Stock Market Analysis: Dow Futures, China's Economic Policies, And Tariff Impacts

Table of Contents

Understanding Dow Futures and Their Significance

Dow Futures are contracts obligating the buyer to purchase (or the seller to sell) a specific number of Dow Jones Industrial Average (DJIA) index shares at a predetermined price on a future date. They serve as a powerful tool for predicting market trends and managing risk. Analyzing Dow futures data allows investors to gauge market sentiment and anticipate potential price movements in the underlying index.

- Mechanism of Dow futures trading: Trading occurs on designated exchanges, with prices fluctuating based on supply and demand, reflecting overall market expectations.

- Key factors influencing Dow futures prices: These include macroeconomic indicators (GDP growth, inflation, interest rates), geopolitical events, corporate earnings reports, and investor sentiment.

- Relationship between Dow futures and the actual Dow Jones Industrial Average: Dow futures prices generally track the DJIA, often acting as a leading indicator of short-term market direction. Discrepancies can signal potential shifts in investor sentiment or upcoming market volatility.

- Use of Dow futures for hedging and speculation: Investors use Dow futures to hedge against potential losses in their stock portfolios or to speculate on future price movements of the DJIA.

China's Economic Policies and Their Global Impact

China's economic policies significantly impact global markets, including the US. Recent shifts in China's Economic Policies, such as adjustments to monetary policy and ongoing trade negotiations, have far-reaching consequences. Understanding these policies is crucial for any comprehensive Stock Market Analysis.

- Recent changes in Chinese monetary policy and their implications: Changes in interest rates and reserve requirements influence capital flows, investment decisions, and overall economic growth, impacting global markets.

- Analysis of China's GDP growth and its global significance: China's economic growth directly affects global demand, supply chains, and commodity prices, creating ripple effects across various sectors.

- The role of Chinese investments in global markets: Significant Chinese investments in various sectors influence market valuations and investor sentiment.

- Impact of Chinese regulations on specific industries: New regulations and policies in China can dramatically affect specific industries and their corresponding stocks, leading to market volatility.

The Impact of Tariffs on Stock Market Performance

Tariff Impacts on the stock market can be substantial and far-reaching. Trade wars and tariff disputes create uncertainty, influencing investor confidence and impacting the performance of various sectors.

- The impact of tariffs on import/export businesses: Companies heavily reliant on international trade are particularly vulnerable to tariff increases, experiencing reduced profitability and potentially stock price declines.

- How tariffs affect inflation and consumer spending: Tariffs increase the cost of goods, potentially leading to higher inflation and reduced consumer spending, negatively impacting market growth.

- Case studies of specific companies affected by tariffs: Analyzing specific examples provides a clear understanding of the direct effects of tariffs on individual company performance and stock prices.

- The role of geopolitical factors in tariff imposition: Geopolitical tensions and trade disputes significantly influence tariff policies, creating market uncertainty and volatility.

Interconnectedness: Dow Futures, China's Economic Policies, and Tariff Impacts

The interplay between Dow Futures, China's Economic Policies, and Tariff Impacts creates a complex and dynamic relationship. Changes in one area often trigger ripple effects across the others.

- How changes in Chinese economic policy affect Dow futures: Economic slowdowns or policy shifts in China can negatively affect investor sentiment, leading to downward pressure on Dow futures prices.

- The role of tariffs in influencing investor sentiment towards Chinese assets: Increased tariffs on Chinese goods can negatively impact investor confidence in Chinese companies and assets.

- The combined effect of tariffs and Chinese economic slowdown on the Dow: A simultaneous slowdown in the Chinese economy and escalating tariffs can significantly depress the Dow Jones Industrial Average.

- Potential scenarios and their impact on the stock market: Analyzing various scenarios helps investors understand potential risks and opportunities, making informed decisions.

Conclusion: Stock Market Analysis – Navigating Uncertainty

Effective Stock Market Analysis requires a comprehensive understanding of the interconnectedness between Dow Futures, China's Economic Policies, and Tariff Impacts. Monitoring these indicators is crucial for making informed investment decisions in today's volatile market. By staying informed about key economic indicators, geopolitical events, and policy changes, investors can better navigate market uncertainty and manage risk. To enhance your Stock Market Analysis, consider subscribing to a reputable financial newsletter or utilizing a robust market analysis platform to stay updated on these critical factors. Proactive monitoring of these areas is key to successful investment strategies.

