Activision Blizzard Acquisition: FTC's Appeal And The Future Of Gaming

Table of Contents

The FTC's Case Against the Activision Blizzard Acquisition

Antitrust Concerns:

The FTC argues that the Activision Blizzard acquisition would create a monopoly, significantly reducing competition and harming consumers. Their central concern revolves around the potential for Microsoft to leverage its control over Activision Blizzard's properties, particularly the immensely popular Call of Duty franchise, to stifle competition.

- Microsoft's potential to make Call of Duty exclusive to its Xbox ecosystem: This would severely disadvantage competitors like Sony PlayStation, potentially driving players towards Xbox and harming the PlayStation ecosystem.

- Impact on competitors like Sony PlayStation: Losing access to Call of Duty, a major title, could significantly impact Sony's market share and profitability. The game’s popularity is undeniable, and its absence could create a significant competitive imbalance.

- Limiting consumer choice and innovation in the gaming industry: An acquisition resulting in a lack of competition would reduce consumer choice and potentially stifle innovation within the gaming market as a whole.

- Stifling competition in cloud gaming services: Microsoft's acquisition could also lead to anti-competitive behavior within the burgeoning cloud gaming market, limiting access and innovation for gamers who prefer cloud-based gaming solutions.

Evidence and Arguments:

The FTC presented a substantial amount of evidence to support its claims, aiming to demonstrate the anti-competitive nature of the merger.

- Analysis of Microsoft's market share and potential dominance: The FTC provided market analysis showing Microsoft's potential to achieve a dominant position in the gaming market following the acquisition.

- Examination of the importance of Call of Duty in the gaming landscape: The FTC highlighted Call of Duty's significant market share and cultural impact, emphasizing its importance as a key driver of console sales and engagement.

- Expert testimony and economic modelling: The FTC relied on expert testimony from economists and industry analysts to support its claims regarding the potential for reduced competition and consumer harm.

Potential Remedies:

To address the antitrust concerns, the FTC explored potential remedies that could be implemented if the acquisition were allowed to proceed.

- Behavioral remedies, such as licensing agreements for Call of Duty: These would involve legally binding agreements requiring Microsoft to license Call of Duty to competitors for a specific period.

- Structural remedies, such as divestiture of certain Activision Blizzard assets: This could involve Microsoft selling off certain parts of Activision Blizzard to maintain a competitive landscape.

Microsoft's Defense and Counterarguments

Commitment to Competition:

Microsoft strongly countered the FTC's arguments, emphasizing its commitment to maintaining a competitive gaming market and ensuring consumer benefits.

- Plans to bring Activision Blizzard games to more platforms, including cloud gaming services: Microsoft pledged to continue releasing Activision Blizzard games on various platforms, including PlayStation and cloud gaming services, to avoid exclusivity.

- Investments in game development and technological advancements: Microsoft highlighted its commitment to invest in further development and innovation within the gaming industry, potentially benefitting gamers with more and better games.

- Commitment to fair licensing agreements with competitors: Microsoft promised fair and reasonable licensing agreements with competitors to maintain access to Activision Blizzard titles.

Rebuttal of FTC Claims:

Microsoft directly challenged the FTC's findings and arguments, offering alternative perspectives.

- Challenging the FTC's assessment of market power: Microsoft disputed the FTC’s assessment of its potential market dominance, arguing that the gaming market remains competitive even with the acquisition.

- Emphasizing the benefits of integrating Activision Blizzard's technologies and talent: Microsoft highlighted the synergies between its own technology and Activision Blizzard's expertise, potentially leading to innovation and improved gaming experiences.

- Presenting alternative scenarios to illustrate the competitive landscape: Microsoft offered counter-arguments and different market scenarios to demonstrate that the acquisition would not create a monopoly and would maintain competition.

The Appeal Process and its Implications

Legal Proceedings:

The FTC's appeal against the initial court decision represents a significant legal battle with wide-reaching consequences.

- Timeline of the legal battle: This section would detail the timeline of the legal proceedings, from the initial FTC lawsuit to the appeal and its potential outcomes.

- Key arguments presented during the appeal: A deeper analysis of the legal arguments presented by both sides during the appeal process would provide a comprehensive understanding of the complexities of the case.

- Potential outcomes of the appeal process: The potential outcomes—affirmation of the original ruling, reversal of the ruling, or a negotiated settlement—and their implications would be discussed.

Impact on Future Mergers and Acquisitions:

The outcome of this appeal will set a significant precedent, greatly influencing future mergers and acquisitions in the gaming and tech industries.

- Implications for regulatory oversight: The decision will significantly influence future regulatory scrutiny of large mergers and acquisitions in the tech industry.

- Effects on investor confidence: The outcome will impact investor confidence in the gaming industry and the willingness of companies to engage in large-scale mergers and acquisitions.

- Future strategies for companies considering mergers and acquisitions: The legal battle will shape the strategies and approaches companies will take when considering future mergers and acquisitions, influencing due diligence and risk assessment.

