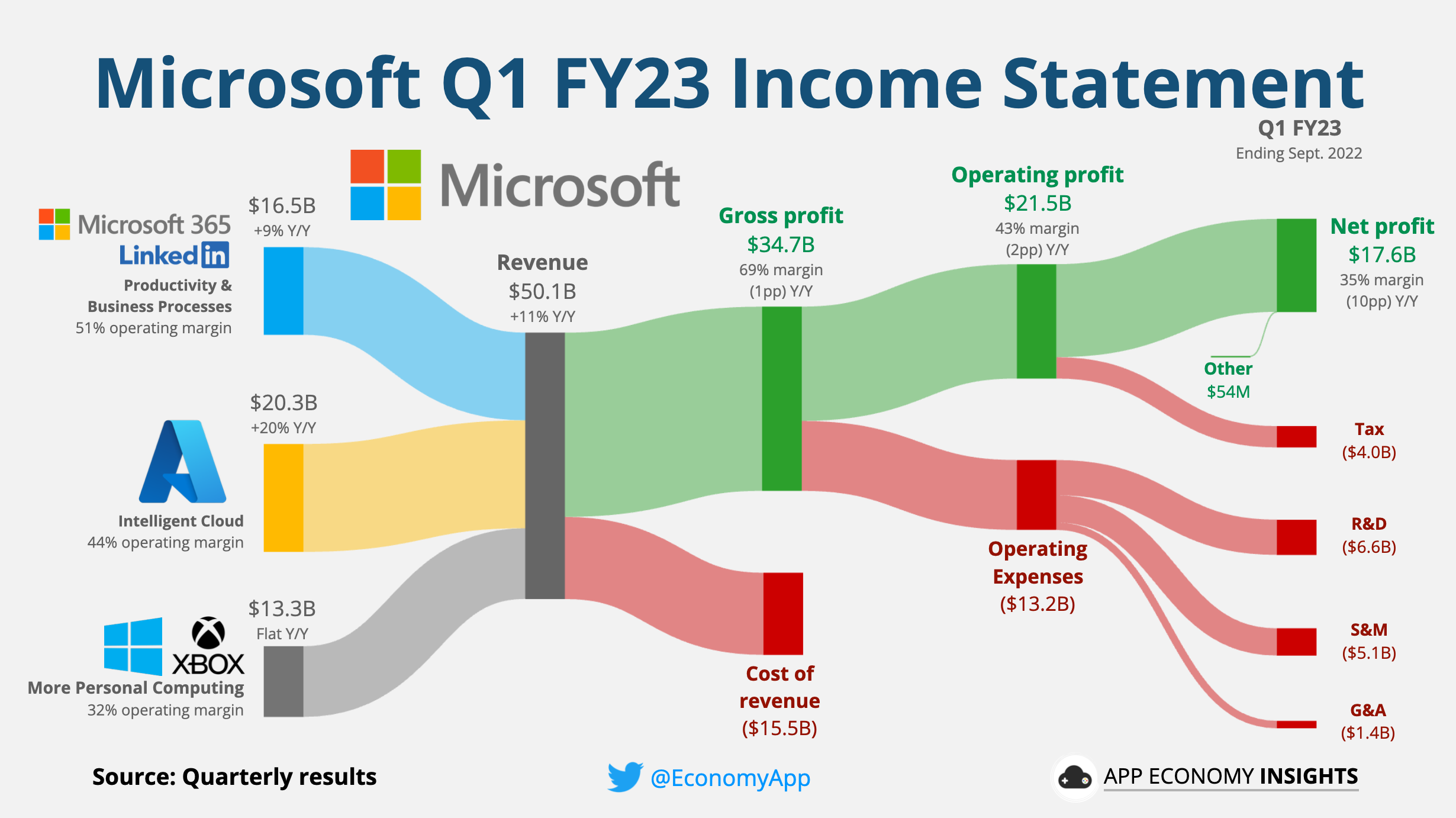

(Insert a chart or graph visually representing the key financial figures: net income, revenue, and EPS for Q1 2024 compared to Q1 2023 and previous quarters.)

Impact of Price Wars and Increased Competition in the EV Market

The EV market is rapidly evolving, characterized by increasing competition and aggressive pricing strategies. Tesla, once the dominant player, now faces stiff competition from established automakers like Ford and GM, as well as emerging Chinese EV manufacturers such as BYD and Nio.

-

Key Competitors and Their Strategies: Competitors are aggressively expanding their EV offerings, often employing strategies that directly challenge Tesla's market position. [Mention specific examples of competitor strategies and their impact on the market].

-

Analysis of Pricing Strategies and Their Impact: The price wars initiated by Tesla and subsequently matched by competitors have significantly impacted profitability across the board. While increasing sales volumes in the short term, the strategy has also compressed profit margins.

-

Discussion of Market Share Changes: Tesla's market share in the EV sector has [Increased/Decreased/Remained Stable] in Q1 2024, reflecting the intensified competitive landscape. [Include data on market share changes if available].

Political Headwinds and Regulatory Challenges Facing Tesla

Tesla's Q1 2024 performance was also affected by several political and regulatory challenges:

-

Specific Examples of Political Headwinds: [Mention specific examples, such as trade disputes affecting supply chains, new environmental regulations impacting production costs, or geopolitical instability impacting sales in certain regions].

-

Impact on Supply Chains, Production, and Sales: These political factors have created disruptions to Tesla's supply chains, impacting production timelines and potentially affecting sales figures.

-

Potential Future Implications for Tesla: The ongoing political and regulatory uncertainties pose significant risks to Tesla's long-term growth and profitability. These challenges require careful navigation and proactive adaptation by the company.

