Nifty 50 Index: Recent Market Developments And Future Predictions (India)

Table of Contents

Recent Performance and Key Influencing Factors of the Nifty 50 Index

The Nifty 50's performance is a complex interplay of various macroeconomic and global factors. Understanding these influences is critical for accurate Nifty 50 analysis and informed investment decisions in the Indian stock market.

Macroeconomic Indicators and their Impact

India's macroeconomic environment significantly impacts the Nifty 50. GDP growth, inflation, and interest rate changes directly influence investor sentiment and corporate profitability. Strong GDP growth typically boosts the index, while high inflation and rising interest rates can dampen investor enthusiasm.

- GDP Growth: A robust GDP signifies economic expansion, leading to increased corporate earnings and a positive impact on the Nifty 50. Conversely, slow GDP growth can lead to a decline.

- Inflation Rates: High inflation erodes purchasing power and can trigger monetary policy tightening, negatively impacting the Nifty 50. Stable inflation, however, fosters a positive investment climate.

- Interest Rate Changes: Interest rate hikes can increase borrowing costs for businesses, impacting profitability and potentially slowing down the Nifty 50's growth. Conversely, rate cuts can stimulate economic activity and boost the index.

- Government Policies: Government initiatives like infrastructure spending, tax reforms, and ease of doing business reforms can positively influence the Nifty 50. Conversely, policy uncertainty can lead to market volatility. For example, the recent emphasis on infrastructure development in India has positively affected related sectors within the Nifty 50.

Global Market Dynamics and their Influence on Nifty 50

The Nifty 50 is not immune to global market dynamics. Events in major global economies, especially the US, significantly influence the Indian stock market.

- Correlation with US Markets: The Nifty 50 often shows a correlation with US market performance. A downturn in the US market can lead to risk aversion and capital outflow from emerging markets like India, negatively impacting the Nifty 50.

- Geopolitical Events: Geopolitical instability, trade wars, and global crises can cause significant volatility in the Nifty 50. Uncertainty surrounding global events often leads to investors seeking safer havens, potentially impacting the index.

- International Trade: Fluctuations in global commodity prices and changes in international trade policies can directly influence specific Nifty 50 sectors, like energy or manufacturing. For example, rising crude oil prices negatively impact sectors like transportation and logistics within the Nifty 50.

Sectoral Performance within the Nifty 50

Analyzing the performance of individual sectors within the Nifty 50 provides a granular understanding of the index's overall movement.

- IT Sector: The IT sector has historically been a significant contributor to the Nifty 50's growth, but its performance is highly susceptible to global economic conditions and currency fluctuations.

- Financials: The financial sector, encompassing banking and insurance, usually reflects the overall health of the Indian economy and plays a crucial role in the Nifty 50's performance.

- FMCG (Fast-Moving Consumer Goods): FMCG companies usually exhibit relatively stable performance, even during economic downturns, making them important components of the Nifty 50.

- Other Sectors: Other sectors like energy, pharmaceuticals, and infrastructure also contribute significantly to the Nifty 50's overall performance, with their movements dependent on specific industry-related factors.

Analyzing Current Market Sentiment and Investor Behavior

Market sentiment and investor behavior are crucial drivers of the Nifty 50's performance. Understanding the roles of different investor groups provides valuable insights.

Foreign Institutional Investor (FII) Activity

FIIs are substantial players in the Indian stock market. Their investment decisions significantly impact the Nifty 50.

- FII Inflows: Large FII inflows usually lead to increased demand and push the Nifty 50 upwards.

- FII Outflows: Conversely, FII outflows can trigger sell-offs and put downward pressure on the index.

- Global Economic Conditions: FII investment decisions are often influenced by global economic conditions and risk appetite.

Domestic Institutional Investor (DII) Activity

DIIs, including mutual funds and insurance companies, also play a vital role in shaping the Nifty 50's trajectory.

- DII Participation: Increasing DII participation can add stability and support to the market, counteracting potential negative impacts from FII movements.

- Long-term Investment Strategy: DIIs generally have a longer-term investment horizon compared to FIIs, contributing to a more stable market environment.

Retail Investor Participation and Sentiment

The increasing participation of retail investors in the Indian stock market is a key factor to consider when analyzing Nifty 50 predictions.

- Retail Investor Sentiment: Retail investor sentiment, often driven by market news and speculation, can contribute to market volatility.

- Increased Access to Markets: Increased access to online trading platforms has led to greater retail investor participation, boosting market liquidity but also potentially increasing volatility.

Future Predictions and Outlook for the Nifty 50 Index

Predicting the future of the Nifty 50 is challenging, but analyzing current trends and macroeconomic forecasts can offer potential scenarios.

Short-Term Predictions (Next 6-12 months)

The short-term outlook for the Nifty 50 depends on several factors, including global economic growth, inflation trends, and investor sentiment. Potential scenarios include continued moderate growth, or a period of consolidation followed by a renewed upward trend. Price targets will vary depending on the chosen scenario and the underlying assumptions.

Long-Term Predictions (Next 3-5 years)

India's long-term economic growth prospects are generally positive, fueled by a young population, rising consumption, and government infrastructure investments. This suggests a positive long-term outlook for the Nifty 50, but potential challenges like inflation and global economic headwinds need to be considered. Long-term price targets should be viewed with caution, as they are highly susceptible to changes in the underlying economic and political landscape.

Risks and Uncertainties

Several factors could negatively impact the Nifty 50's performance.

- Global Economic Slowdown: A global recession could negatively impact Indian exports and foreign investment, leading to a decline in the Nifty 50.

- High Inflation: Persistent high inflation could erode corporate profits and trigger monetary tightening, potentially dampening market growth.

- Geopolitical Risks: Geopolitical instability or regional conflicts could create uncertainty and lead to market volatility.

