Tariff Hopes Boost Stock Market: Dow, Nasdaq, And S&P 500 Performance

Table of Contents

The Dow Jones Industrial Average's Response to Tariff Hopes

Analyzing Dow Performance

The Dow Jones Industrial Average experienced a notable increase following the positive tariff-related news. For instance, on [Insert Date], the Dow surged by [Insert Point Increase] points, representing a [Insert Percentage Change]% gain. This impressive rally was driven, in part, by the positive sentiment surrounding reduced trade tensions. Specific companies within the Dow that benefited significantly include [Insert Company 1] and [Insert Company 2], whose stock prices rose due to their [Explain Reason - e.g., reliance on international trade, exposure to specific affected sectors]. This demonstrates the direct correlation between reduced tariff uncertainty and increased market confidence, fueling significant stock market gains. Keywords like "Dow Jones," "market rally," "stock market gains," and "tariff reduction" highlight the direct impact of these developments.

Factors Contributing to Dow's Growth

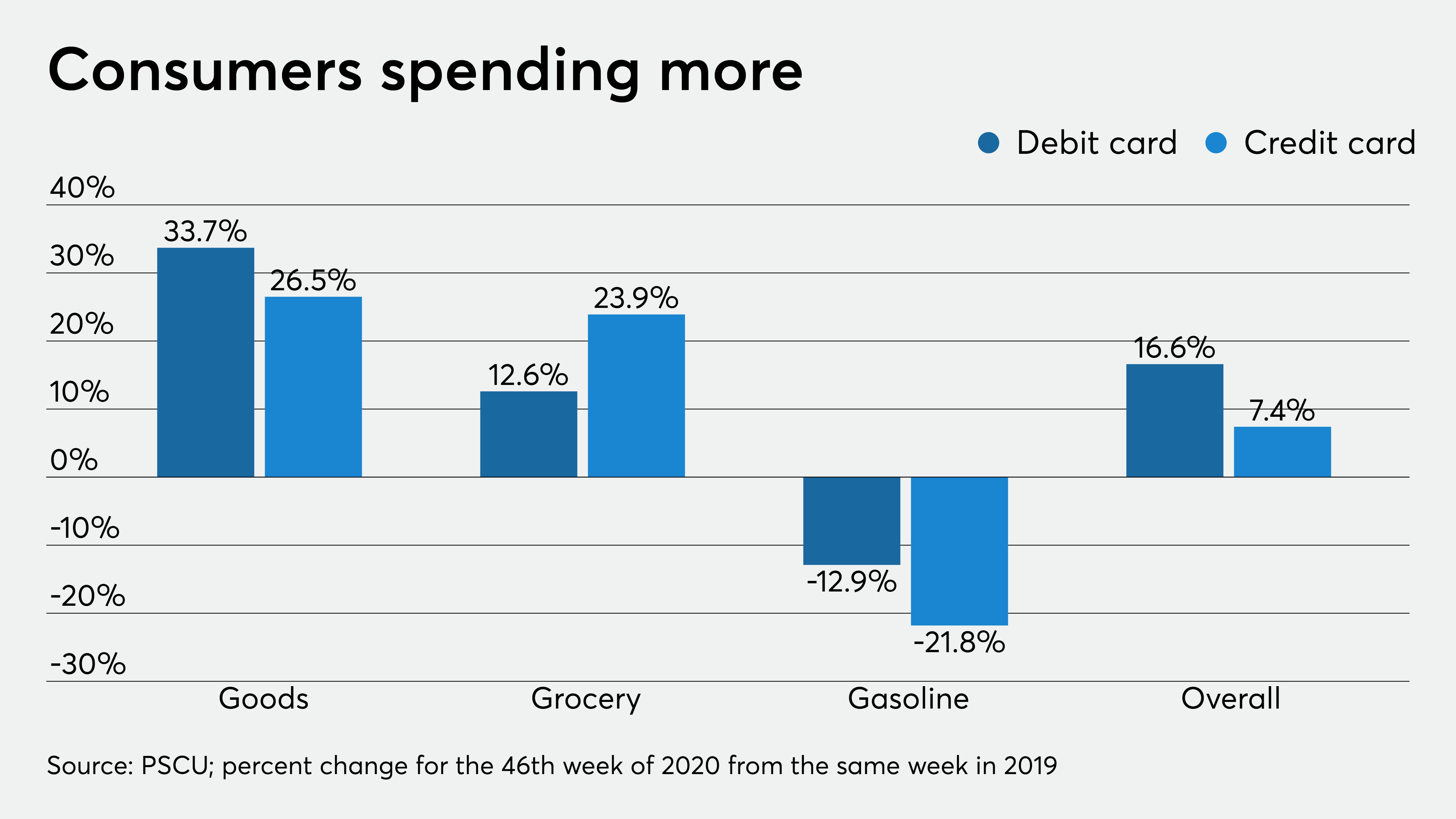

While tariff hopes were a primary driver, other factors contributed to the Dow's growth. Positive economic indicators like [Insert Economic Indicator, e.g., strong employment numbers, increased consumer spending] further boosted investor confidence. This positive economic outlook, coupled with reduced trade anxieties, created a perfect storm for market expansion.

