Navigating The Trump Era: The Upcoming Challenges For The Federal Reserve Chair

Table of Contents

Political Pressure and Independence

The Trump administration's relationship with the Federal Reserve was far from conventional. The unprecedented level of public criticism leveled against the institution and its Chair significantly impacted interest rate decisions and the overall functioning of the central bank.

Direct Presidential Influence

Trump's frequent and highly public criticism of the Federal Reserve's monetary policy decisions created a unique challenge for the Federal Reserve Chair. His pronouncements, often delivered via Twitter, directly targeted interest rate hikes, which he viewed as detrimental to economic growth.

- Examples: Trump repeatedly labeled interest rate increases as "crazy" and "ridiculous," publicly pressuring the Federal Reserve to lower rates to boost the economy.

- Impact: This overt political pressure raised concerns about the Federal Reserve's independence and its ability to make objective decisions based solely on economic data, rather than political expediency. The perception of political interference could undermine the credibility of the institution and its ability to effectively manage inflation and economic stability. This era highlighted the crucial need for robust "Federal Reserve independence" and the potential dangers of unchecked "political interference" in "interest rate policy."

Appointment and Confirmation Process

The process of appointing and confirming a Federal Reserve Chair became significantly more complex during the Trump administration. The highly polarized political climate increased the difficulty in finding a candidate acceptable to both the President and the Senate.

- Confirmation Hurdles: The confirmation process faced increased scrutiny, with nominees subjected to intense political vetting and potentially lengthy delays.

- Political Polarization: Finding a candidate who could navigate the political divides and gain bipartisan support became a critical challenge. The importance of securing a nominee acceptable to both parties underscored the profound impact of "political polarization" on the "Federal Reserve Chair appointment" and "Senate confirmation" processes.

Economic Volatility and Unpredictability

The Trump era was characterized by significant economic volatility driven largely by unpredictable policy decisions. The Federal Reserve Chair faced the immense task of navigating these turbulent waters and mitigating their impact on the US economy.

Trade Wars and Global Uncertainty

Trump's aggressive trade policies, including the imposition of tariffs and the initiation of trade disputes with major economic partners, created considerable global uncertainty. This uncertainty directly impacted the US economy and placed immense pressure on the Federal Reserve.

- Economic Impacts: Trade wars directly affected inflation, employment, and overall economic growth, creating challenges for the Federal Reserve in forecasting economic trends and implementing appropriate monetary policies.

- Monetary Policy Response: The Federal Reserve had to carefully consider the complex implications of these trade disputes when making decisions regarding interest rates and other monetary policy tools aimed at mitigating the negative economic effects. The challenge was to effectively manage "economic volatility" and "global uncertainty" through strategic "monetary policy response."

Fiscal Policy Coordination

Coordinating monetary policy with the Trump administration's expansionary fiscal policies proved to be a significant challenge. The combination of substantial tax cuts and increased government spending created the potential for conflicting policy goals.

- Conflicting Goals: Stimulating economic growth through fiscal policy could conflict with the Federal Reserve's mandate to control inflation.

- Monetary Policy Effectiveness: The effectiveness of monetary policy was impacted by the substantial fiscal stimulus, requiring careful calibration to avoid overheating the economy or exacerbating existing inflationary pressures. The intricate interplay between "fiscal policy" and "monetary policy coordination" demanded precise strategies to balance "economic stimulus" with managing "budget deficits."

Long-Term Implications for the Federal Reserve

The Trump era's impact on the Federal Reserve extends beyond the immediate challenges faced by its Chair. The experience has long-term implications for the institution's independence, public trust, and future effectiveness.

Erosion of Public Trust

The highly publicized political clashes between the Trump administration and the Federal Reserve potentially eroded public trust in the institution's independence and credibility.

- Consequences of Politicization: Politicizing monetary policy decisions can undermine public confidence in the central bank's ability to act objectively and in the best interests of the overall economy.

- Rebuilding Trust: The Federal Reserve needs to implement strategies to reaffirm its commitment to political neutrality and rebuild public confidence in its independence and expertise. Maintaining "public trust" and "credibility" are essential for the long-term success of any "central bank independence."

Future Challenges for the Federal Reserve Chair

The lingering effects of the Trump era present ongoing challenges for future Federal Reserve Chairs. Navigating economic headwinds and maintaining the institution's independence will require strategic leadership and a deep understanding of the political and economic landscape.

- Future Economic Headwinds: Predicting future economic headwinds, including potential shifts in global trade and the implications of lingering fiscal policy effects, requires adept economic forecasting and proactive policy adjustments.

- Maintaining Effectiveness: Strategies for maintaining the Federal Reserve's independence and effectiveness will be paramount, requiring deft navigation of political pressures and a steadfast commitment to evidence-based policymaking. Successfully addressing "future challenges" and ensuring "policy effectiveness" demands exceptional "Federal Reserve leadership."

Conclusion

The Trump era presented unprecedented challenges for the Federal Reserve Chair, demanding a delicate balancing act between political pressures and the mandate to maintain economic stability. The period highlighted the vulnerability of "Federal Reserve independence" to political interference and the critical need for effective monetary policy in navigating volatile economic landscapes. The long-term implications include the potential erosion of public trust and the ongoing need to reinforce the institution's credibility and effectiveness. We must understand the complexities of the Federal Reserve's role and the importance of strong "Federal Reserve leadership" to navigate future challenges effectively. Further research into the role of the Federal Reserve Chair and the evolving challenges facing this crucial institution is vital for informed civic engagement.

