Credit Card Industry Faces Headwinds As Consumer Spending Slows

Table of Contents

Decreased Consumer Spending and its Impact on Credit Card Usage

Falling consumer spending is a major factor impacting credit card usage. Several economic indicators point to a reduction in discretionary spending, creating significant headwinds for the credit card industry.

- Falling retail sales: Recent data shows a decline in retail sales, indicating reduced consumer confidence and a pullback in non-essential purchases. This directly translates to lower credit card transaction volumes.

- Inflation erodes purchasing power: Soaring inflation significantly reduces the purchasing power of consumers. With essential expenses like groceries and energy consuming a larger portion of disposable income, less money is available for non-essential items typically purchased using credit cards.

- Higher interest rates increase borrowing costs: The Federal Reserve's efforts to combat inflation through interest rate hikes have made borrowing more expensive. Higher interest rates on credit cards discourage consumers from using them for non-essential purchases, opting instead to save or pay cash.

- Increased savings rates: Consumers are increasingly prioritizing saving, reflecting a cautious approach to spending in uncertain economic times. This shift away from spending impacts credit card usage and transaction volumes.

Analyzing recent retail sales data from sources like the U.S. Census Bureau and consumer confidence indices from organizations like the Conference Board provides a clearer picture of the decrease in spending and its direct correlation with credit card usage. The decrease in consumer confidence directly impacts credit card spending.

Rising Interest Rates and Increased Credit Card Debt

The increase in interest rates is another significant headwind. Higher interest rates directly impact credit card debt levels and consumer financial health.

- Increased debt servicing costs: Higher interest rates on credit cards lead to significantly increased debt servicing costs for consumers. This makes it harder to manage existing balances and can lead to a vicious cycle of debt.

- Difficulty making minimum payments: Many consumers struggle to meet even minimum payments on their credit cards, resulting in increased delinquency and default rates.

- Reduced profitability for credit card companies: Higher default rates translate to reduced profitability for credit card companies, impacting their financial performance and shareholder returns.

- Burdened consumers: Consumers are increasingly burdened by high-interest debt, negatively impacting their overall financial health and potentially hindering future economic growth.

The current interest rate environment, with higher APRs on credit cards, is exacerbating this issue. Statistics on credit card debt levels and default rates from organizations like the Federal Reserve and credit bureaus paint a concerning picture of the financial strain on consumers.

The Impact on Credit Card Companies and Their Strategies

Credit card companies are actively responding to these headwinds, adapting their strategies to navigate the challenging economic climate.

- Tightening lending standards: To mitigate risk, credit card companies are tightening their lending standards, becoming more selective in approving new applications. This reduces potential losses from defaults.

- Shifting marketing strategies: Marketing strategies are shifting towards promoting responsible borrowing and financial literacy, emphasizing the importance of managing credit card debt.

- Increased focus on risk management: Credit card companies are enhancing their risk management and fraud prevention measures to minimize losses and protect their financial stability.

- Potential for decreased profitability: The combination of reduced spending, increased defaults, and tighter lending standards could lead to decreased profitability and shareholder returns for credit card companies in the short term.

Examining the financial performance reports of major credit card companies like Visa, Mastercard, and American Express provides insights into their strategies for navigating this economic downturn. Their responses will significantly shape the future of the credit card industry.

Potential for Increased Competition and Innovation

The changing economic landscape is also fostering increased competition and innovation within the financial services sector.

- Competition from fintech companies: Fintech companies are offering alternative lending solutions and digital payment options, posing a significant challenge to traditional credit card companies.

- Growth of Buy Now, Pay Later (BNPL) services: BNPL services provide consumers with alternative payment options, further fragmenting the credit card market.

- Innovation in digital payment technologies: Innovation in digital payment technologies, such as mobile wallets and peer-to-peer payment systems, continues to reshape the credit card landscape.

The emergence of fintech companies and their disruptive technologies will significantly impact the future competitiveness of traditional credit card companies. This competition will likely drive innovation and potentially offer consumers more choices and flexibility.

