Investing In Chinese Car Brands: Risks And Opportunities

Table of Contents

The Allure of Investing in Chinese Automakers

The rapid expansion of the Chinese automotive industry is undeniable. Domestic car brands are capturing significant market share, fueled by several key factors.

Rapid Growth and Market Share

The China car market is the world's largest, and Chinese domestic brands are increasingly dominating. This phenomenal growth is driven by:

- Government Support: Significant government initiatives promoting electric vehicles (EVs) and technological advancements within the Chinese auto industry are boosting domestic brands.

- Rising Consumer Spending Power: A growing middle class with increased disposable income fuels demand for automobiles, particularly in the rapidly expanding EV market China.

- Technological Innovation: Chinese automakers are investing heavily in research and development, leading to innovative designs and features. Companies like BYD and NIO are prime examples of this success.

This surge has resulted in a significant increase in market share for Chinese car brands, making them increasingly attractive investment opportunities. Keywords: Chinese electric vehicles, EV market China, Chinese auto industry growth, domestic car brands China.

Technological Advancements and Innovation

Chinese automakers are not just catching up; they are innovating. They are at the forefront of several key technological advancements:

- Electric Vehicle (EV) Technology: China is a global leader in EV production and battery technology, with companies like CATL dominating the battery supply chain. This positions Chinese EV makers for significant global expansion.

- Autonomous Driving Technology: Chinese companies are making significant strides in autonomous driving technology, collaborating with international partners and investing heavily in research and development.

- Connectivity and Software: Chinese automakers are integrating advanced connectivity features and software into their vehicles, offering sophisticated infotainment systems and driver-assistance technologies.

These technological advancements offer a significant competitive edge, making them compelling investments in the long term. Keywords: autonomous driving China, electric vehicle technology China, Chinese automotive technology, innovation in Chinese auto industry.

Navigating the Risks of Investing in the Chinese Auto Sector

While the opportunities are substantial, investing in the Chinese auto sector also entails significant risks.

Geopolitical and Regulatory Risks

The geopolitical landscape and regulatory environment in China present challenges for investors:

- Trade Wars and Sanctions: The potential for trade disputes or sanctions could significantly impact the automotive industry, creating uncertainty for investors.

- Regulatory Changes: Rapid changes in government regulations and policies can create unexpected hurdles for companies operating in China.

- Intellectual Property Concerns: Protecting intellectual property rights remains a significant challenge in China, posing a risk to investors.

Careful consideration of these factors is crucial before investing. Keywords: China investment risks, geopolitical risks China, regulatory uncertainty China, trade war impact China auto.

Competition and Market Saturation

The Chinese car market is fiercely competitive:

- Intense Competition: Established global players and a growing number of domestic brands compete for market share, leading to price wars and pressure on profit margins.

- Market Saturation: Certain segments of the market, such as budget sedans, may experience saturation, limiting growth opportunities for new entrants.

- Brand Differentiation: Establishing a strong brand identity and differentiating products in a crowded market is crucial for success.

Understanding this competitive landscape is critical for making informed investment decisions. Keywords: competitive landscape China auto, market saturation China, brand competition China, Chinese car market challenges.

Financial and Operational Risks

Financial and operational risks associated with Chinese companies require careful scrutiny:

- Accounting Transparency: Concerns about accounting transparency and corporate governance practices in some Chinese companies can make it difficult to assess their true financial health.

- Debt Levels: High debt levels among some automakers pose a risk of financial instability.

- Currency Fluctuations: Fluctuations in the Chinese Yuan can impact the profitability of investments.

A thorough due diligence process is essential to mitigate these risks. Keywords: financial risk China, currency risk China, accounting transparency China, operational risk China.

Due Diligence and Investment Strategies for Chinese Car Brands

Successfully navigating the Chinese auto market requires a strategic approach.

Thorough Research and Risk Assessment

Before investing, conduct thorough due diligence:

- Financial Statement Analysis: Carefully analyze financial statements to assess the company's financial health and growth prospects.

- Regulatory Framework Understanding: Understand the relevant regulations and policies affecting the automotive industry in China.

- Geopolitical Risk Assessment: Assess the potential impact of geopolitical events on the company's operations.

A comprehensive risk assessment is crucial for making informed investment decisions. Keywords: due diligence China, investment strategy China auto, risk assessment China, China investment analysis.

Diversification and Portfolio Management

Diversification and effective portfolio management are key to mitigating risk:

- Diversified Investments: Diversify investments across different segments of the Chinese automotive industry and consider international exposure.

- Portfolio Rebalancing: Regularly rebalance your portfolio to adjust to changing market conditions and risk levels.

- Long-Term Perspective: Investing in the Chinese auto sector requires a long-term perspective, recognizing that growth may be uneven.

A well-diversified portfolio can help reduce overall risk and enhance long-term returns. Keywords: portfolio diversification, risk mitigation strategies, investment portfolio management, global investment strategy.

Conclusion: Making Informed Decisions on Investing in Chinese Car Brands

Investing in Chinese car brands presents both significant opportunities and substantial risks. The potential for high returns is undeniable, driven by the rapid growth of the Chinese car market and technological advancements within the Chinese auto industry. However, geopolitical risks, intense competition, and potential financial challenges require careful consideration. Thorough due diligence, a robust risk assessment, and a well-diversified investment strategy are crucial for maximizing returns while mitigating risks. Conduct further research, understand the specific challenges and opportunities presented by each company, and make informed decisions. The future of the Chinese car market is bright, and savvy investors can profit from the growth of Chinese car brands and the opportunities within the Chinese automotive industry. Keywords: invest in Chinese car brands, opportunities in Chinese auto industry, Chinese auto investment, future of Chinese car market.