- Stronger-than-expected economic data: Positive surprises in key economic indicators helped fuel investor optimism.

- Improved investor sentiment: Reduced uncertainty around trade policies led to increased confidence in the market.

- Lower market volatility: The reduction in trade tensions led to a calmer, more predictable market environment.

Nasdaq's Reaction to Shifting Tariff Policies

Nasdaq's Performance and Tariff News

The Nasdaq Composite, heavily weighted with technology companies, also reacted positively to the tariff news. The index saw a [Insert Percentage Increase]% increase on [Insert Date], with a significant increase in trading volume, reflecting heightened investor activity. Technology companies, often highly sensitive to global trade policies, benefitted greatly from the easing of trade tensions. The decreased uncertainty allowed investors to focus on the fundamentals of these companies, boosting their valuations. Keywords such as "Nasdaq Composite," "tech stocks," "trade war impact," and "global trade" illustrate the unique relationship between the tech sector and international trade dynamics.

Sector-Specific Analysis

Within the Nasdaq, certain sectors outperformed others. The [Insert Sector, e.g., software] sector experienced particularly strong gains, while [Insert Sector, e.g., semiconductor] companies also saw significant increases in their share prices. This sector-specific performance reflects the varying degrees to which different companies are affected by global trade.

- Software as a Service (SaaS) companies: These companies often operate globally and benefit from reduced trade barriers.

- E-commerce companies: Increased global trade can boost sales for companies operating in this sector.

- Hardware companies: These firms can benefit from reduced costs of imported components.

S&P 500's Performance in the Face of Tariff Uncertainty

S&P 500's Response to Tariff Hopes

The S&P 500, a broad market index representing 500 large-cap U.S. companies, mirrored the positive trend observed in the Dow and Nasdaq. The index saw a [Insert Percentage Change]% increase on [Insert Date], demonstrating the widespread impact of tariff hopes on the broader market. This increase signifies a positive market breadth, suggesting that the rally wasn't limited to a few specific sectors. Keywords like "S&P 500 Index," "broad market index," "market breadth," and "stock market trends" accurately reflect the performance and scope of the market movement.

Impact on Various Sectors

The impact of tariff hopes varied across different sectors within the S&P 500. While many sectors experienced gains, the magnitude of these gains differed significantly. For example, the [Insert Sector, e.g., manufacturing] sector, previously impacted by tariffs, showed particularly strong growth. Conversely, some sectors, such as [Insert Sector, e.g., certain consumer discretionary sectors], showed more moderate gains or even slight declines. This highlights the sector-specific nature of the impact of international trade on the overall market.

- Cyclicality: Sectors sensitive to economic cycles responded strongly to the positive news.

- International exposure: Companies with significant international operations benefited greatly from eased tensions.

- Domestic focus: Companies predominantly focused on the domestic market experienced more moderate growth.

Conclusion: Tariff Hopes and Future Stock Market Outlook

The recent positive developments regarding tariffs have had a demonstrably positive impact on the Dow, Nasdaq, and S&P 500, boosting investor confidence and driving significant market gains. While tariff hopes played a crucial role, other economic factors also contributed to this rally. The future performance of the stock market will, to a large extent, depend on the continuation of these positive trends and the overall economic outlook. Staying informed about tariff developments and their potential impact on various market sectors is essential for investors to formulate effective investment strategies. To stay updated on how tariff hopes boost the stock market and other market trends, continue to follow [Your Publication/Website Name] for insightful analysis and timely updates.

Featured Posts

-

The Impact Of Reduced Nonessential Spending On The Credit Card Industry

Apr 24, 2025

The Impact Of Reduced Nonessential Spending On The Credit Card Industry

Apr 24, 2025 -

Hisd Mariachi Headed To Uil State Competition After Viral Whataburger Video

Apr 24, 2025

Hisd Mariachi Headed To Uil State Competition After Viral Whataburger Video

Apr 24, 2025 -

Columbia Student Mahmoud Khalils Ice Deportation Case Denied Request To Attend Sons Birth

Apr 24, 2025

Columbia Student Mahmoud Khalils Ice Deportation Case Denied Request To Attend Sons Birth

Apr 24, 2025 -

Lg C3 77 Inch Oled Tv Is It Worth The Price

Apr 24, 2025

Lg C3 77 Inch Oled Tv Is It Worth The Price

Apr 24, 2025 -

Village Roadshows 417 5 Million Deal Approved Alcons Stalking Horse Bid Wins

Apr 24, 2025

Village Roadshows 417 5 Million Deal Approved Alcons Stalking Horse Bid Wins

Apr 24, 2025