Conclusion:

The FTC's appeal against the Activision Blizzard acquisition is a pivotal moment for the gaming industry. The outcome will have a profound impact on competition, innovation, and the future landscape of gaming. Understanding the arguments presented by both sides and the legal ramifications is crucial for anyone invested in the future of gaming. Stay informed about the ongoing developments in this landmark case as it shapes the future of the Activision Blizzard acquisition and the broader gaming ecosystem. Keep following news and analysis surrounding the Activision Blizzard merger to fully comprehend its lasting impact. The future of gaming depends, in part, on the resolution of this complex legal battle surrounding the Activision Blizzard deal.

Featured Posts

-

Economic Power Shift California Outpaces Japan

Apr 26, 2025

Economic Power Shift California Outpaces Japan

Apr 26, 2025 -

Ukraines Nato Bid Trumps Skepticism And Its Significance

Apr 26, 2025

Ukraines Nato Bid Trumps Skepticism And Its Significance

Apr 26, 2025 -

Actors Join Writers Strike A Complete Shutdown Of Hollywood

Apr 26, 2025

Actors Join Writers Strike A Complete Shutdown Of Hollywood

Apr 26, 2025 -

Ahmed Hassaneins Road To The Nfl A Historic Possibility

Apr 26, 2025

Ahmed Hassaneins Road To The Nfl A Historic Possibility

Apr 26, 2025 -

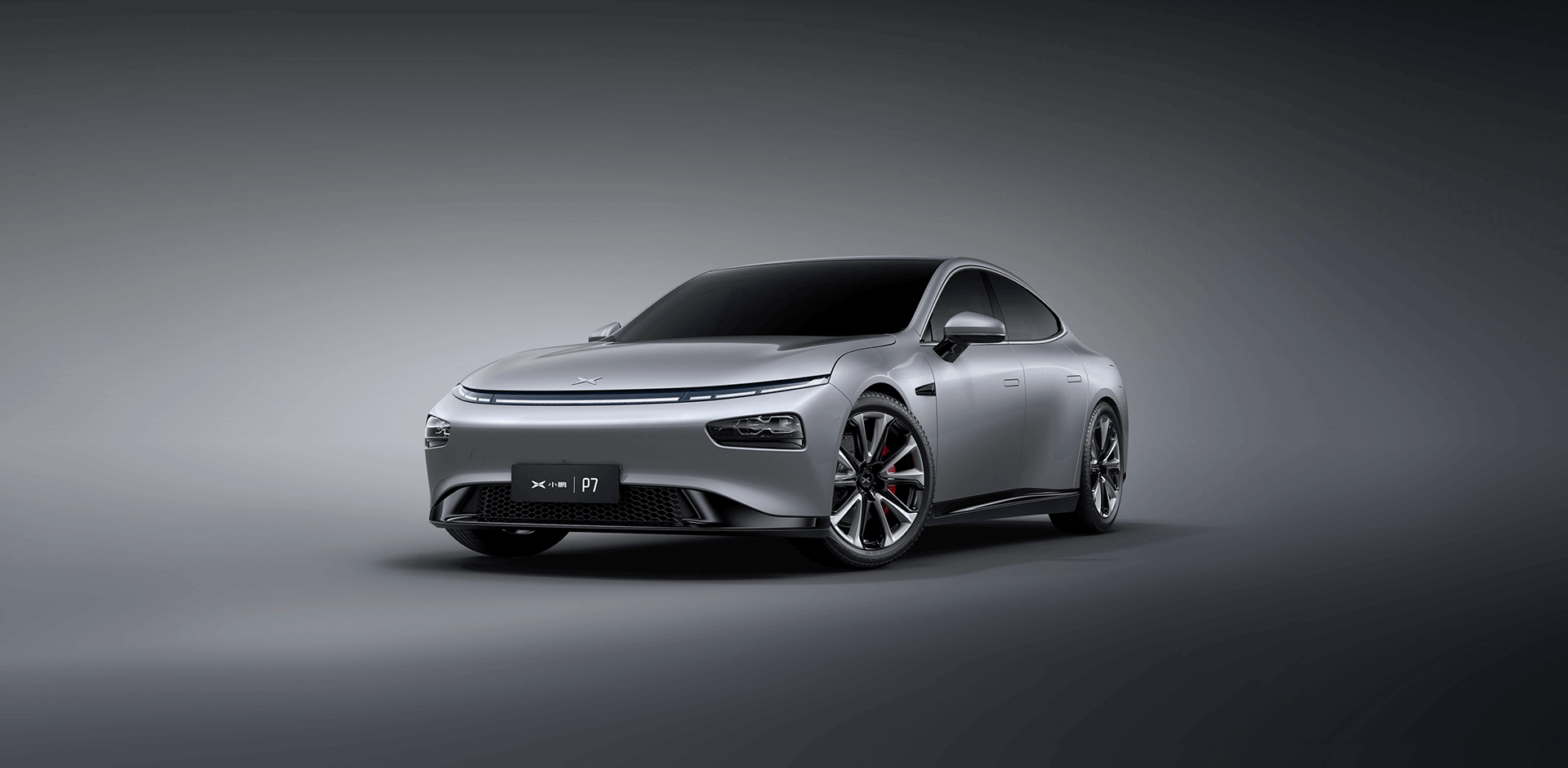

The Rise Of Chinese Automakers A Competitive Analysis

Apr 26, 2025

The Rise Of Chinese Automakers A Competitive Analysis

Apr 26, 2025