The Impact Of Reduced Nonessential Spending On The Credit Card Industry

Table of Contents

Decreased Transaction Volumes and Revenue for Credit Card Companies

Reduced nonessential spending directly translates to fewer credit card transactions, significantly impacting credit card companies' bottom lines. This decrease manifests in several key areas:

- Lower merchant fees: Credit card companies earn a percentage of each transaction processed (merchant processing fees). Fewer transactions mean lower earnings from these fees. The impact is particularly felt in sectors heavily reliant on discretionary spending, such as travel, entertainment, and luxury retail. Credit card fees, in general, are taking a hit.

- Reduced interest income: Lower spending leads to lower outstanding balances on credit cards, directly impacting interest income, a crucial revenue stream for credit card issuers. Lower interest rates further compound this effect.

- Potential impact on credit card company profits and stock prices: The combined effect of reduced transaction volumes and interest income puts pressure on credit card companies' profitability, potentially leading to decreased stock prices and impacting investor confidence.

Shifting Consumer Spending Habits and Credit Card Usage

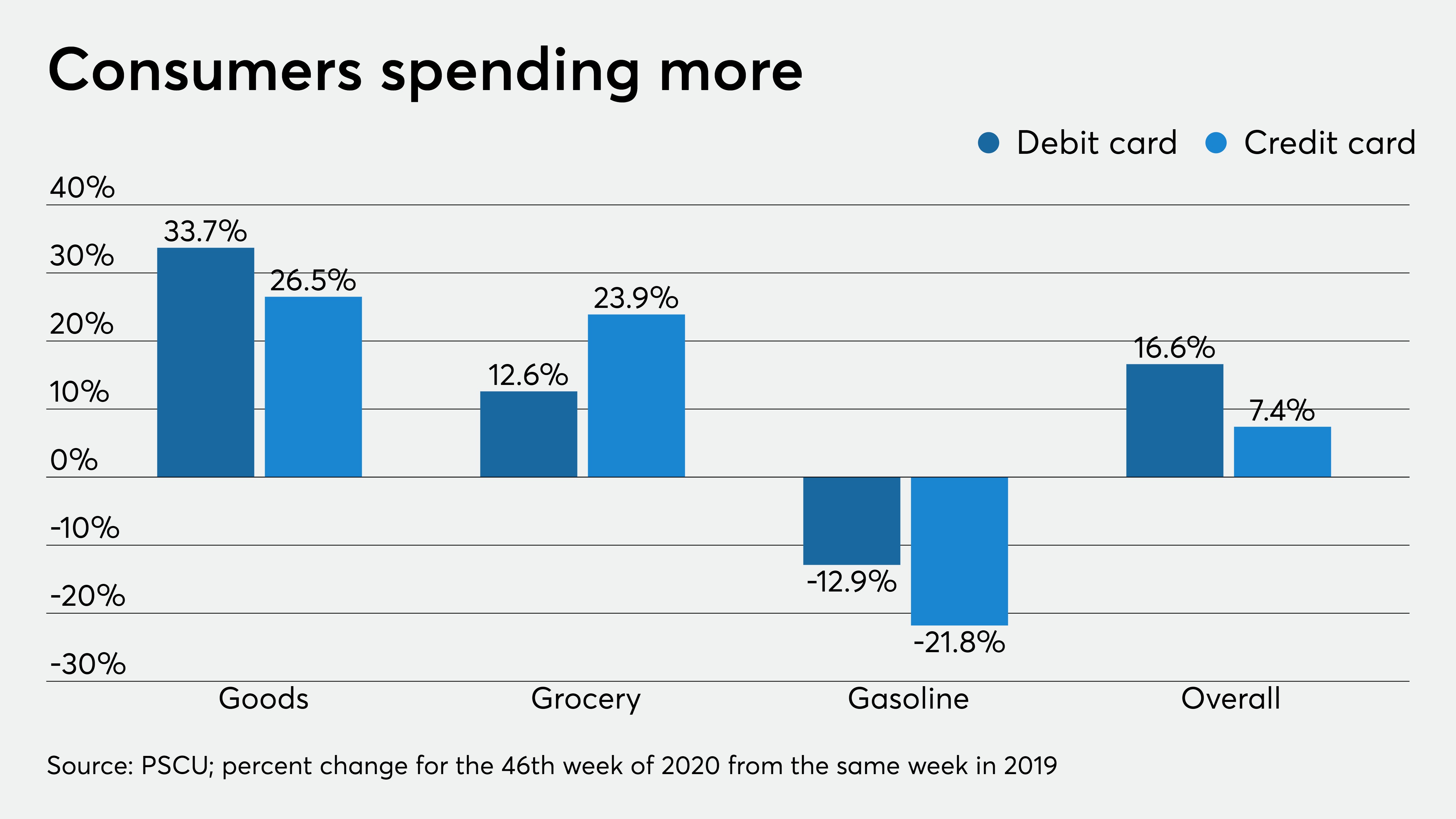

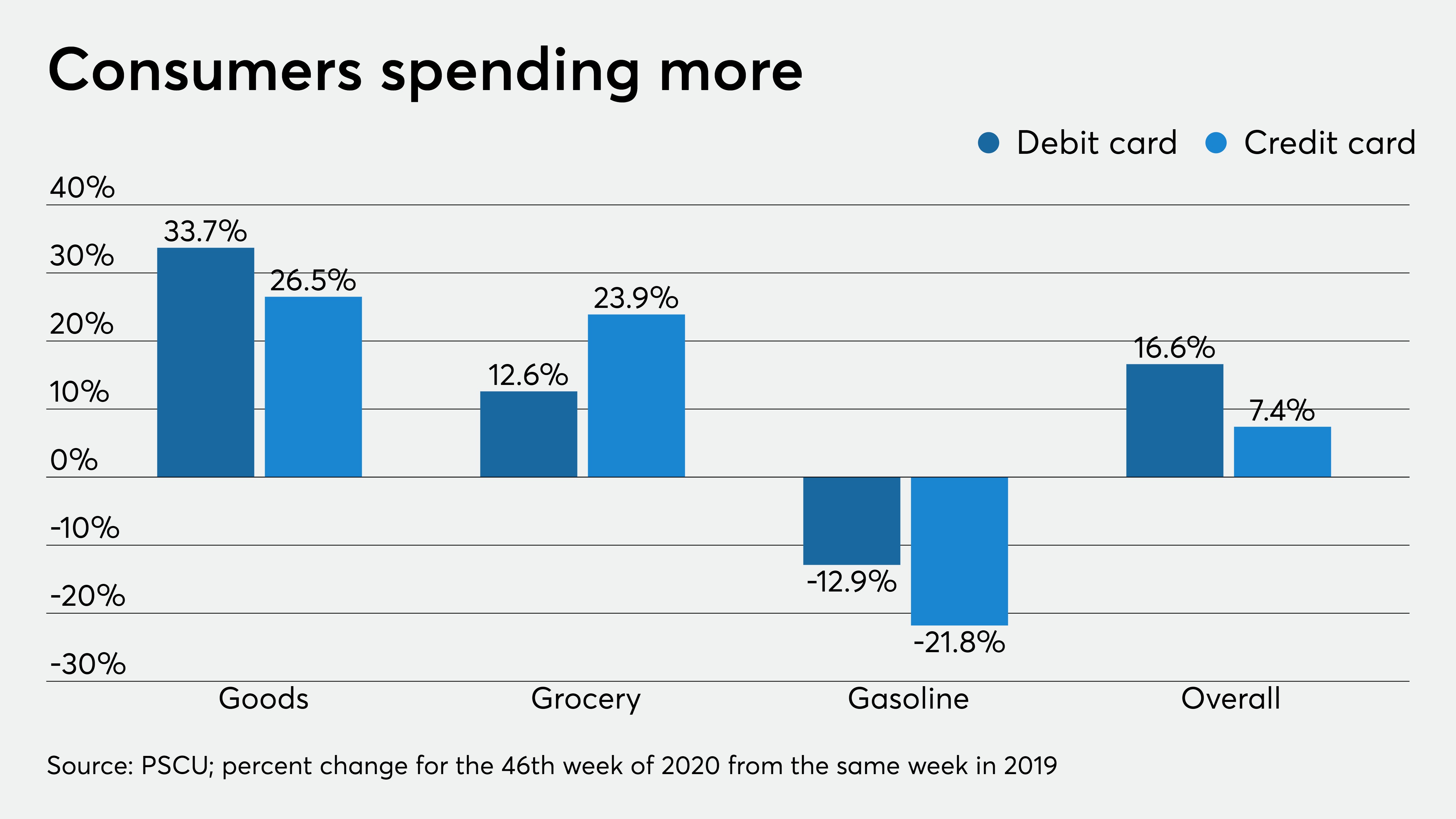

Economic uncertainty is forcing consumers to re-evaluate their spending habits. We're witnessing a significant shift in how people utilize credit and other payment methods:

- Increased focus on essential spending: Consumers are prioritizing essential expenses like groceries, utilities, and rent, leaving less room for nonessential purchases.