Featured Posts

-

Investing In Chinese Car Brands Risks And Opportunities

Apr 26, 2025

Investing In Chinese Car Brands Risks And Opportunities

Apr 26, 2025 -

A Military Base In The Crosshairs Understanding The Us China Competition

Apr 26, 2025

A Military Base In The Crosshairs Understanding The Us China Competition

Apr 26, 2025 -

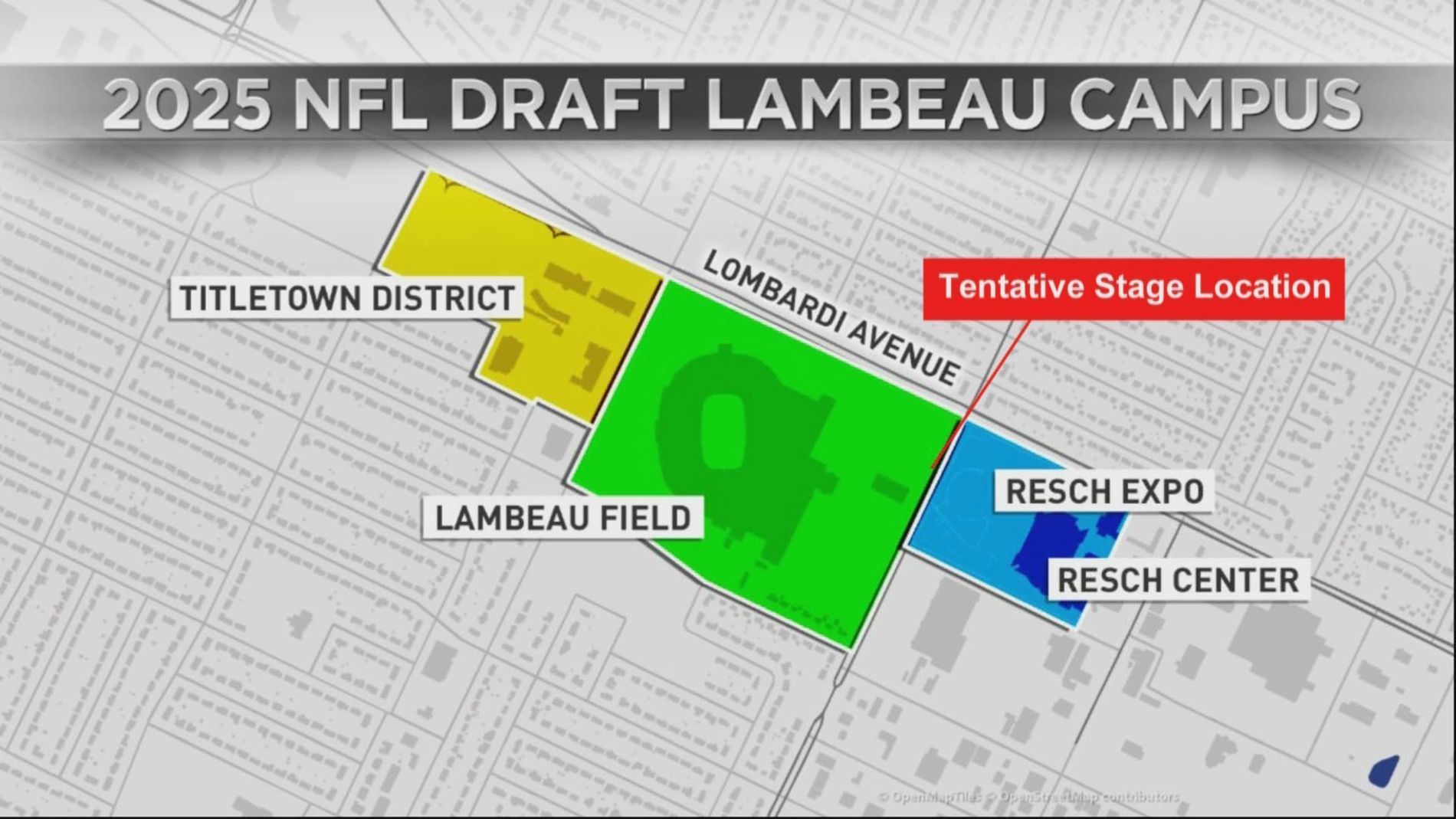

2024 Nfl Draft Green Bays Opening Night

Apr 26, 2025

2024 Nfl Draft Green Bays Opening Night

Apr 26, 2025 -

California Now Fourth Largest Economy Surpassing Japan

Apr 26, 2025

California Now Fourth Largest Economy Surpassing Japan

Apr 26, 2025 -

Open Ais 2024 Event Easier Voice Assistant Creation Tools Unveiled

Apr 26, 2025

Open Ais 2024 Event Easier Voice Assistant Creation Tools Unveiled

Apr 26, 2025