Investor Reaction and Future Outlook for Tesla Stock

The release of the Q1 2024 earnings report triggered a significant [Increase/Decrease] in Tesla's stock price. [Insert data on stock price fluctuations]. Analyst opinions are divided, with some expressing concern over the declining profitability, while others remain optimistic about Tesla's long-term prospects.

-

Stock Price Fluctuations after the Earnings Release: [Detail the immediate and subsequent stock price movements after the earnings announcement].

-

Analyst Ratings and Predictions: [Summarize the range of analyst predictions and ratings for Tesla stock].

-

Potential Scenarios for Tesla's Future Growth: [Discuss various scenarios for Tesla's future growth, considering factors like innovation, market expansion, and overcoming the challenges discussed above].

Navigating the Storm: Tesla's Path Forward After Q1 2024 Earnings

Tesla's Q1 2024 earnings revealed a challenging operating environment marked by a significant drop in net income, intensified competition, and substantial political headwinds. The company faces critical challenges in navigating the price wars, maintaining profitability, and adapting to the ever-evolving regulatory landscape. However, Tesla's history of innovation and its strong brand recognition offer potential avenues for future growth and recovery. To stay informed about Tesla's performance and the evolving EV market, subscribe to our newsletter and follow us for updates on future Tesla earnings reports and Tesla stock performance. Understanding the impact of political headwinds on Tesla and the broader electric vehicle market is crucial for informed investment decisions.

Featured Posts

-

Teslas Q1 Earnings Report 71 Drop In Net Income Due To Political Backlash

Apr 24, 2025

Teslas Q1 Earnings Report 71 Drop In Net Income Due To Political Backlash

Apr 24, 2025 -

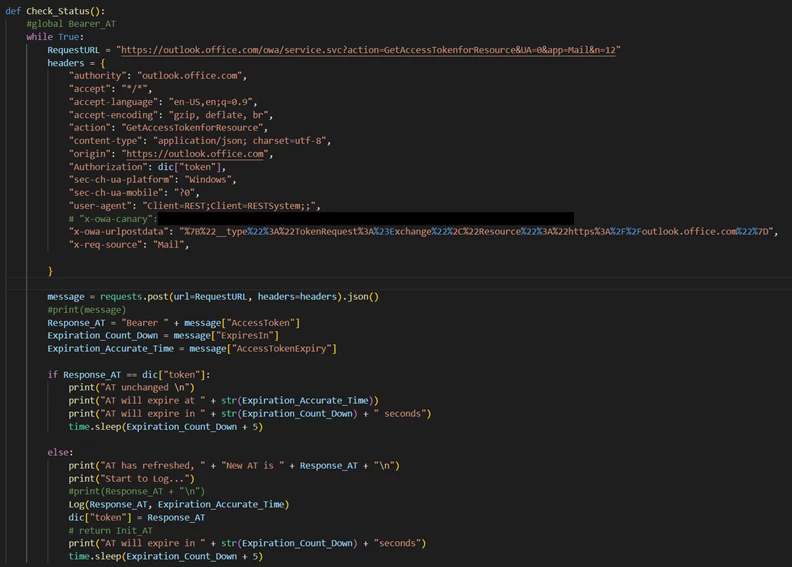

Cybercriminal Accused Of Millions In Office365 Executive Email Account Breaches

Apr 24, 2025

Cybercriminal Accused Of Millions In Office365 Executive Email Account Breaches

Apr 24, 2025 -

Saving Money On Mobile Google Fis 35 Unlimited Option

Apr 24, 2025

Saving Money On Mobile Google Fis 35 Unlimited Option

Apr 24, 2025 -

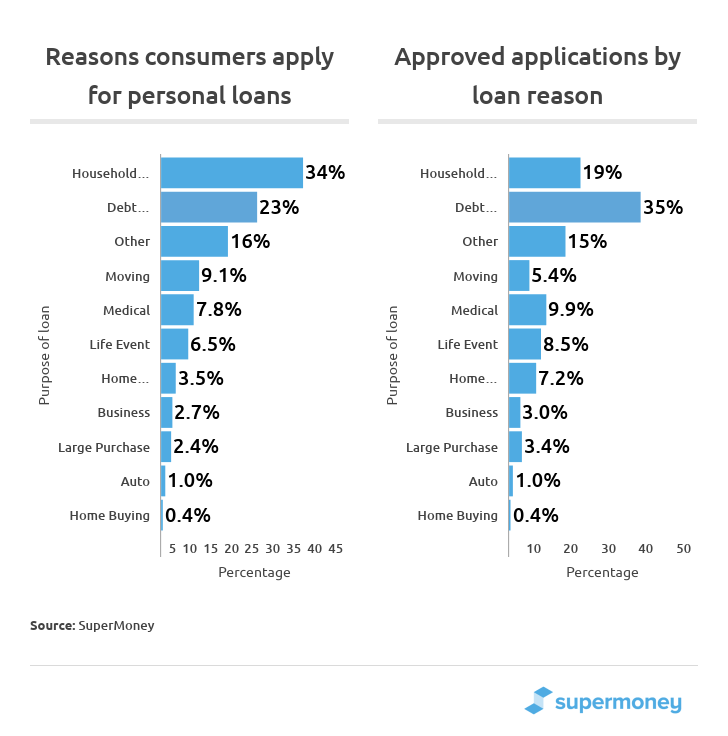

Credit Card Industry Faces Headwinds As Consumer Spending Slows

Apr 24, 2025

Credit Card Industry Faces Headwinds As Consumer Spending Slows

Apr 24, 2025 -

Restoring Fiscal Responsibility In Canada An Alternative Economic Vision

Apr 24, 2025

Restoring Fiscal Responsibility In Canada An Alternative Economic Vision

Apr 24, 2025