Featured Posts

-

From Scatological Documents To Podcast Gold An Ai Powered Solution

Apr 26, 2025

From Scatological Documents To Podcast Gold An Ai Powered Solution

Apr 26, 2025 -

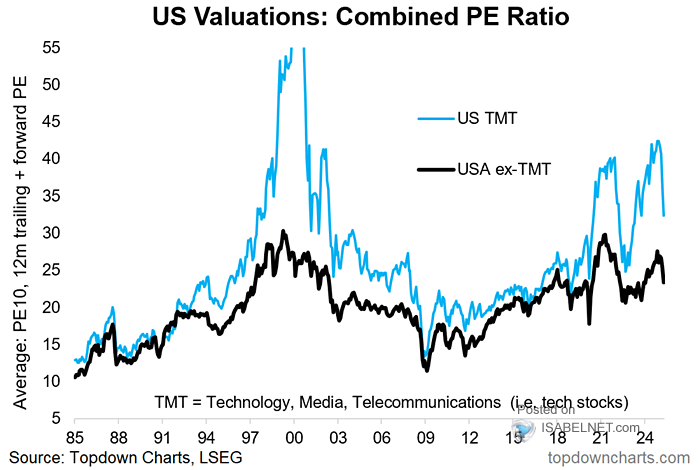

Stock Market Valuations Bof A Explains Why Investors Shouldnt Panic

Apr 26, 2025

Stock Market Valuations Bof A Explains Why Investors Shouldnt Panic

Apr 26, 2025 -

A Conservative Harvard Professors Prescription For Harvards Future

Apr 26, 2025

A Conservative Harvard Professors Prescription For Harvards Future

Apr 26, 2025 -

Investing In Elon Musks Private Ventures A Lucrative Side Hustle

Apr 26, 2025

Investing In Elon Musks Private Ventures A Lucrative Side Hustle

Apr 26, 2025 -

Navigating The Chinese Market The Struggles Of Bmw Porsche And Competitors

Apr 26, 2025

Navigating The Chinese Market The Struggles Of Bmw Porsche And Competitors

Apr 26, 2025

Latest Posts

-

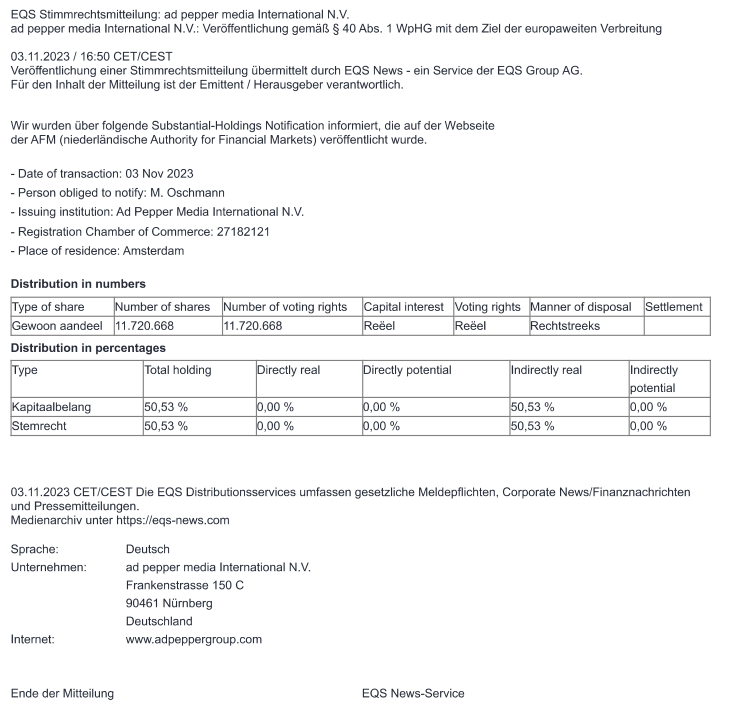

Offenlegung Gemaess Artikel 40 Absatz 1 Wp Hg Pne Ag

Apr 27, 2025

Offenlegung Gemaess Artikel 40 Absatz 1 Wp Hg Pne Ag

Apr 27, 2025 -

Pne Ag Veroeffentlichung Gemaess Artikel 40 Absatz 1 Wp Hg Europaweite Verbreitung

Apr 27, 2025

Pne Ag Veroeffentlichung Gemaess Artikel 40 Absatz 1 Wp Hg Europaweite Verbreitung

Apr 27, 2025 -

Pne Ag Ad Hoc Mitteilung Gemaess Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025

Pne Ag Ad Hoc Mitteilung Gemaess Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025 -

Eqs Pvr Pne Ag Veroeffentlicht Gemaess Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025

Eqs Pvr Pne Ag Veroeffentlicht Gemaess Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025 -

Nfl Players Find Second Chances With Mc Cook Jewelers Help

Apr 27, 2025

Nfl Players Find Second Chances With Mc Cook Jewelers Help

Apr 27, 2025