- Regulatory Changes: Unexpected regulatory changes could negatively impact specific sectors within the Nifty 50.

Conclusion

This article analyzed recent market developments and influencing factors impacting the Nifty 50 Index. We explored macroeconomic indicators, global market dynamics, sectoral performances, and investor behavior. While the future is inherently uncertain, our analysis suggests potential scenarios for both short-term and long-term performance, considering both opportunities and risks.

Call to Action: Understanding the Nifty 50 Index is crucial for any investor interested in the Indian stock market. Stay informed about the latest developments and continue your research to make informed investment decisions regarding the Nifty 50 Index and other related Indian equities. Learn more about effective Nifty 50 investment strategies and keep track of the latest Nifty 50 predictions for a successful investment journey. Remember that Nifty 50 analysis requires careful consideration of various factors, and professional financial advice is always recommended before making any investment decisions.

Featured Posts

-

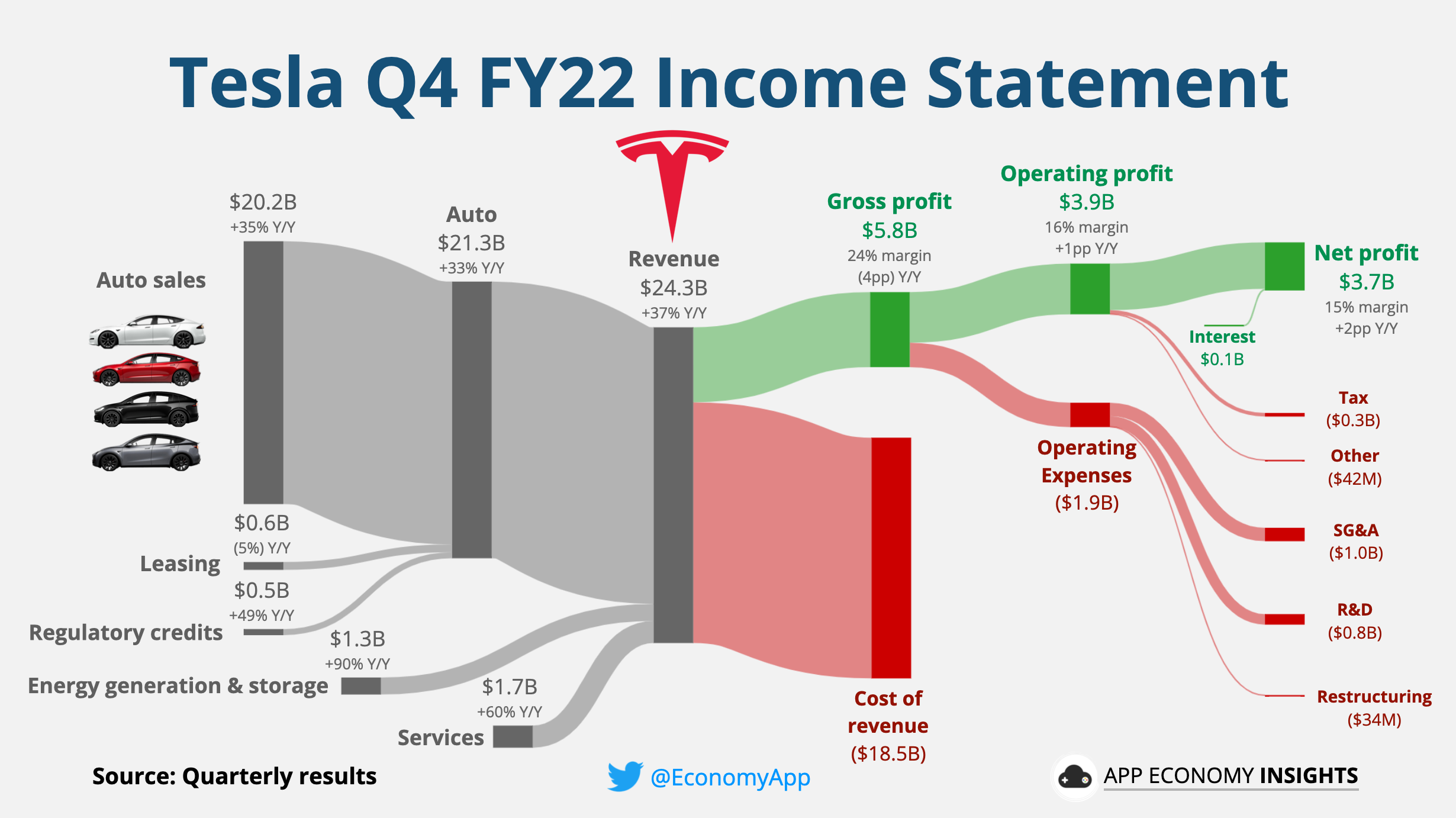

Tesla Earnings Plunge 71 Decline In Q1 Net Income Explained

Apr 24, 2025

Tesla Earnings Plunge 71 Decline In Q1 Net Income Explained

Apr 24, 2025 -

Potential Sale Of Utac Update On Chinese Buyout Firms Plans

Apr 24, 2025

Potential Sale Of Utac Update On Chinese Buyout Firms Plans

Apr 24, 2025 -

Nba

Apr 24, 2025

Nba

Apr 24, 2025 -

Ray Epps Sues Fox News For Defamation Jan 6th Falsehoods Lawsuit Explained

Apr 24, 2025

Ray Epps Sues Fox News For Defamation Jan 6th Falsehoods Lawsuit Explained

Apr 24, 2025 -

Btc Price Increase Impact Of Trumps Actions On Market Sentiment

Apr 24, 2025

Btc Price Increase Impact Of Trumps Actions On Market Sentiment

Apr 24, 2025