Conclusion

The credit card industry is undeniably facing significant headwinds as consumer spending slows due to inflation and rising interest rates. Decreased consumer spending, coupled with higher interest rates, is leading to increased credit card debt and potential financial strain for both consumers and credit card companies. Credit card companies are responding by adapting their strategies, tightening lending, and focusing on risk management. However, the increasing competition from innovative fintech companies presents both challenges and opportunities.

Call to Action: Understanding the current challenges facing the credit card industry is crucial for both consumers and businesses. Stay informed about the latest trends in consumer spending and the credit card industry to make informed financial decisions. Regularly assess your personal credit card usage and debt levels to maintain a healthy financial outlook in this ever-evolving economic climate. Careful management of your credit card debt is essential in this challenging environment for the credit card industry.

Featured Posts

-

Eus Energy Strategy Addressing The Phaseout Of Russian Gas From The Spot Market

Apr 24, 2025

Eus Energy Strategy Addressing The Phaseout Of Russian Gas From The Spot Market

Apr 24, 2025 -

California Gas Prices Governor Newsom Seeks Industry Collaboration To Ease Costs

Apr 24, 2025

California Gas Prices Governor Newsom Seeks Industry Collaboration To Ease Costs

Apr 24, 2025 -

My Experience With The Lg C3 77 Inch Oled Tv

Apr 24, 2025

My Experience With The Lg C3 77 Inch Oled Tv

Apr 24, 2025 -

Extreme Price Hike Broadcoms V Mware Proposal Sparks Outrage From At And T

Apr 24, 2025

Extreme Price Hike Broadcoms V Mware Proposal Sparks Outrage From At And T

Apr 24, 2025 -

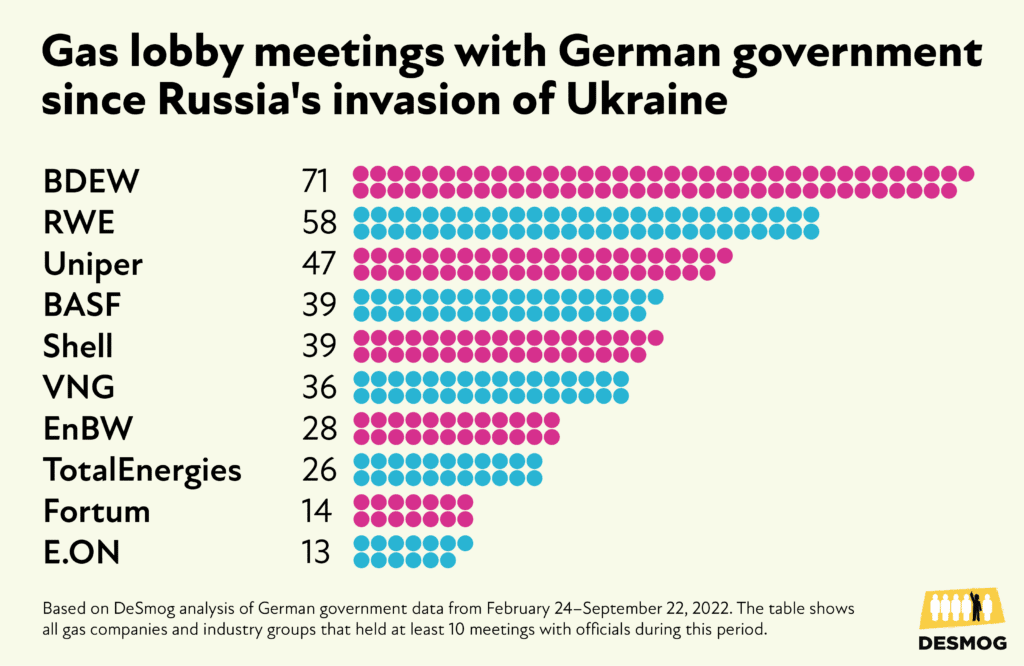

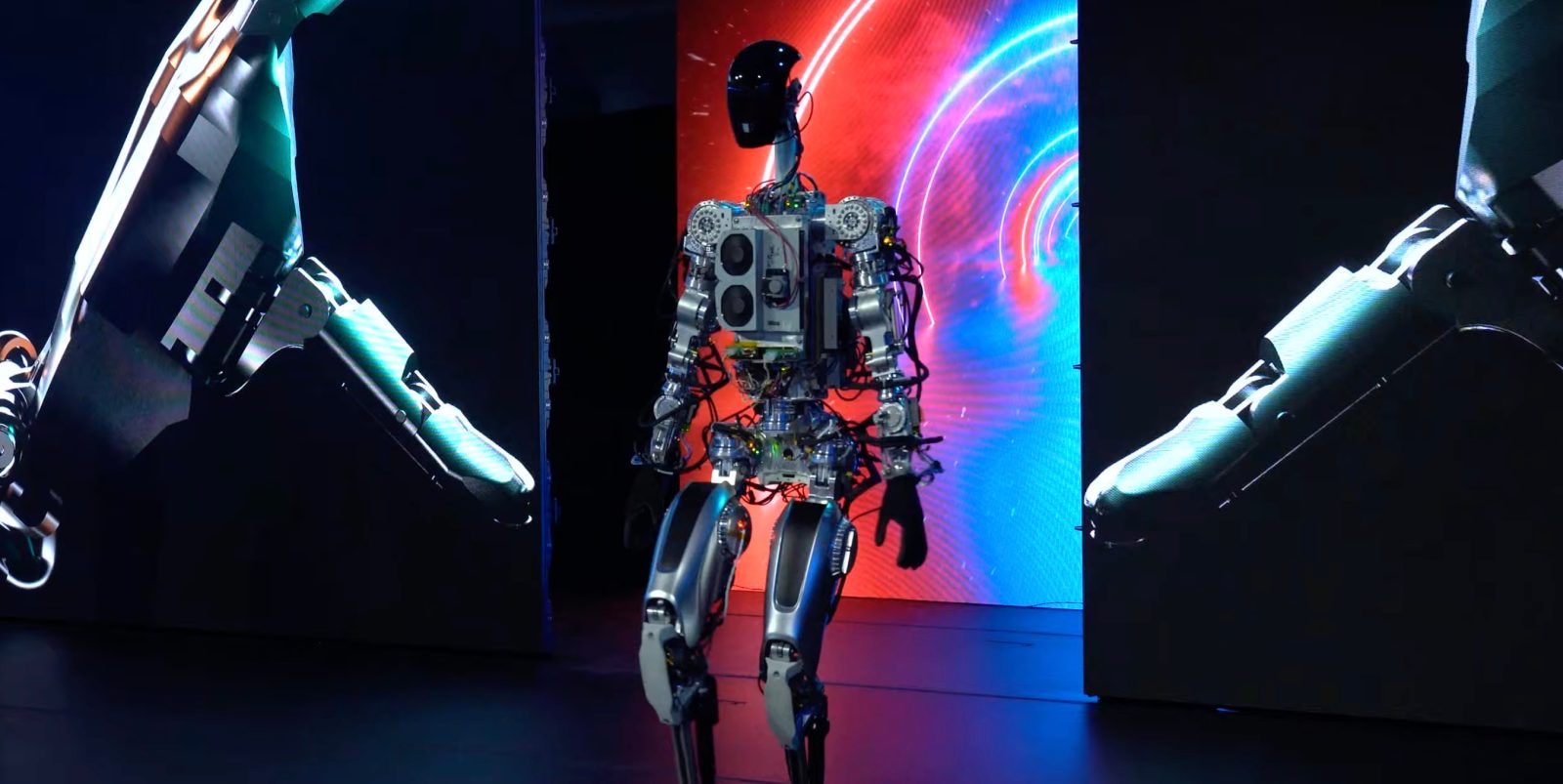

Teslas Optimus Robot Chinas Rare Earth Restrictions Cause Delays

Apr 24, 2025

Teslas Optimus Robot Chinas Rare Earth Restrictions Cause Delays

Apr 24, 2025