- Increased use of debit cards or cash: To minimize debt accumulation and manage budgets more effectively, many consumers are opting for debit cards or cash for everyday transactions. This directly reduces credit card transaction volumes.

- Potential increase in reliance on buy-now-pay-later (BNPL) services: While not directly related to traditional credit cards, the rise of BNPL services reflects a continued consumer desire for flexible payment options, potentially diverting spending away from credit cards. This change in consumer behavior is reshaping the financial landscape.

The Rise of "Conscious Spending" and its Influence

A growing trend of conscious consumerism is further impacting spending habits. Consumers are becoming more deliberate in their purchasing decisions:

- Increased awareness of personal finance and budgeting: Consumers are increasingly utilizing budgeting apps and financial literacy resources to track expenses and make informed spending choices.

- Growing preference for sustainable and ethical brands: Consumers are increasingly prioritizing brands that align with their values, often choosing sustainable and ethically produced goods over cheaper alternatives, impacting spending on luxury and discretionary items.

- Impact on luxury and discretionary spending: The shift towards conscious spending directly impacts spending on luxury goods and discretionary items, a significant segment for credit card companies.

Impact on Credit Card Debt and Default Rates

Reduced spending has a complex impact on credit card debt and default rates:

- Lower new debt accumulation: Reduced nonessential spending naturally leads to lower new debt accumulation.

- Potential increase in default rates: However, consumers facing financial hardship due to job losses or reduced income may struggle to manage existing credit card debt, potentially leading to an increase in default rates.

- Impact on credit scores and consumer creditworthiness: Defaults and late payments negatively impact credit scores, affecting consumers' ability to access credit in the future. Effective debt management strategies become crucial during times of economic uncertainty.

Strategies for Credit Card Companies to Adapt and Mitigate the Impact

Credit card companies are responding to the changing market by implementing various strategies:

- Offering more rewards and incentives: Companies are offering attractive rewards programs and cashback incentives to stimulate spending and retain customers.

- Developing new products and services: Credit card companies are developing new products and services tailored to evolving consumer needs, such as tailored rewards programs and flexible payment options. Financial innovation is key to navigating this challenging environment.

- Implementing stricter credit approval processes: To mitigate risks associated with potential increases in default rates, companies are implementing stricter credit approval processes. Robust risk management is crucial in this environment.

Conclusion: Navigating the Changing Landscape of the Credit Card Industry

Reduced nonessential spending has significantly impacted the credit card industry, leading to decreased transaction volumes, shifting consumer habits, and potential changes in debt and default rates. Credit card companies are adapting through innovative strategies, but the evolving financial landscape demands vigilance. Stay informed about the latest trends impacting the credit card industry and how reduced nonessential spending continues to reshape the financial sector. Learn more about the future of finance and credit card strategies at [link to related resource].

Featured Posts

-

My Experience With The Lg C3 77 Inch Oled Tv

Apr 24, 2025

My Experience With The Lg C3 77 Inch Oled Tv

Apr 24, 2025 -

Why The Popes Signet Ring Is Destroyed

Apr 24, 2025

Why The Popes Signet Ring Is Destroyed

Apr 24, 2025 -

Niftys Strong Performance Analyzing The Market Buzz In India

Apr 24, 2025

Niftys Strong Performance Analyzing The Market Buzz In India

Apr 24, 2025 -

Canadas Fiscal Future A Vision For Responsible Governance

Apr 24, 2025

Canadas Fiscal Future A Vision For Responsible Governance

Apr 24, 2025 -

Will Liam Survive His Collapse On The Bold And The Beautiful

Apr 24, 2025

Will Liam Survive His Collapse On The Bold And The Beautiful

Apr 24, 2025