Featured Posts

-

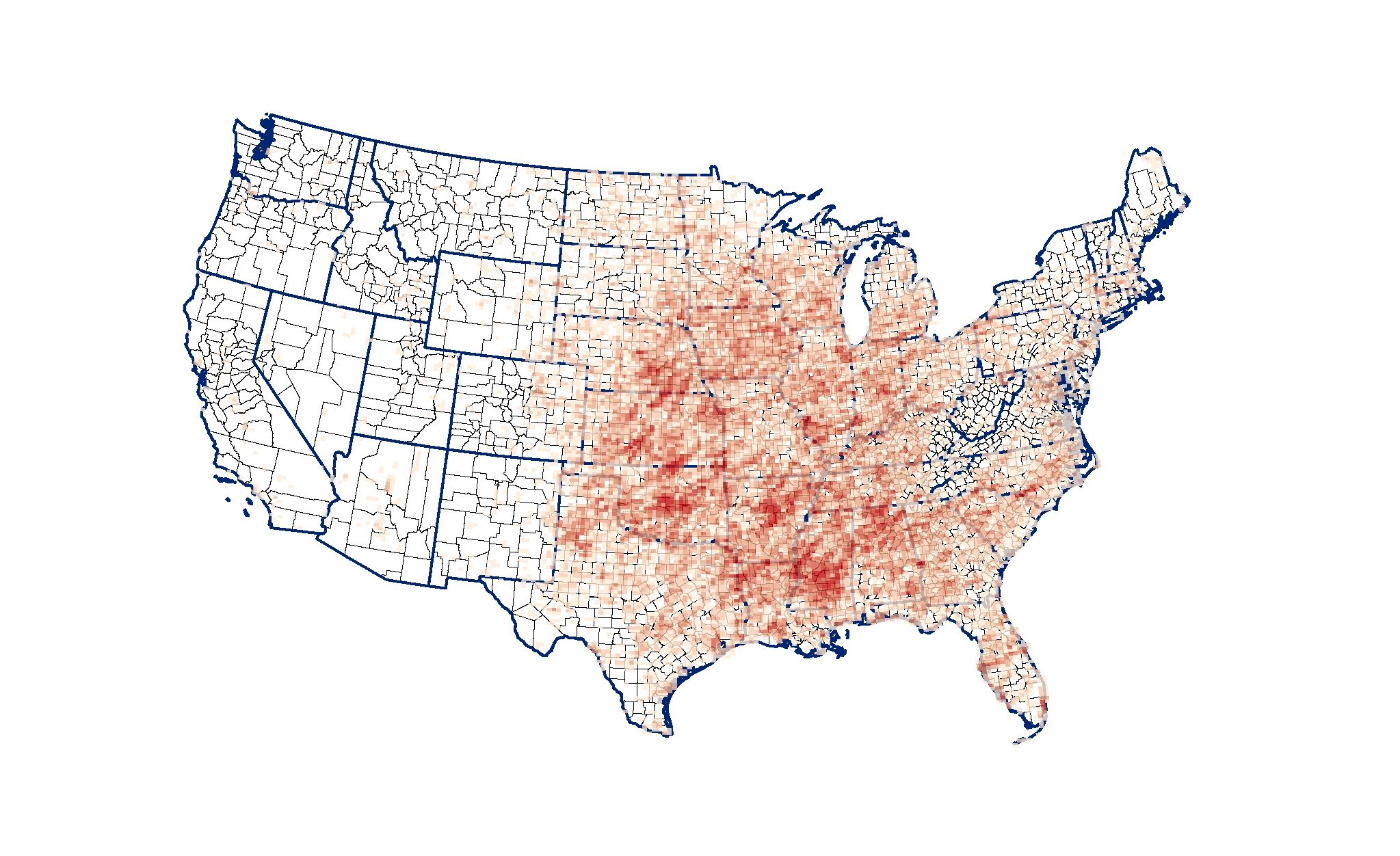

New Business Hot Spots Across The Country An Interactive Map And Analysis

Apr 26, 2025

New Business Hot Spots Across The Country An Interactive Map And Analysis

Apr 26, 2025 -

Activision Blizzard Acquisition Ftcs Appeal And The Future Of Gaming

Apr 26, 2025

Activision Blizzard Acquisition Ftcs Appeal And The Future Of Gaming

Apr 26, 2025 -

Harvards Challenges A Conservative Professors Analysis And Solutions

Apr 26, 2025

Harvards Challenges A Conservative Professors Analysis And Solutions

Apr 26, 2025 -

The Zuckerberg Trump Dynamic Implications For Tech And Governance

Apr 26, 2025

The Zuckerberg Trump Dynamic Implications For Tech And Governance

Apr 26, 2025 -

Stock Market Today Dow Futures Fluctuate Chinas Economic Support Pledge Amid Tariff Tensions

Apr 26, 2025

Stock Market Today Dow Futures Fluctuate Chinas Economic Support Pledge Amid Tariff Tensions

Apr 26, 2025