Stock Market Live: Dow, Nasdaq, And S&P 500 Gains Explained

Table of Contents

Dow Jones Industrial Average Surge

The Dow Jones Industrial Average experienced a substantial surge today, reflecting positive sentiment across several key areas. This upward trajectory wasn't a singular event but rather a confluence of factors boosting investor confidence.

Positive Economic Indicators

Strong economic indicators played a significant role in the Dow's climb. Several reports painted a picture of a healthy economy, boosting investor optimism.

- Robust Employment Numbers: The unemployment rate fell to 3.5%, exceeding analyst expectations and signaling a strong labor market. This fuels confidence in consumer spending and overall economic growth.

- Positive GDP Growth: Preliminary estimates suggest a healthy GDP growth rate for the quarter, further reinforcing the positive economic narrative. This sustained growth encourages investment and fuels stock prices.

- High Consumer Confidence: Consumer confidence indices reached a multi-month high, indicating strong consumer spending and a positive outlook on the economy. This directly translates to increased demand for goods and services, benefiting many Dow components.

Strong Corporate Earnings

Many Dow Jones components reported strong corporate earnings, exceeding market expectations. This positive news directly impacts stock prices.

- Technology Sector Strength: Companies in the technology sector within the Dow, like those focused on software and cloud services, reported significant earnings growth, driven by strong demand.

- Financial Sector Outperformance: Financial institutions also performed well, exceeding profit forecasts. This indicates confidence in the overall financial health of the economy.

- Exceeding Expectations: Several blue-chip companies, including (replace with examples – e.g., Microsoft and JPMorgan Chase), exceeded earnings expectations, driving up their stock prices and contributing significantly to the Dow's overall gain.

Impact on the broader market

The Dow's robust performance significantly influences the broader market. Its strength generally signals a healthy economy and increased investor confidence, impacting other indices and investor sentiment. The correlation between the Dow and other market indicators, like the S&P 500, is typically strong, leading to a ripple effect across the market.

Nasdaq Composite's Tech-Driven Rally

The Nasdaq Composite, heavily weighted towards technology stocks, experienced a significant tech-driven rally, fueled by advancements and renewed investor interest.

Technological Advancements

Positive developments in key technology sectors contributed significantly to the Nasdaq's surge.

- AI Breakthroughs: Recent breakthroughs in artificial intelligence (AI) and machine learning generated significant excitement and investment in related companies.

- Semiconductor Innovation: New developments in semiconductor technology, crucial for various tech applications, also boosted investor confidence in the sector.

- Innovative Product Releases: Several tech giants launched innovative products, further driving investor enthusiasm and pushing stock prices higher. (replace with examples – e.g., new Apple product launches, advanced chip releases from Nvidia).

Increased Investor Appetite for Tech Stocks

Renewed interest in technology stocks is a key factor driving the Nasdaq's rally.

- Lower Interest Rates (if applicable): Lower interest rates (mention if applicable, and explain the impact on investor appetite for growth stocks) make growth stocks, including tech stocks, more attractive.

- Future Growth Potential: The long-term growth potential of the tech sector continues to attract significant investment.

- Positive Regulatory Developments (if applicable): Positive regulatory developments or reduced regulatory uncertainty (mention if applicable) can significantly influence investor confidence.

Implications for the Tech Sector

The Nasdaq's performance has significant long-term implications for the tech sector. While the current rally is positive, investors should remain aware of potential risks and challenges. Continued innovation, global economic conditions, and regulatory landscapes will all play a role in shaping the sector's future.

S&P 500's Broad-Based Gains

The S&P 500, a broader market index representing 500 large-cap U.S. companies, also saw significant gains, reflecting strength across various sectors.

Diverse Sector Performance

The S&P 500's gains were broad-based, indicating a healthy and robust economy.

- Multiple Sectors Contributing: Strong performance wasn't limited to a single sector; gains were seen across multiple industries, including consumer discretionary, healthcare, and industrials. This points towards a generally positive economic outlook.

- Resilience Across Industries: The broad-based gains demonstrate resilience across diverse sectors, indicating a strong economy not overly reliant on any single industry.

Improved Consumer Spending

Increased consumer spending played a significant role in driving overall market growth, as reflected in the S&P 500's performance.

- Retail Sales Data: Positive retail sales data points to increased consumer confidence and spending, which in turn benefits a wide range of companies in the S&P 500.

- Consumer Sentiment Surveys: Positive consumer sentiment surveys further support the narrative of increased spending and a healthy consumer economy.

Overall Market Sentiment

The S&P 500's performance reflects a generally positive overall market sentiment. This positive sentiment suggests that investors are largely optimistic about the future economic outlook. However, it's important to monitor for shifts in sentiment that could impact market performance.

Conclusion

Today's stock market saw significant gains across the Dow, Nasdaq, and S&P 500, driven by positive economic indicators, strong corporate earnings, and increased investor confidence. The tech sector showed particularly robust performance, while the broader S&P 500 reflected a generally positive sentiment across multiple sectors. These gains highlight the importance of staying informed about market trends.

Call to Action: Stay informed about the latest stock market developments by regularly checking back for updates on our "Stock Market Live" analysis. Understanding the factors driving the Dow, Nasdaq, and S&P 500 is crucial for making informed investment decisions. Keep up with our daily updates to stay ahead in the dynamic world of stock market trading and investment.

Featured Posts

-

Exclusive High Rollers John Travolta Action Movie Poster And Photo Preview

Apr 24, 2025

Exclusive High Rollers John Travolta Action Movie Poster And Photo Preview

Apr 24, 2025 -

Canada Election Conservatives Vow Tax Cuts Deficit Control

Apr 24, 2025

Canada Election Conservatives Vow Tax Cuts Deficit Control

Apr 24, 2025 -

Miami Steakhouse John Travoltas Pulp Fiction Culinary Experience

Apr 24, 2025

Miami Steakhouse John Travoltas Pulp Fiction Culinary Experience

Apr 24, 2025 -

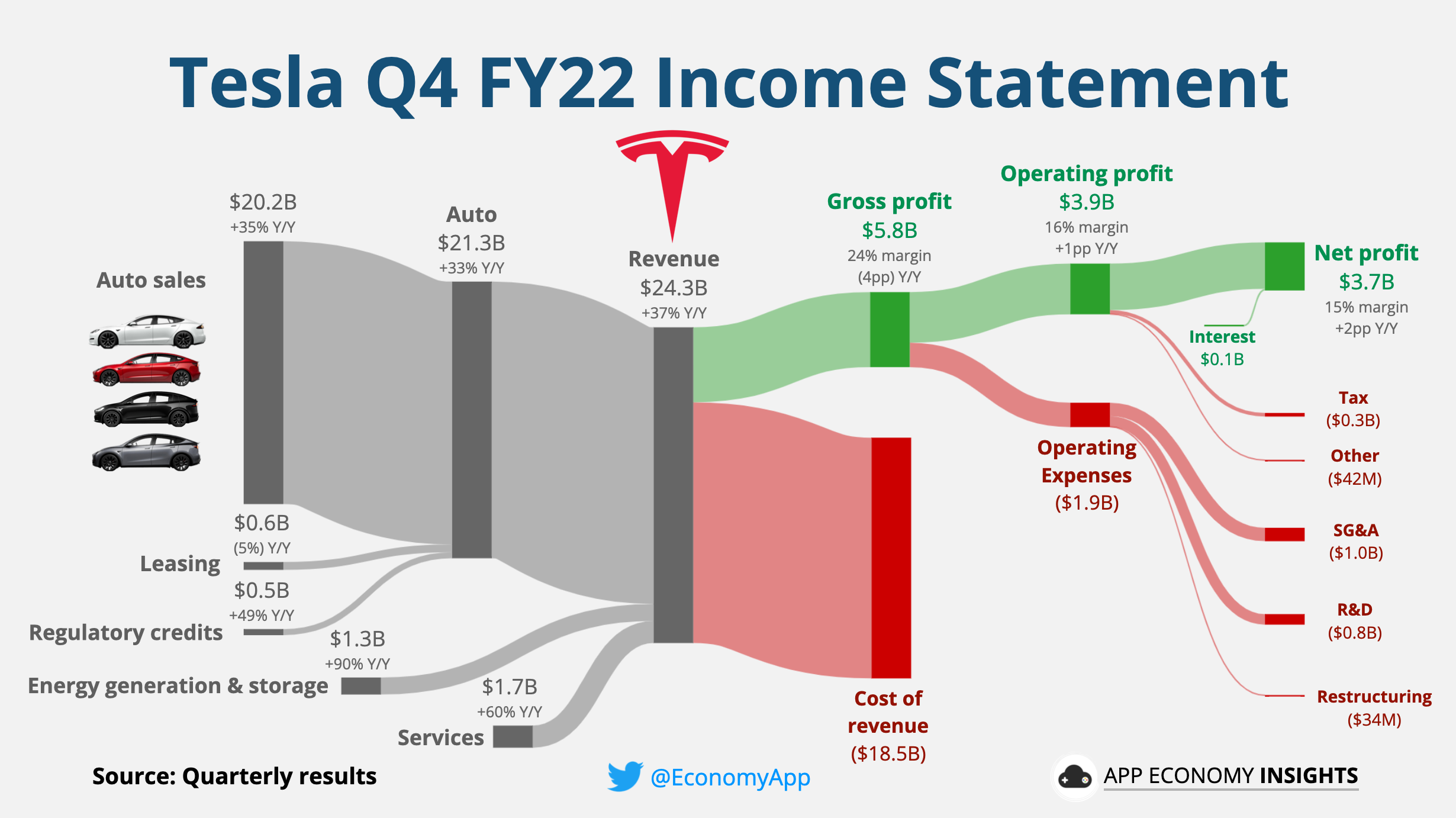

Tesla Earnings Plunge 71 Decline In Q1 Net Income Explained

Apr 24, 2025

Tesla Earnings Plunge 71 Decline In Q1 Net Income Explained

Apr 24, 2025 -

Dollar Rises As Trumps Criticism Of Fed Chair Powell Lessens

Apr 24, 2025

Dollar Rises As Trumps Criticism Of Fed Chair Powell Lessens

Apr 24, 2025